Strategy Clients

AVAILABLE IN:

Introduction

The Clients tab allows you to view all clients who have subscribed to a particular strategy. It provides a centralized overview of client portfolios, the instruments they hold and detailed performance metrics.

Key Terminologies

Term (A-Z) | Definition |

|---|---|

ID | Identifier for the instrument. |

CASH_INFO | Status indicating the order is waiting for available cash. |

Client Orders Tab | Screen where confirmed client orders can be reviewed, edited, and executed. |

Current Value | Current market value of the instrument in the strategy. |

Current Weight | Current allocation percentage of the instrument in the portfolio/strategy. |

EOMS | Execution via Execution Order Management System (broker/external platform). |

Execution Rules Tab | Allows defining how the platform should rebalance the portfolio. |

Exchange | Market/exchange where the order will be executed. |

GOOD_TILL_CANCEL | Instruction to keep the order active until manually canceled. |

GOOD_TILL_DATE | Instruction to keep the order active until a specified date. |

Instruction | Defines the time validity of the order (DAY, GOOD_TILL_CANCEL, GOOD_TILL_DATE). |

Limit Order | Executes only at or better than the specified price. |

Market Order | Executes at the market price. |

Min Amount | Minimum order amount required by exchange/broker. |

Min Increment | Minimum trading unit allowed for the instrument. |

Quantity | Number of units to be bought or sold. |

Qty Buy | Quantity of units to buy for an instrument. |

Qty Sell | Quantity of units to sell for an instrument. |

Recalculate | Action to update order values after changes. |

👉 New to some terms? Check out our full Platform Glossary for more.

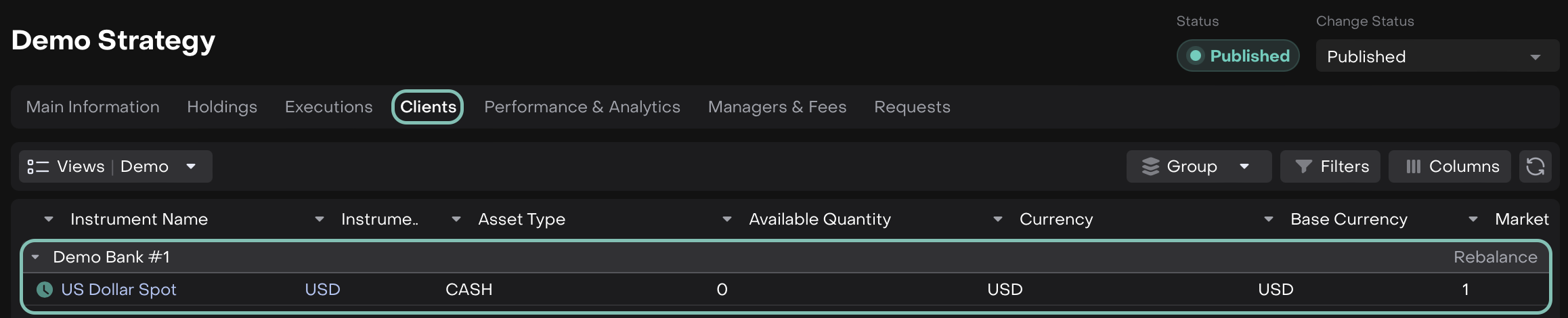

Find Strategy Clients

Go to Clients tab > You can view the Client(s) associated with the Strategy.

🔗 Learn more here on managing executions across different statuses.

Click on Rebalance and the following screen pops up.

In case of a rebalancing error, please contact your Admin for assistance.

Start Rebalancing/Execution Process

With this, the platform starts the asset rebalancing process.

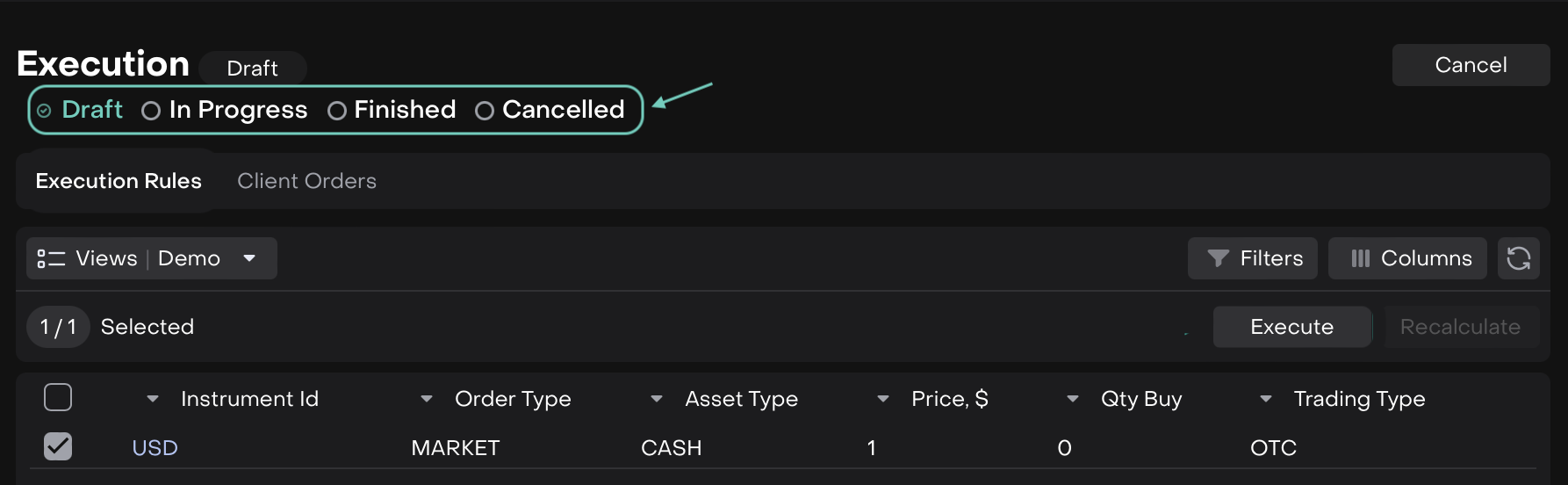

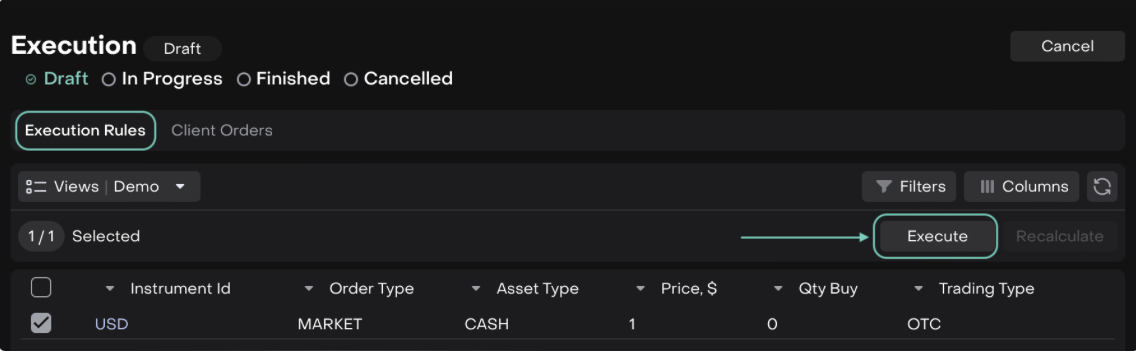

Execution Rules Tab

It allows you to define how the platform should rebalance the portfolio.

The Execution Rules screen opens, showing all assets in the strategy that can be rebalanced.

By default, all assets are selected via checkboxes. You can unselect assets you do not want to rebalance.

Steps:

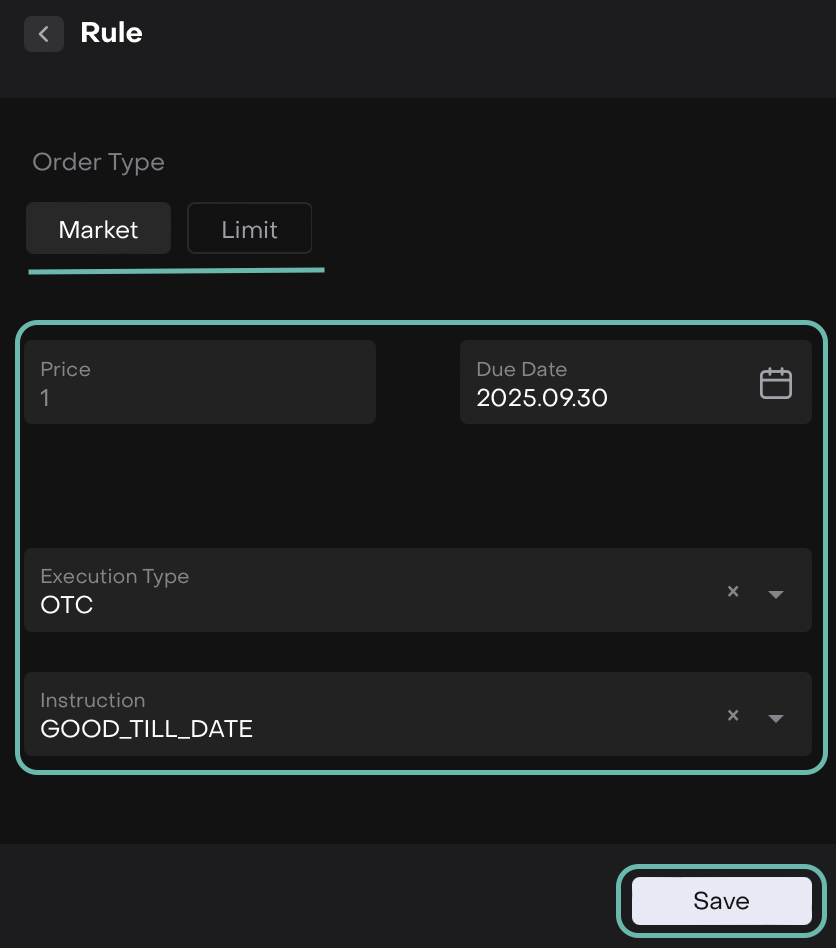

In Draft mode, double click on the row to add/edit a rule.

You can only edit rules while the execution is in Draft. Once you move forward, they are locked.

Adjust order parameters where needed (e.g., change to market/limit order, set due date, etc).

Fill in the required fields, reference in the table below.

Click Save.

Once confirmed, the platform applies your choices and automatically creates corresponding Client Orders.

Now, click on Execute to move to next step.

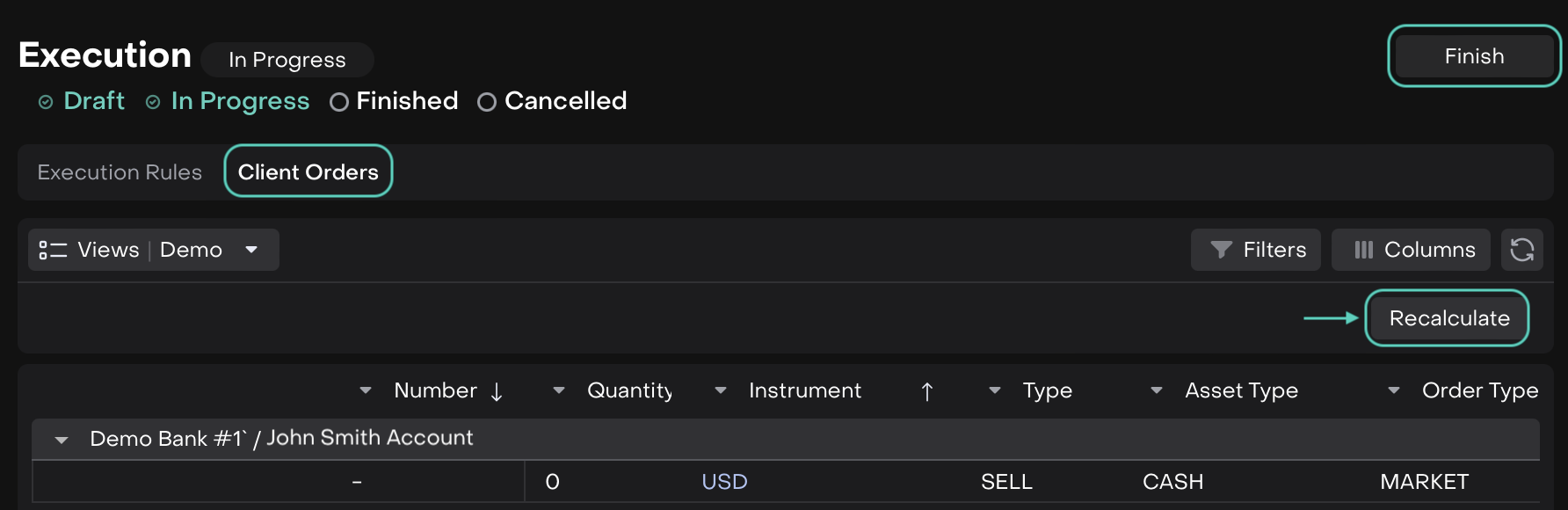

Client Orders Tab

You are redirected to the Client Orders screen, where you can review and edit the order details but only for the assets you confirmed during rebalancing.

Use Recalculate if you make changes and want to update order values.

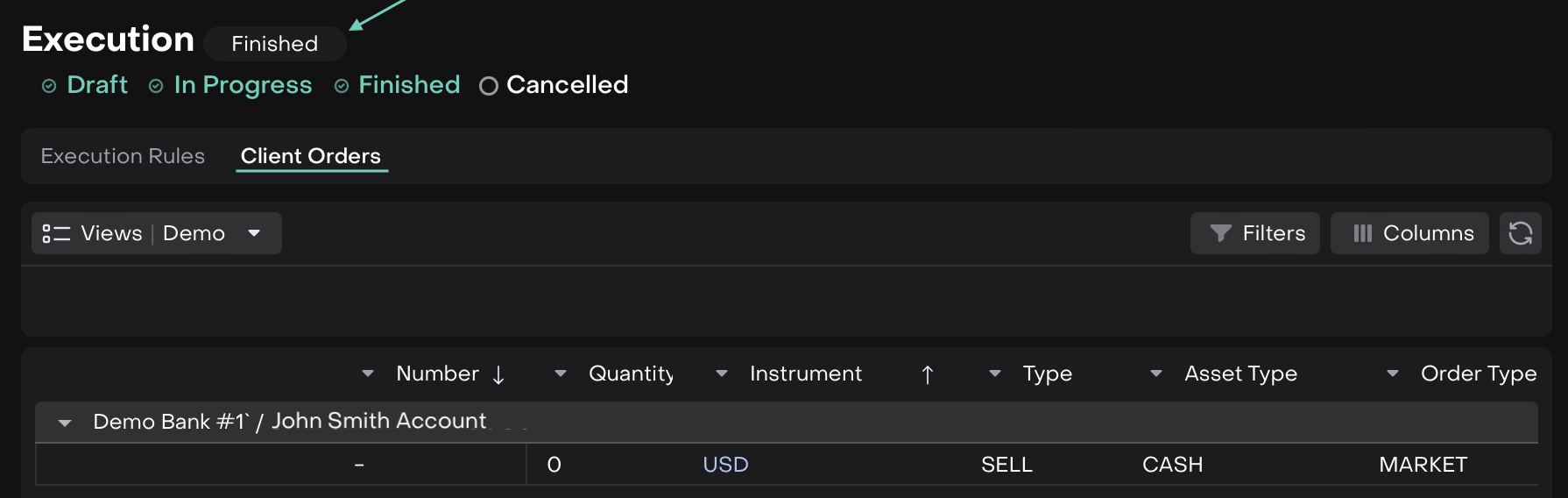

Click Finish once all orders are completed to close the execution cycle.

Quantity changes is not supported for CASH_INFO strategy orders, even if the field appears editable on the table.

After confirmation, selected positions cannot be changed within the same rebalance. To adjust, you must start a new rebalancing.

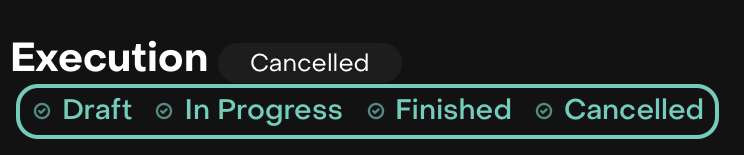

If you need to abort an execution run, click Cancel.

The status will update to Cancelled.