Postallocate FX Transactions

Introduction

On the Reluna platform, you can postallocate FX transactions that include FX (DEBIT) and FX (CREDIT) transactions, and optionally a FEE transaction. This mechanism ensures your FX transactions are correctly processed, creating corresponding SELL FX orders automatically and updating the transaction status to Confirmed.

Key Terminologies

Term (A-Z) | Definition |

|---|---|

Buy Currency | The currency being purchased in a foreign exchange (FX) transaction. |

Commission | A fee paid to an intermediary (broker, bank, or platform) for facilitating a transaction or trade. |

FX (CREDIT) | A foreign exchange transaction where currency is received into an account; represents an inflow. |

FX (DEBIT) | A foreign exchange transaction where currency is sent out of an account; represents an outflow. |

Omnibus Bank Account | A pooled account used to hold funds on behalf of multiple clients, often used in investment or brokerage operations. |

Order Number | A unique identifier assigned to a trade or transaction order for tracking and reference. |

Postallocate | The process of allocating transactions (e.g., FX trades) to orders after they are recorded but before final execution or confirmation. |

Price | The exchange rate or cost at which a currency or asset is bought or sold. |

Sell Currency | The currency being sold in a foreign exchange (FX) transaction. |

Standard Bank Account | A typical personal or corporate bank account used for individual transactions. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

How to Use the Mechanism

Back office uses postallocation by:

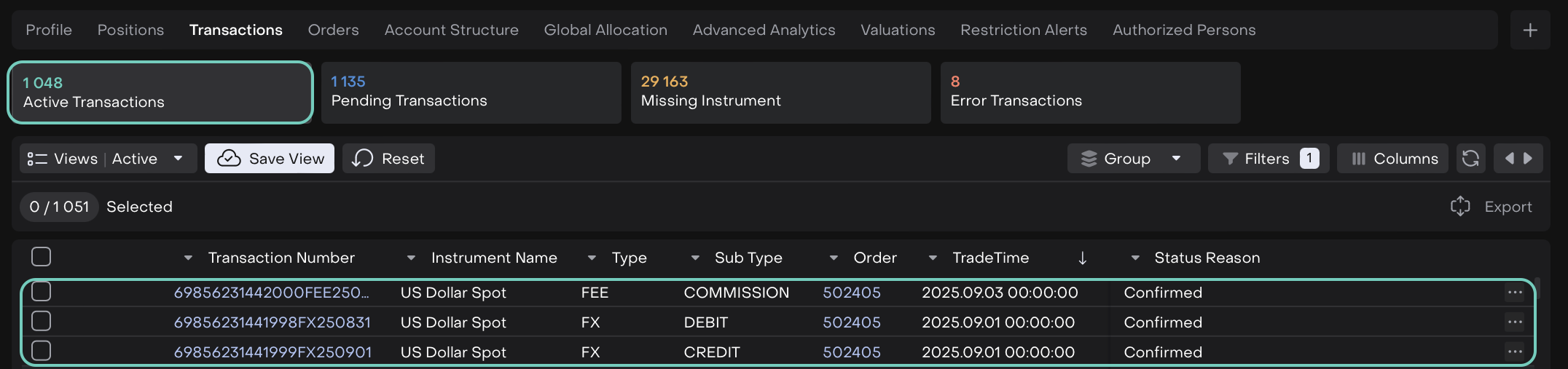

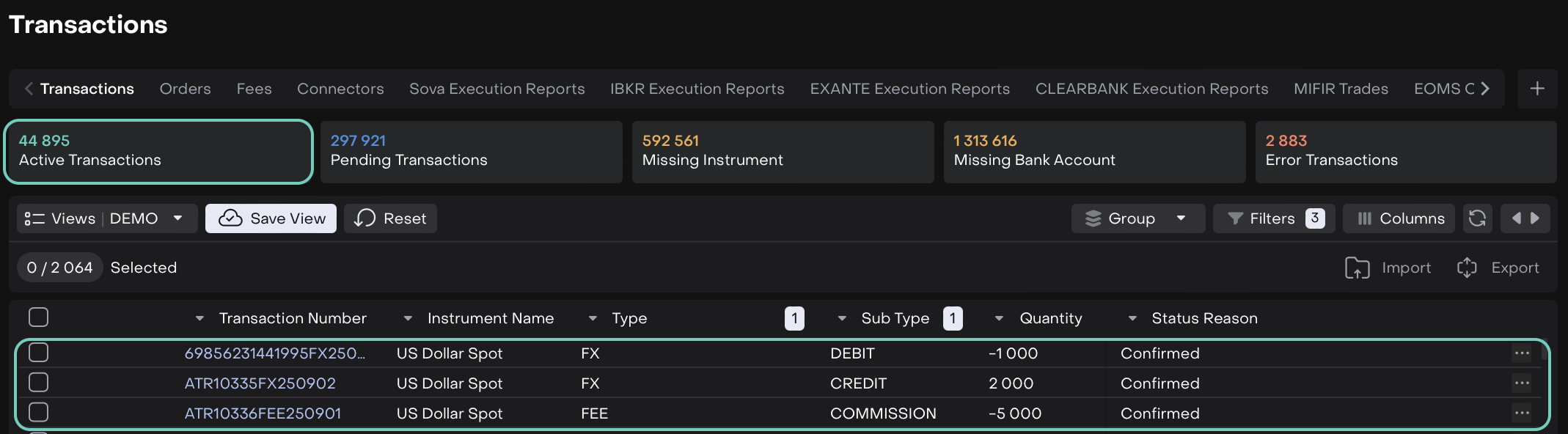

Navigate to All Transactions or Portfolios > Transactions tab.

Select transactions according to the following criteria:

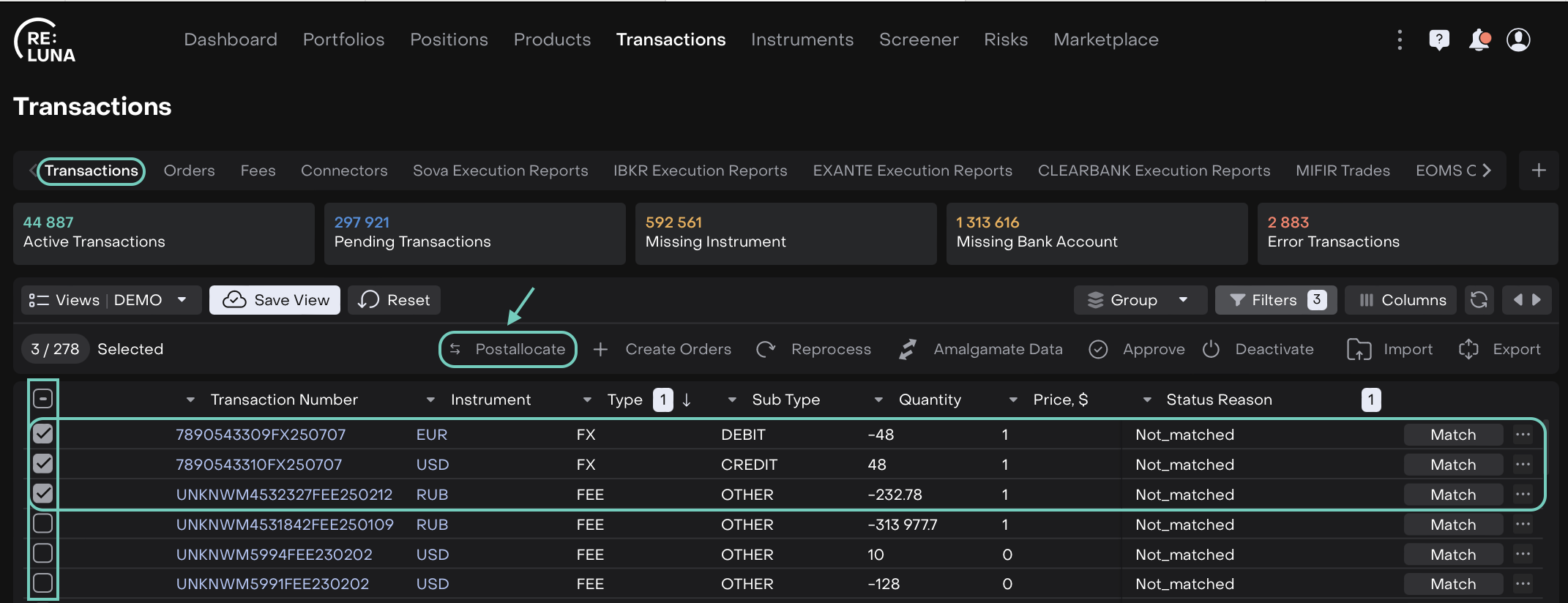

Transaction Type: FX (DEBIT) and FX (CREDIT), optionally including FEE transactions related to forex operations.

Transaction Status: PENDING_CONFIRMATION or NOT_MATCHED.

Order Link: Ensure the transaction is not already linked to an order (Order Number field is empty).

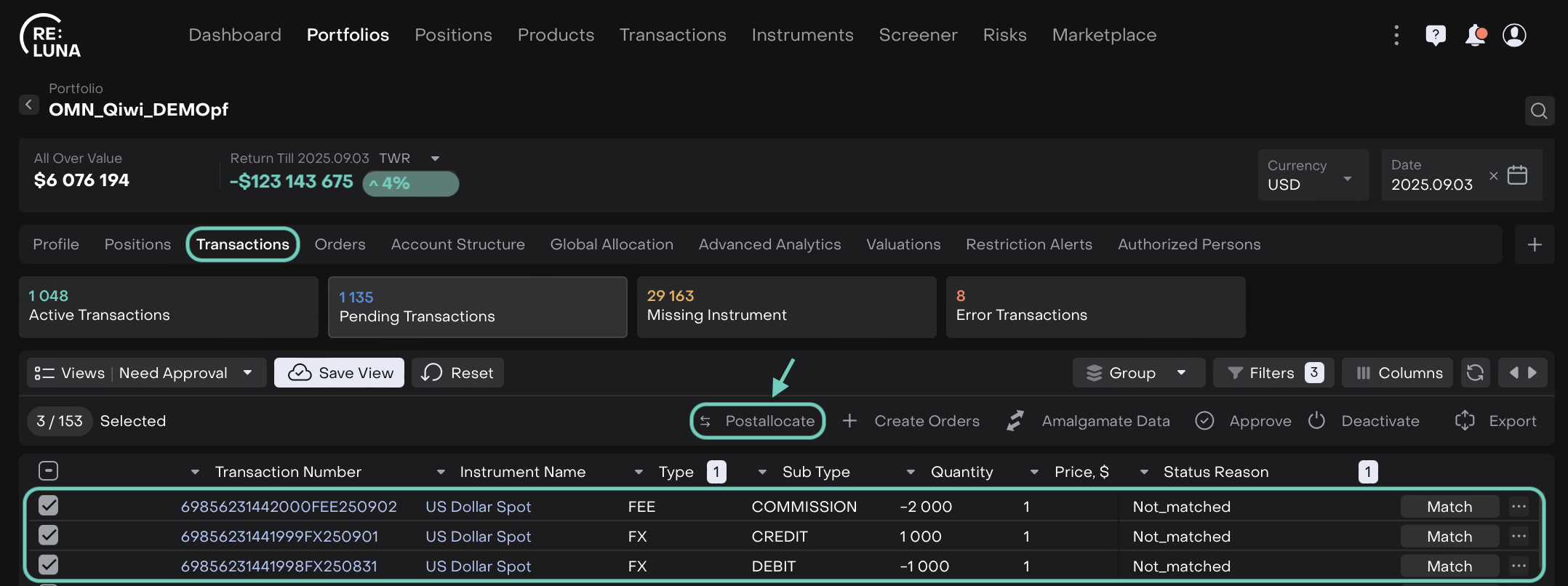

Click the Postallocate button.

The Postallocate button is visible only if you have the Transactions_modify permission.

Similarly, the Create Orders button will appear when you select at least one transaction.

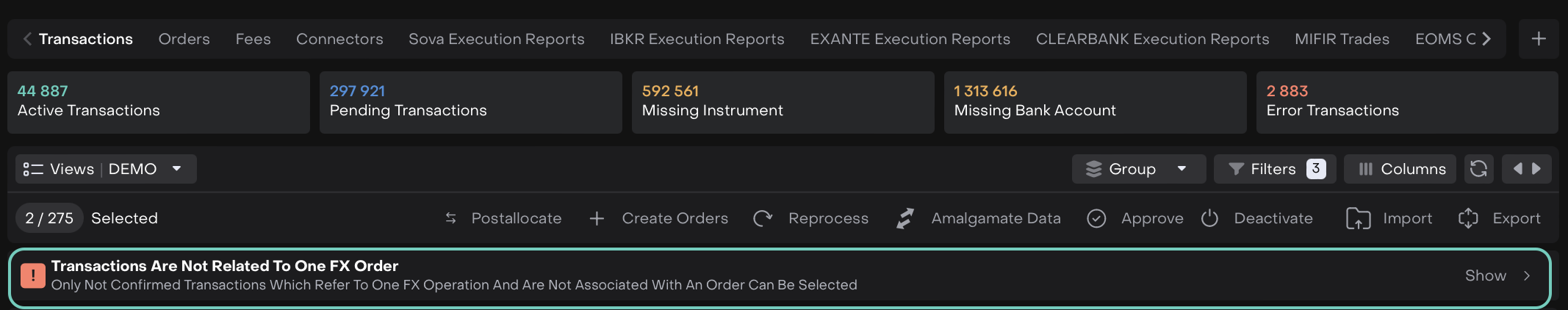

If some transactions do not meet these criteria, the platform will show an error. In this case:

Review the selected transactions.

Deselect transactions that do not meet the criteria.

Repeat the postallocation procedure.

Postallocation by Bank Account Type

Standard Bank Account

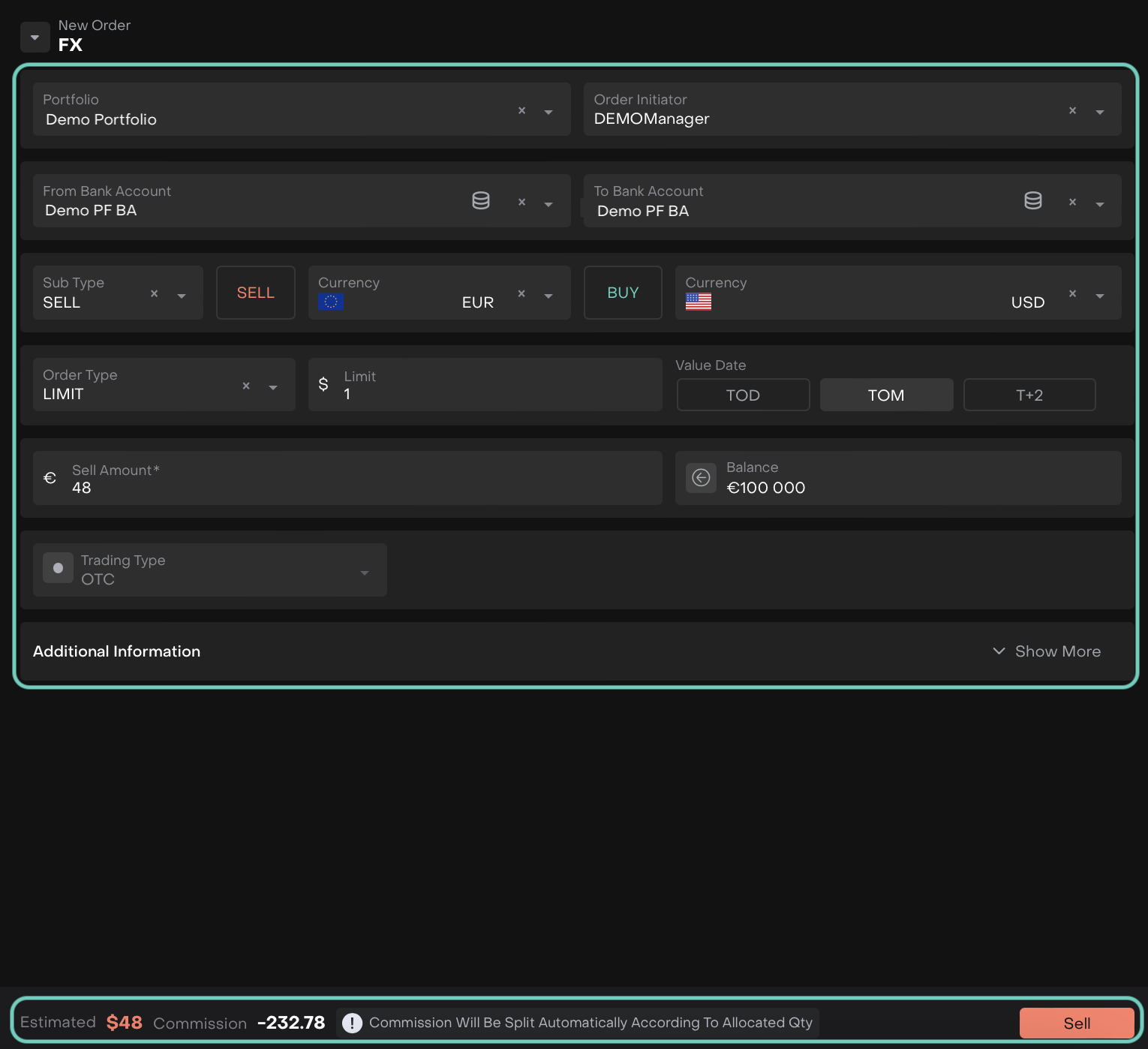

When your selected transactions belong to a Standard Bank Account, the platform opens a form after you click Postallocate.

You need to fill in or review the following details:

Additional Information:

After filling/reviewing the form, click Sell or Buy to create the SELL/BUY FX order.

The order is automatically executed.

All selected FX transactions and associated Commission transactions are updated to Confirmed status.

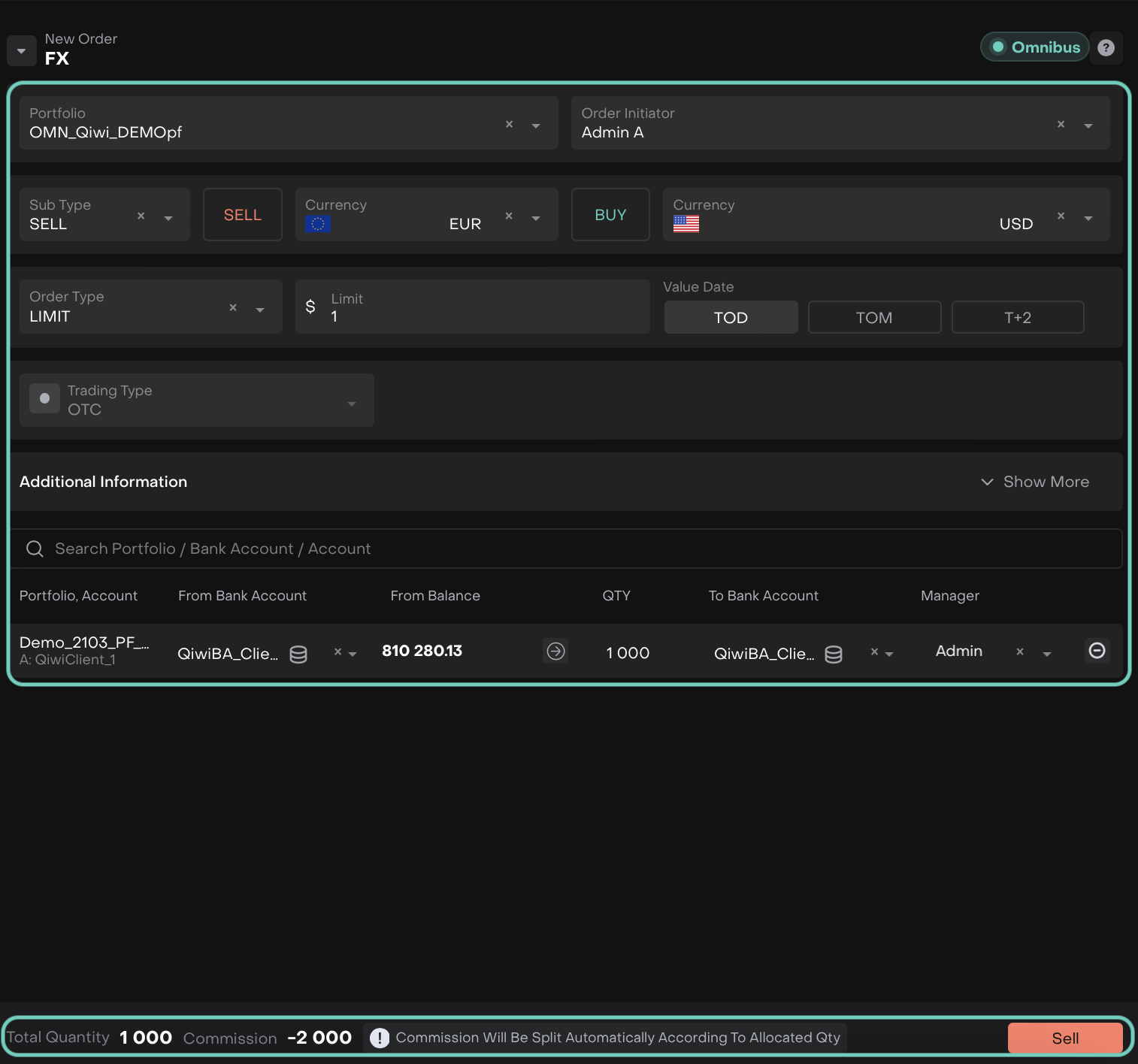

Omnibus Bank Account

When your selected transactions belong to an Omnibus Bank Account, the platform opens a form after you click Postallocate.

You need to fill in or review the following details:

The platform automatically splits Commission (from Fee transaction) according to allocated quantity.

Additional Information:

The order is automatically executed.

All selected FX transactions and Commission transactions are updated to Confirmed on both:

Omnibus level

Individual clients’ level