Strategy Positions Calculation Overview

Introduction

Product positions represent the aggregated view of all underlying instrument-level positions that belong to a particular product.

Access Strategy Positions

To view or manage strategy positions in the platform, follow either of the methods below:

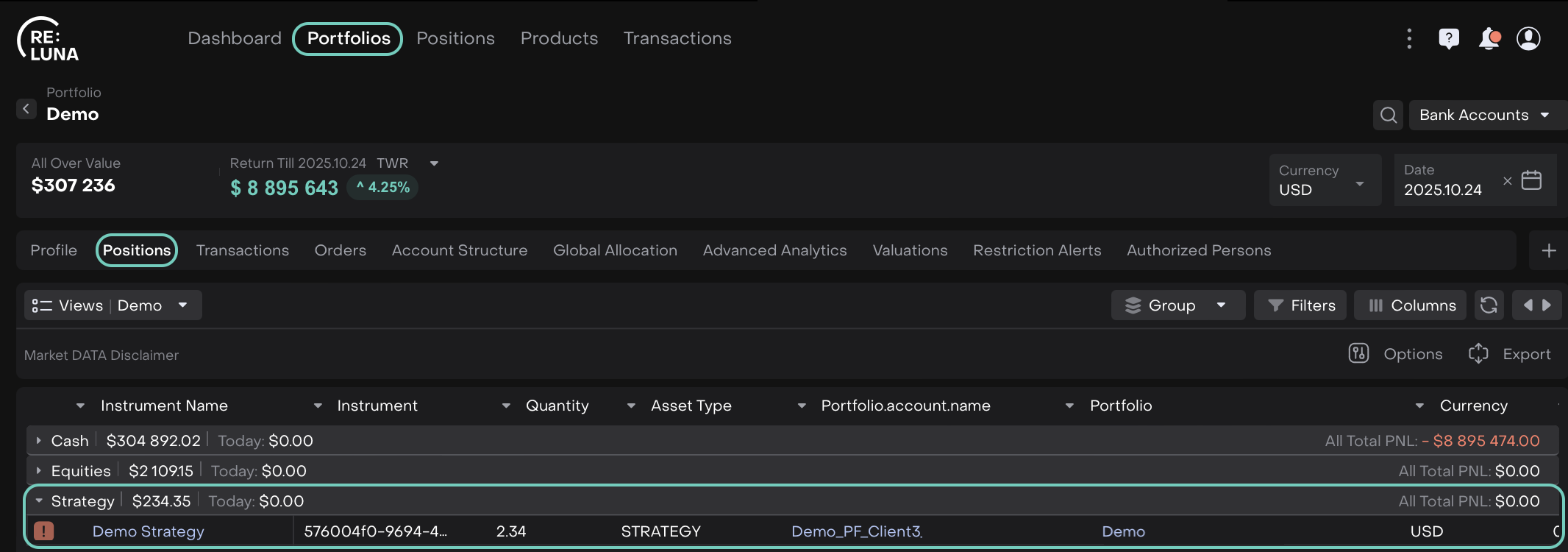

Method 1: Via Portfolios Screen

Navigate to Portfolios and select the desired portfolio.

Go to its Positions tab (Group by Asset type to quickly locate and view the Strategy section for the selected asset type).

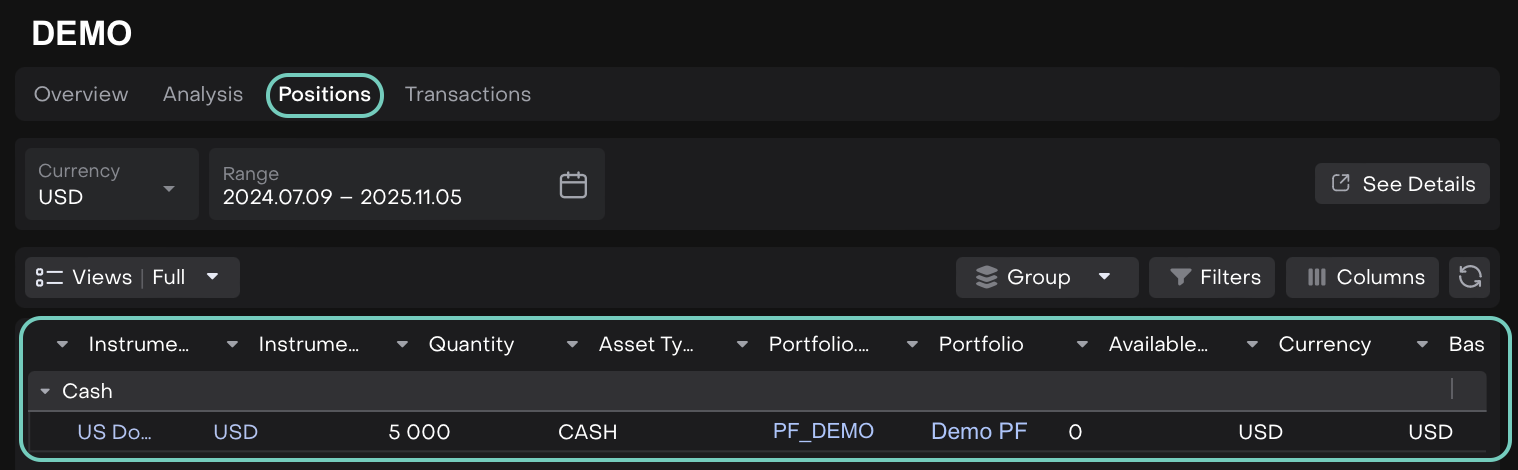

Double click on Strategy to view its Positions.

Method 2: Via Positions Screen

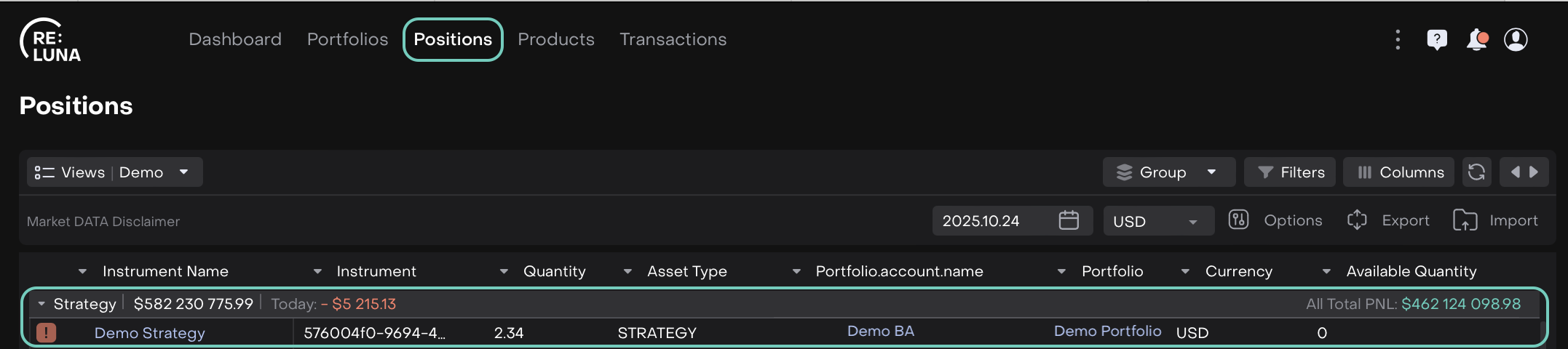

Navigate to Positions > Find Strategy (Group by Asset type).

And double click on it to view its Positions (same like shown above).

Strategy Positions Calculation Logic

Field (A–Z) | Calculation / Formula | Description |

|---|---|---|

Accrued |

| Total accrued interest or income accumulated across all positions, converted into the base currency(strategy currency). This amount reflects earnings that have been generated but not yet paid. Example: If two bonds have accrued interest of $120 and $80, then Accrued = 120 + 80 = 200 (Base Currency). |

Cash |

| Available cash in base currency. |

Cost |

| Represents the total purchase cost of all instruments, converted into the base currency using the applicable FX rate. This value reflects the original amount invested in the instruments before any PnL is realized. Example: If 100 shares were purchased at $150 each and FX = 1.10, |

Daily PnL |

| Daily profit or loss in base currency. |

Errors / Flags |

| Shows data inconsistencies. |

InitPos |

| Value at purchase price. |

InstrumentDB CreatedAt |

| Indicates when each product position was first created in the platform. It helps track the initiation date of positions included in a strategy or portfolio. |

InstrumentDB Last Tradable Date |

| Most recent transaction among underlying positions. |

Investments |

| Total invested amount converted into base currency. |

Market Price |

| Current market price expressed as a percentage of the initial investment value. Example: If the Total PnL is 500 and the Value Base Investments is 10,000, |

Market Price Difference |

| Relative change in market price. |

MTD |

| Total PnL accumulated from the beginning of the current month up to the present day, summed across all positions and converted into the base currency. |

Paid Accrued |

| Total amount of accrued income (such as interest or dividends) that has already been paid out and received in the base currency. |

Purchase Price (Average) |

Transaction Conditions:

Transaction Value (in Strategy Currency):

| The weighted average price at which the strategy was purchased, expressed in the strategy’s base currency. At the time of purchase, the Purchase Price = 100%. |

Quantity |

| Number of units held. All quantities are displayed up to 2 decimal places. |

Realized PnL |

where Base Currency = Strategies Currency | Realized PnL including closed positions. |

Realized PnL Base Ccy |

| Realized income of all assets in strategy in strategy currency or portfolio currency. |

Realized PnL Closed |

| Represents closed realized PnL, but this value is not shown separately — it’s already included in the Total PnL and Realized PnL calculations. Example: If a position was sold and generated a profit of 200 USD, that amount is already reflected in Realized PnL and Total PnL, so Realized PnL Closed = 0. |

Settled Value |

| Value of settled transactions in base currency. |

Total PnL |

where Base Currency = Strategies Currency Or,

| Total profit or loss (realized and unrealized) in the strategy’s base currency, reflecting performance across all included positions. |

Total PnL Base Ccy |

where Base Currency = Currency of the portfolio | Total value of the strategy. |

Total PnL All Time Base Ccy |

| Total income = Realized PnL + Unrealized PnL. |

Total PnL % |

| Total return in percentage. |

Unrealized PnL |

where Base Ccy = Strategies Currency Or,

| The potential PnL on open positions that are still held and not yet sold. It is calculated based on the difference between the current market price and the purchase price, multiplied by the quantity, and converted into the base currency. |

Unrealized PnL Base Ccy |

| The total unrealized PnL from all open positions, expressed in the base currency. This value shows the potential gain or loss that would be realized if all open positions were closed at the current market price. |

Unsettled Value |

| Value of unsettled transactions in base currency. |

Value |

Or,

| Total value of all underlying positions in base currency. |

Value Base Currency |

Or,

| Strategy’s total base currency value. |

Value Base Investments This is not a field but a calculated parameter used to simplify subsequent strategy calculations. |

Transaction Value Consideration:

| Represents the base investment amount in the strategy, used as a key parameter for calculating metrics such as Purchase Price (Average) and Market Price. |

Withdrawals |

Sum of all withdrawn amounts after FX conversion. Withdrawal is identified when the quantity or net amount is less than 0. | Total withdrawn amount for the selected date, converted into the product’s base currency using the FX rate available on that date. Applies to the following transaction types:

Values are not cumulative and reflect withdrawals only for that specific day. |

wtd |

| Total PnL accumulated from the start of the current week up to the present day, with all values converted into the base currency using the FX rate. Example: |

YTD |

| Total PnL accumulated from the start of the year up to the current date, summed across all positions and converted into the base currency. Example: |

All calculations are FX-adjusted to the product’s base currency using the last available FX rate on the position date (when the instrument currency differs from the base currency).

Purchase Price and Quantity are calculated cumulatively over all investments and withdrawals.

👉 All percentage-based PnL fields (PnL%, YTD%) follow same calculation logic used for portfolio positions. Refer here for detailed formula and explanation.

Purchase Price (Average) Calculation

Two additional fields are used to calculate the Purchase Price on the platform:

Field (A–Z) | Calculation / Formula | Description |

|---|---|---|

Net Cost Value | Σ( | Cumulative sum of all capital movements in viewing currency. |

Net Cost Price | Σ( | Uses the prior day’s market price (previous totalPnl% + 100). |

Purchase Price |

| Derived average purchase price in viewing currency. |

Quantity | Σ(( | Cumulative quantity adjusted by market price. |

Quantity Adjustment for Closed and Active Products

Ensure accuracy for closed or active products with zero quantity products:

Condition | Action |

|---|---|

If Absolute Value < 0.01 | Set |

If | Set |

This prevents issues with rounding and zero-quantity inconsistencies.