Use Advanced Trading Order Form

AVAILABLE IN:

Introduction

The Reluna platform has an Advanced form of Trading Orders. Advanced form of order gives additional opportunities to Initiator. This form provides additional configuration options, empowering the Initiator to tailor orders beyond the standard setup.

Permission Requirement

Access to the Advanced Trading Order Form is restricted to users with specific permissions.

Contact Reluna Support team to update your permissions in the platform.

When Using Advanced Form

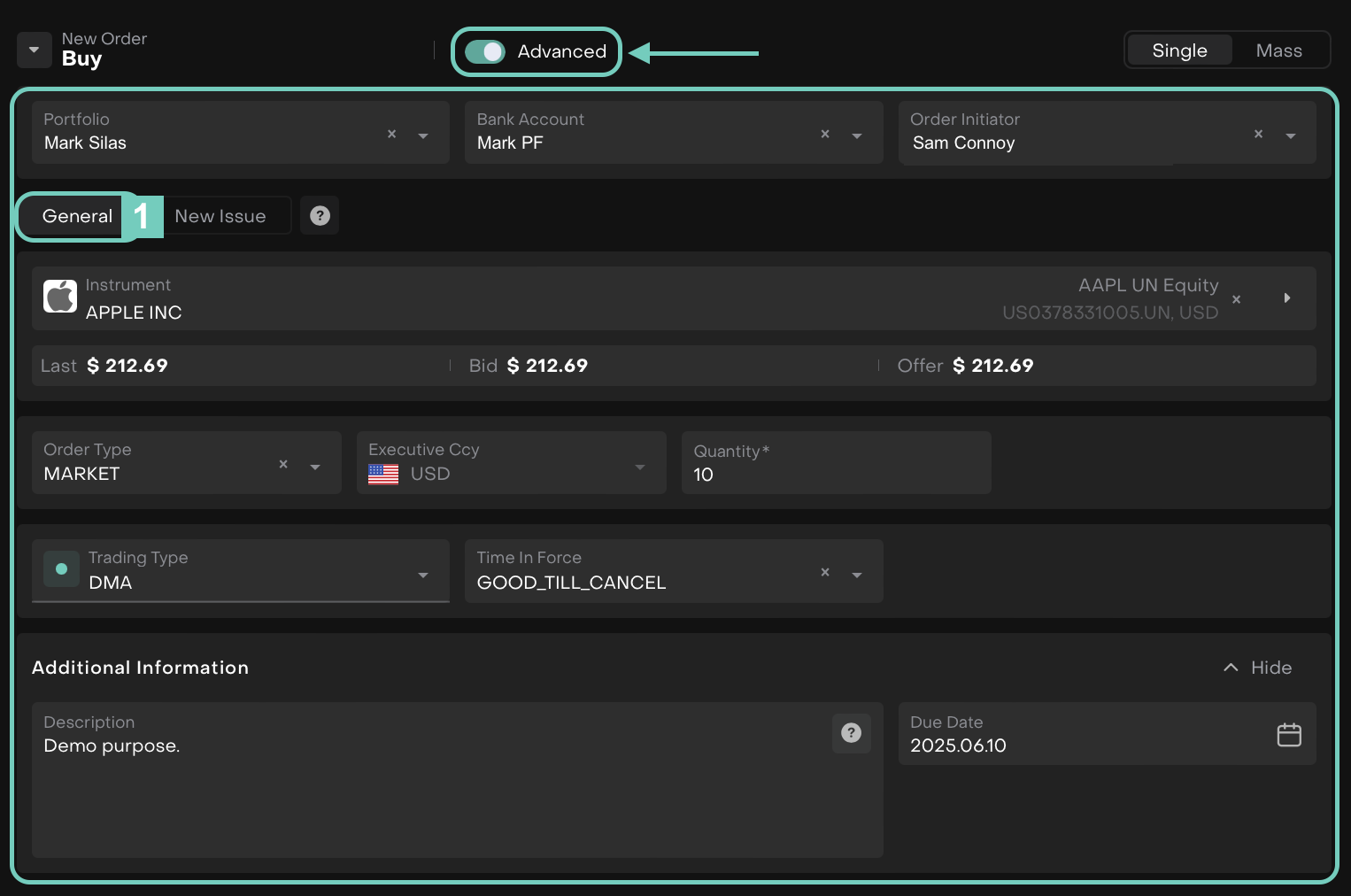

Switch to Advanced mode (top toggle) to access features not available in the basic form:

Choose between Single or Mass order modes.

Access the Executive Currency field for currency trades.

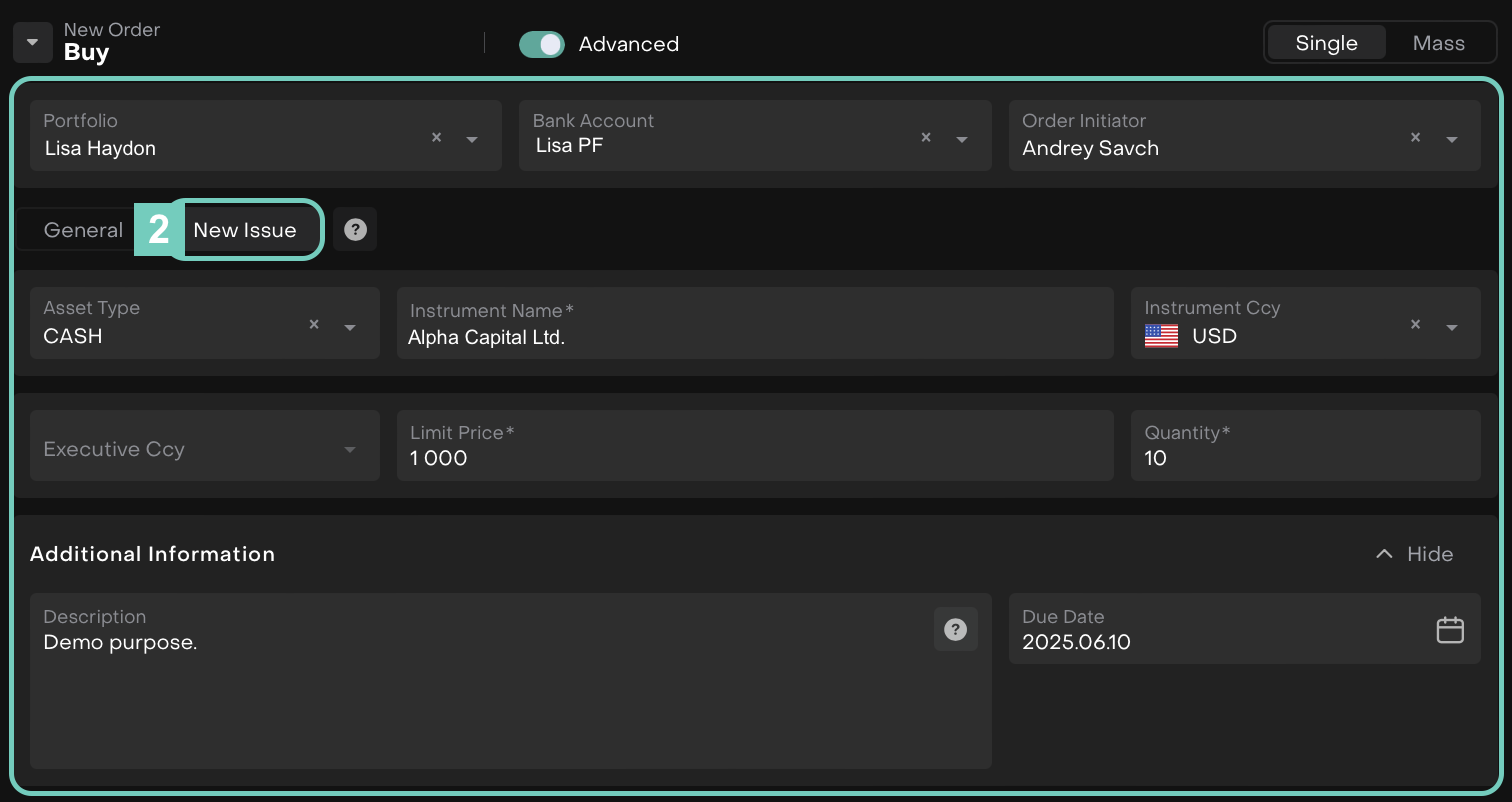

Use the (1) General tab for existing instruments or the (2) New Issue tab for upcoming/off-book instruments.

These options allow you to place one or more orders across different Bank Accounts, depending on your trading needs.

General Tab

Use this when placing an order for instruments already listed and available for trade.

Follow the same steps as in the New Order Creation form.

Fill in the required fields as outlined in the table below.

Review all inputs and confirm the details.

Click Buy/Sell to finalize the order.

Once the order is created, proceed with the same steps used for Order Execution.

New Issue Tab

Use this when placing a BUY order for a security that is not yet available in the market, such as an IPO or structured deal.

Follow the same steps as in the New Order Creation form.

Fill in the required fields as outlined in the table below.

The New Issue tab allows greater flexibility but requires manual input. Make sure your asset details are confirmed before placing the order.

Review all inputs and confirm the details.

Click Buy to finalize the order.

Once the order is created, proceed with the same steps used for Order Execution.