Manage Investment Profiles & Restrictions

AVAILABLE IN:

Introduction

The platform provides integrated tools for managing Investment Profiles, enabling organizations to:

Define and enforce portfolio restrictions.

Establish and monitor risk levels.

Align portfolios with internal policies and regulatory expectations.

This module is designed for risk managers, compliance officers and senior stakeholders responsible for investment oversight. With built-in monitoring, rule enforcement and validation mechanisms, it ensures that risk is not only measurable but also actively managed.

What’s Included in the Investment Profile Module

✅ Investment Profile setup and configuration

✅ Portfolio-level restrictions and limits

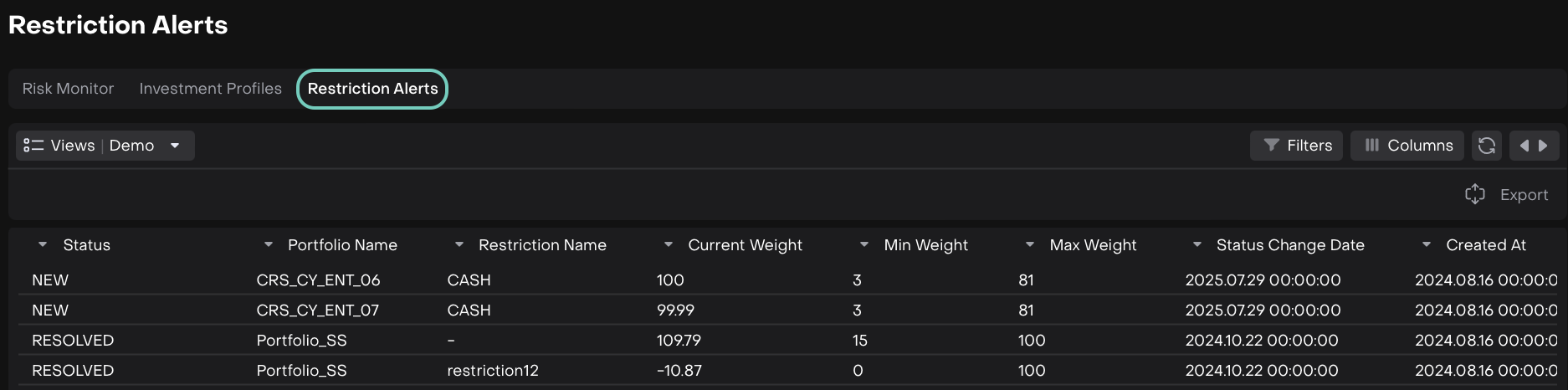

✅ Restriction alerts and breach notifications

✅ Daily portfolio monitoring

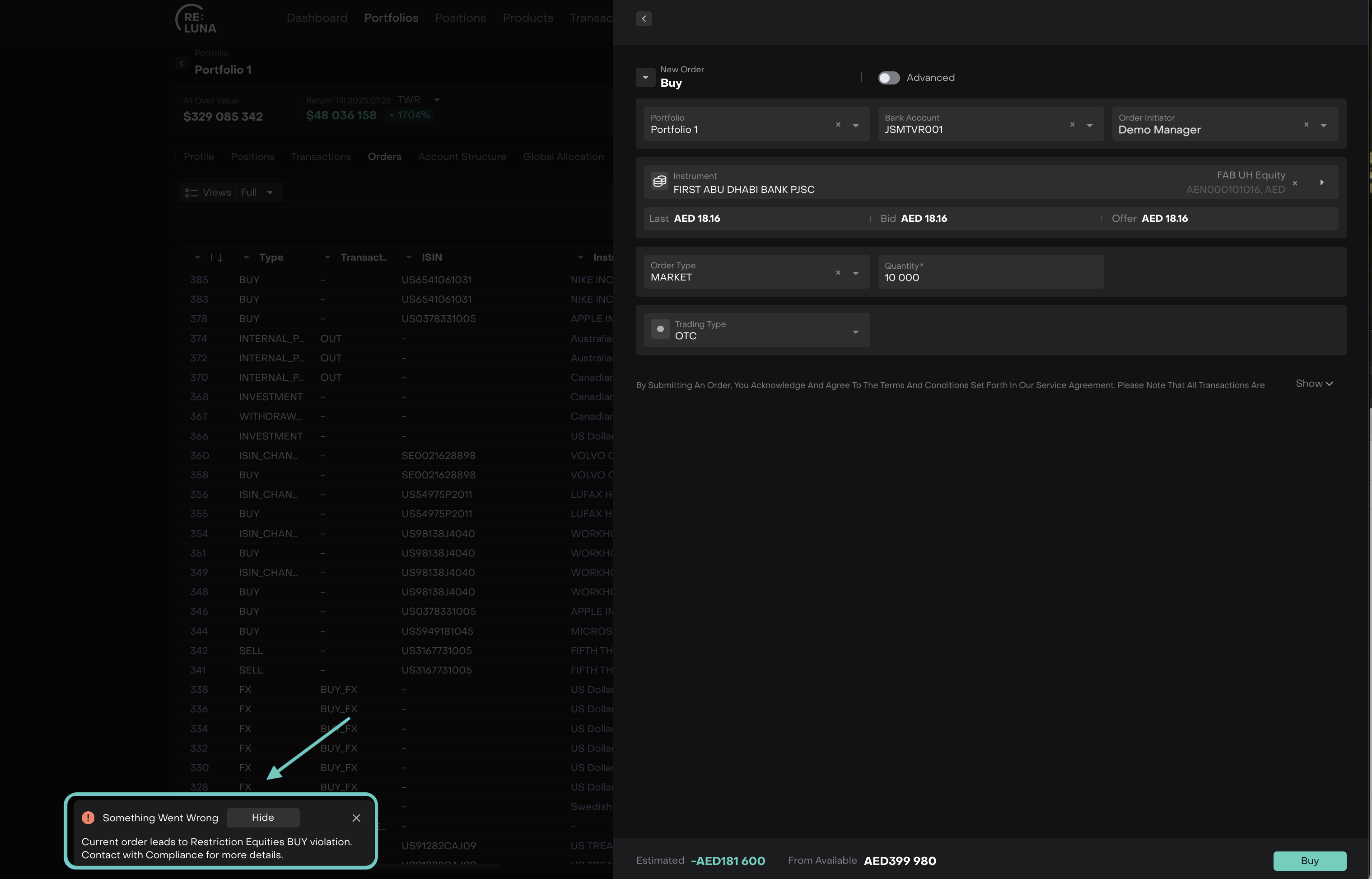

✅ Pre-trade validation and breach blocking

Permission Requirements

Platform Objects | Permission IDs |

|---|---|

Investment Profiles |

|

Restriction Alerts |

|

Creating Investment Profiles

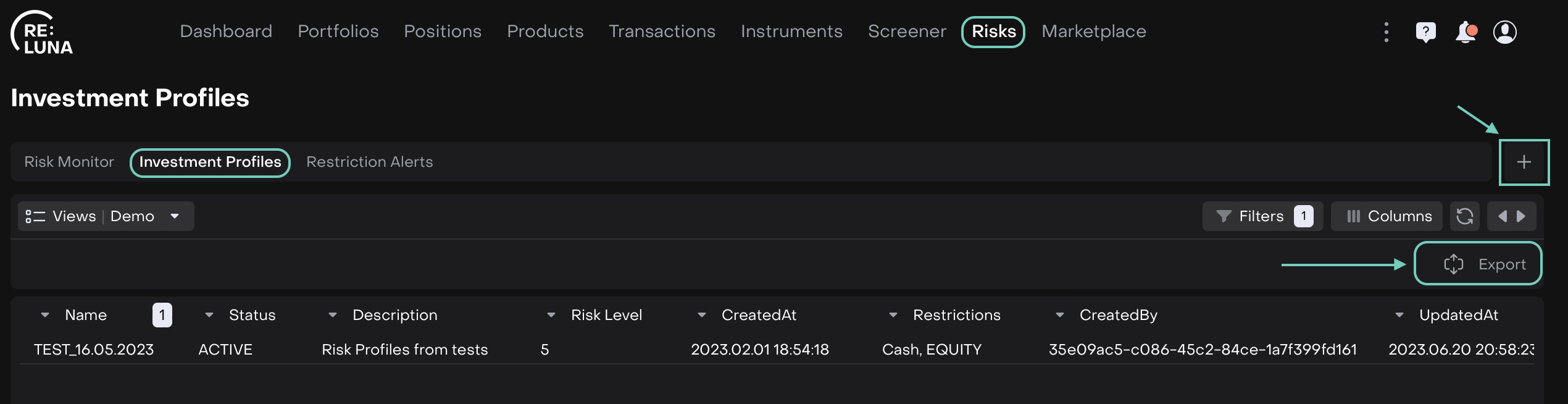

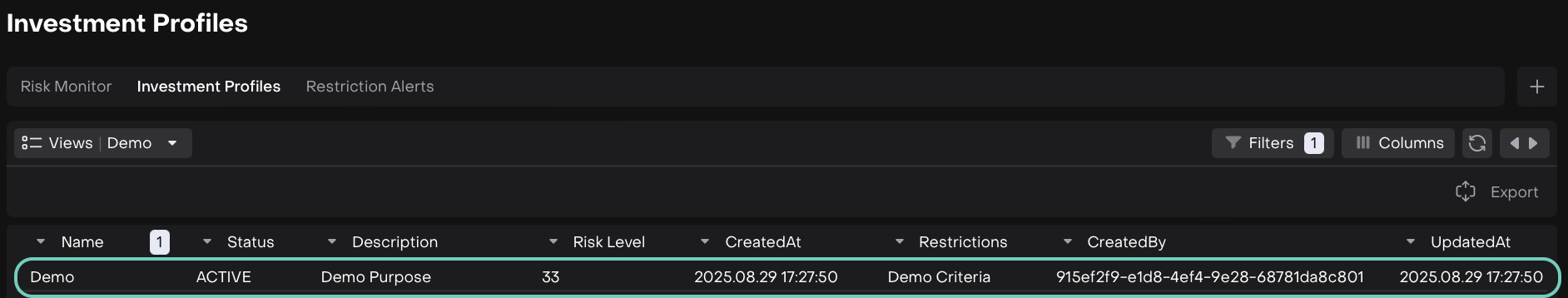

Investment Profiles are created and managed under: Risks > Find Investment Profiles tab.

Click the ➕ icon to add a new profile.

Or,

Use the Export option to download and review profiles in Excel format.

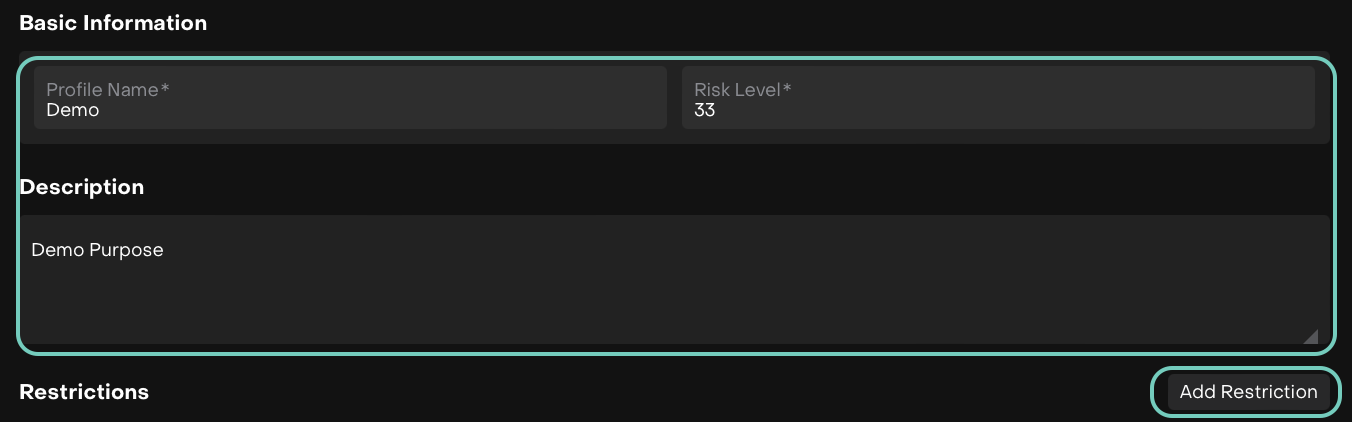

A form opens. Fill in Profile Name(*), a unique Risk Level(*) from 0-100 and Description.

Click on Add Restrictions.

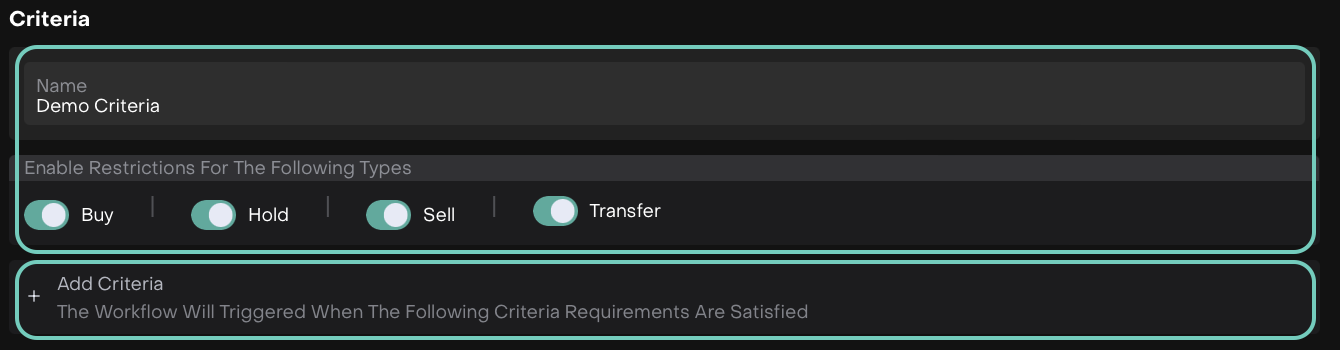

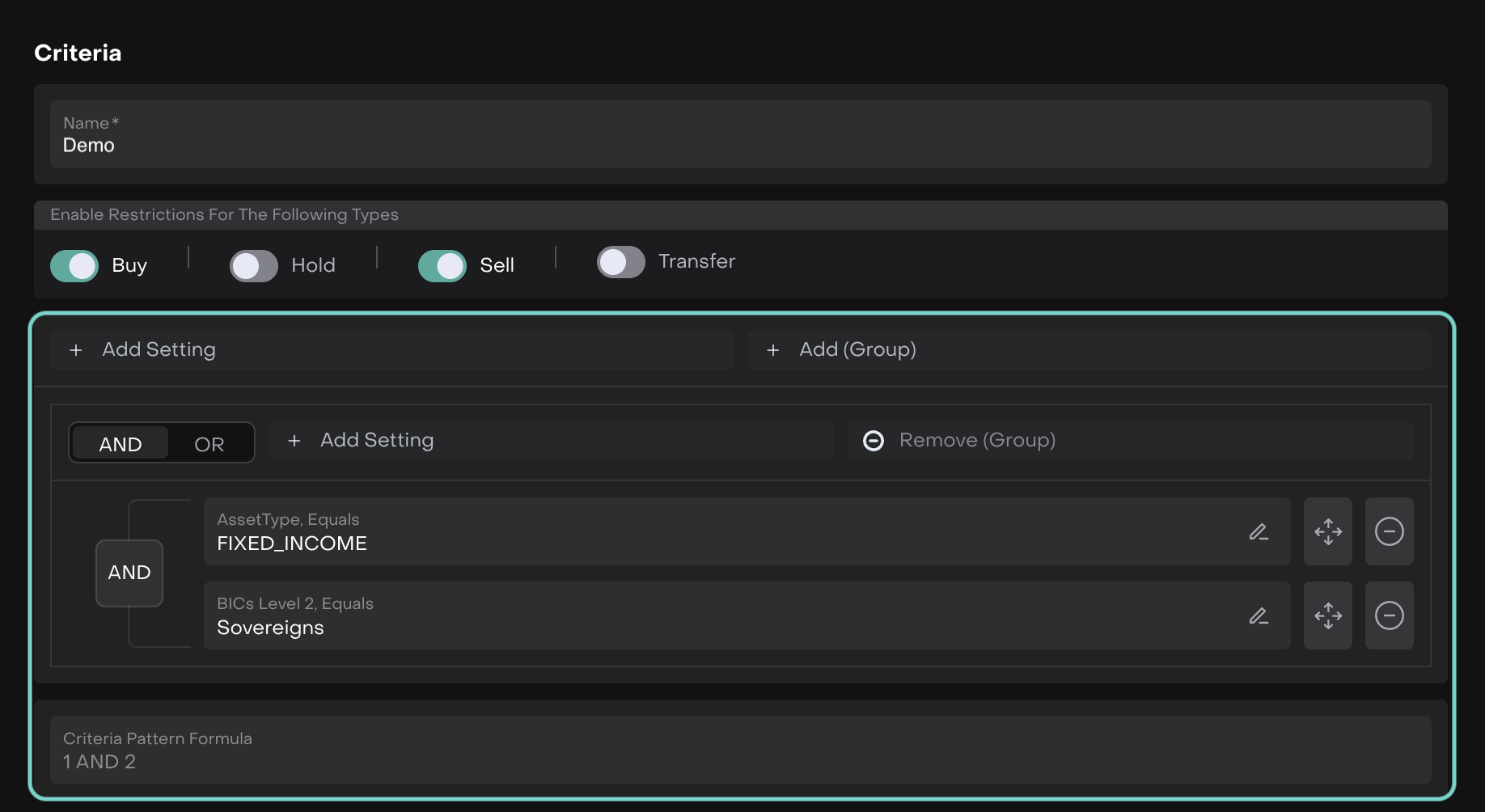

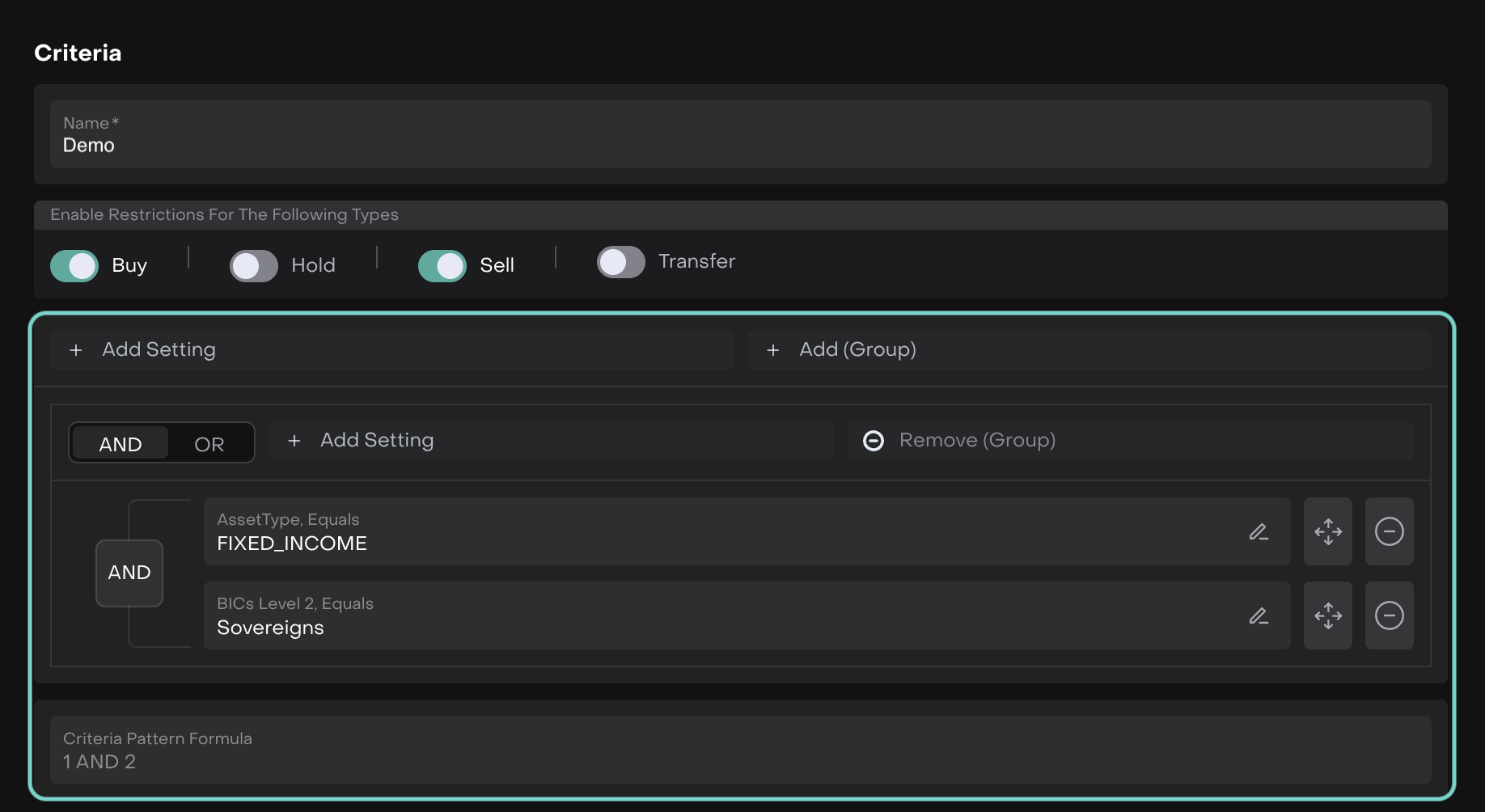

Fill in the Name(*) and Enable Restrictions for the following types: Buy/Hold/Sell/Transfer and then, click on Add Criteria.

Now, fill in the System Field(*) and select its Criteria Operator(*) along with its Value(*)

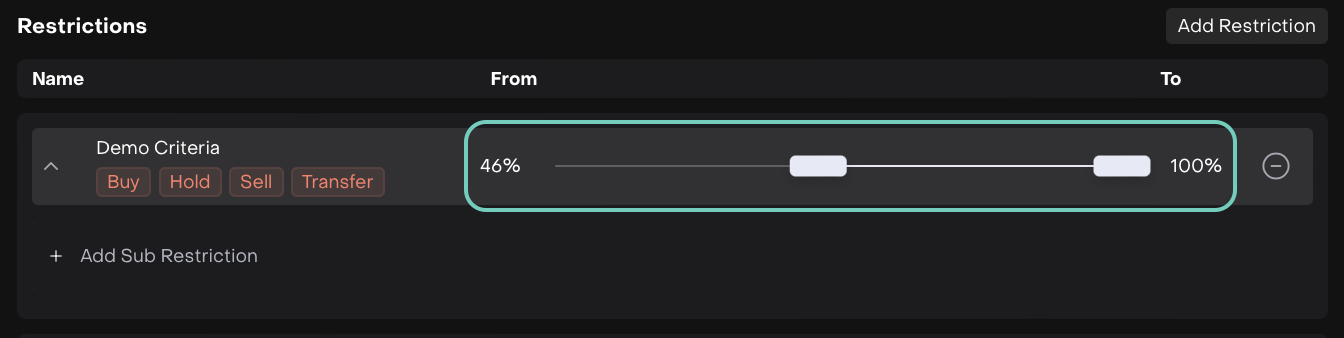

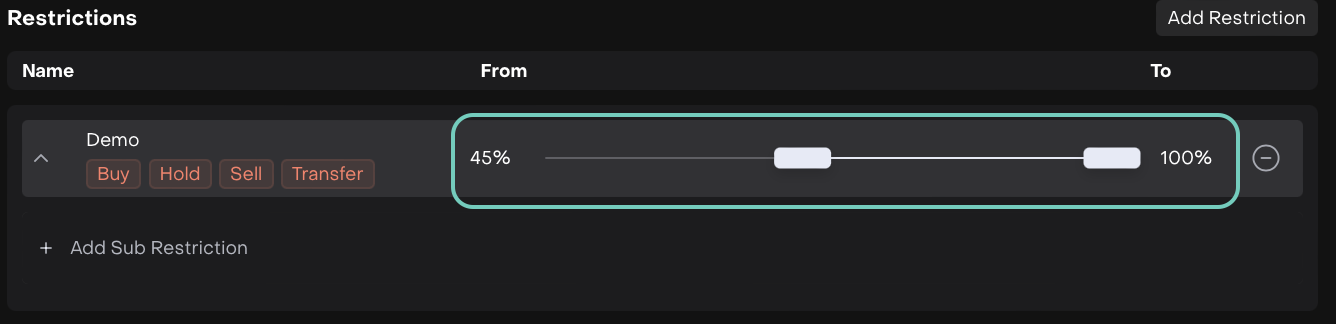

Click Save and set up the percentage of the instruments that shall fall under the criteria.

Or,

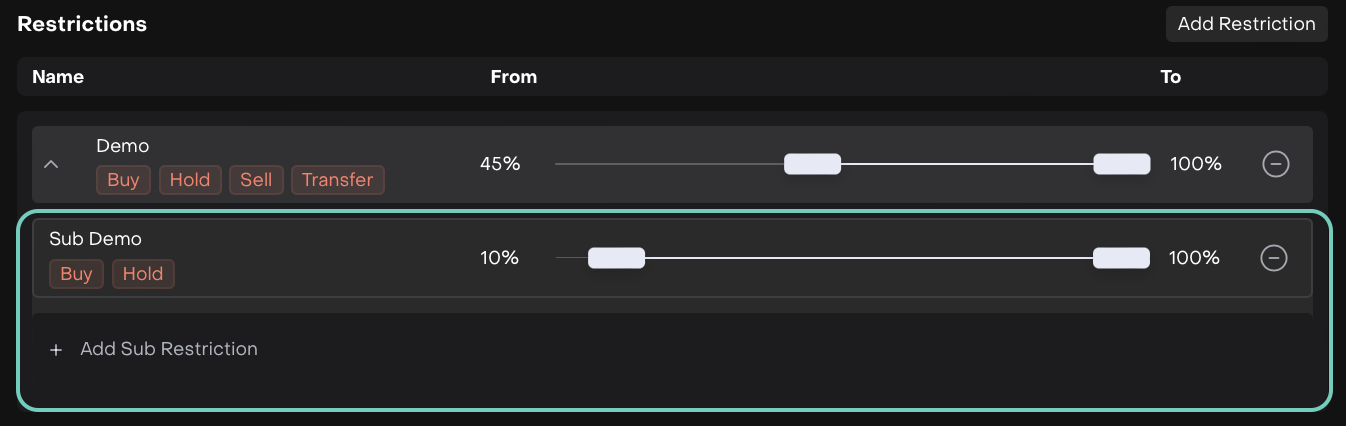

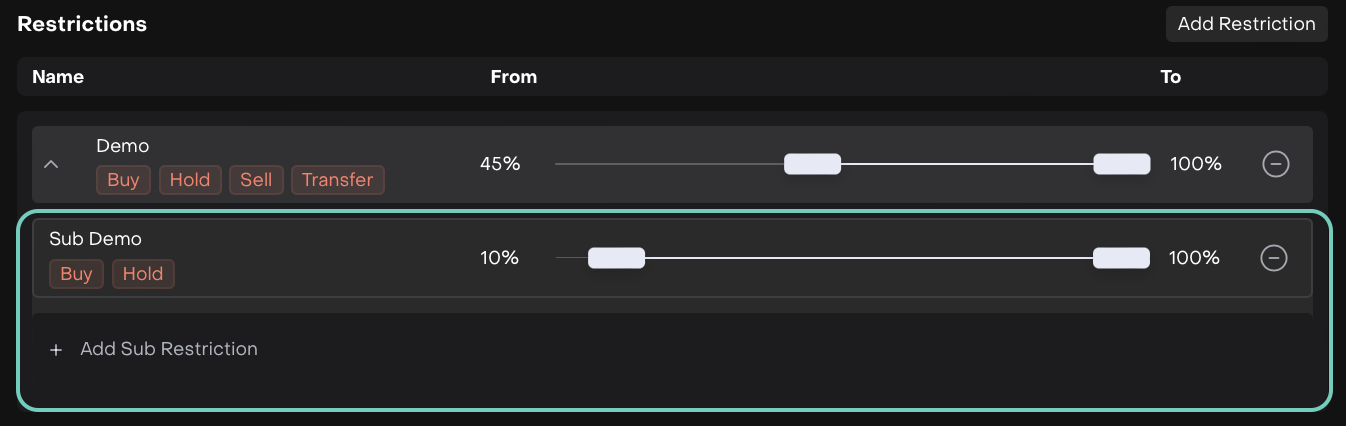

You can add Sub Restriction and set its Criteria.

Click Create to confirm.

Assigning a Investment Profile to a Mandate

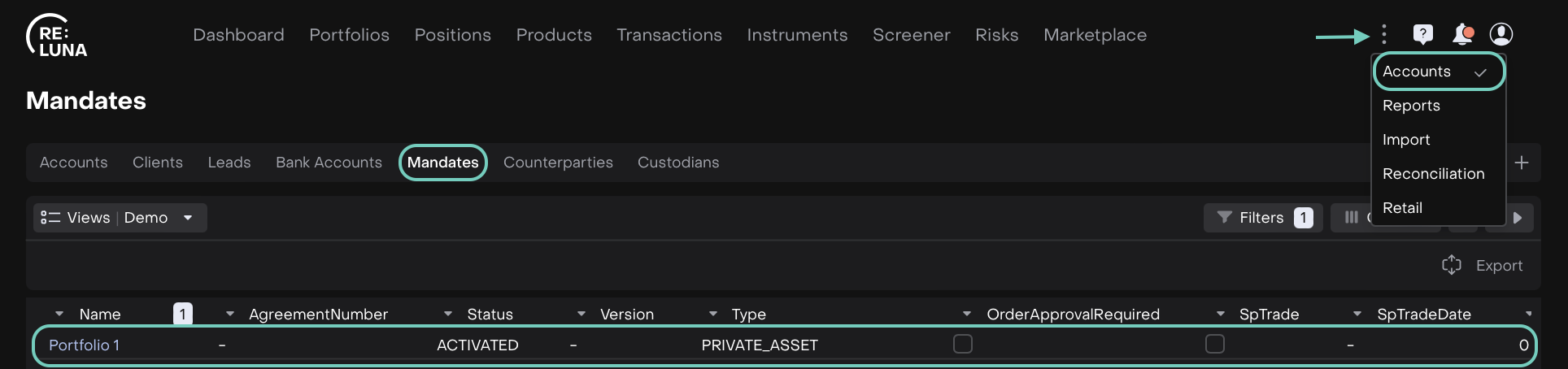

You must first create a Mandate and fill in all required fields(*).

Go to Accounts > Open the Mandate Form.

Go to the Investment Profile tab.

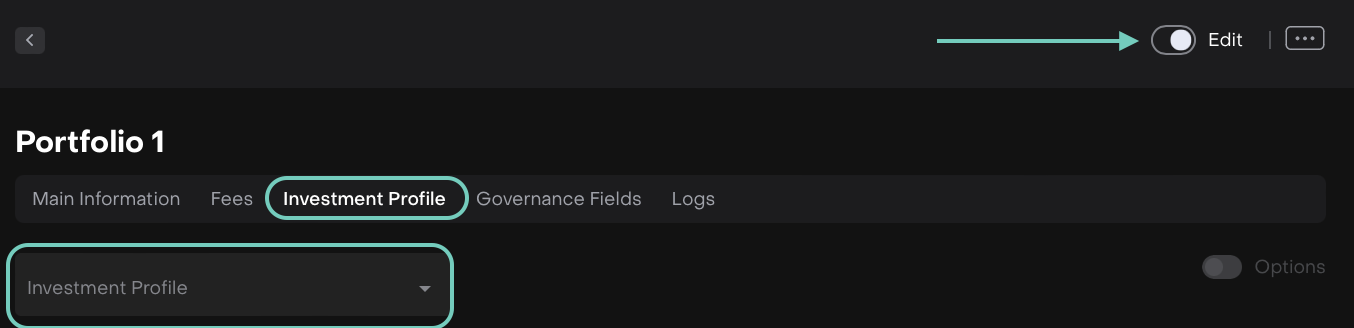

Click on the Investment Profile dropdown field and platform displays a list of active profiles.

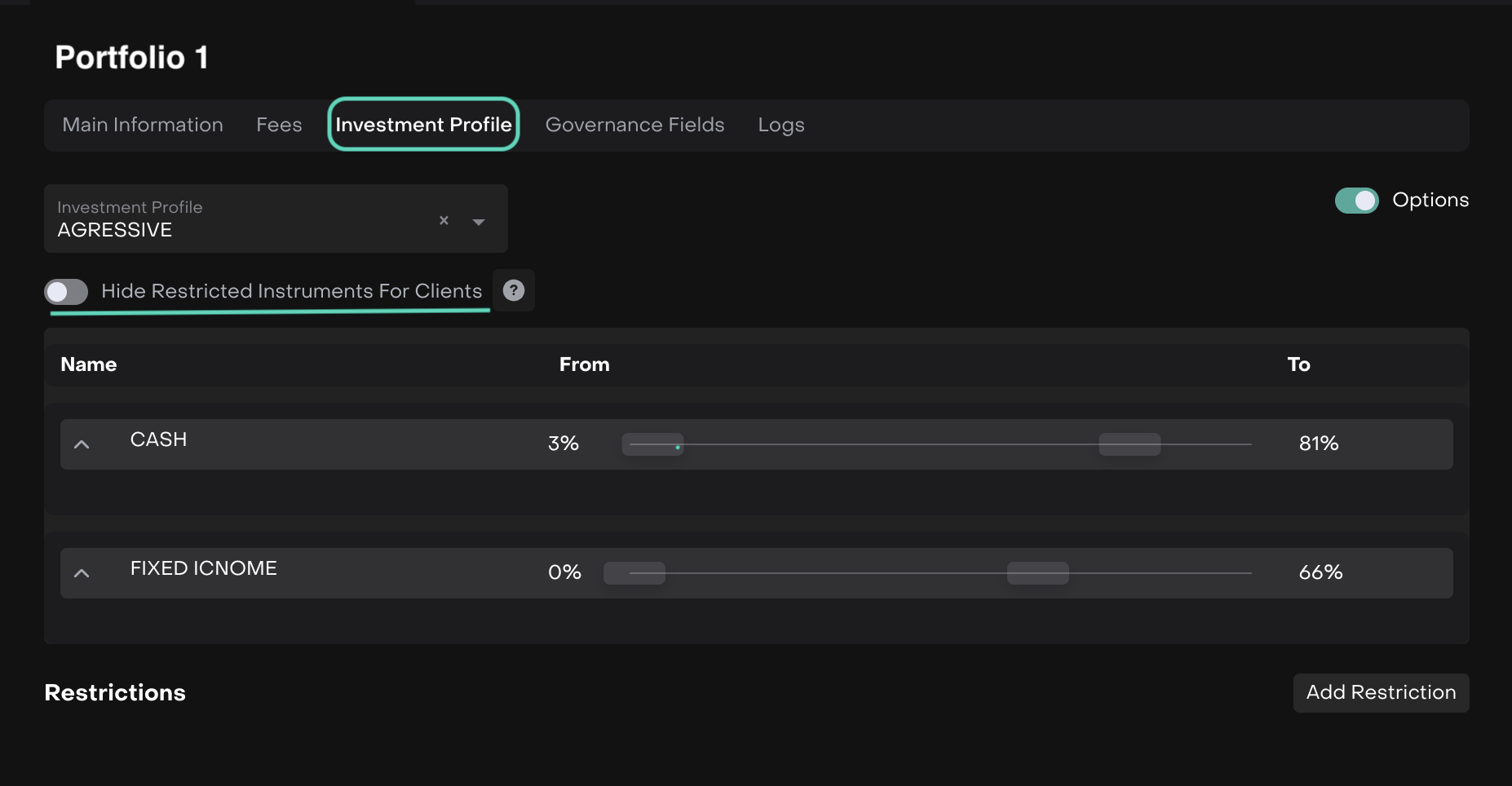

Select the appropriate profile from the dropdown list.

Only one active Investment Profile can be assigned to a mandate. If no active profiles exist, the selection list will appear empty.

Toggle the available Options ON/OFF to review.

Or,

Toggle Hide Restricted Instruments for Clients ON/OFF.

When you enable this option, any instruments with 0% restrictions will be hidden from your clients when they search during order creation. Your clients will only see instruments that are eligible for trading under the Investment Profile (those with no restriction or more than 0% allowed).

To add Restrictions, click on Add Restriction and Enter Name(*)

Set up the Criteria and enable Restrictions for the following types: Buy/Hold/Sell/Transfer.

Click on Add Settings/Group and fill in System Field(*), Value(*) and Select Criteria Operator(*).

Click Save and set up the percentage of the instruments that shall fall under the criteria.

Or,

You can add Sub Restriction as well along with its Criteria.

Then, once filled in, click on Save.

Active vs Passive Breaches – Platform Behavior

In risk-managed investment platforms, breaches of portfolio restrictions are categorized as either active or passive. Understanding this distinction is critical for proper control and timely response.