AVAILABLE IN:

Introduction A Recommendation is information suggesting or advising one or more financial instruments, including any opinion on their current or future value or price. Unlike a Strategy , a Recommendation does not allocate specific quantities of assets. This gives you, as a Client or Portfolio Manager, the flexibility to decide how much of the instrument to purchase.

Key Terminologies Term (A–Z)

Definition

Approve / Reject

Actions you can take on each Recommendation to either accept or decline the proposed investment.

Bank Account

The bank account linked to a portfolio for settlement purposes.

Draft

A Strategy Recommendation in preparation. The Investment Declaration and Holdings sections are completed, trading settings are configured and the draft is sent for approval.

Portfolio

Your client’s or personal investment account where Recommendations or Strategies can be applied.

Private Recommendation

A Recommendation visible only to Sales Managers within your company. It can only be shared by Managers.

Public Recommendation

A Recommendation visible to all users who have access to the Marketplace.

Published

The Recommendation becomes active and execution can begin.

Strategy

A structured investment plan with predefined asset allocation.

Permission Requirement Platform Name

Permission ID

Permission Levels

Recommendation

Recommendation

View, Modify, Create

👉 Explore Related Topics:

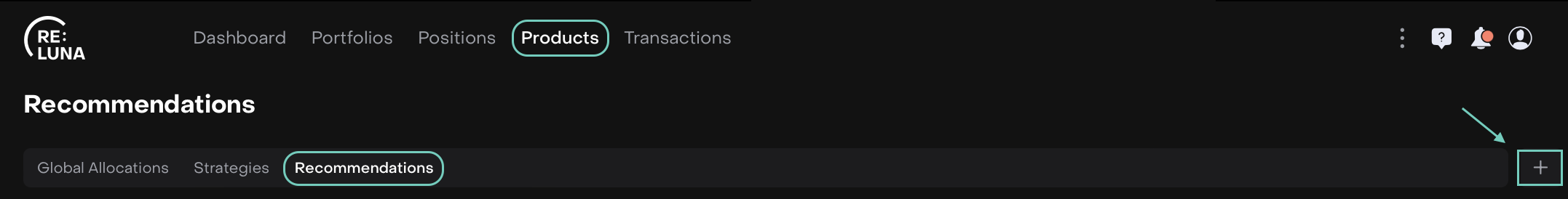

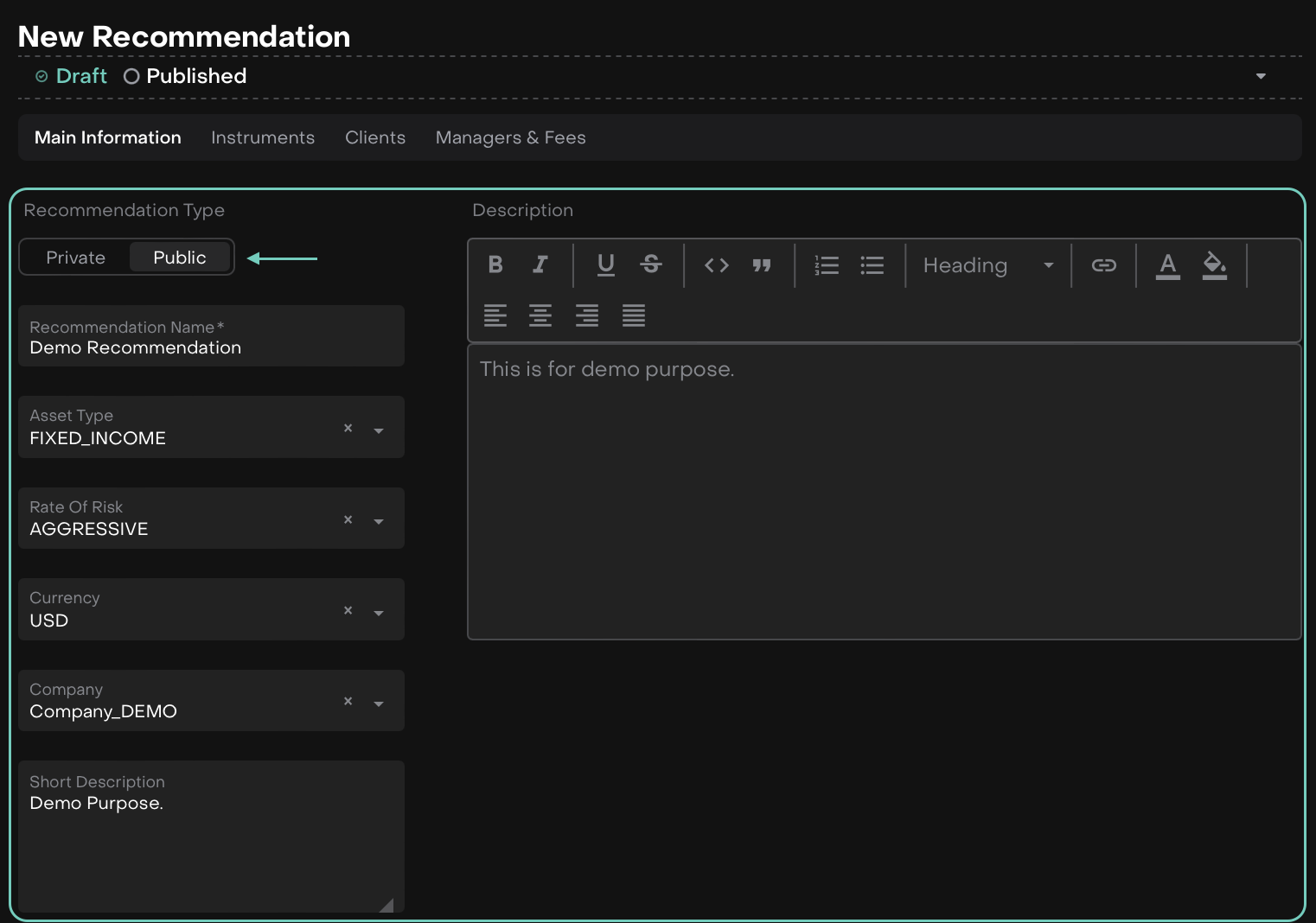

Accessing Recommendation Create a Recommendation Choose Recommendation Type and toggle to select Private/Public .

Fill in the required fields, as shown in the table below.

Detailed Form Fields Here:

Field Name

Defintion

What to Fill In

Recommendation Type* (switch button)

Defines the visibility of the Recommendation.

Select Private (visible only to Sales Managers of your company) or Public (visible to all users with Marketplace access).

Recommendation Name*

The title of the Recommendation that helps identify it in the platform.

Enter a clear, descriptive name for the Recommendation.

Asset Type*

Choose the type of assets that will be included under the strategy recommendation. Defines the nature of investments.

Select the type of assets from:

ALTERNATIVE_ASSETS

CASH

CERTIFICATE

COMMODITIES

CRYPTO

DEPOSIT

DERIVATIVE

EQUITIES

ETF

FIXED INCOME

FUNDS

FUTURES

FX

GRANTED LOAN

HEDGE FUND

INDEX

INTANGIBLE ASSET

LOAN

MUTUAL FUND

OPTIONS

OTHER

PRIVATE EQUITY

RECOMMENDATION

REPO

SP

STRATEGY

TANGIBLE ASSET

Rate of Risk*

Defines the overall risk profile of the strategy recommendation. Helps clients understand potential returns vs. risks.

Aggressive – High risk, high return (volatile assets).

Conservative – Low risk, capital preservation.

Moderate – Balanced between risk and return.

Moderately Aggressive – More risk than Moderate, less than Aggressive.

Moderately Conservative – More cautious than Moderate, less than Conservative.

Currency*

Choose the base reporting currency for the strategy.

Select from available currencies from the dropdown.

Once created, this field cannot be changed.

Company*

Select the company under which the strategy recommendation is created.

Dropdown list of available companies.

Short Description

Provide a precise note.

Free text.

Description

Provide a summary. Displays in Marketplace/Shop.

Free text.

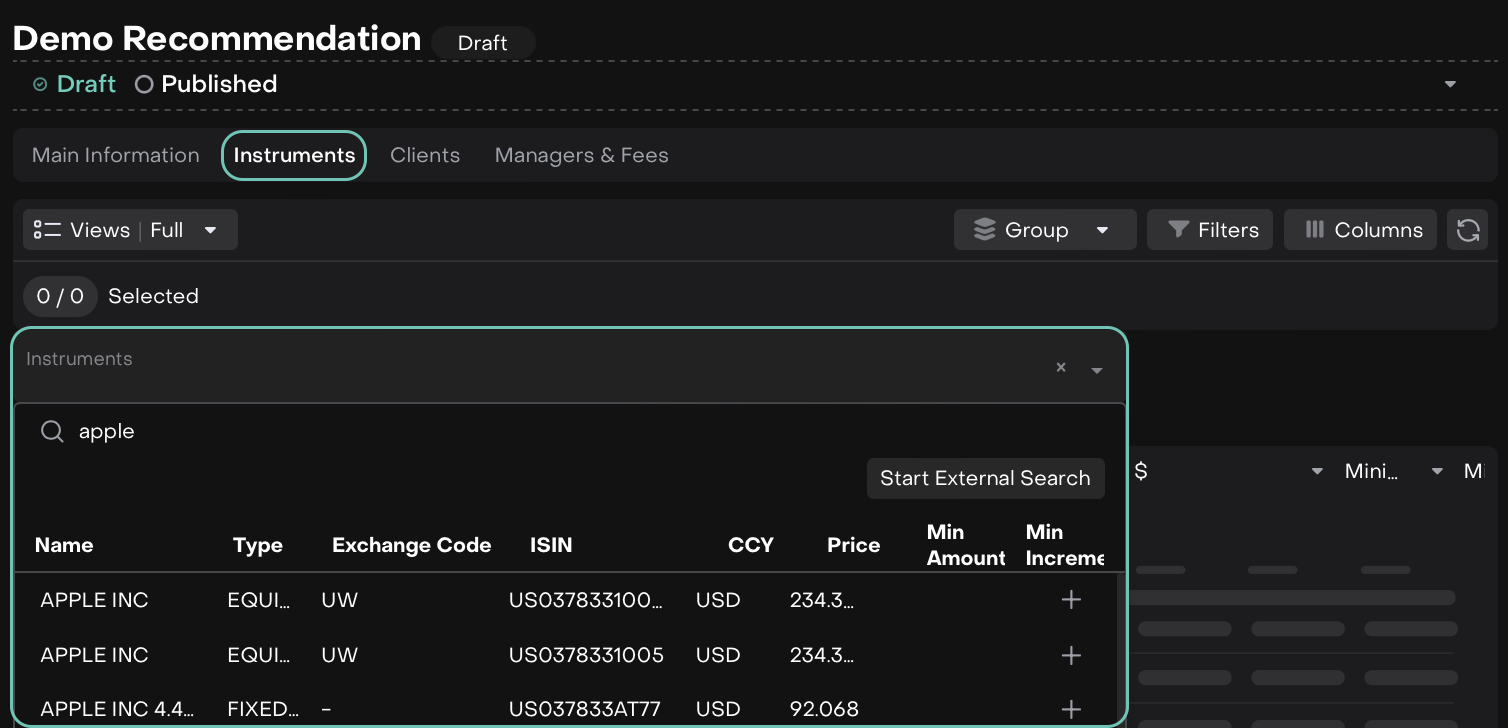

Once filled, click on Save Draft.

Then, the platform enables these below buttons. You can either:

Or/And,

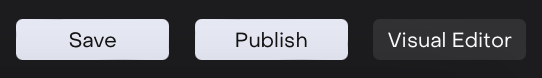

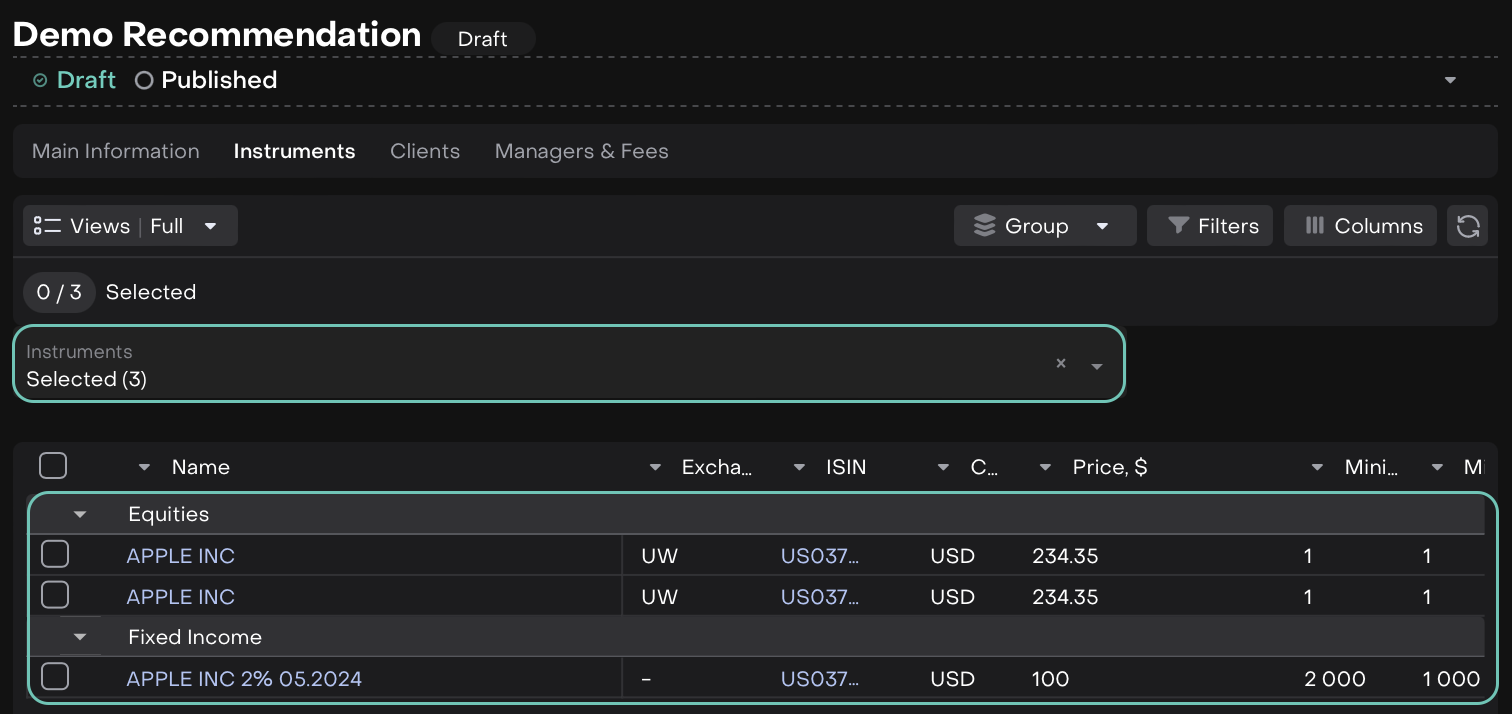

Instruments Tab Now, select the Instrument by external/internal search.

Then, click on the + icon to add them.

Detailed Table Fields Here:

Field Name

Definition

Name

The name of the financial instrument, organized under its asset type grouping on platform.

Type

The asset type category of the instrument.

Exchange

The market or exchange where the instrument is traded.

ISIN

The unique International Securities Identification Number of the instrument.

CCY

The trading currency of the instrument.

Price, $

The current market price of the instrument.

Minimum Increment

The smallest tradable unit for the instrument.

Minimum Amount

The minimum required investment amount for the instrument.

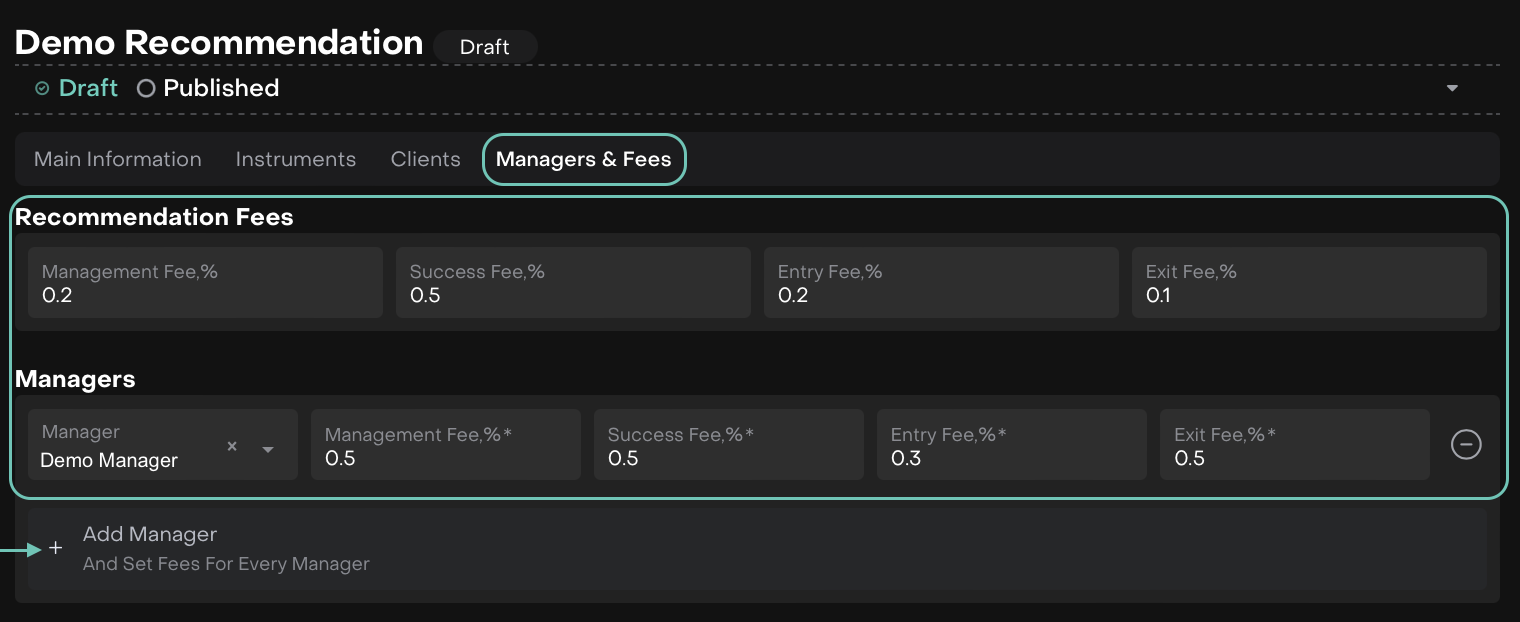

Managers & Fees Tab Here, fill in the required Recommendation Fees and Managers fields.

You can add multiple Managers by clicking on + Add Manager .

Detailed Fields Table Here:

Field Name

Definition

What to Fill In

Recommendation Fees

Management Fee, %

The percentage fee charged for managing the Recommendation.

Enter the management fee as a percentage.

Success Fee, %

The performance-based fee, applied if the Recommendation achieves positive results.

Enter the success fee as a percentage.

Entry Fee, %

The fee charged when entering into the Recommendation.

Enter the entry fee as a percentage.

Exit Fee, %

The fee charged when exiting the Recommendation.

Enter the exit fee as a percentage.

Managers

Management Fee, %*

The manager-specific percentage fee for managing the Recommendation.

Enter the manager’s management fee as a percentage.

Success Fee, %*

The performance-based fee charged by the manager.

Enter the manager’s success fee as a percentage.

Entry Fee, %*

The fee charged by the manager when entering the Recommendation.

Enter the manager’s entry fee as a percentage.

Exit Fee, %*

The fee charged by the manager when exiting the Recommendation.

Enter the manager’s exit fee as a percentage.

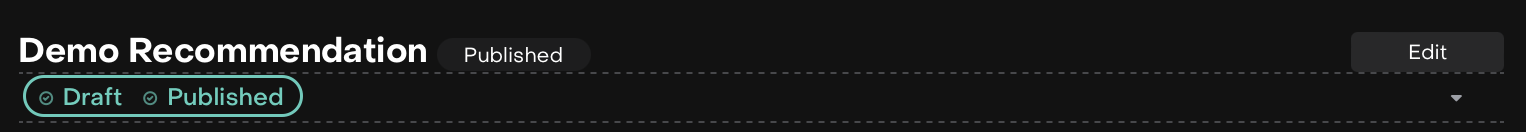

Click Save or Publish it to put up on Marketplace.

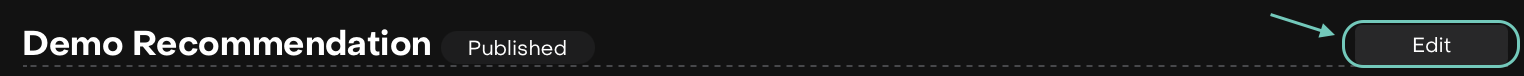

Once published, the status of the recommendation will change from Draft to Published .

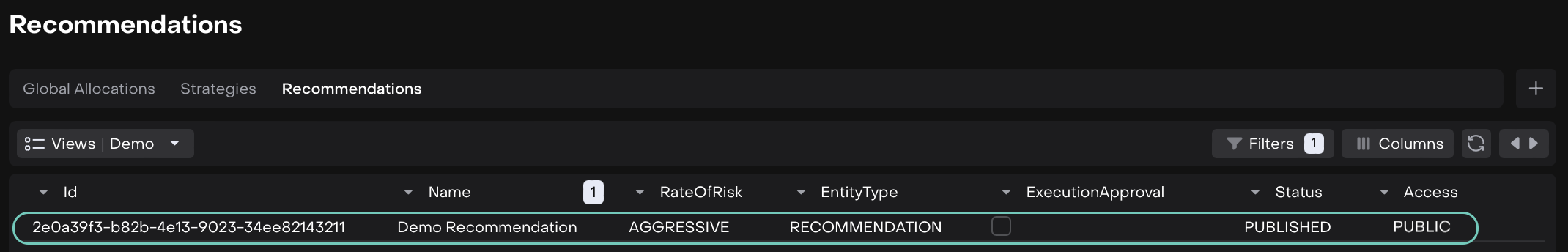

All Table Fields Explained Here:

Field Name

Definition

What is Filled In

Id

Unique platform-generated identifier for the Recommendation.

Auto-generated ID (cannot be edited).

Name

The title of the Recommendation.

Entered Recommendation name.

Rate of Risk

The risk level associated with the Recommendation.

Risk rate set during creation.

Entity Type

Defines the type of entity.

Always set as Recommendation .

Execution Approval

Indicates whether approval is required before execution.

Displayed as a tick mark/checkbox if approval is set.

Status

Current state of the Recommendation.

Draft (in preparation) or Published (active and available).

Access

Visibility of the Recommendation.

Private (internal) or Public (Marketplace).

Minimum Investment

The minimum amount required to invest in the Recommendation.

Value entered during creation.

Custody Fee

Fee charged for safekeeping and custody services.

Entered percentage/amount.

CCY

The base currency of the Recommendation.

Currency entered.

Manager Fee

Ongoing management fee percentage charged by the manager.

Value entered.

Success Fee

Performance-based fee charged if returns are achieved.

Value entered.

Exit Fee

Fee charged when exiting the Recommendation.

Value entered.

Entry Fee

Fee charged when entering into the Recommendation.

Value entered.

Safekeeping Fee

Fee charged for holding the assets securely.

Value entered.

Description

Detailed explanation of the Recommendation.

Long text description entered during creation.

Short Description

A brief summary of the Recommendation.

Short text summary entered during creation.

Asset Type

The type/category of assets included in the Recommendation.

Asset type(s) selected.

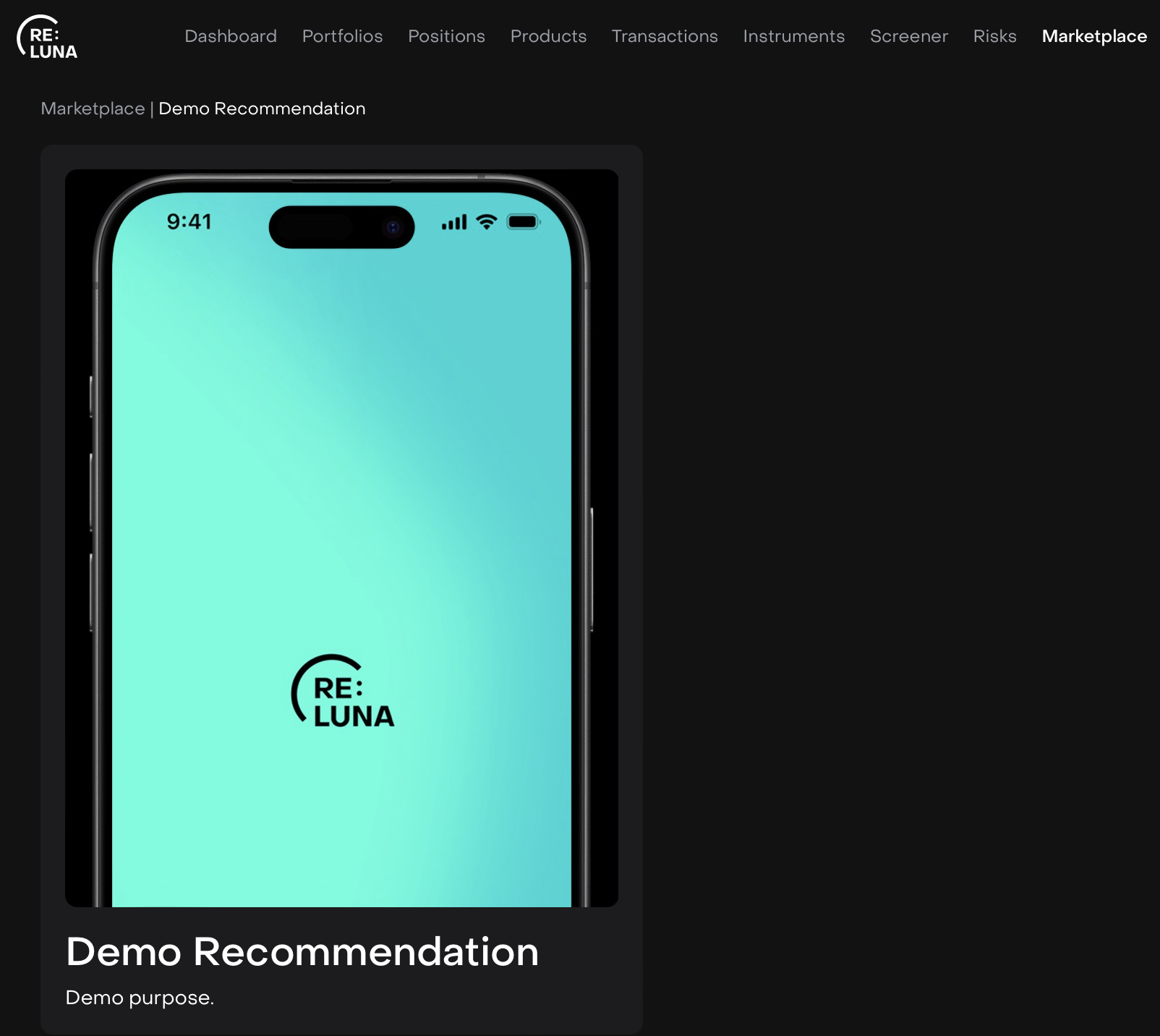

Background

Visual/branding materials attached to the Recommendation.

Image or video files uploaded. Once published, shown on Marketplace.

Created At

The date and time when the Recommendation was created.

Auto-filled timestamp.

Created By

The user who created the Recommendation.

Auto-filled with creator’s name/profile.

Updated At

The date and time when the Recommendation was last modified.

Auto-filled timestamp.

Updated By

The user who last modified the Recommendation.

Auto-filled with updater’s name/profile.

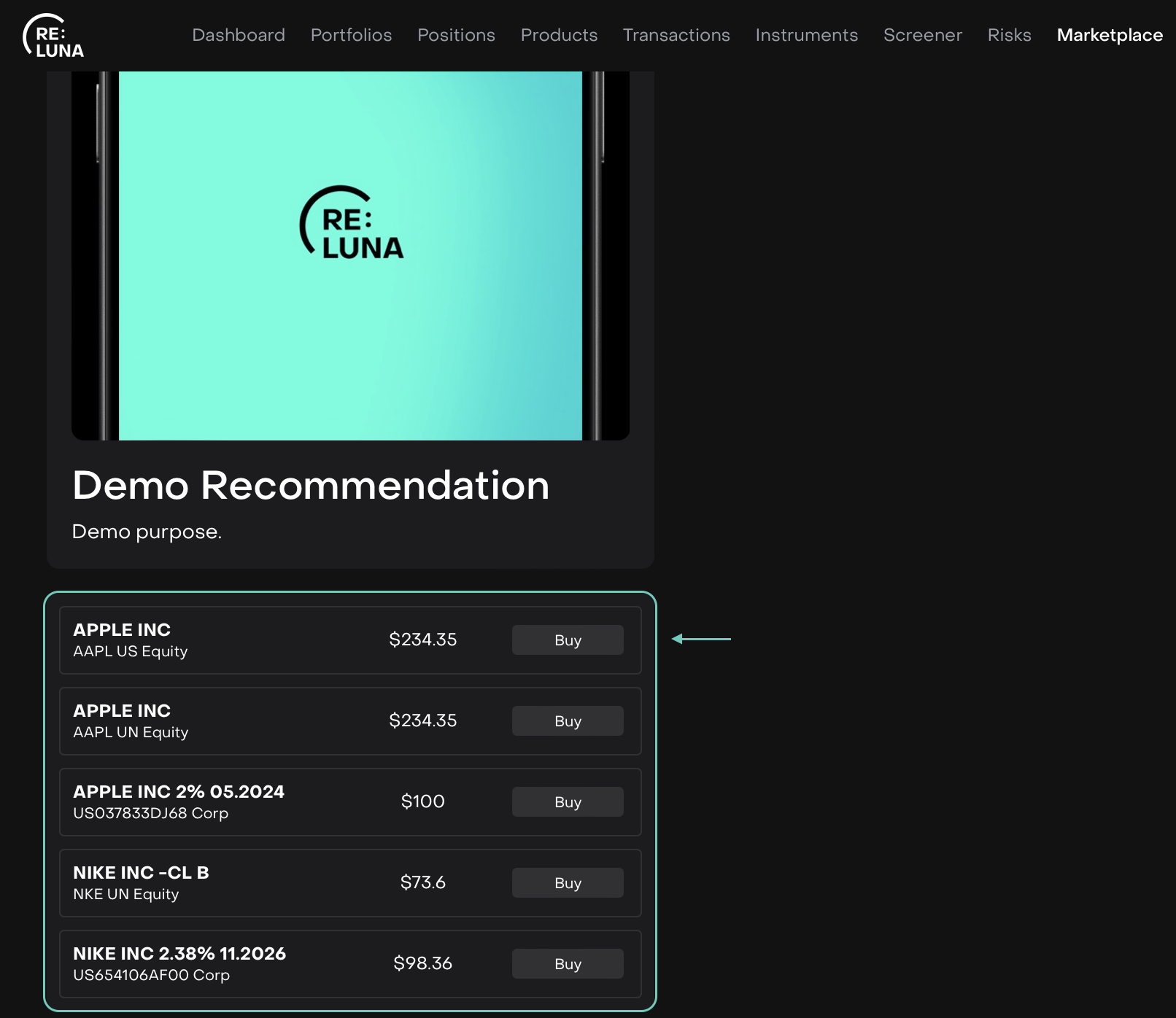

Click on Visual Editor at the bottom and the platform redirects to Marketplace .

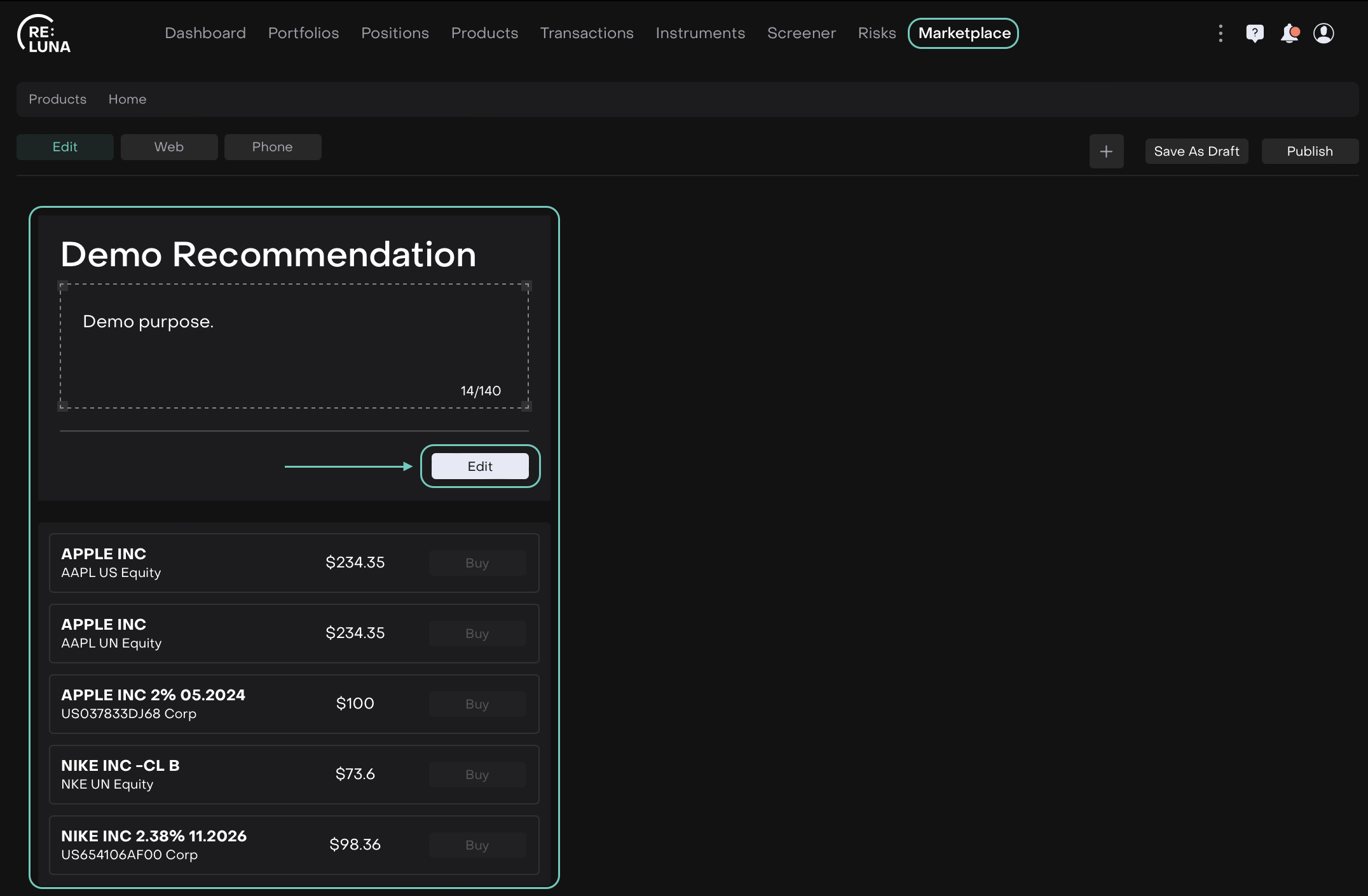

By default, the Edit screen opens on the Marketplace tab.

🔗 Click here

Shows the list of added Instruments here. Buy option is disabled but once published on Shop, it’ll be available to place the order.

Detailed Fields Table Here:

Field Name

Definition

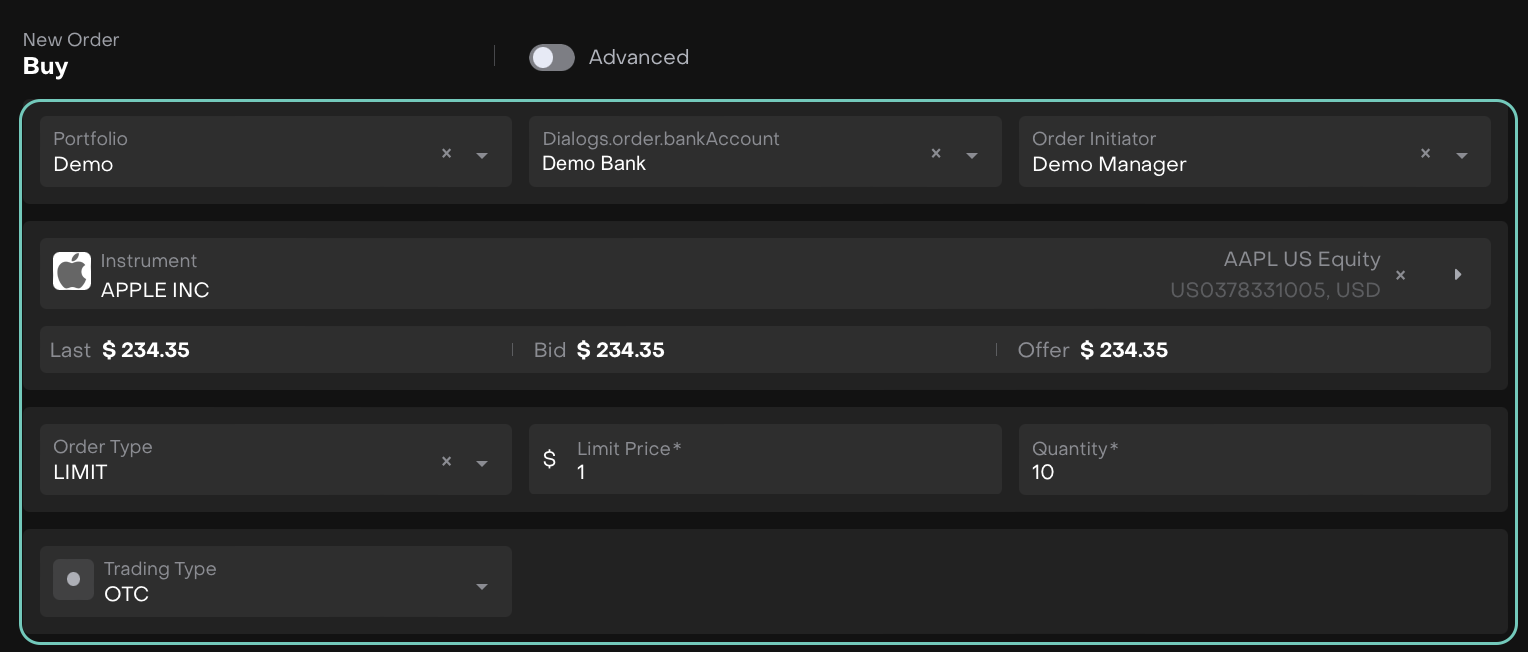

What to Fill In

Portfolio*

The portfolio in which the order will be executed.

Select the portfolio from the dropdown.

Bank Account*

The bank account linked to the portfolio for settlement.

Select the bank account from the dropdown.

Order Initiator

The user who is creating the order.

Auto-selected as the current user; can change from dropdown.

Instrument*

The asset to be bought.

Auto-filled from the instrument chosen in the marketplace.

Order Type*

Specifies whether the order is a Limit or Market order.

Select: Limit or Market. If Market is chosen, additional field Limit Price * appears.

Limit Price*

The maximum price per unit to buy (only for Limit orders).

Enter the price per asset.

Quantity*

Number of units to buy in this order.

Enter the quantity to buy.

Trading Type

Specifies the type of trading execution.

Select: OTC or DMA. If DMA is selected, additional field Force In Time * appears.

Force In Time*

The time validity instruction for DMA orders.

Select from options:

GOOD_TILL_CANCEL

DAY

AT_THE_OPENING

IMMEDIATE_OR_CANCEL

FILL_OR_KILL

GOOD_TILL_DATE

AT_THE_CLOSE

GOOD_THROUGH_CROSSING

Learn more here

🔗 Click here

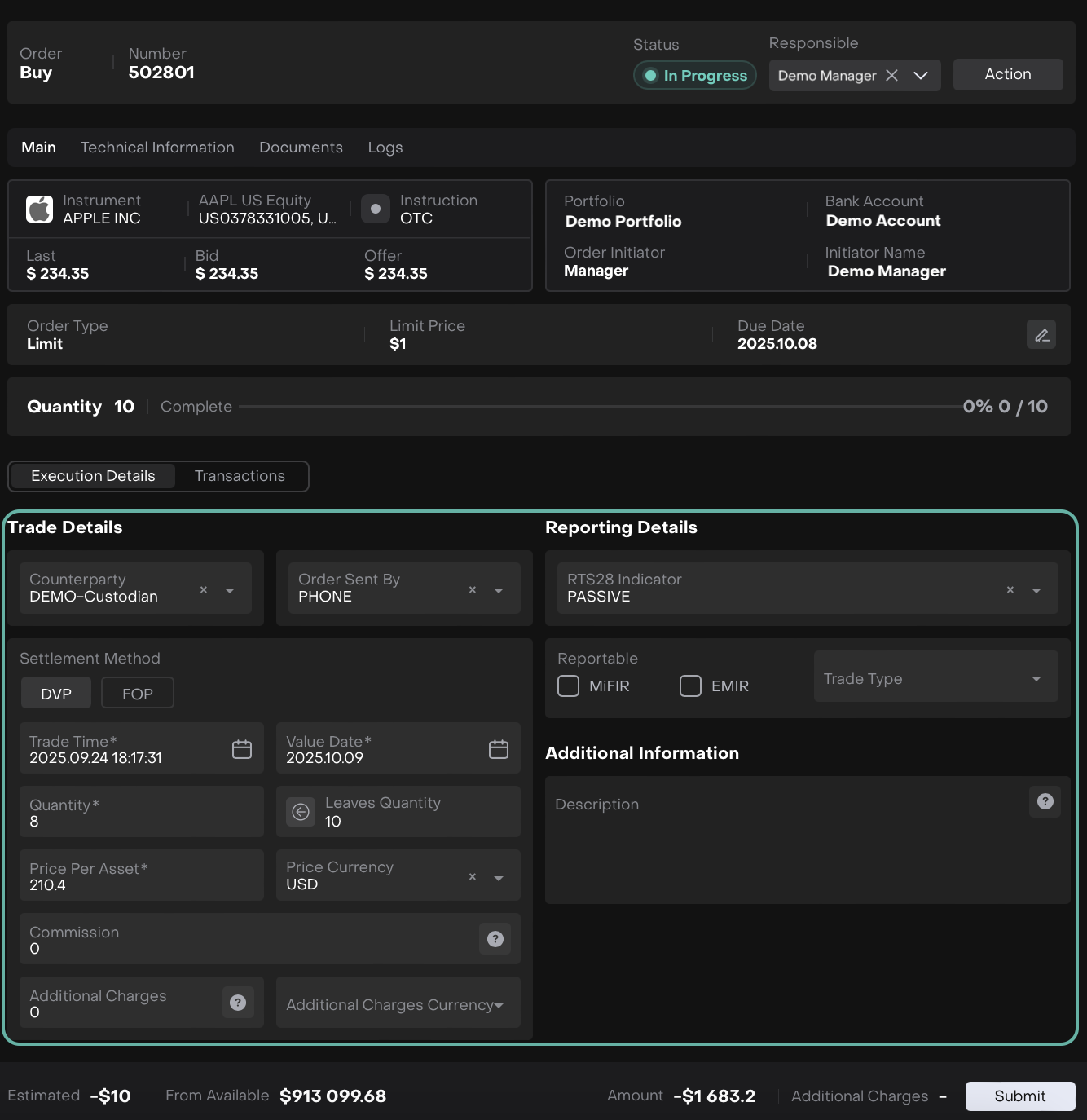

Order Execution Detailed Fields Table Here:

Field Name

Definition

What to Fill In

Counterparty*

The broker, bank or institution with whom the order is being executed.

Select the counterparty name.

Order Sent By*

The channel used to send the order to the counterparty.

Choose one: PHONE, EMAIL, BLOOMBERG, ELECTRONIC, OTHER, QUIK, FIX

Settlement Method

The method used to settle the order.

Toggle: DVP / FOP

Payment Date

Required only if FOP is selected; date when payment will occur.

Select from calendar.

Trade Time*

The time the order is executed.

Auto-filled by the platform.

Value Date*

The date the transaction will settle.

Auto-filled by the platform.

Quantity*

Amount of asset being executed in this order.

Enter the quantity; can be partial or full execution.

Leaves Quantity

Remaining quantity from the original order that hasn’t been executed yet.

Auto-calculated; read-only.

Price Per Asset*

Execution price per unit of the asset.

Enter the price per asset.

Price Currency*

Currency in which the price is quoted.

Select from options, e.g., USD, EUR.

Commission

Any commission charged for executing this order.

Enter the value if applicable.

Additional Charges

Other fees related to executing the order.

Enter the value if applicable.

Additional Charges Currency

Currency for additional charges.

Select from options, e.g., USD, EUR.

RTS28 Indicator

Regulatory indicator showing the type of trading strategy.

Select: AGGRESSIVE, DIRECTED, PASSIVE, N_A

Reportable

Regulatory reporting flags.

Checkboxes: MiFiR, EMIR; select Trade Type from dropdown if applicable.

Additional Information

Any extra notes or instructions for execution.

Free text.

🔗 Click here

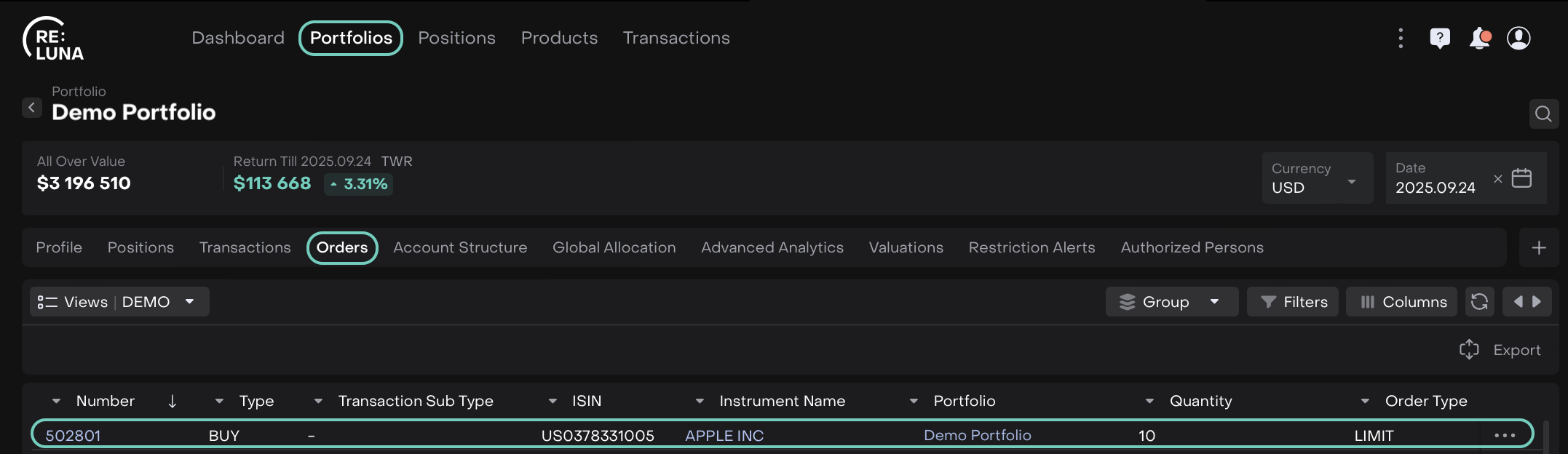

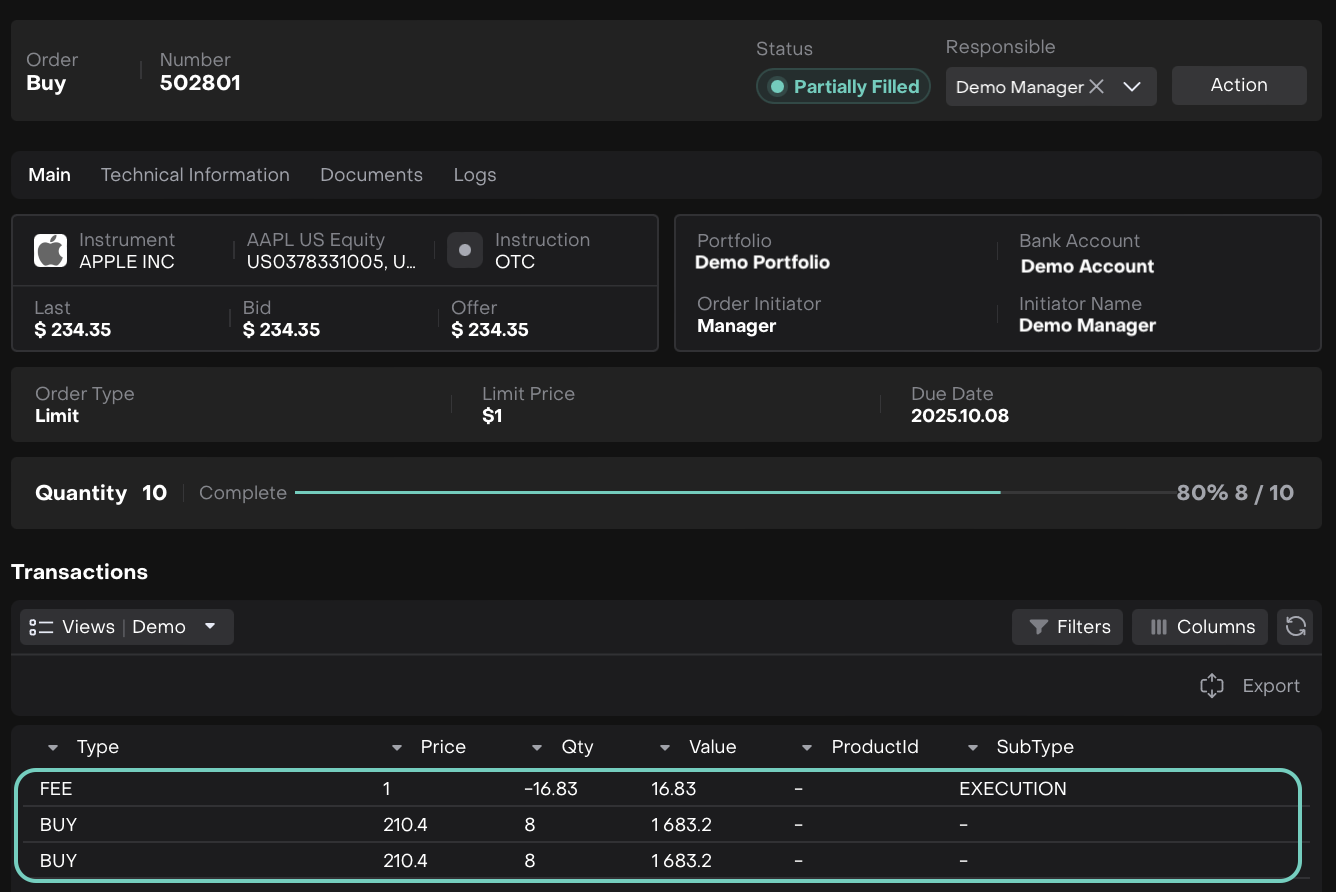

What Happens After Execution When Partially Filled

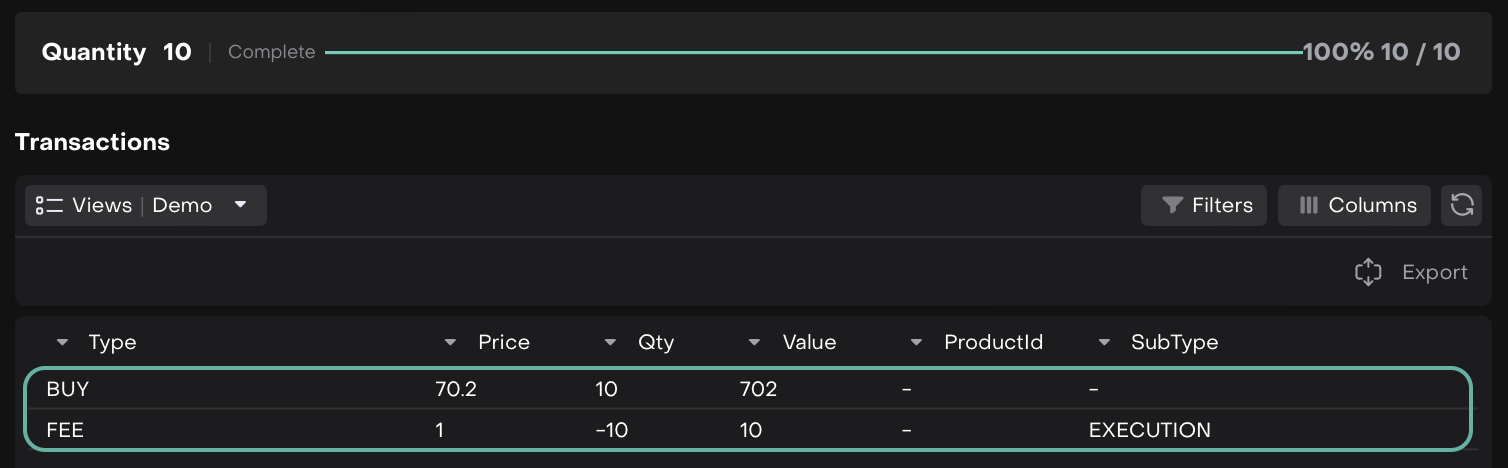

When Fully Executed