Strategy Holdings

AVAILABLE IN:

Introduction

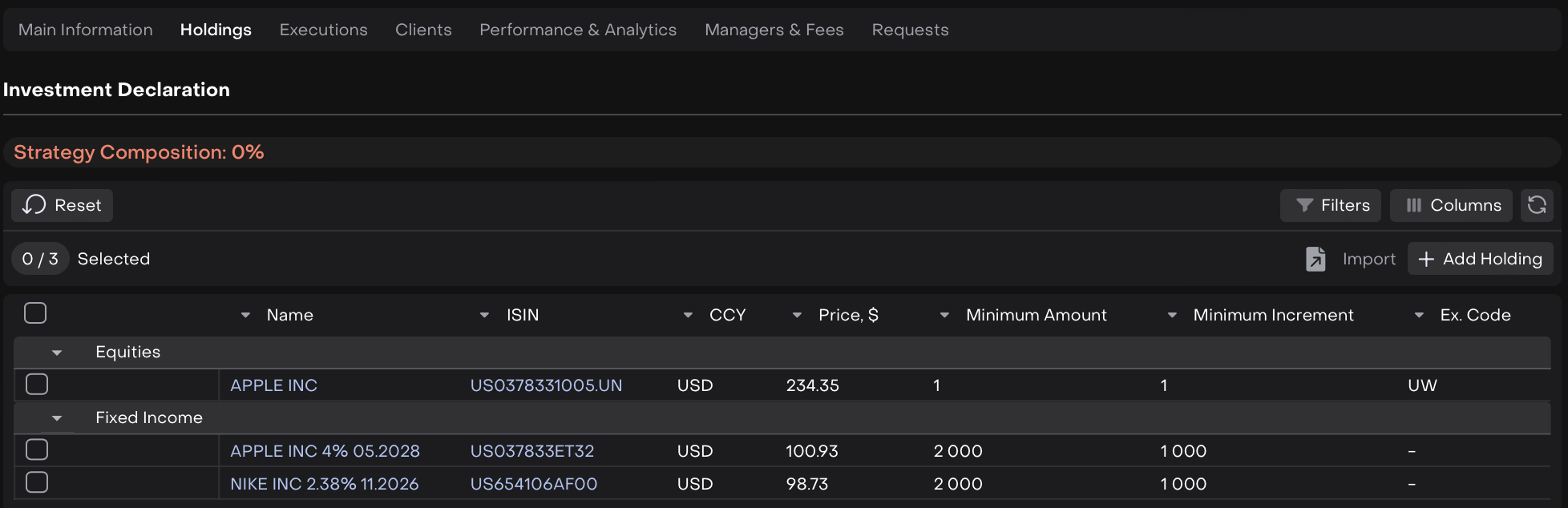

The Holdings tab lets you define the instruments included in your strategy. Here, you can view details such as instrument type, currency, price and specify the target allocation.

For accurate calculations, the necessary parameters must be provided based on the asset type:

Equities and ETFs: The minimum lot quantity must be validated.

Fixed Income instruments (bonds): The minimum investment amount and the minimum yield must be validated.

Options: The option contract size must be validated.

These field validations depend on the type of asset.

Holdings Management Workflow

Holdings Workflow

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Add Holding | Option to add new instruments (Internal or External) to your strategy holdings. |

Asset Type | Category of the financial instrument. |

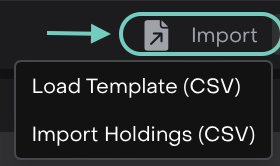

CSV Import | A bulk upload option that allows you to import holdings from a CSV template instead of adding them manually. |

Holdings | Represent the contents of portfolio related to its strategy. They define what assets are part of the strategy and how much each contributes (its target allocation) to the overall composition. |

Import Template | Predefined file format used to bulk import holdings with validation checks. |

Investment Declaration | Displays the overall composition of your strategy in a progress bar. Each segment represents the allocation percentage of an asset or asset class. |

Minimum Amount | The least amount required to invest in a particular instrument as per asset type rules. |

Minimum Increment | The smallest additional investment allowed for a holding, ensuring increments follow defined steps. |

Option Contract Size | Defines the number of underlying units per option contract; must be validated before inclusion. |

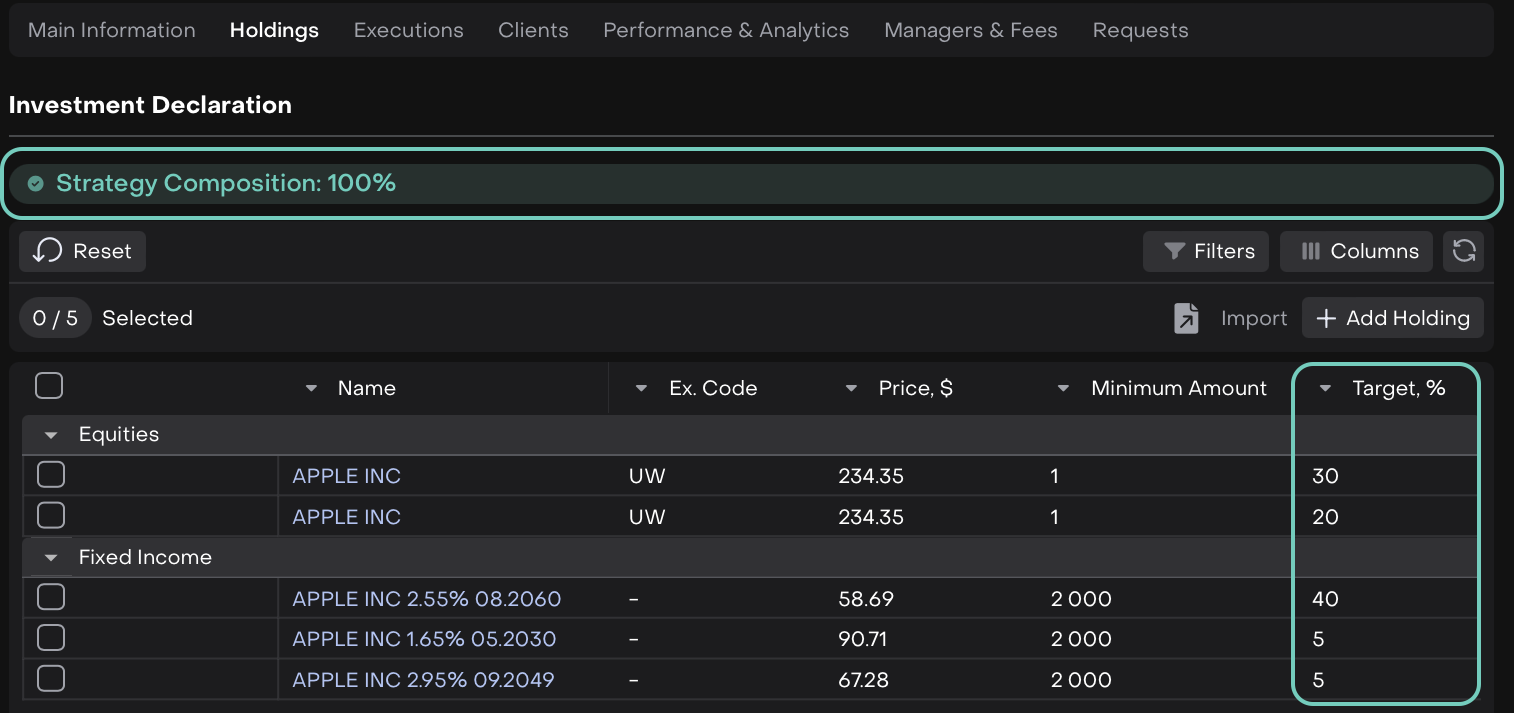

Target % | Defines how much of the overall strategy each asset represents; total target allocation should be 100%. |

👉 New to some terms? Check out our full Platform Glossary for more.

Manage Holdings Manually

Toggle Edit to enable changes.

Click + Add Holding, search for instruments (Internal or External) and select them using the + icon.

The selected entries appear in the table below. For multiple instruments, the platform validates:

Required fields (price, min. amount, min. increment)

Existence in the database (internal/external)

Allocation and weight calculations

Manual Holding Setup

🔗 Learn here on how to use platform Filters or Columns.

The sections "Investment Declaration/Holdings” are filled in and the trading settings are set and is sent for approval. If no one is assigned, the request will be skipped.

If users are assigned, Manager shall see the request under Strategy Request for further action.

The Target % column represents the instrument’s share in the overall strategy composition.

The sum of all target percentages should ideally total 100%.

You can save a draft with less than 100% but you must reach 100% allocation to approve and publish the strategy.

Import Holdings

Use the Import Option to load a CSV Template and import holdings in bulk.

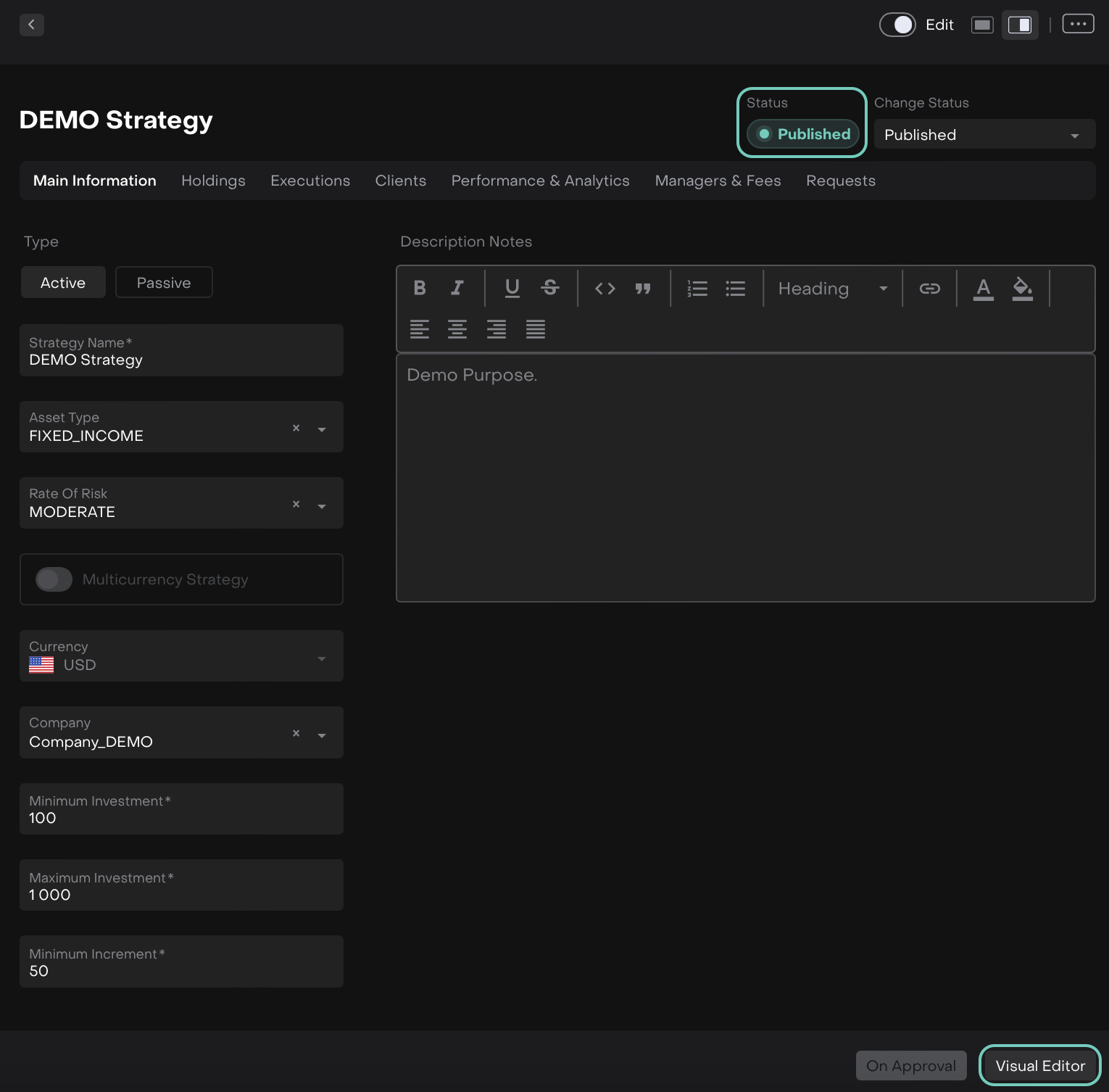

Once entries are complete, you can click Save Draft or On Approval to proceed.

And if,

Clicked On Approval button the strategy gets Published and it becomes active.

Now, when you click on Visual Editor, you’ll be redirected to the Marketplace page, where you can further edit the details.

🔗 Learn here on how to manage Marketplace.