Manage Client Valuation Reports

AVAILABLE IN:

Introduction

The Client Valuation Report (CVR) provides a comprehensive, consolidated summary of a client’s portfolio valuation, including Assets Under Management (AUM), risk profile, asset allocation and recommendations.

It consolidates client and portfolio information into a PDF report, enabling advisors and managers to present insights to clients in a clear and structured format.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

AUM (Assets Under Management) | The total market value of assets managed on behalf of a client. |

Client ID | A unique identifier assigned to each client. |

Corporate Actions | Events such as dividends, interest payments, or redemptions that affect portfolio holdings. |

Coupon Projection (xls) | A report containing a list of future payments for bonds related to the selected client bank account over a specified period. |

Last Send Status | Outcome of the last attempt to send a report (e.g., Sent or Send Error). |

MWR (Money Weighted Return) | A PNL calculation method that factors in the timing and size of cash flows to measure investment performance. |

A file format (Portable Document Format) used to present reports in a consistent and printable layout across devices. | |

P&L Report (xls) | A report on client income for a specific period, separately reflecting income from asset sales or redemptions, as well as dividend/coupon payments. |

Portfolio | The client’s set of investments across asset classes. |

Portfolio Name | Name of the portfolio associated with a report or transaction. |

Report Block | A report section (e.g., Performance, Trades, Cash Movements) that you can include or exclude. |

Request Date Time | Date and time when a report was requested. |

Risk Profile | A measure of a client’s investment risk tolerance, used to guide portfolio strategy. |

Send Error | A status indicating that sending the report to a client failed. |

Skip Empty Pages | An option to remove report sections with no data to keep the report concise. |

Start Date | Start date of the reporting period. |

Status | Current state of the report (e.g., New, Approved, Rejected). |

TWR (Time Weighted Return) | A PNL calculation method that measures performance independently of external cash flows, ideal for comparing manager performance. |

End Date | End date of the reporting period. |

👉 New to some terms? Check out our full Platform Glossary for more.

Permission Requirements

Tab | Feature | Access Level |

|---|---|---|

Reports | All reports | View, Modify, Create |

Client Reports | Client Valuation Report (CVR) | View only |

Contact Support if you cannot access a report you are authorized to view.

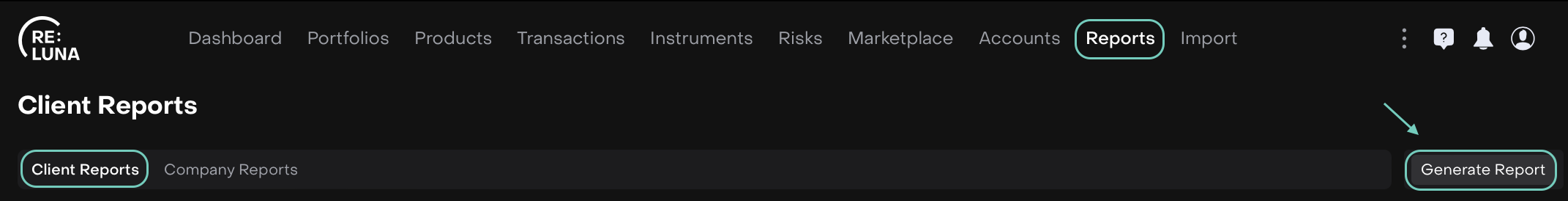

Where to Find Client Reports

Navigate to Reports from the dashboard.

Find Client Reports tab and click Generate Reports to create new.

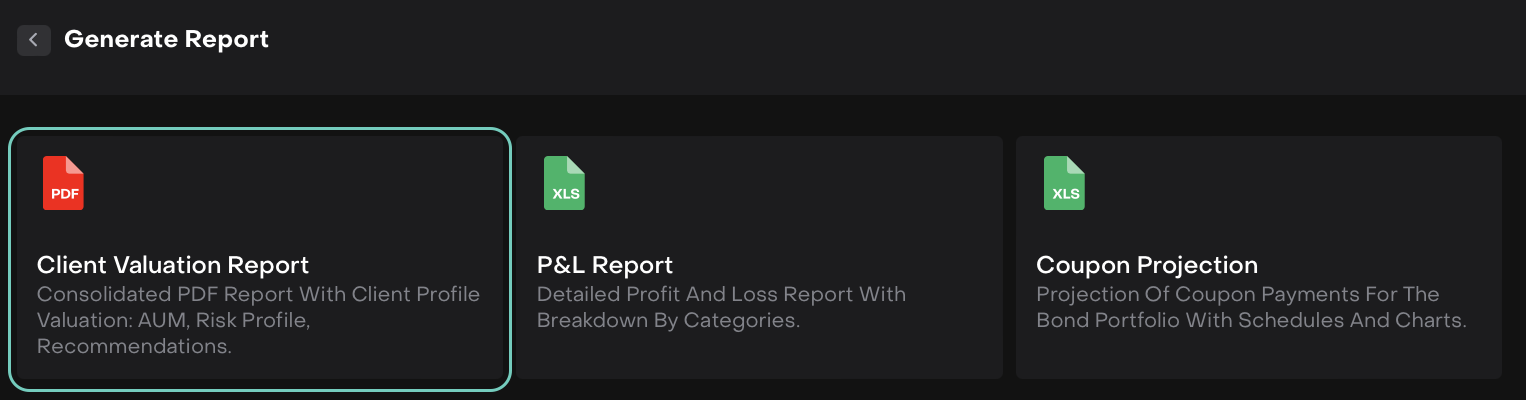

Choose Client Valuation Report (CVR).

The platform will open with a two-step setup:

Step 1: Customization

Step 2: Portfolio

Create Client Valuation Report

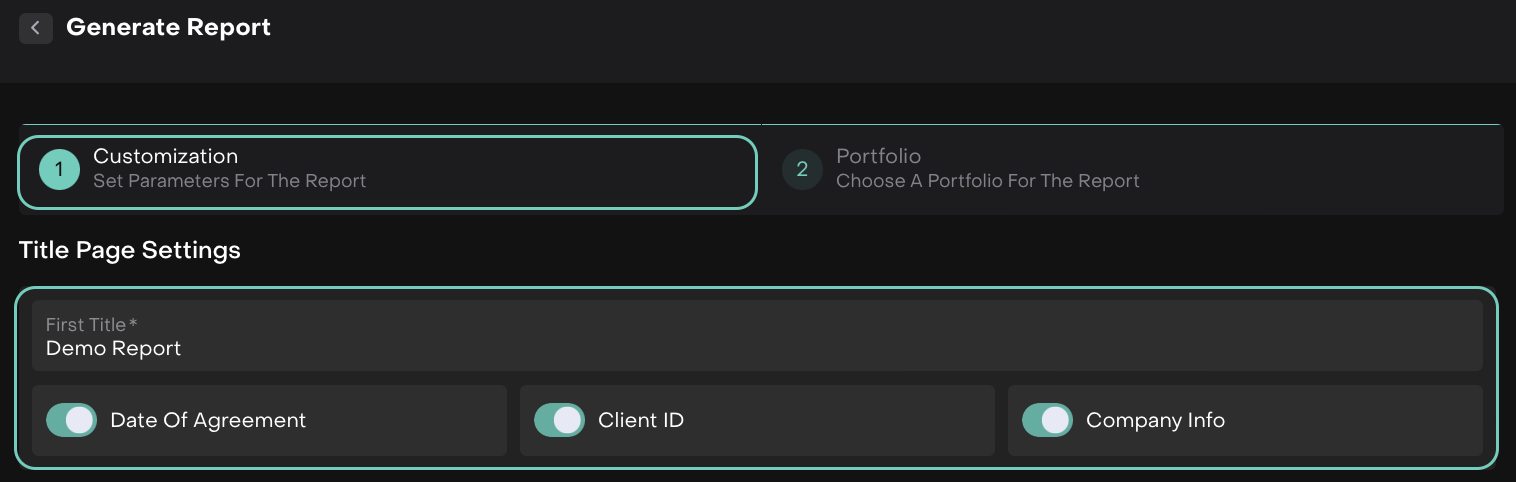

Step 1: Customization

In this step, you define the structure, layout, content of the report and set calculation parameters.

Title Page Settings: Configure the main details shown on the report’s title page.

If you wish to exclude related manager/company details, disable Company Info.

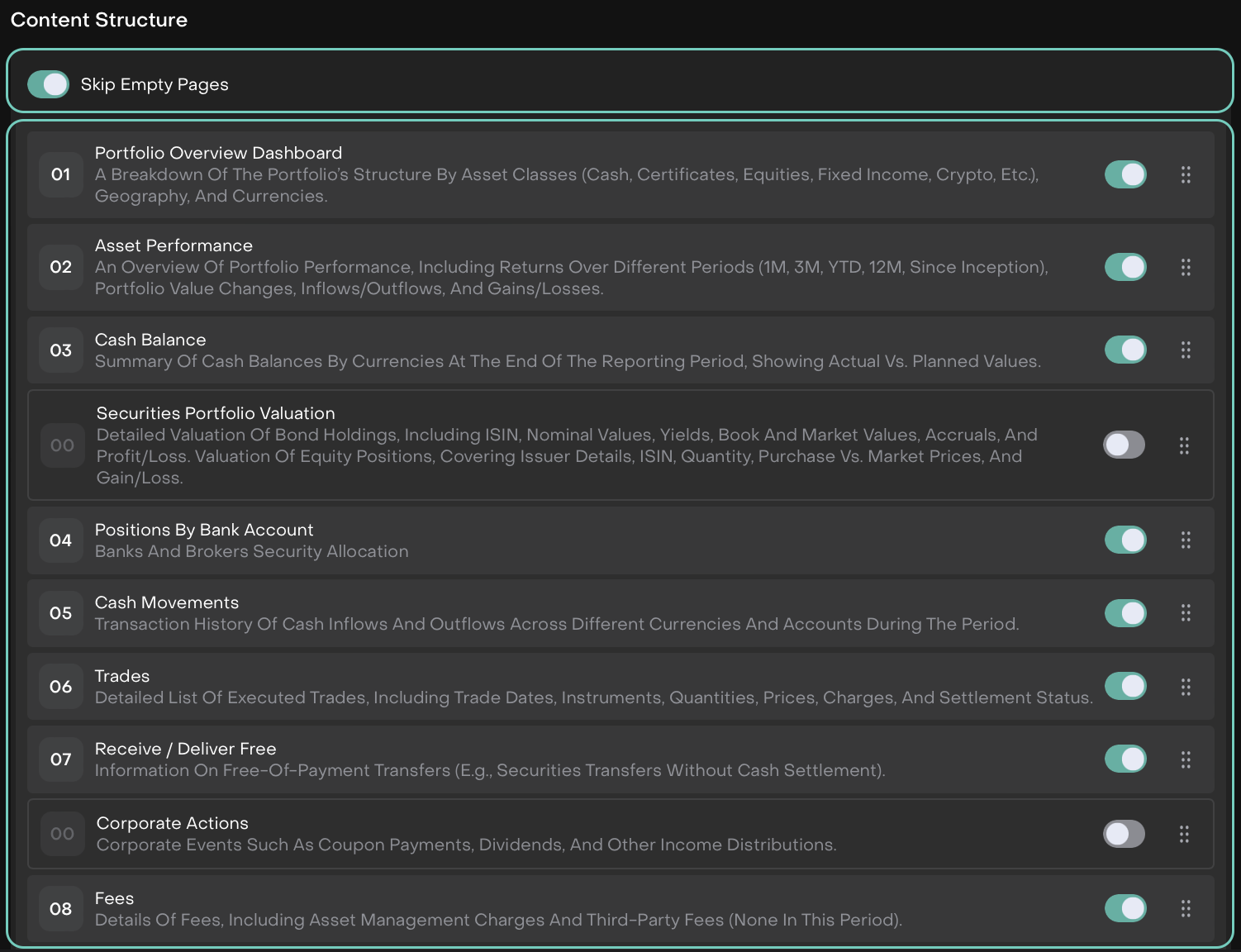

Content Structure: Use the Content Structure section to select which data blocks appear in the report. Each section can be toggled ON/OFF or rearranged by drag and drop.

Additional Option:

Skip Empty Pages – Enable this toggle to exclude sections on report without data.

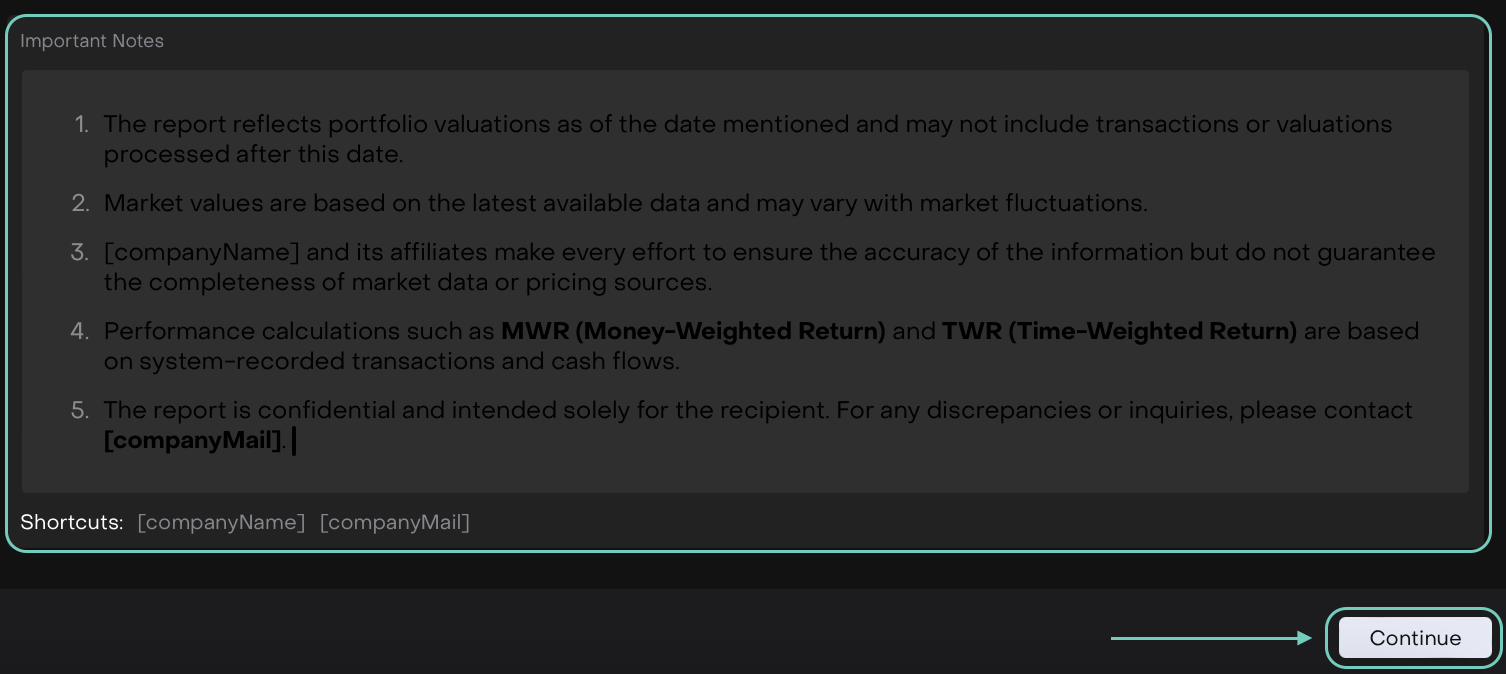

Important Notes: These notes will appear at the end of your downloaded report. You can edit or keep them as standard disclosure text.

Click on Continue to move to Step 2.

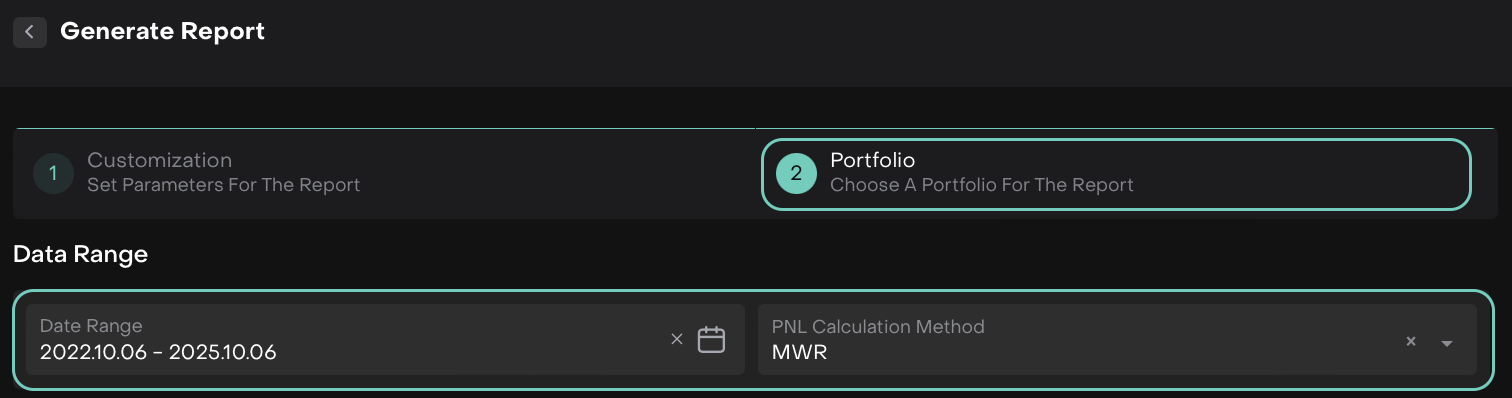

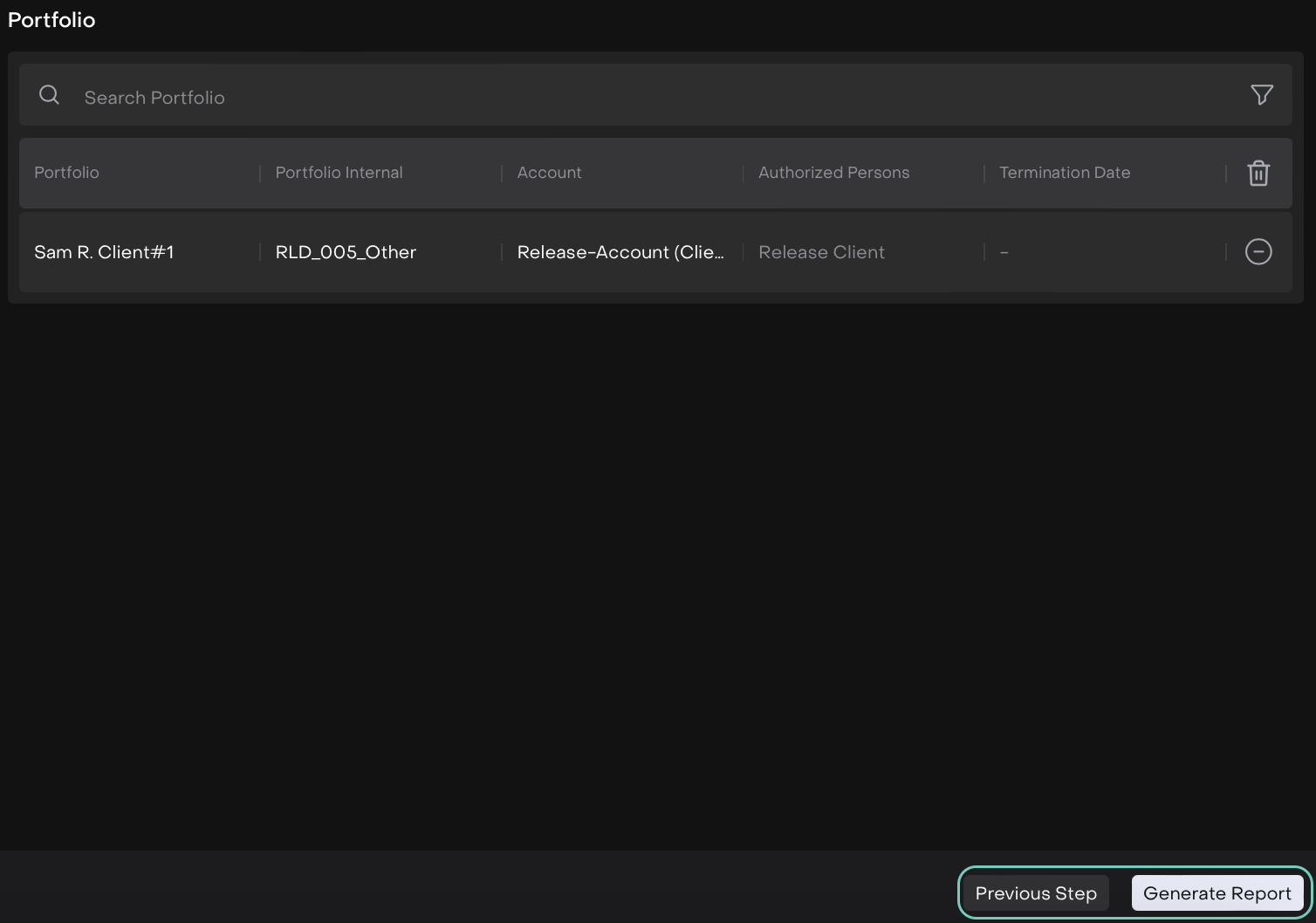

Step 2: Portfolio

Once report customization is done, move to Portfolio to select the relevant portfolio(s).

Date Range must be in the past; current or future dates cannot be selected.

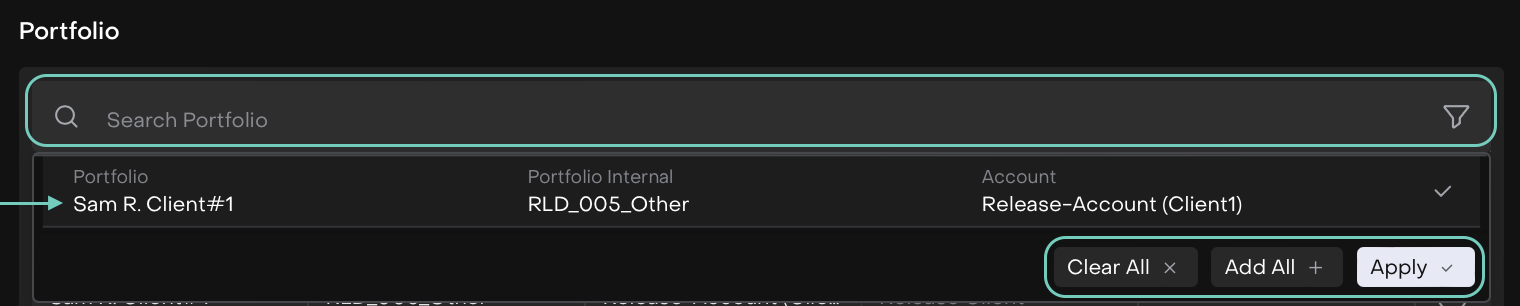

Portfolio(s) Selection:

Use the search bar to find portfolios by name.

Alternatively, click on it to view and select from the list of available portfolios.

You can also apply filters to narrow down your selection, if needed.

Actions:

Add All – Includes all available portfolios in the report.

Clear All – Removes all current selections.

Apply – Confirms and saves your selected portfolios.

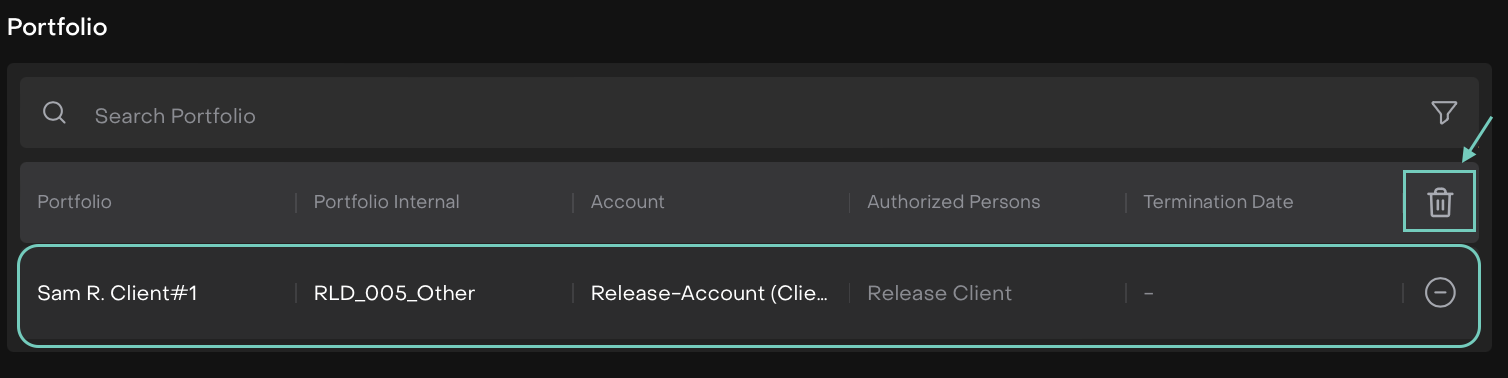

Once applied, the selected portfolios will appear in the list.

To make changes:

Click the icon to remove an individual portfolio.

Or,

Click Delete to clear all selected portfolios at once.

Use the Previous Step button to update fields in Step 1.

Click Generate Report to confirm.

Generating Report

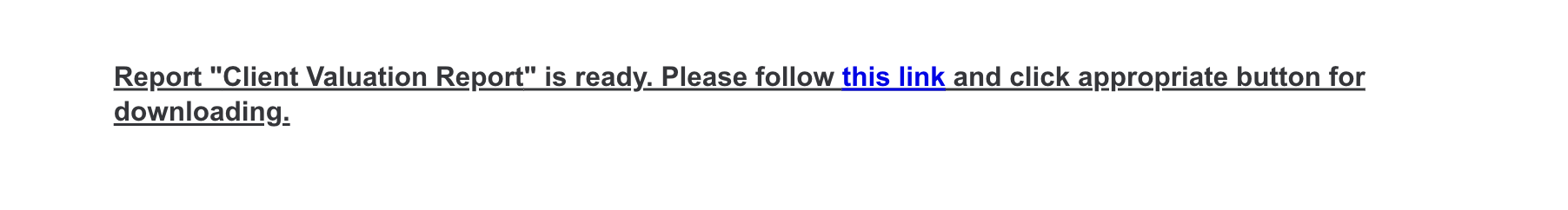

The platform will start compiling the Consolidated PDF Report.

When the report is ready, you’ll receive an in-platform notification and an email confirmation.

Email Confirmation

Alternatively, the generated report will appear in the report list.

If the report fails to generate, you’ll receive an error notification via email.