Manage Structured Products (Notes)

Introduction

Structured Notes are complex financial instruments that combine elements of bonds or derivatives. Due to their complexity, they require proper tracking and visibility. In the Reluna Platform, you can view and track all Structured Product Notes through Instruments, which holds information on every instrument used in the platform.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Accumulation | Condition where the price of the lowest-performing equity falls below the Coupon Barrier. |

Autocall Level | A predefined level at which the Structured Note is automatically called before maturity, if underliers meet the required performance criteria on specific dates. |

Autocallable Note | A Structured Note that is automatically redeemed before maturity if the underliers meet certain performance thresholds at scheduled observation dates. |

Early Redemption | Occurs when the price of the lowest-performing equity exceeds the current Autocall Level, triggering early payout and closure of the Note. |

Structured Note | A debt instrument issued by financial institutions. Its return is linked to the performance of one or more underlying assets, such as equities, indexes, interest rates, commodities, or currencies. |

Term Sheet | A non-binding document that outlines the basic terms and conditions of a Structured Note. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

How Structured Notes Appear on the Platform

Structured Notes can appear in your platform in two ways:

When a Structured Note is transferred to the Bank Account of a client, it automatically appears in their Portfolio.

In this case, the Back Office is responsible for monitoring the Structured Note.

When a Structured Note is bought under the control of these departments, the Investment Department is responsible for entering all necessary information about the Note into the platform.

If a Structured Note appears in a client portfolio, the Back Office informs the Investment Department, who then requests the Term Sheet and updates the Note details accordingly.

How to Find Structured Notes in the Instruments

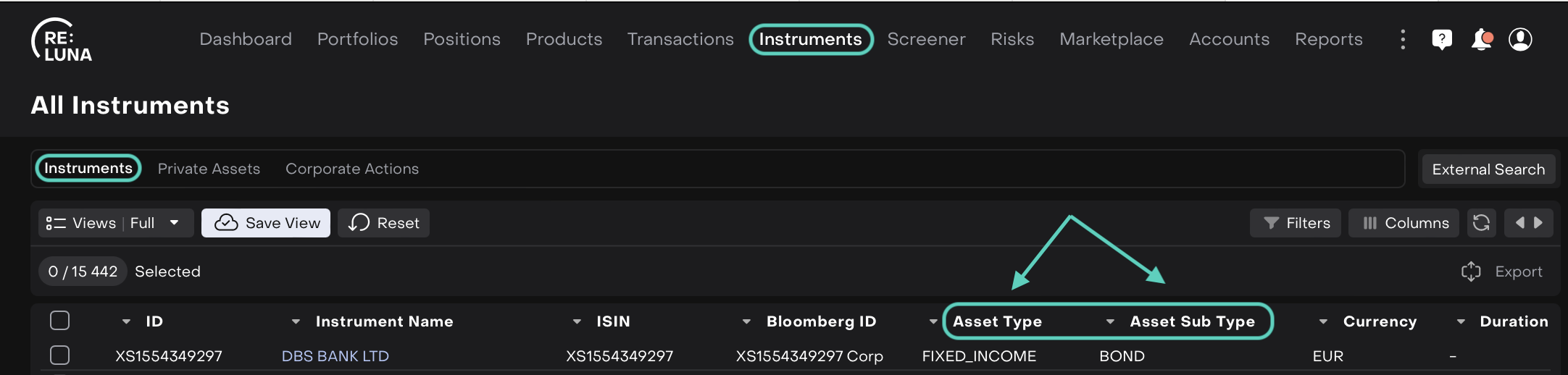

Go the Instruments tab and find All Instruments.

Now, apply the following filters:

Asset Type =

SP(Structured Product)Asset Sub Type =

Note

.png?inst-v=6d963370-3e6f-438e-bf89-d4ca7af0df77)

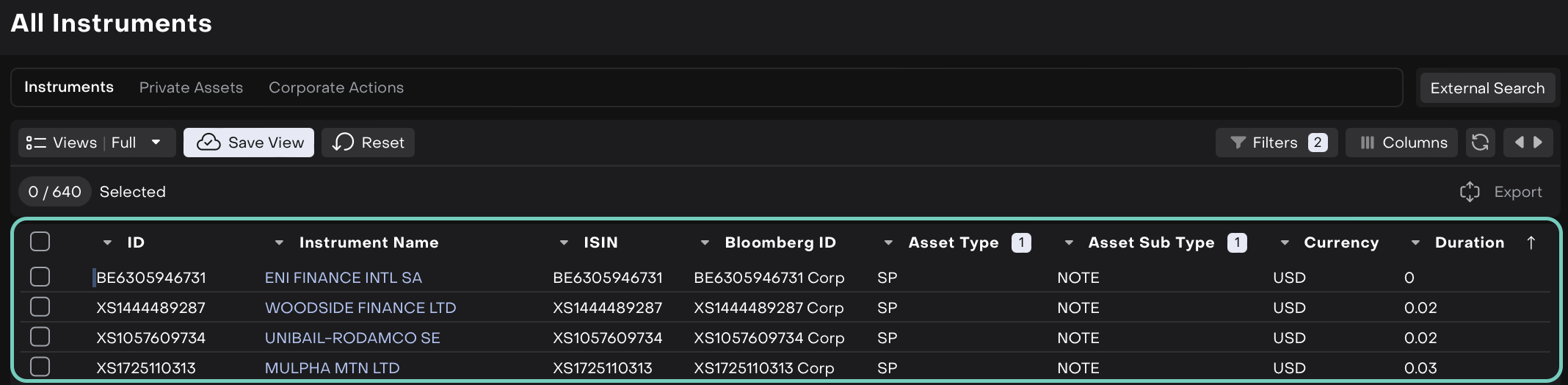

After filtering, you’ll see a list of Structured Notes.

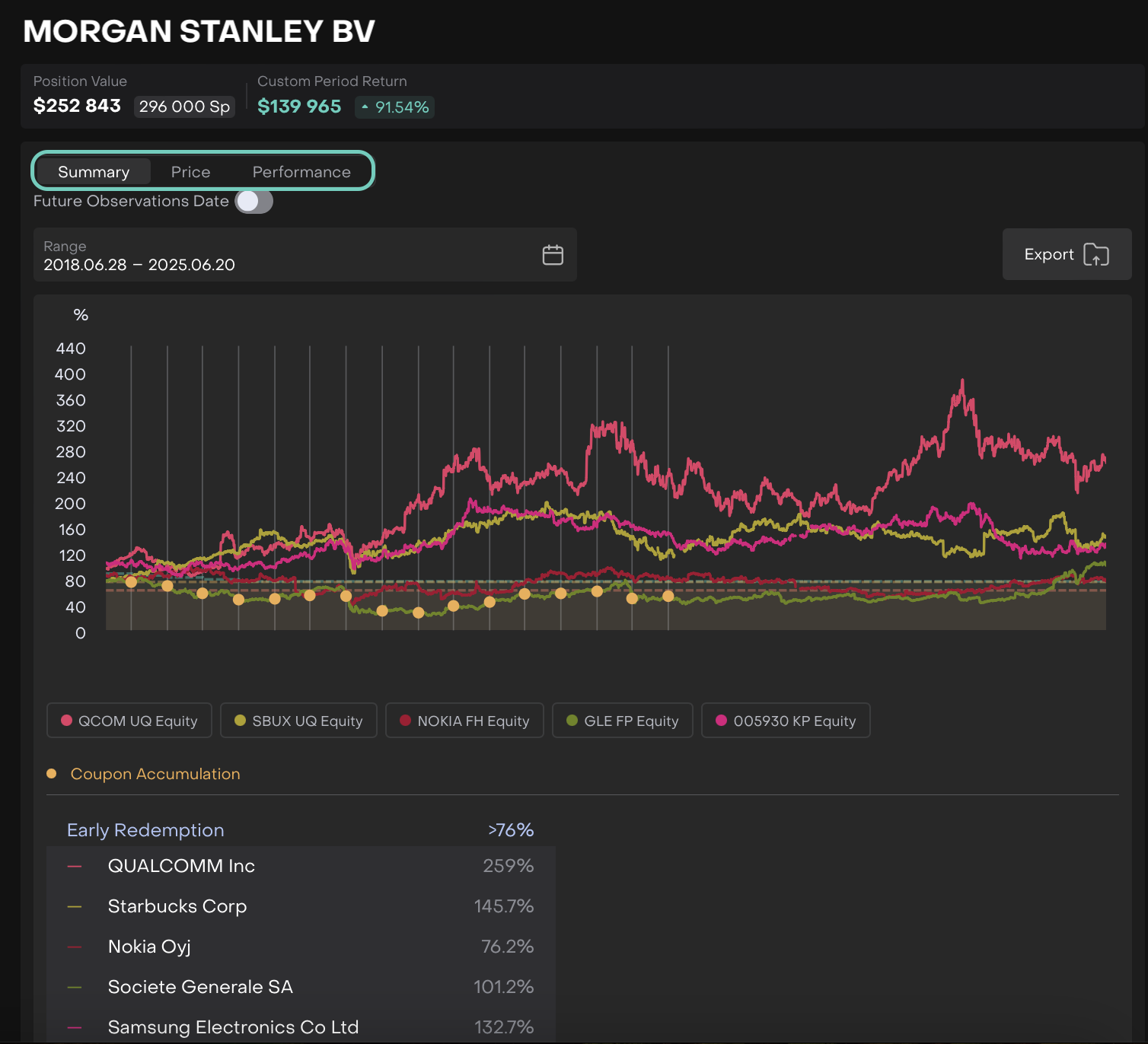

Click any record to view detailed information (example here: Morgan Stanley BV).

Then, find the Notes tab. All the main information about Structured Note is displayed here.

.png?inst-v=6d963370-3e6f-438e-bf89-d4ca7af0df77)

We’ve divided and explained Notes tab into 4 sections as below:

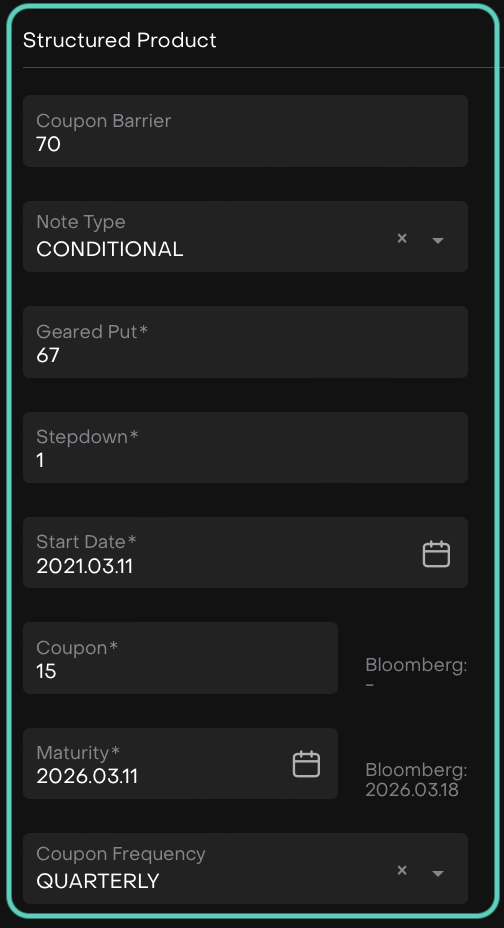

1. Structured Product

This section includes vital payout and term-related information.

Enter all required fields, especially those marked as mandatory.

Field | Description |

|---|---|

Coupon Barrier | A percentage threshold. If the underlier's price is above this barrier on the Observation Date, the coupon is paid. |

Note Type(*) | There are 3 types:

|

Geared Put(*) | Downside protection until a defined % level. Beyond that, investor absorbs losses. |

Stepdown(*) | Reduces the Autocall Level incrementally after each Observation Date. |

Start Date(*) | When the Structured Note was issued. |

Coupon(*) | Regular interest payment made to the investor. In FIXED-type Notes, it's paid on each Observation Date. |

Maturity(*) | The end date of the Structured Note lifecycle. |

Coupon Frequency | How often coupon payments are scheduled. Choose from:

|

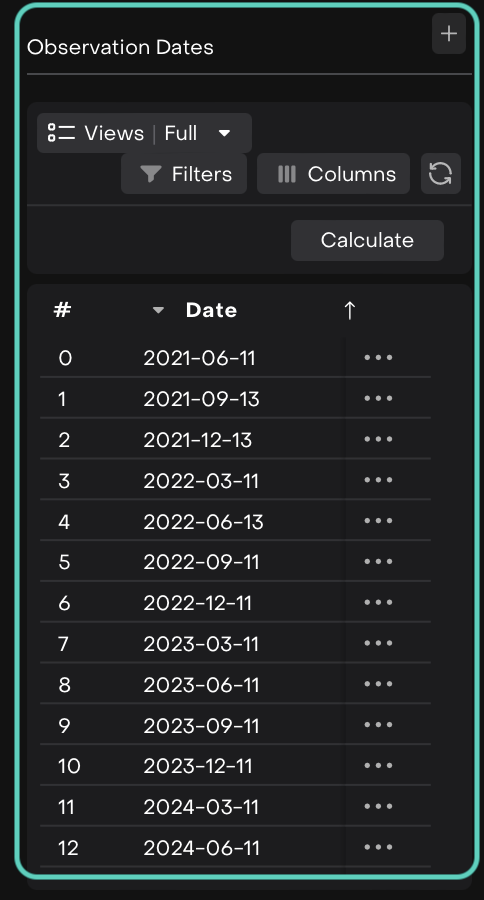

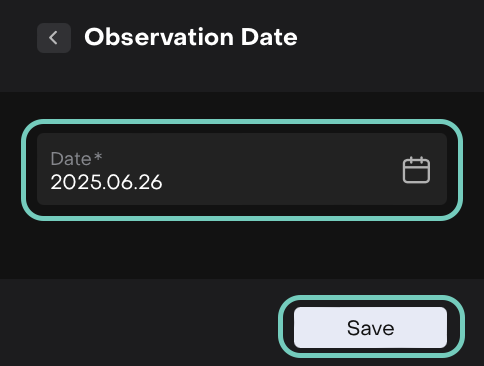

2. Observation Dates

You can find a complete list of observation dates for the Structured Note in the Observation Dates section of the Notes tab.

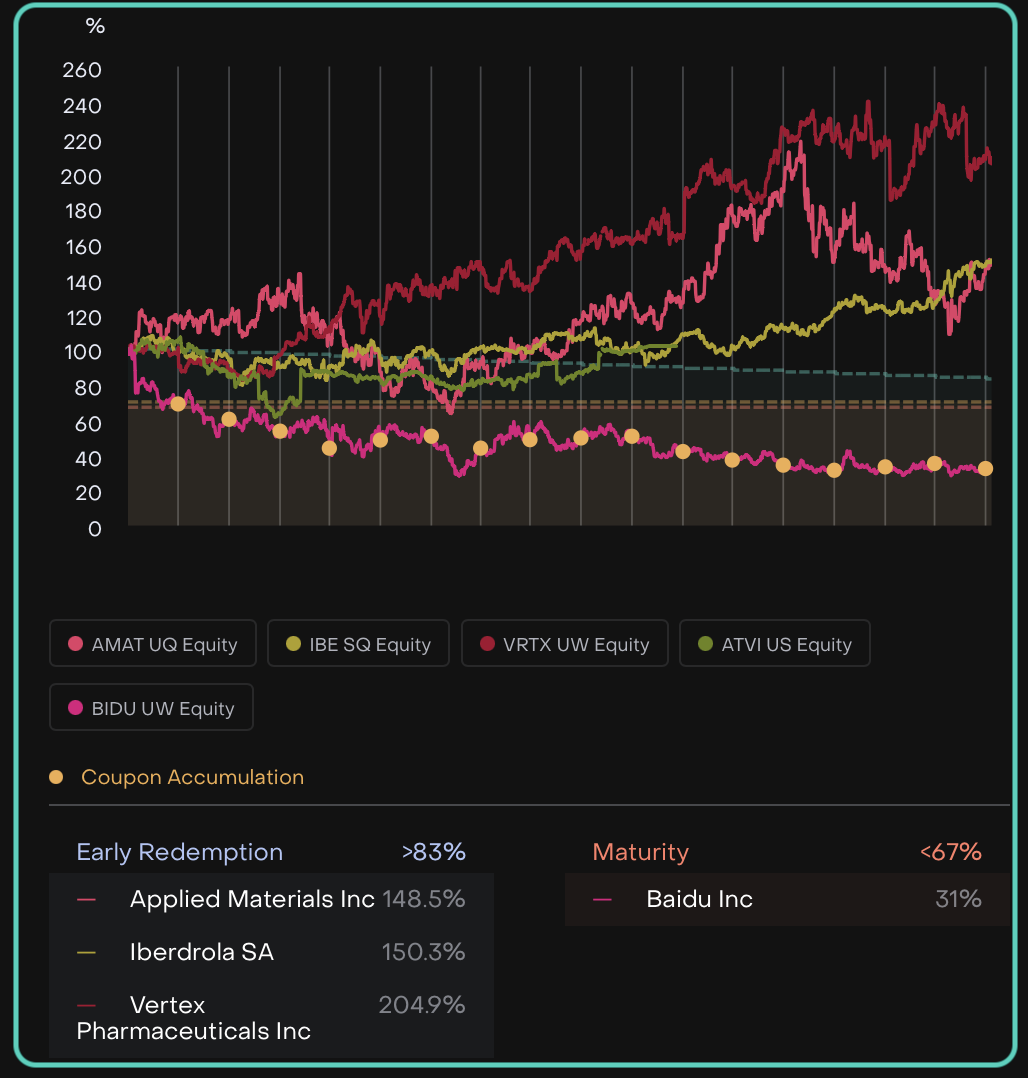

3. Chart (Performance View)

The Chart visually tracks how each underlying instrument performs over time against key thresholds.

What you’ll see on the chart:

Use this view to assess if and when coupons were paid or the Note triggered Early Redemption.

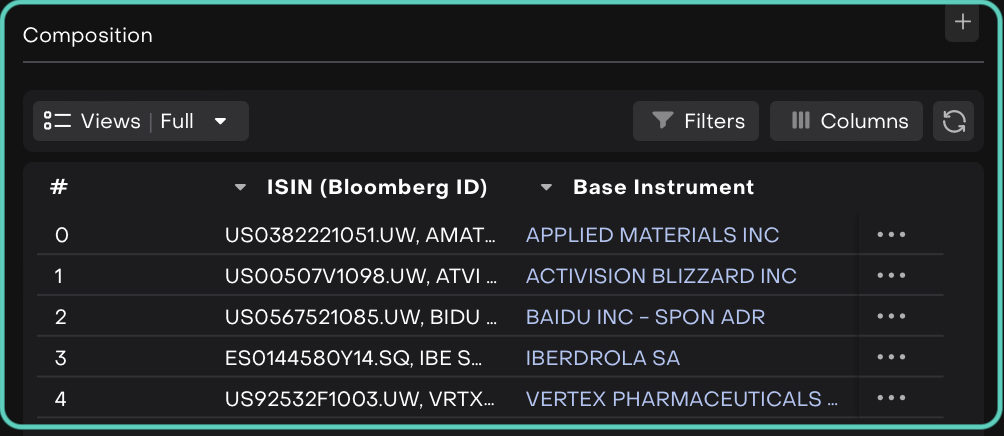

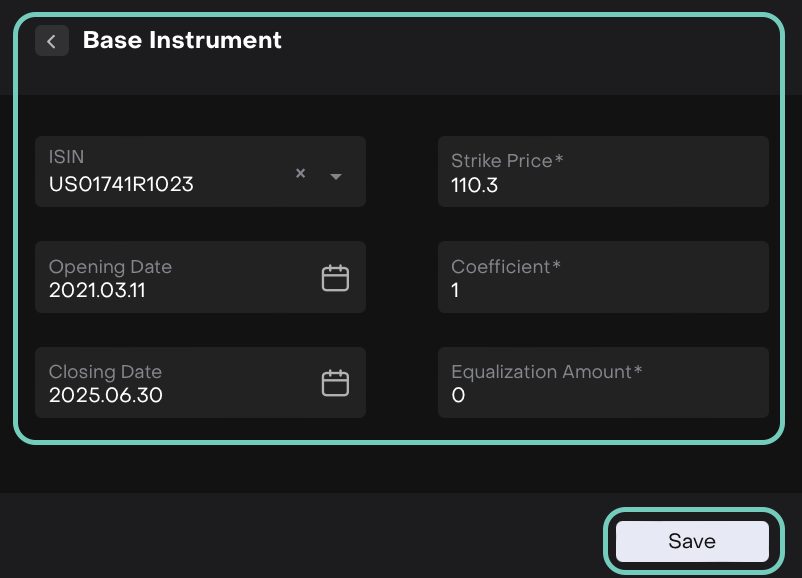

4. Composition

The Composition section gives a complete breakdown of the instruments included within the Structured Note.

To create new entry, click on

icon.

icon.

Enter all required fields, especially those marked as mandatory.

Fields | Description |

|---|---|

ISIN / Bloomberg ID | Unique identifier for each underlying instrument included in the Structured Note. |

Strike Price (*) | Reference price used to evaluate the performance of the component instrument. |

Opening Date / Closing Date | The start and end dates defining the active lifecycle of each instrument. |

Coefficient (*) | A weight assigned to each component, typically between 0 and 1. The sum of all coefficients should equal 1 (or 100%). |

Equalization Amount (*) | Adjustment value used to normalize the valuation or performance contribution of each component in the Structured Note. |

Click on Save button to submit the changes.

To Edit or Delete:

Click the “…” icon next to any item to edit/delete.

How a Structured Product (Note) Appears in Client Portfolios

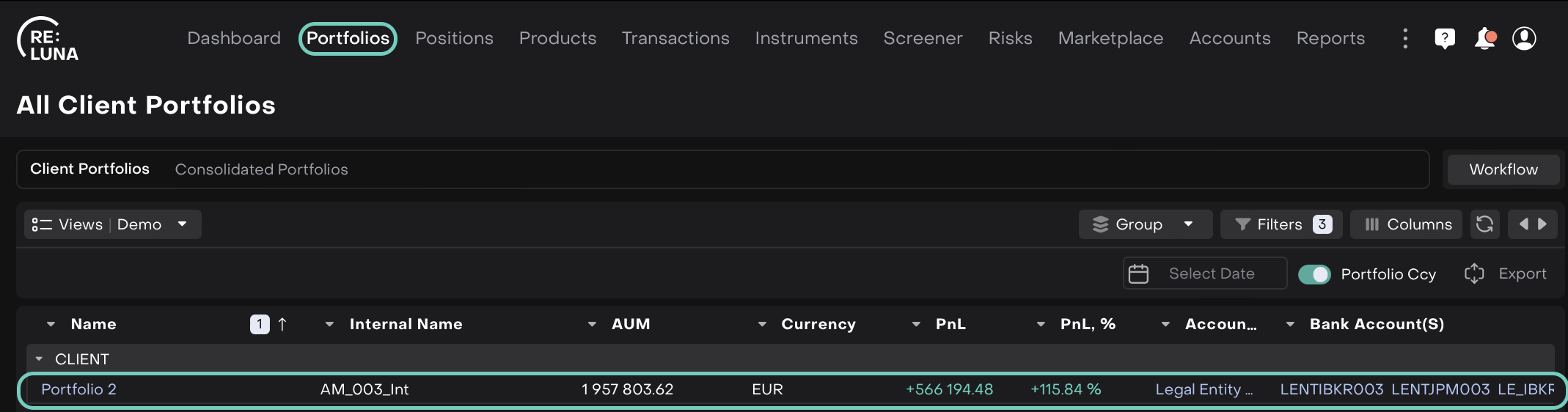

To check the status of a Structured Product (Note) in a client’s portfolio, follow these steps:

Go to Portfolios tab from the dashboard.

Click on the Client Portfolios tab and select the Portfolio you want to review.

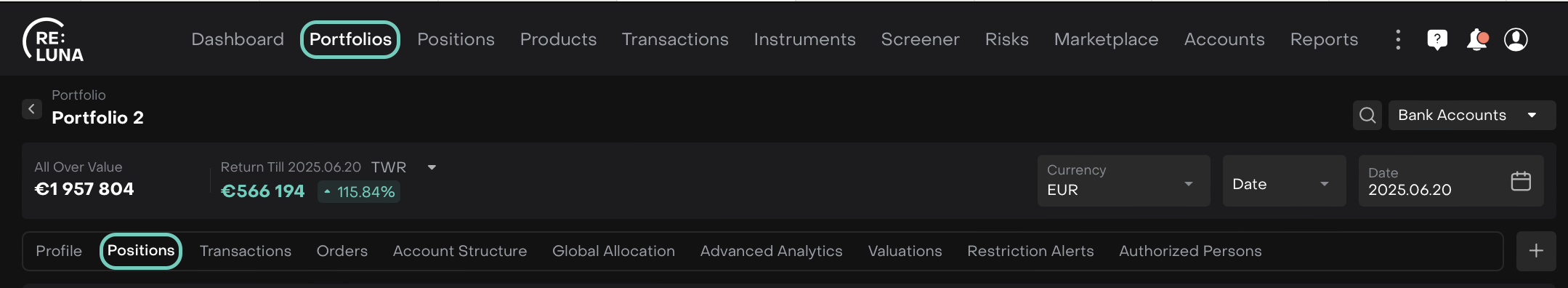

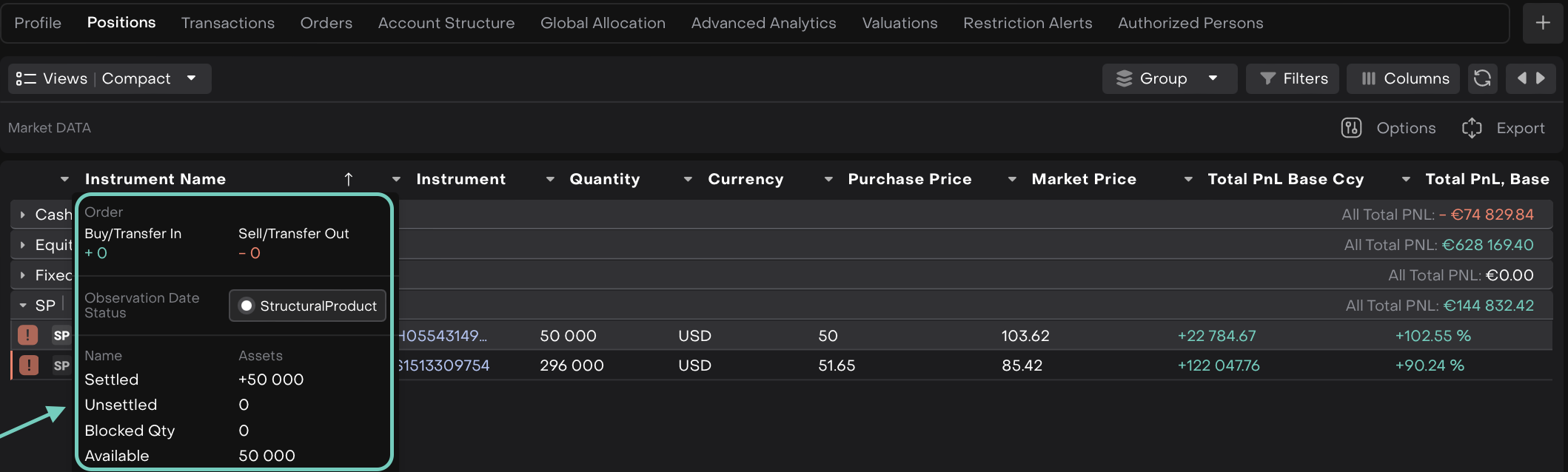

In the portfolio window, switch to the Positions tab.

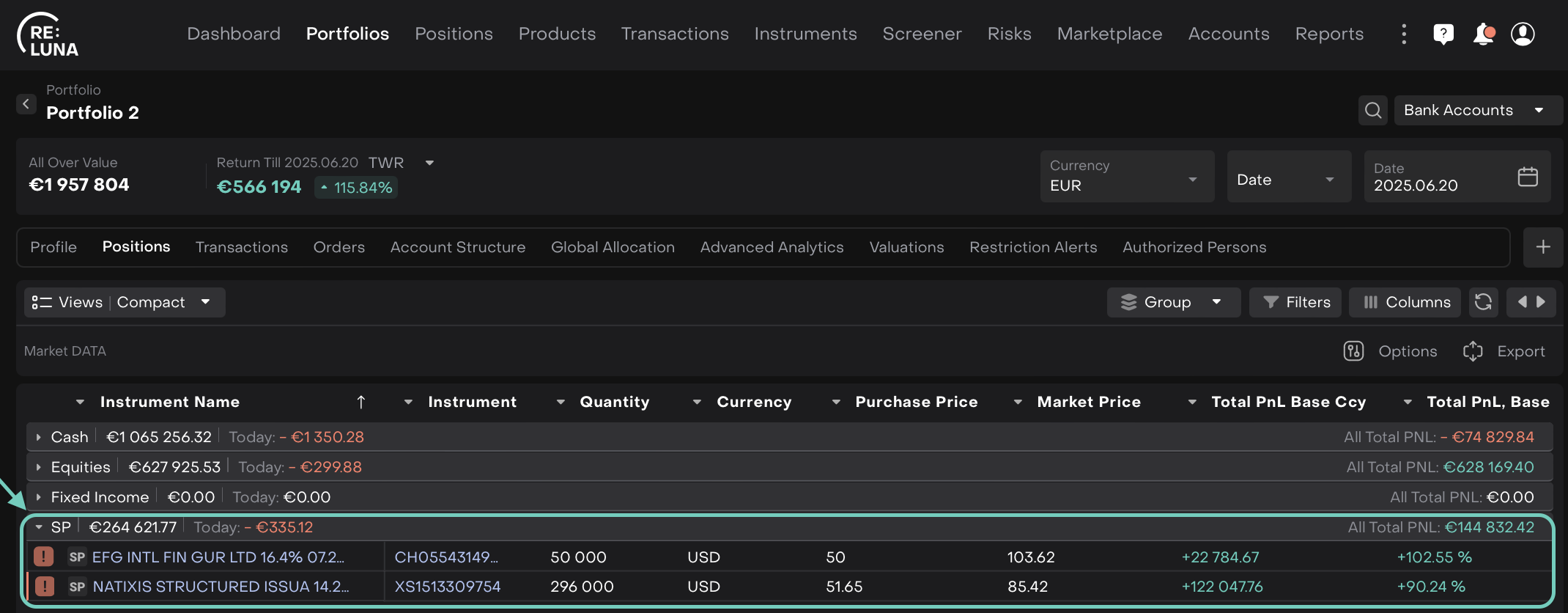

Locate the SP (Structured Product) instrument in the list and expand it.

Hover over the

icon next to the instrument to view its key information.

icon next to the instrument to view its key information.A pop-up window will appear, displaying the main status and details of the Structured Note (as shown in the example below).

Or,

To view more details about its performance, click on the Instrument Name. This opens a side panel showing Summary, Price and Performance positions.

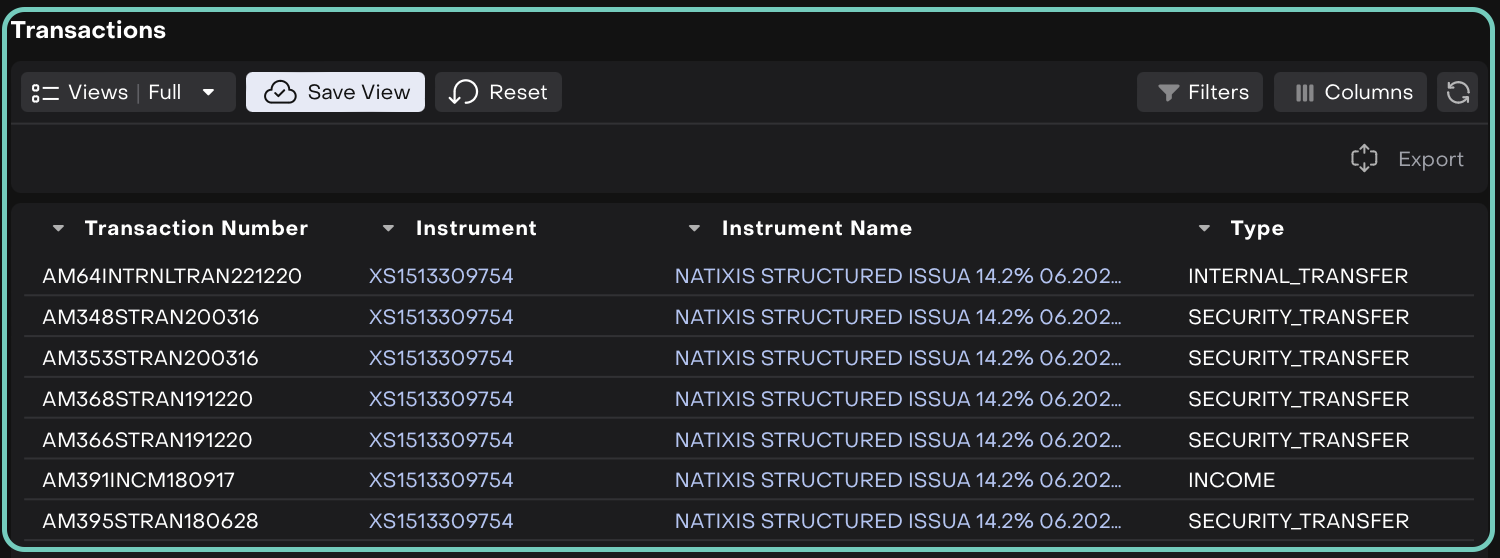

The side panel also includes a list of related Transactions for the selected Structured Note.