Create Transactions Manually

Introduction

This guide explains how to create transactions using the Unified Transaction Form. The form consolidates all capabilities into a single interface, making it easier to work with transactions regardless of their complexity.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Deal Date | The date the transaction was agreed or initiated. |

EMIR Reportable (Checkbox) | Marks trades reportable under EMIR regulation. |

Error Description | Field for recording any errors related to the transaction. |

External Reference | External ID associated with the transaction. |

External Search | Lookup instruments using external market data by ticker ID. |

Gross Amount | Total before deductions: |

IBAN | Bank account identifier for payment. |

Internal Search | Search within platform’s shared instrument database. |

Market Type | Choose between DMA, OTC, or EOMS. |

Matched (Checkbox) | Marks the transaction as confirmed with the counterparty. |

MIFIR Reportable (Checkbox) | Flags transactions for MIFIR reporting. |

Multileg (Checkbox) | Indicates the transaction is part of a multi-leg order. |

Net Amount | Final total after deductions: |

Net Amount Payment Currency | Net amount in selected payment currency. |

Order | Link the transaction to an existing order. |

Parent – Transaction Number | Link the transaction to a parent transaction (if any). |

Payment Date | When payment is due or expected to settle. |

Price Currency | Currency in which the asset is priced. |

Reversal (Checkbox) | Marks the transaction as an adjustment. |

Search By Ticker | Instrument search by symbol. |

Security Exchange | Exchange where the asset is traded. |

Settled (Checkbox) | Marks transaction as fully settled in cash and securities. |

Strategy Info | Links the transaction to a selected strategy. |

Trade Type | Classification of trade type (Buy/Sell/etc). |

Transaction Number | Unique Platform identifier for the transaction. |

Value | Total cost = |

Venue | Dropdown to select the trading venue (linked to Trade Type). |

Access Points

From Transactions Tab

From the top menu, click Transactions

Click the ➕ icon in the top right corner

Select the transaction type or search for it

Click Create +

From Portfolios Tab

Go to Portfolios

Select a portfolio

Navigate to the Transactions tab

Click the ➕ icon

Follow the same process as above

Unified Transaction Form

The form is organized into five sections. Required fields are marked with an asterisk (*).

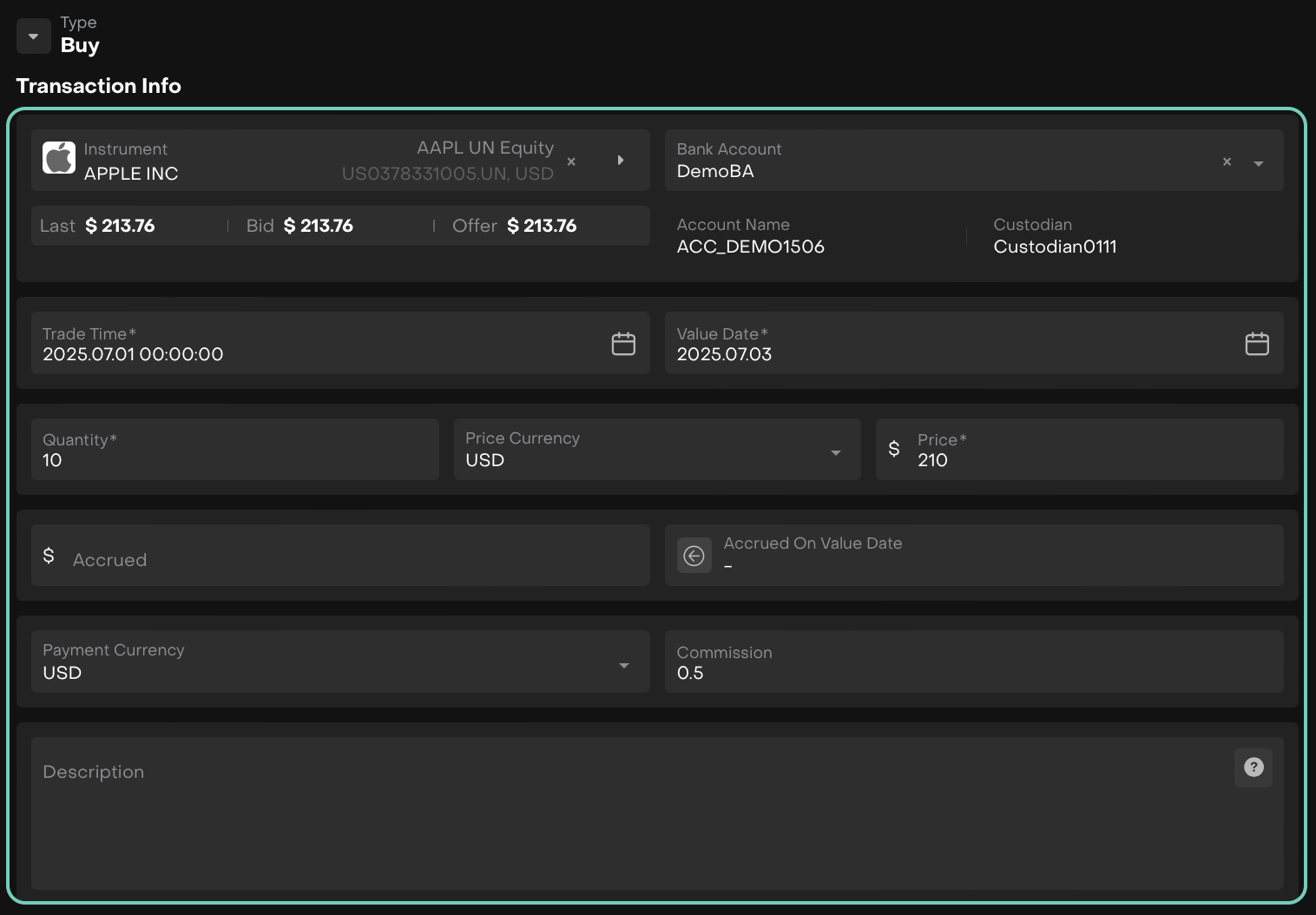

Section 1: Transaction Info

Core transaction details:

Field | Required | Description |

|---|---|---|

Instrument | Yes | Search using Internal/External/Ticker |

Bank Account | Yes | Select from dropdown list |

Trade Time | Yes | Must be current or past (no future timestamps) |

Value Date | Yes | Defaults to Trade Date + 2 working days (editable) |

Quantity | Yes | Number of units |

Price | Yes | Execution price |

Price Currency | Yes | Auto-filled from instrument (editable) |

Accrued on Value Date | No | Populated from bank account |

Payment Currency | Yes | Select from dropdown |

Commission | No | If applicable |

Description | No | Additional notes |

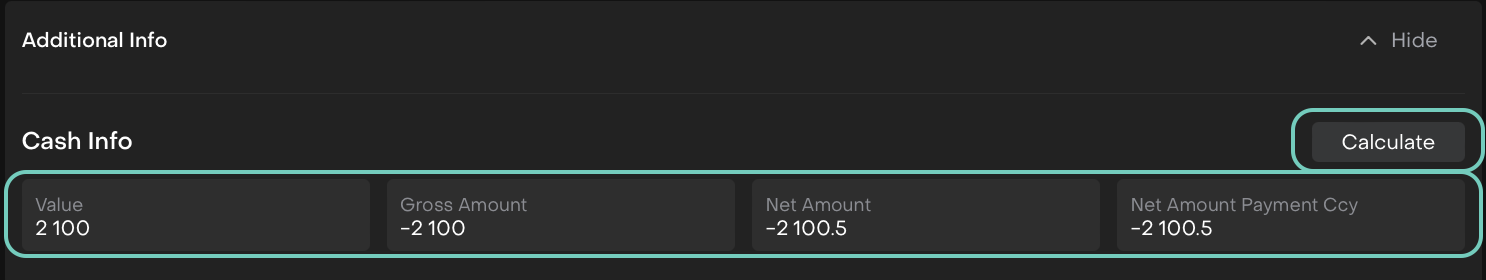

Section 2: Cash Info & Calculations

Click 'Calculate' to auto-compute:

Value

Gross Amount

Net Amount

Platform updates values dynamically when you change quantity, price, accrued, or commission

Net Amount Payment Currency shows the final payable value

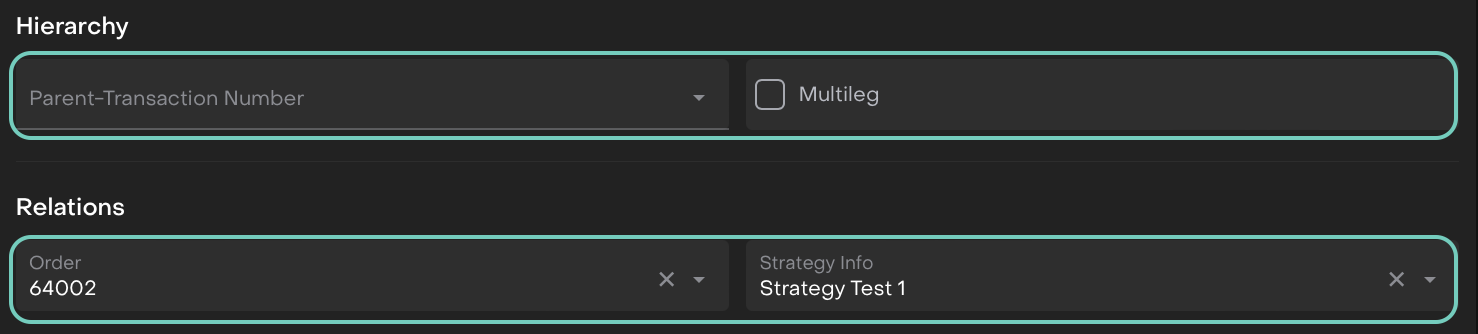

Section 3: Hierarchy & Relations

Define transaction relationships:

Field | Description | Rules |

|---|---|---|

Parent Transaction Number | Link to parent transaction | If filled, Multileg must be False |

Multileg | Part of multi-leg order | If True, leave Parent Transaction Number empty |

Order | Link to existing order | Select from dropdown |

Strategy Info | Link to strategy | Select from dropdown |

Important

Parent Transaction Number and Multileg are mutually exclusive. If one is filled, the other must be empty or False.

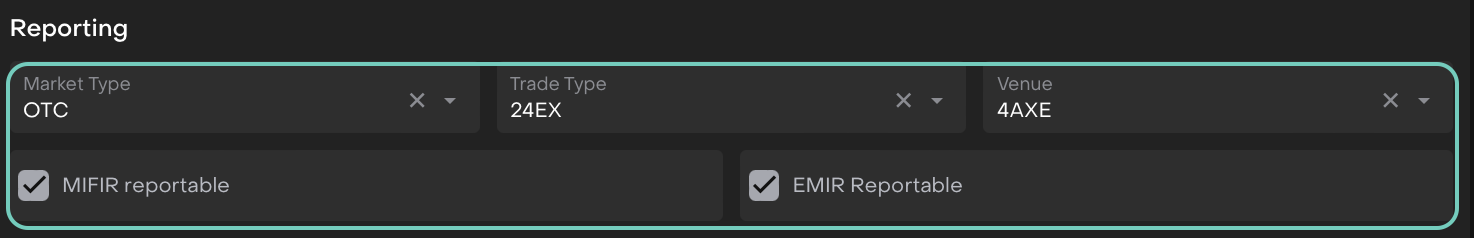

Section 4: Reporting

For regulatory compliance:

Tick EMIR / MiFIR Reportable as needed

Add related reporting info:

Market Type: DMA, OTC, EOMS

Trade Type

Venue

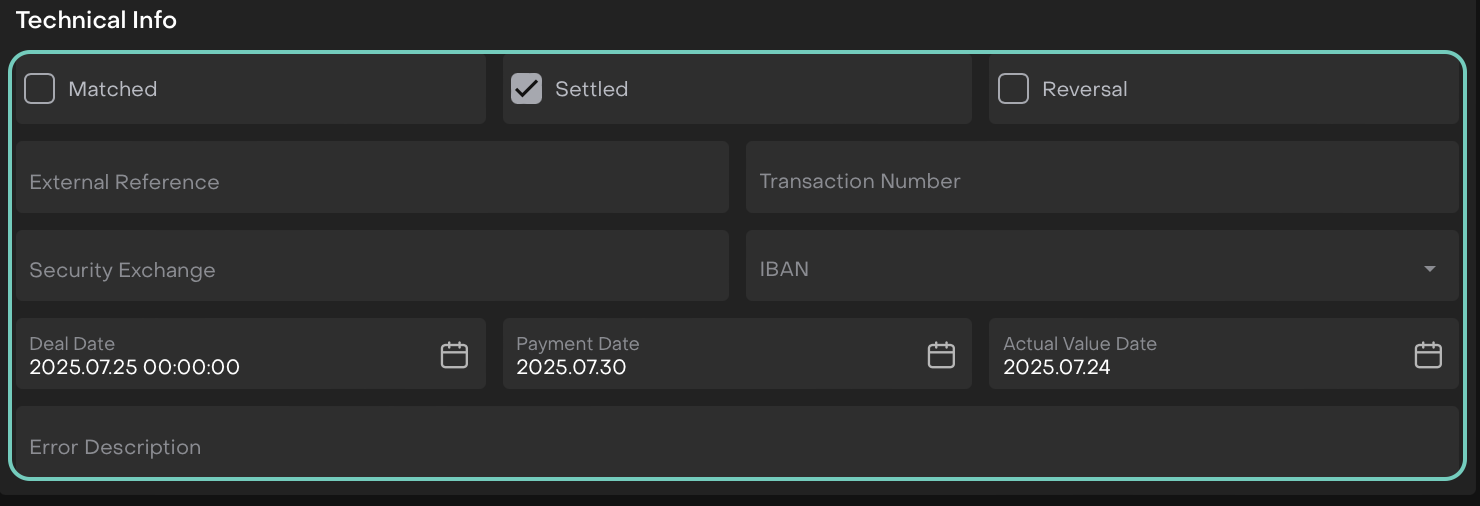

Section 5: Technical Info (Optional)

Additional metadata:

Matched: Check if transaction is reconciled

Settled: Check when transaction is settled

Reversal: Check if this reverses a previous transaction

External Reference: ID from external system

Transaction Number: Internal transaction ID

Security Exchange: Trading venue

IBAN: Bank account details

Deal Date: Trade agreement date

Payment Date: Scheduled payment date

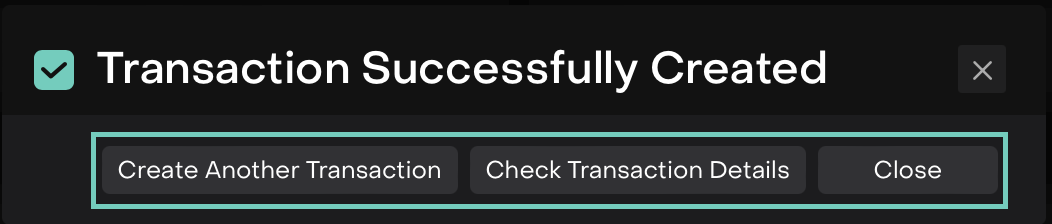

Finalizing the Transaction

Once all required fields are filled:

Click Save to create the transaction (or Close to cancel)

A confirmation screen appears with options:

Create Another Transaction

Check Transaction Details

Close

💡Tip

The platform automatically saves your preferences for certain fields, making it faster to create similar transactions in the future.

Let’s use a BUY transaction as an example to explain the form structure and flow.