Import Transactions Manually

Introduction

Manual import of transactions refers to uploading or entering transaction data into the Platform manually, rather than using automated process. The Reluna platform allows you to upload one or multiple transactions at once, which are then automatically linked with Bank Accounts and Portfolios.

This feature is particularly useful when:

Transaction data is not automatically captured by the Platform.

Working with data from external sources that are not integrated with the Platform.

Key Terminologies

Term (A-Z) | Definition |

|---|---|

CSV File | A text file in a specific format that stores data in a table-like structure. Manual Import accepts semicolon-separated values (.csv) files. |

Import File | Action in the platform to upload a CSV file with transaction data into the system. |

Manual Import | Process of entering or uploading transactions into the Platform manually rather than through automated integration. |

Pre-Filled Template | CSV template with sample data to guide users in formatting transaction data correctly. |

Template | Predefined CSV structure used for manual import of transactions. |

XLS File | A spreadsheet file format created by Microsoft Excel (.xls). If used for manual import, it must be saved/exported as a CSV file before uploading to the platform. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

Permission Requirements

Platform Name | Permission ID | Permission Level |

|---|---|---|

Transactions | Transactions | View, Modify, Create |

Import | Manual import transactions | View, Modify, Create |

When to Use Manual Import

Manual import is typically used in two main scenarios:

Uploading historical transaction data to the Platform.

Uploading transactions when Bank Integration is not available for daily activity.

Transactions loaded via manual import participate in calculations after they receive particular status in the Platform.

Navigation to Import Tab

Manual import is available to authorized users via:

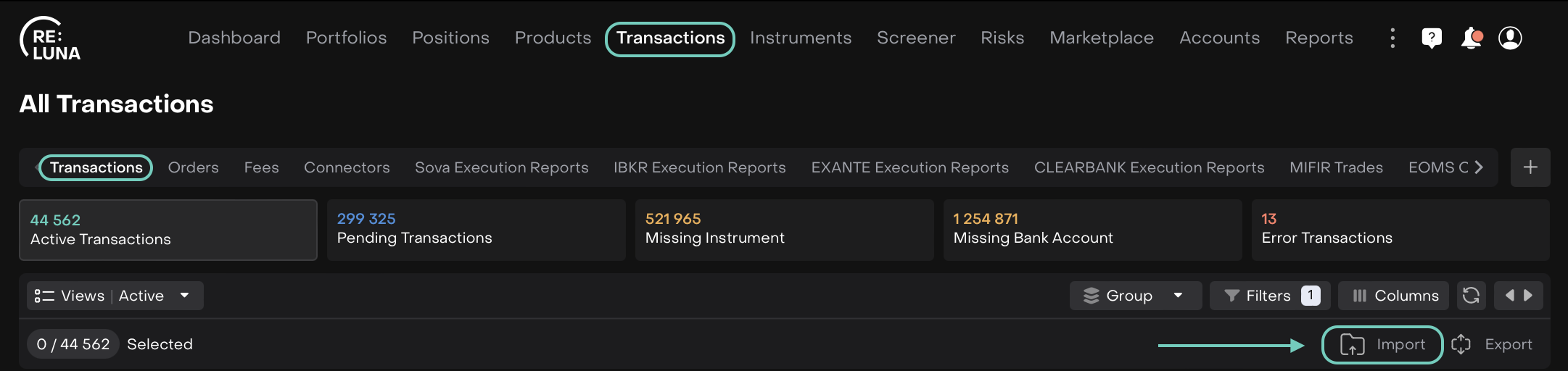

Transactions > All Transactions > Import

Or,

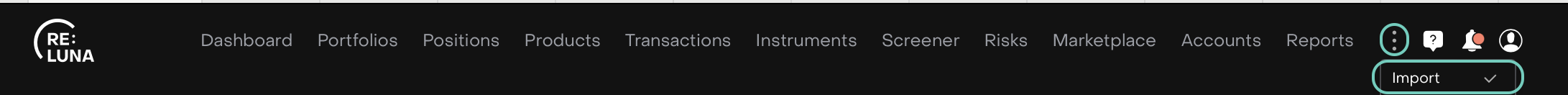

Dashboard > Import page

How to Manually Import Transactions

Click Import option to open the Manual Import window.

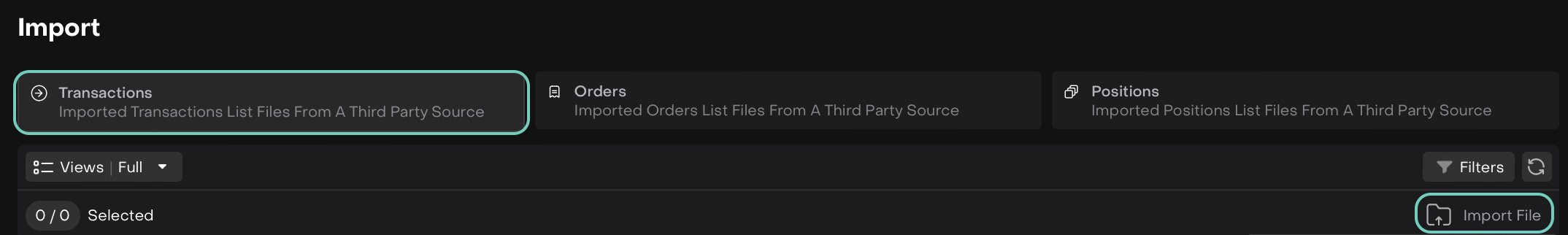

Navigate to the Transactions tab and click Import File.

A stepper based form opens.

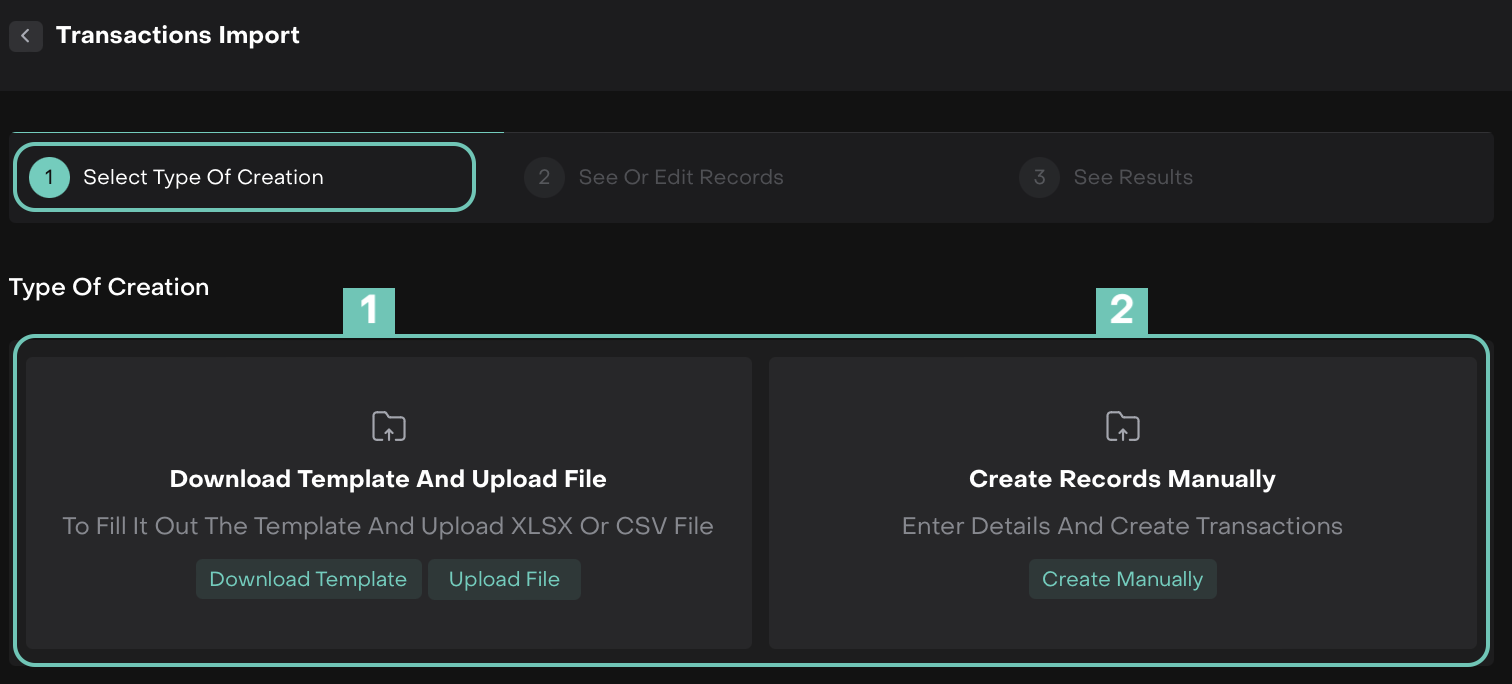

Step 1: Select Type of Creation

You have two ways to begin the import process:

1. Download Template and Upload File

Click Download Template.

Fill out the transaction details in the provided

.xlsxor.csvtemplate file.Click Upload File to import the completed template back into the platform.

The CSV file template gets download on the PC/System; open/view/fill in the columns (in case of Empty Template) to further save and upload.

Once the file is loaded, you'll move to Step 2.

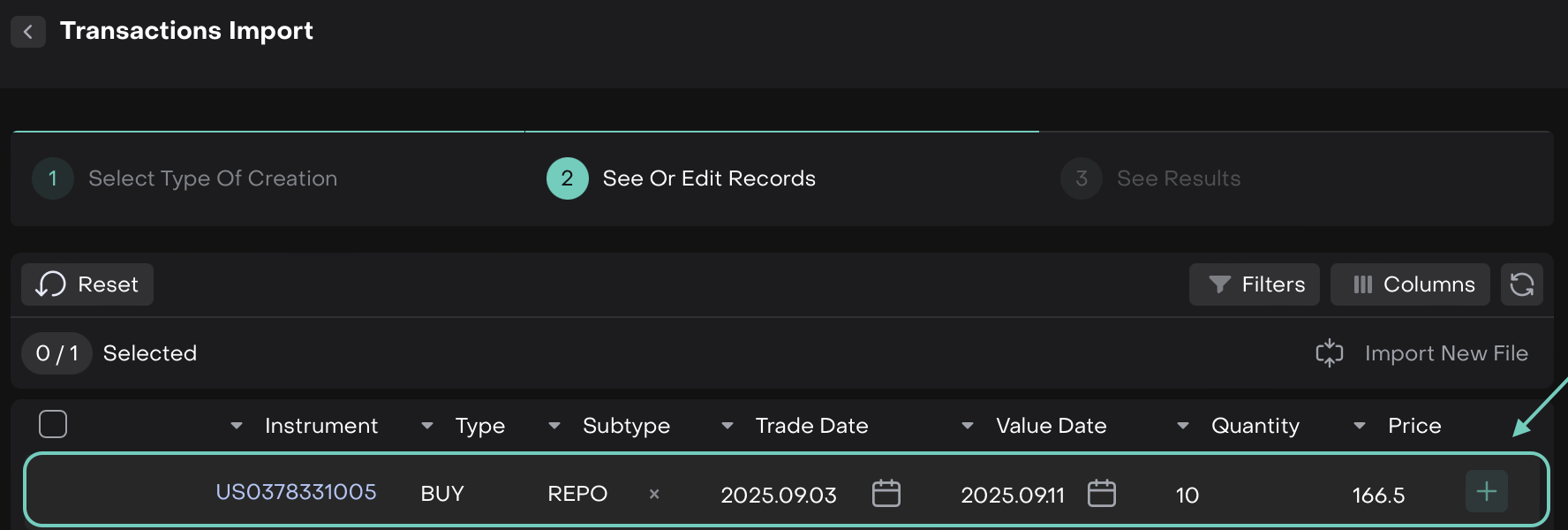

2. Create Records Manually

Click Create Manually and fill out all fields and press + icon.

Choose this if you want to input data one record at a time.

On its click, you'll directly move to Step 2.

Manual Transactions Import Template

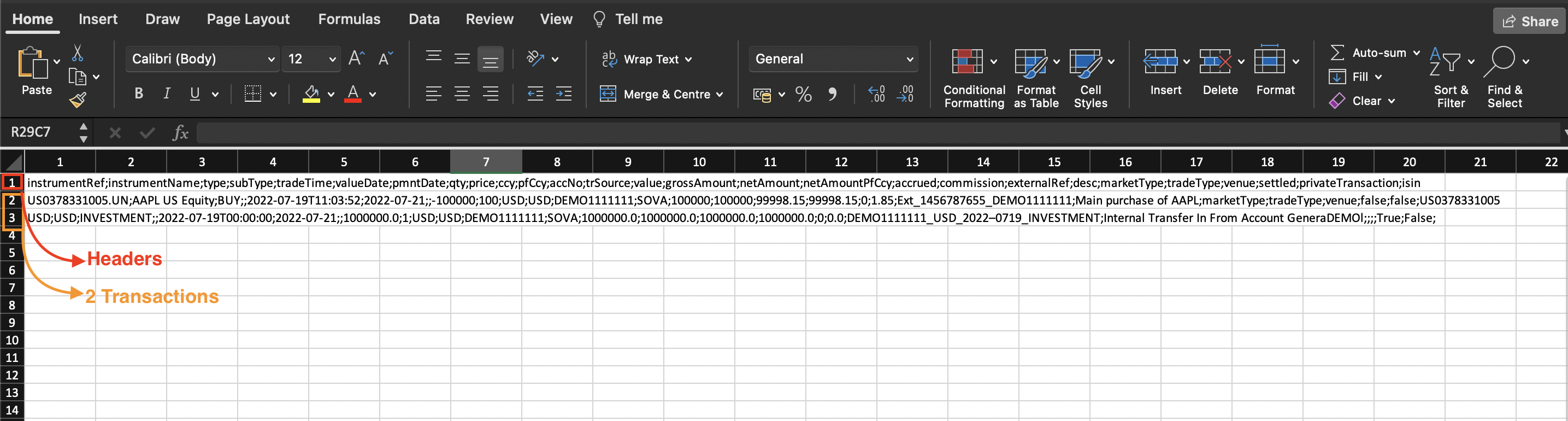

Example of Transaction Template

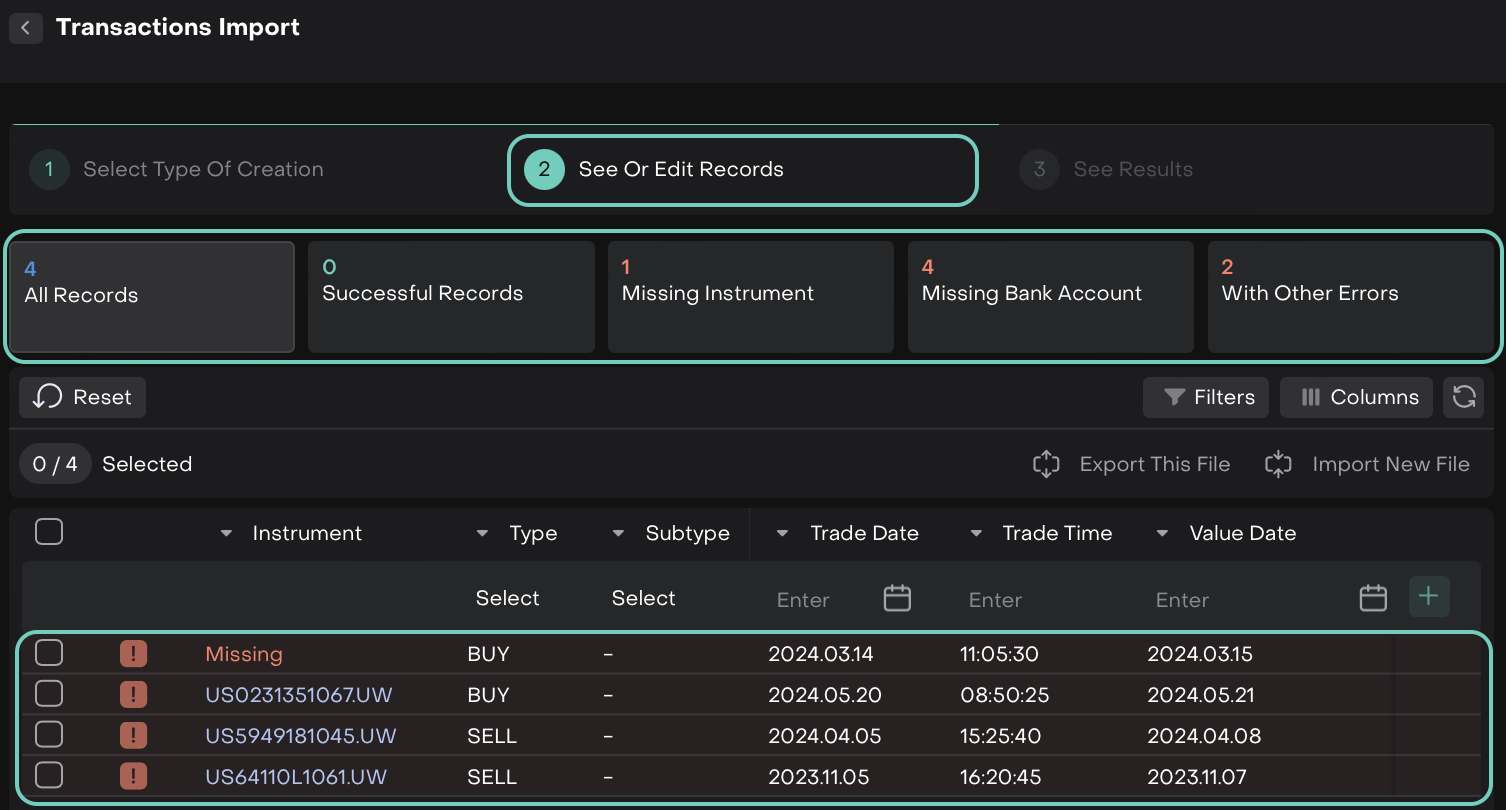

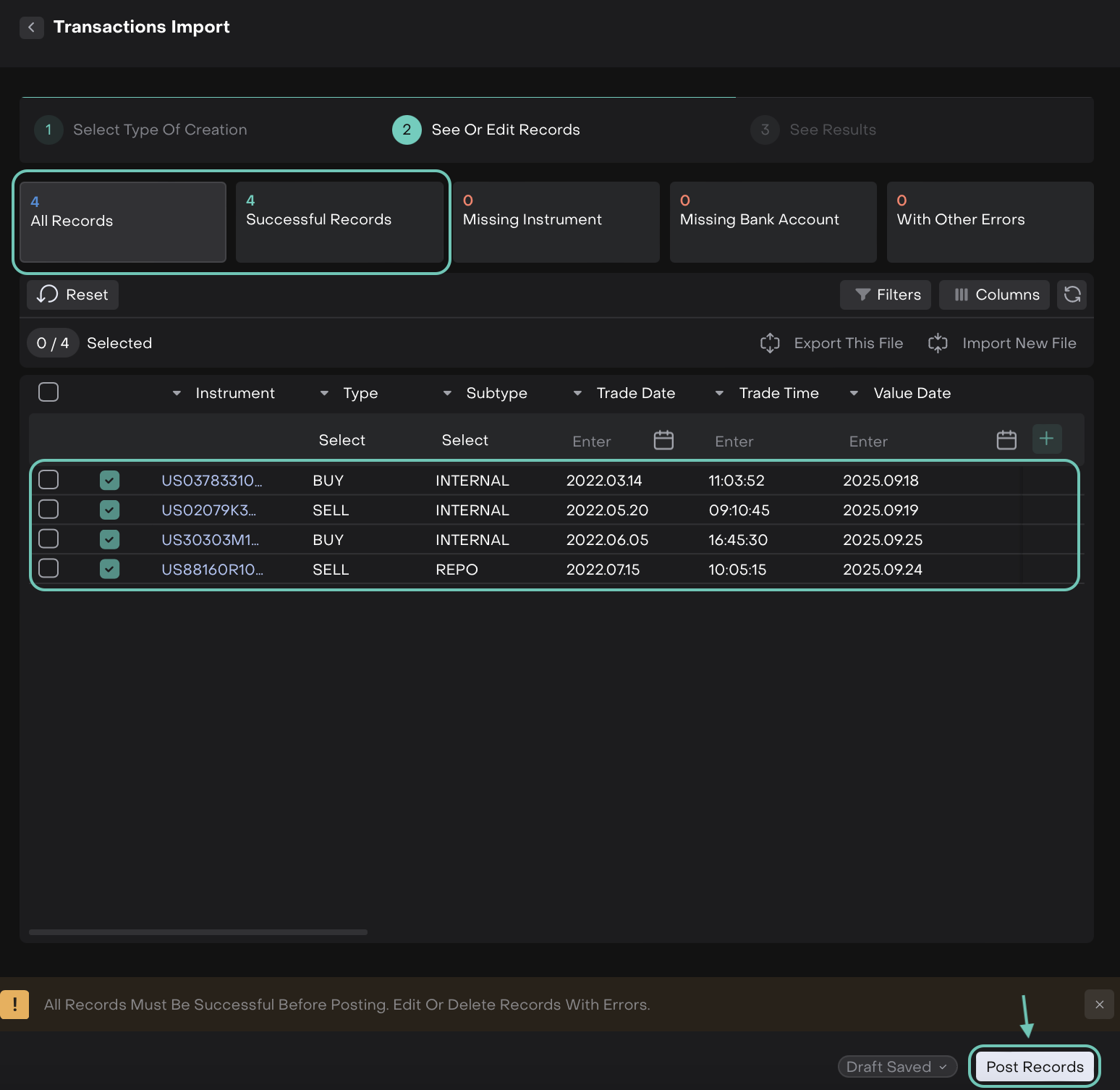

Step 2: See or Edit Records

Here, you'll see all imported or created records categorized into validation blocks.

Make sure all issues are resolved so that Successful Records = All Records.

You cannot fix errors directly in the table view. You must click into each validation block to fix records individually.

Default Buttons in All Record Blocks

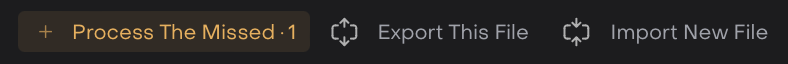

Depending on the validation outcome of your uploaded file, different categories of draft records may appear. Each category offers a specific set of buttons to help you act on the records efficiently:

Once all records are marked successful:

The Post Records button will be enabled.

Click it to push all records to the Transactions module.

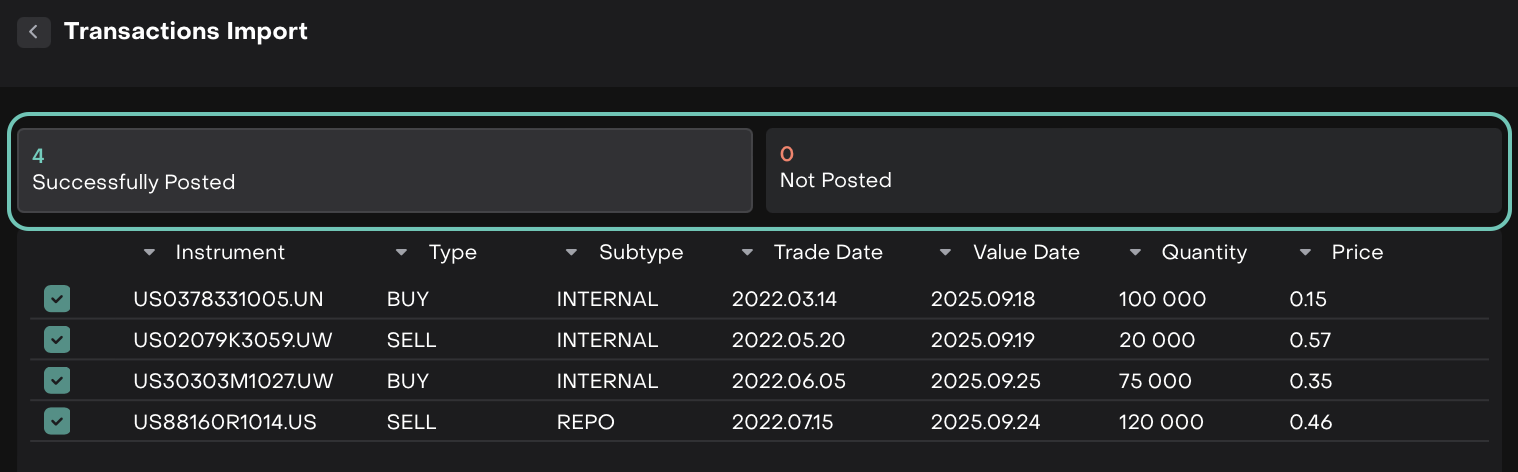

Step 3: See Results

Once records are validated and posted, they’ll appear in the transactions table.

After posting, two confirmation tabs will appear:

Successfully Posted

Not Posted

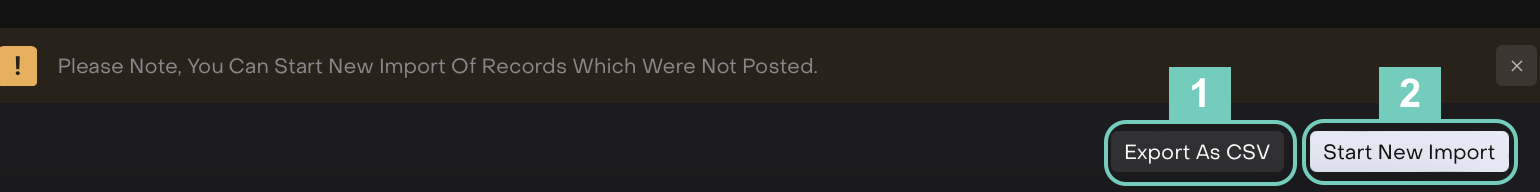

If any record couldn’t be posted, it will appear under the Not Posted tab for further action.

If any records fail to post, you can go to Not Posted tab:

Export as CSV – to download failed records and fix them.

Start New Import – to re-import corrected records.