Manage Omnibus Bank Accounts & Client Bank Accounts

AVAILABLE IN:

Introduction

The Reluna Platform helps you manage transactions and track all activities across Omnibus Bank Accounts and their related Client Bank Accounts.

With the platform, you can:

Monitor transactions at both the Omnibus level and the Client level

Postallocate transactions from the Omnibus Account to the right Client Accounts

Ensure Client Portfolios stay accurate and up to date

Key Terminologies

Term (A-Z) | Definition |

|---|---|

Client Bank Account (related to Omnibus Bank Account) | A Client’s individual bank account that is linked to the Omnibus Bank Account. |

Virtual Client Bank Account | A Client’s account that exists only in the platform (not physically in a bank). |

Client Portfolio | A collection of all positions and performance data for a Client’s bank accounts. |

Omnibus Bank Account | A single bank account that combines transactions for multiple Clients. This account is physically opened in the Bank. |

Omnibus Portfolio | A portfolio in the platform that aggregates performance and positions from all Client Portfolios. Clients do not have access to this portfolio. |

Postallocation of transaction | The process of allocating a transaction received on the Omnibus Bank Account to the respective Client Bank Accounts. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

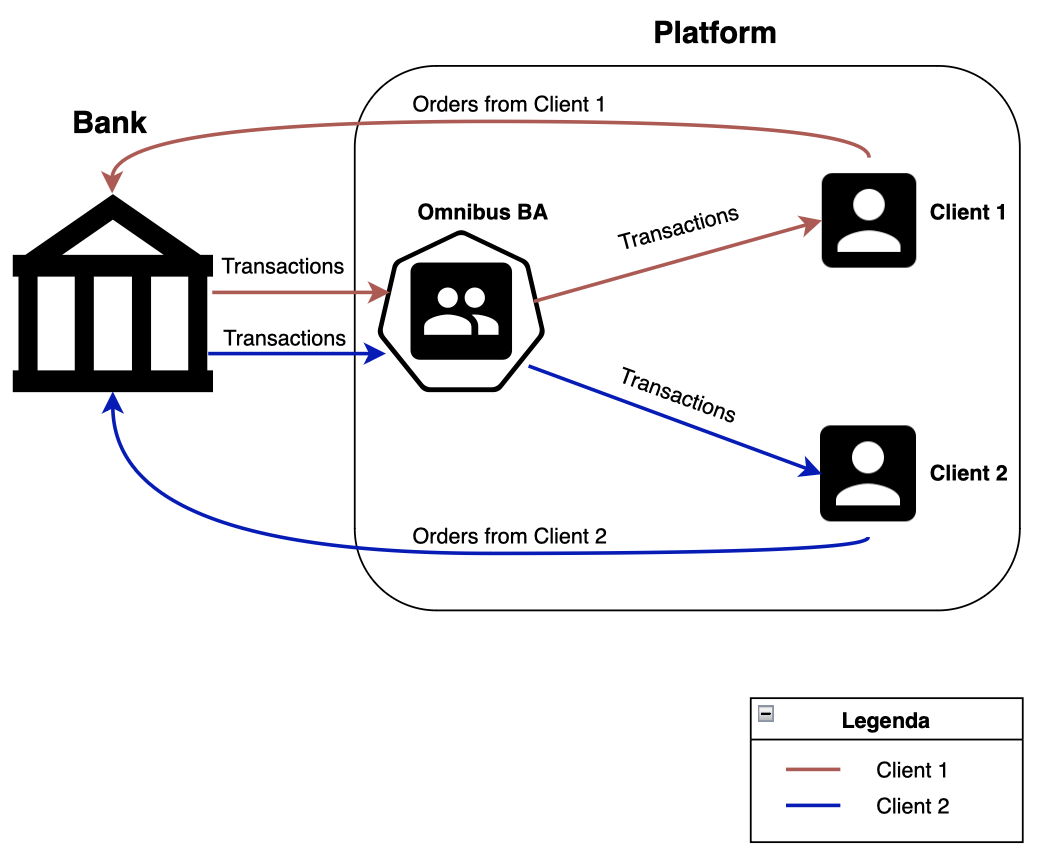

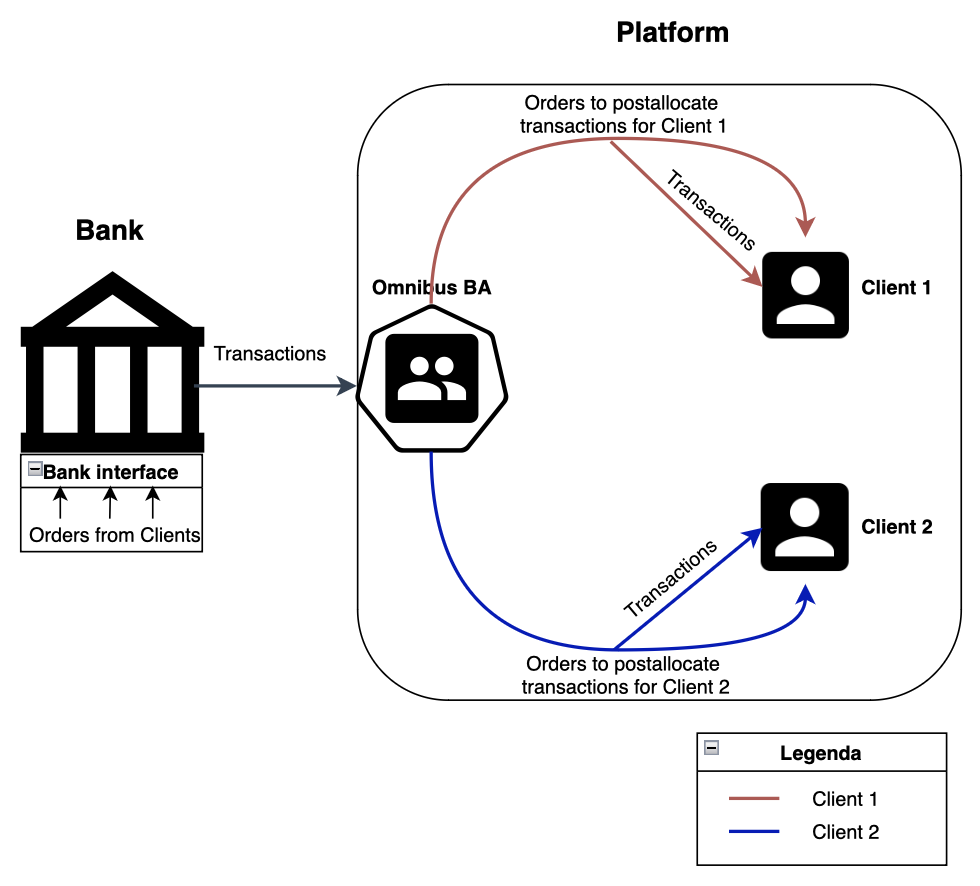

How It Works

The Reluna Platform integrates directly with the Bank/Custodian where the Omnibus Bank Account is opened.

The Omnibus Bank Account is represented in the platform as an Omnibus Portfolio.

All orders and transactions related to Clients flow into this Omnibus Portfolio.

Each Client has their own Client Portfolio, which reflects their specific holdings and activities.

Back Office Managers coordinates with these flows of data between the Omnibus Portfolio and Client Portfolios.

There are two main scenarios you may come across:

Client order is created from the Reluna Platform

Client order is created from the Bank Interface

Scenario 1: Client Order Created

When a Client order is created directly in the platform, here’s what you need to do:

Check Client Portfolio details

Make sure the Client has the correct information in their Portfolio (bank transaction, instrument, and account data).

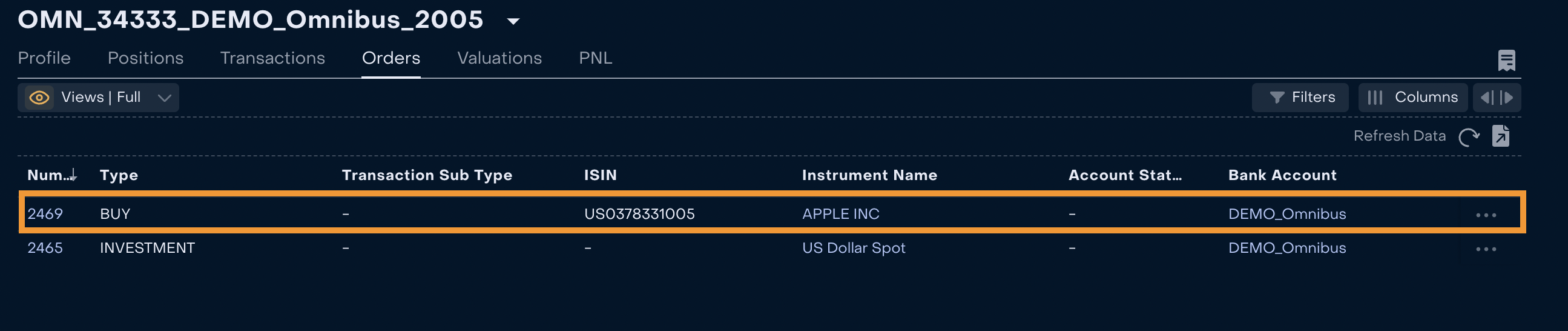

Monitor the order in the Omnibus Portfolio

Go to Omnibus Portfolio > Orders.

You’ll see the order created for one or more Clients.

Review related Client Portfolio orders

The platform automatically creates corresponding orders in the relevant Client Portfolios.

Match the transaction

When the Bank executes the order, the platform receives the transaction.

The system tries to automatically match the bank transaction with the order.

If automatic matching fails, you can perform manual matching.

Confirm updates on Client Accounts

Once the matching is successful, the platform automatically updates related Client Accounts.

Check that:

The transaction is confirmed

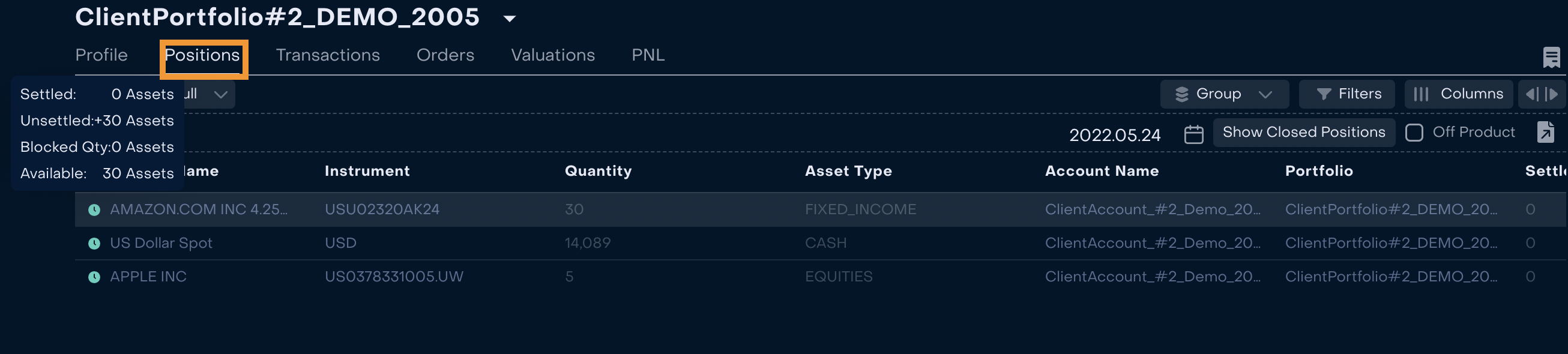

Positions are updated correctly in the Client Portfolio

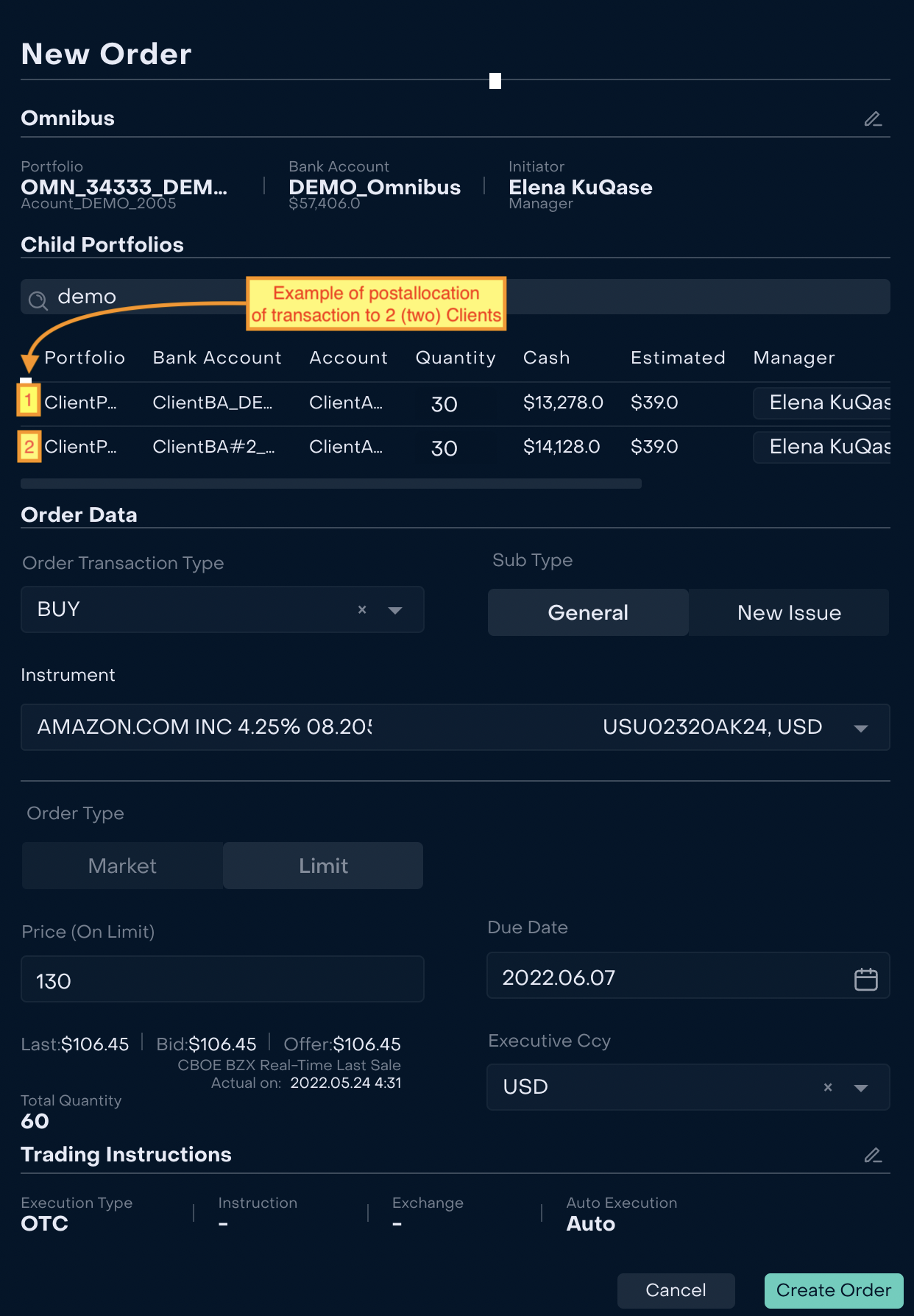

Client order is created from Platform for 1 (one) or more Clients.

2. When the Order is created, Back Office Manager can control it via Omnibus Portfolio → Orders.

3. Related order(s) are created automatically on Client Portfolio(s).

4. Matching process

When the order is executed, Platform receives transactions from the Bank.

4.1. Platform makes automatic matching of order transaction and bank transaction. Manual matching is available when it is not possible to find order transaction and bank transaction automatically.

4.2. When matching process is successfully completed on Omnibus bank account Platform makes automatic changes on related Client accounts. In this case Back Office Manager shall check that transaction on Client account is confirmed and position is changed.

Scenario #2 Client order is created from Bank interface.

Orders also may be created via Bank interface. In this case Back Office Manager creates Order in Platform on the basis of transaction received from the Bank. This action is required to make postallocation of transactions.

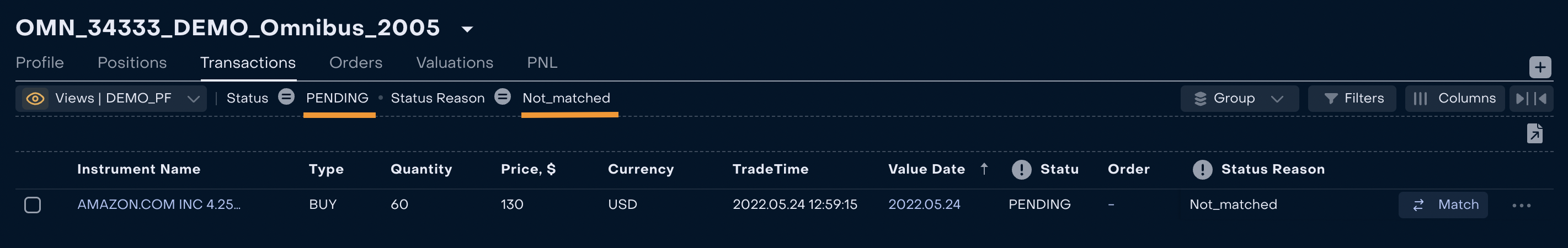

How to understand that it is time to create Order to postallocate transactions to Client Bank Accounts?

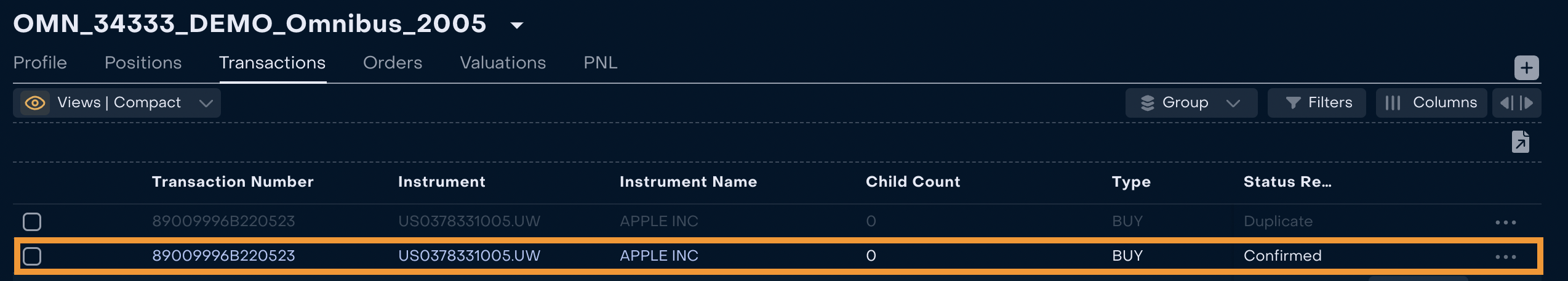

Back Office Manager keeps track of transactions in Status “Pending” and Status Reason “Not_matched” on Omnibus Portfolio (Omnibus Portfolio → Transactions)

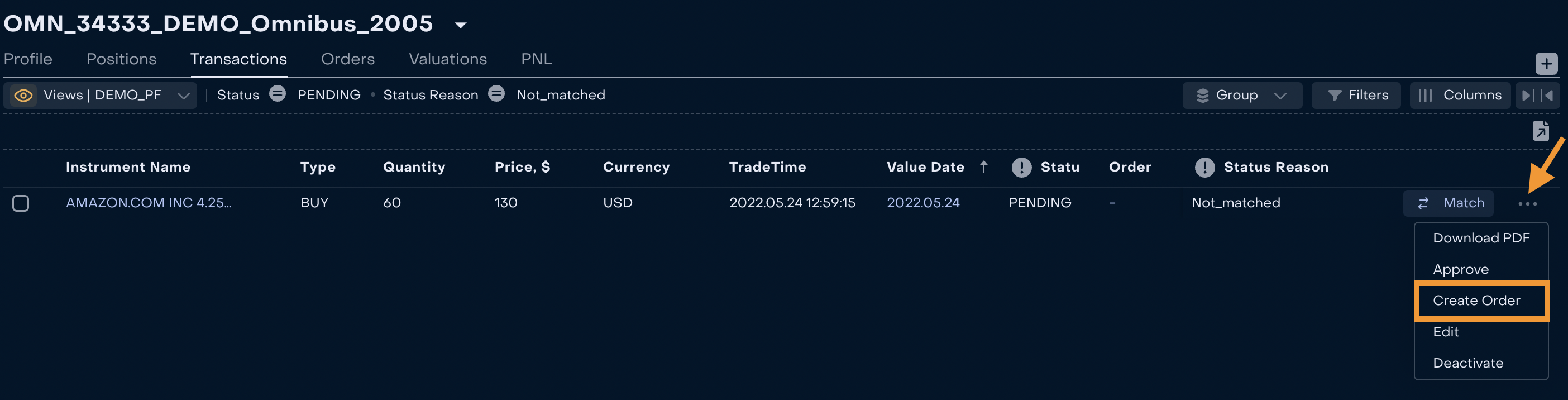

2. Client order is created directly from transaction for postallocation.

Order from transaction can be created for 1 (one) or more Clients at once.

If received transaction is related to several Clients Back Office Manager should create 1 (one) Order and identify in its Child Portfolios allocation (Quantity) for each Client.

Postallocation orders are executed automatically right after creation.

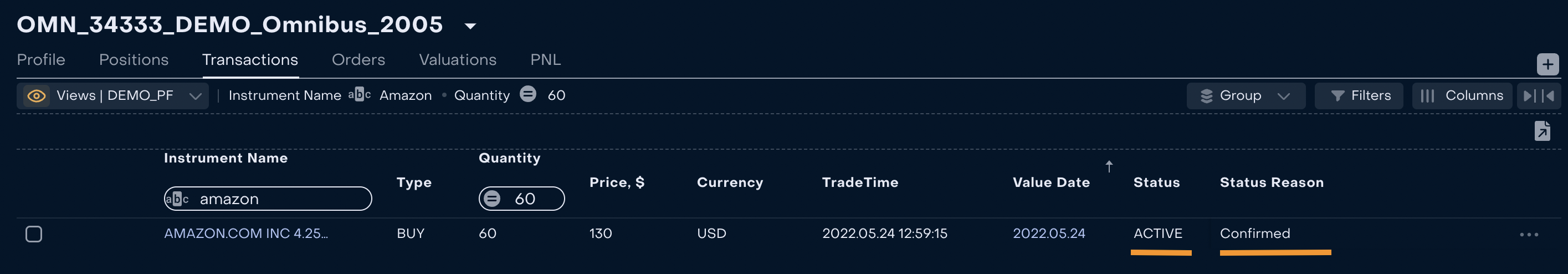

3. When the Order is created and executed, Back Office Manager can control that transaction received Status “Active” and Status Reason “Confirmed” via Omnibus Portfolio → Transactions.

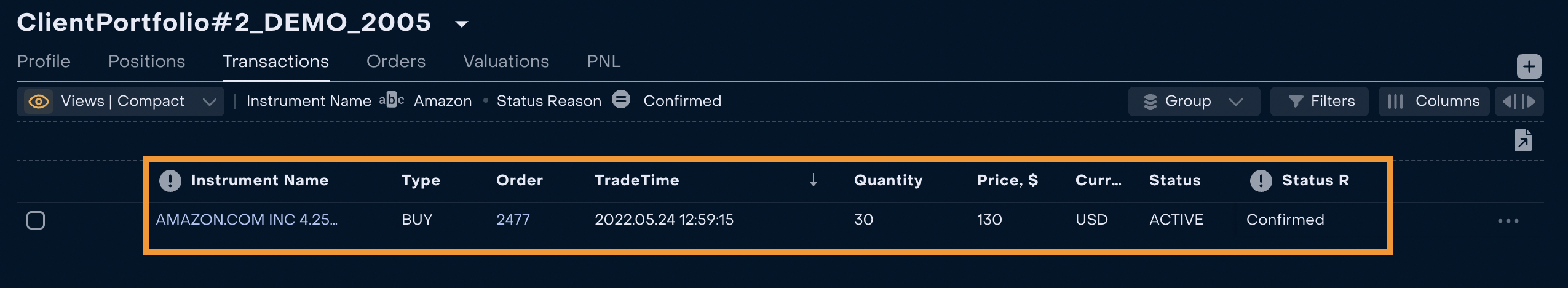

4. Related order(s) are created and executed automatically on Client Portfolio(s).

Back Office Manager can check that correct data is attached to Client Portfolio(s) according to previously created Order. Main information to check: Instrument, Type, Order, Trade Time, Quantity, Price, Currency, Status and Status Reason.

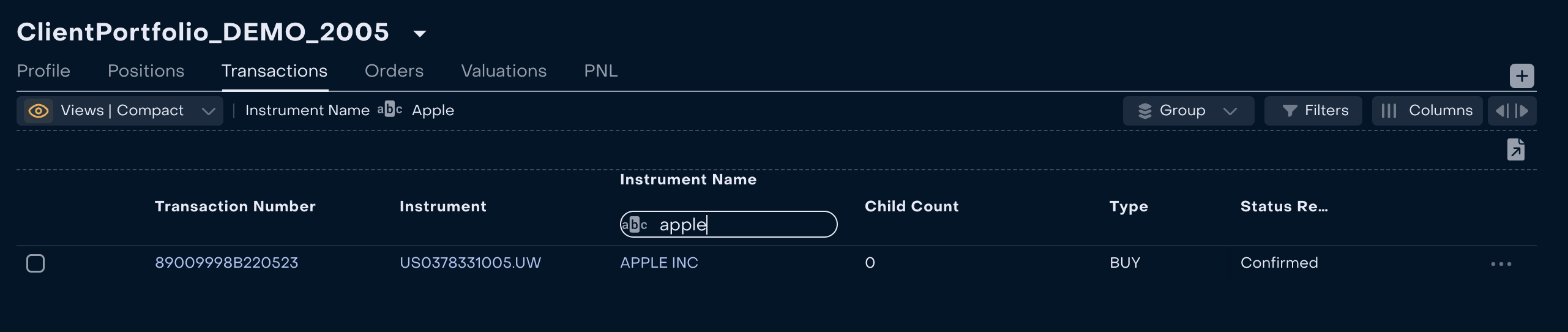

Example: Client 1 Portfolio

Example: Client 2 Portfolio

5. New data is applied to Client(s) Positions.