Manage Marginal Trading

AVAILABLE IN:

Introduction

The platform supports the creation of orders even in cases where the bank account has a negative balance or when the order may result in a negative balance. This applies to both cash and securities positions and reflects the principles of marginal trading.

Such functionality enables users to operate beyond the available balance, allowing for more flexible and strategic trading.

How to Enable Marginal Trading

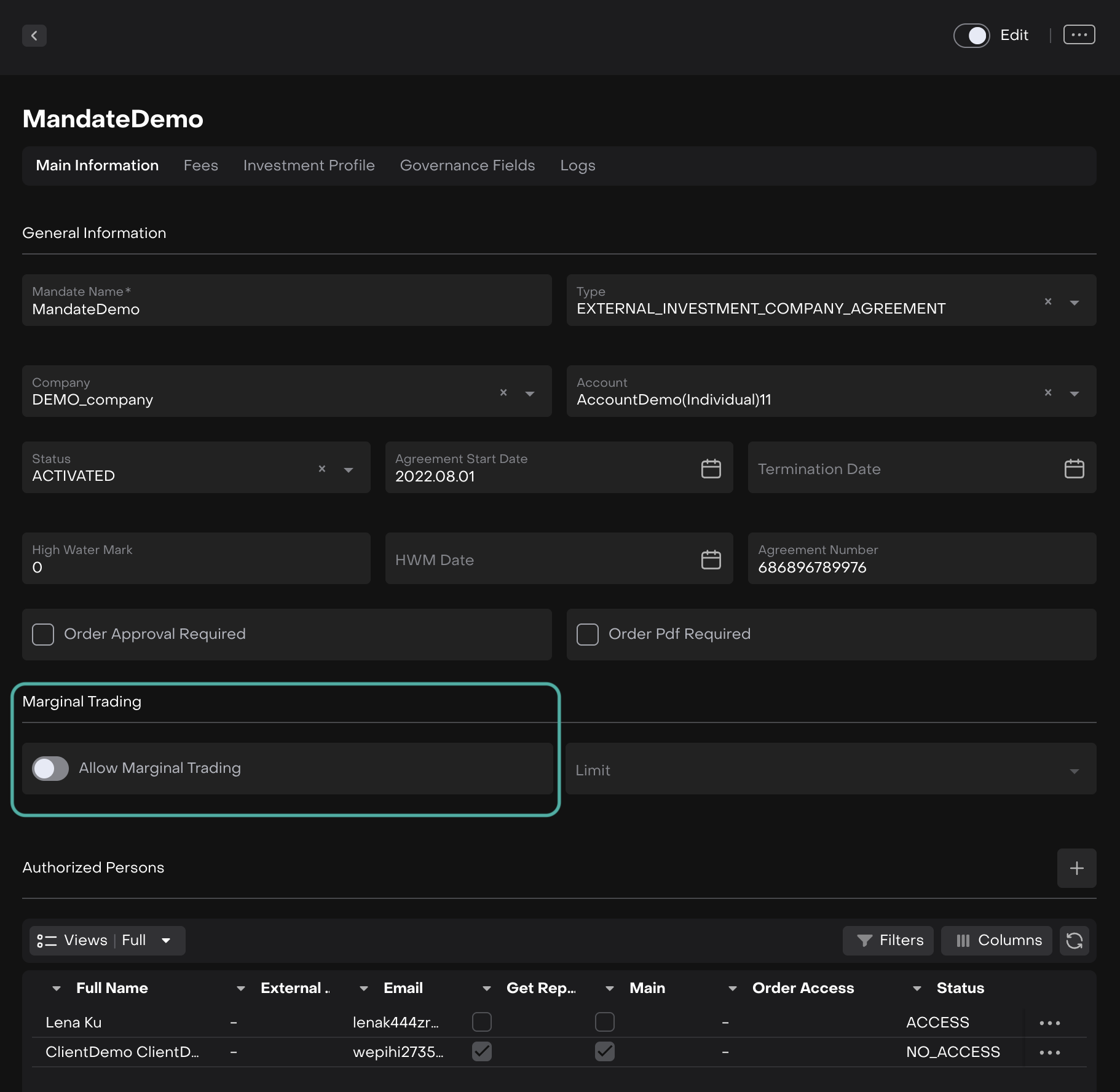

Marginal trading is configured at the Mandate level.

Open the relevant Mandate.

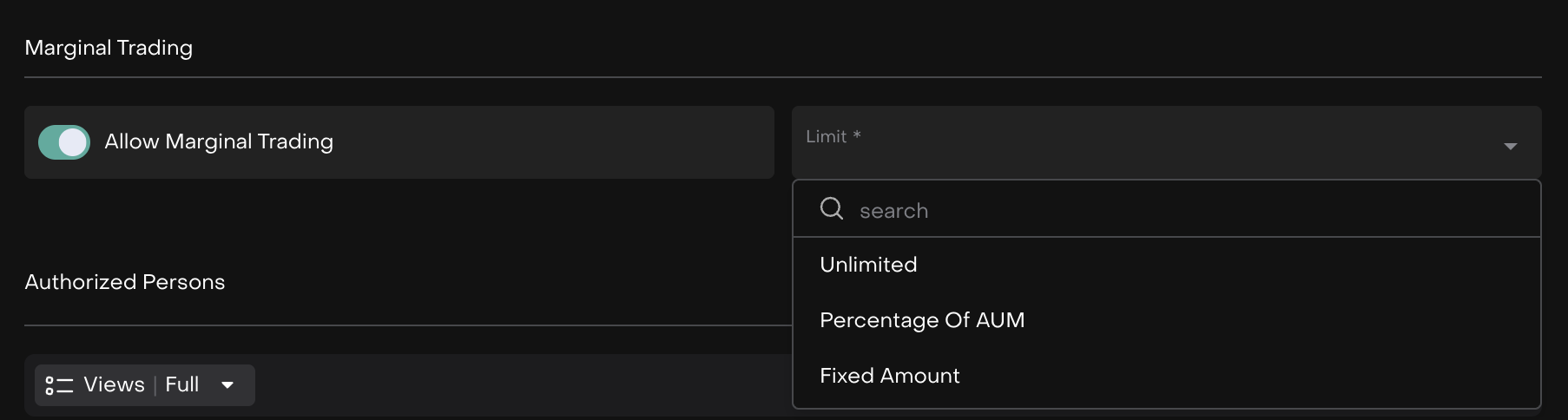

Find the section titled “Marginal Trading”.

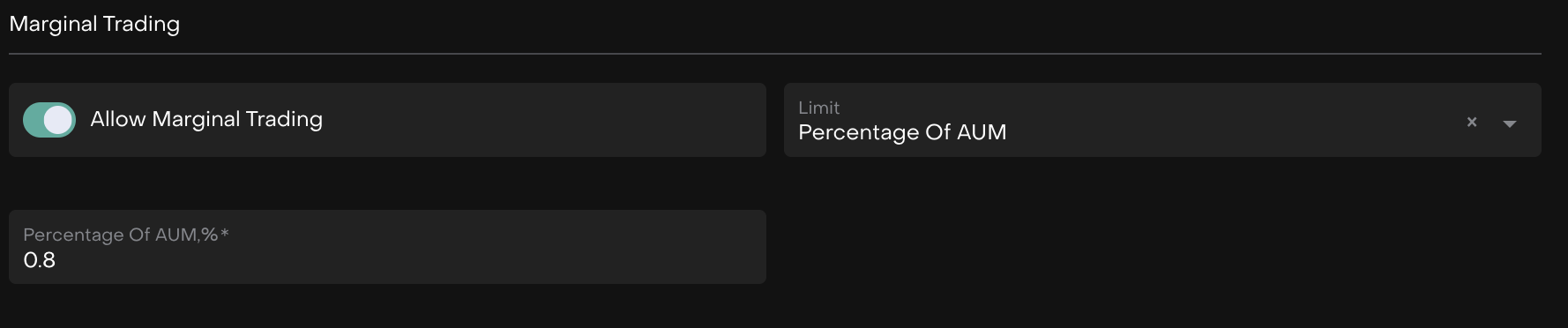

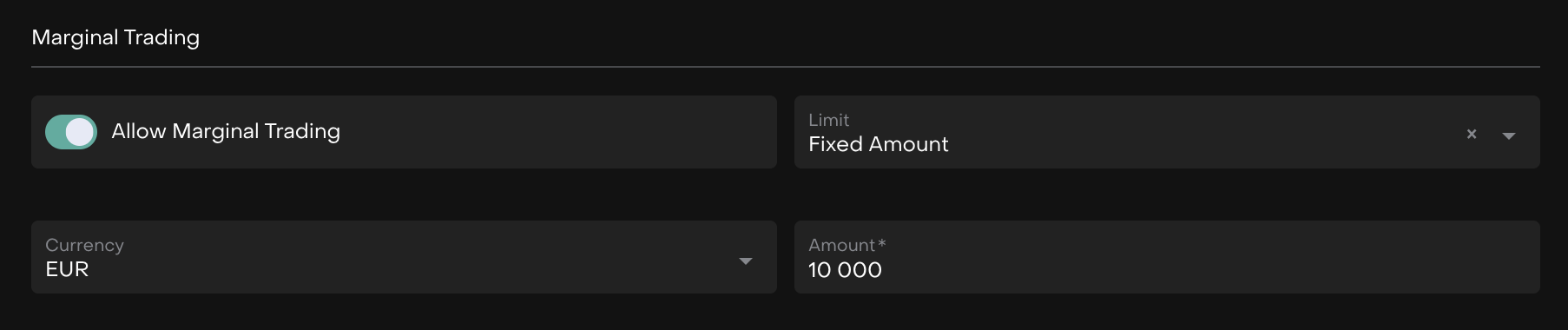

Toggle the switch “Allow Marginal Trading” to enable it.

Once enabled, the platform will prompt you to choose one of the available control options for marginal trading.

How Control of Marginal Trading Works?

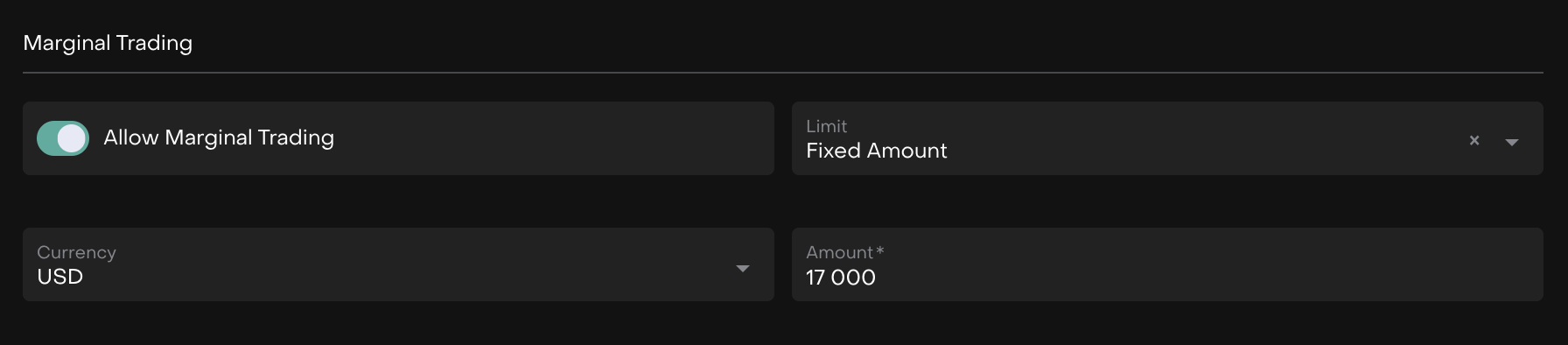

User sets on Mandate marginal trading rule (ex. USD with limit 17 000)

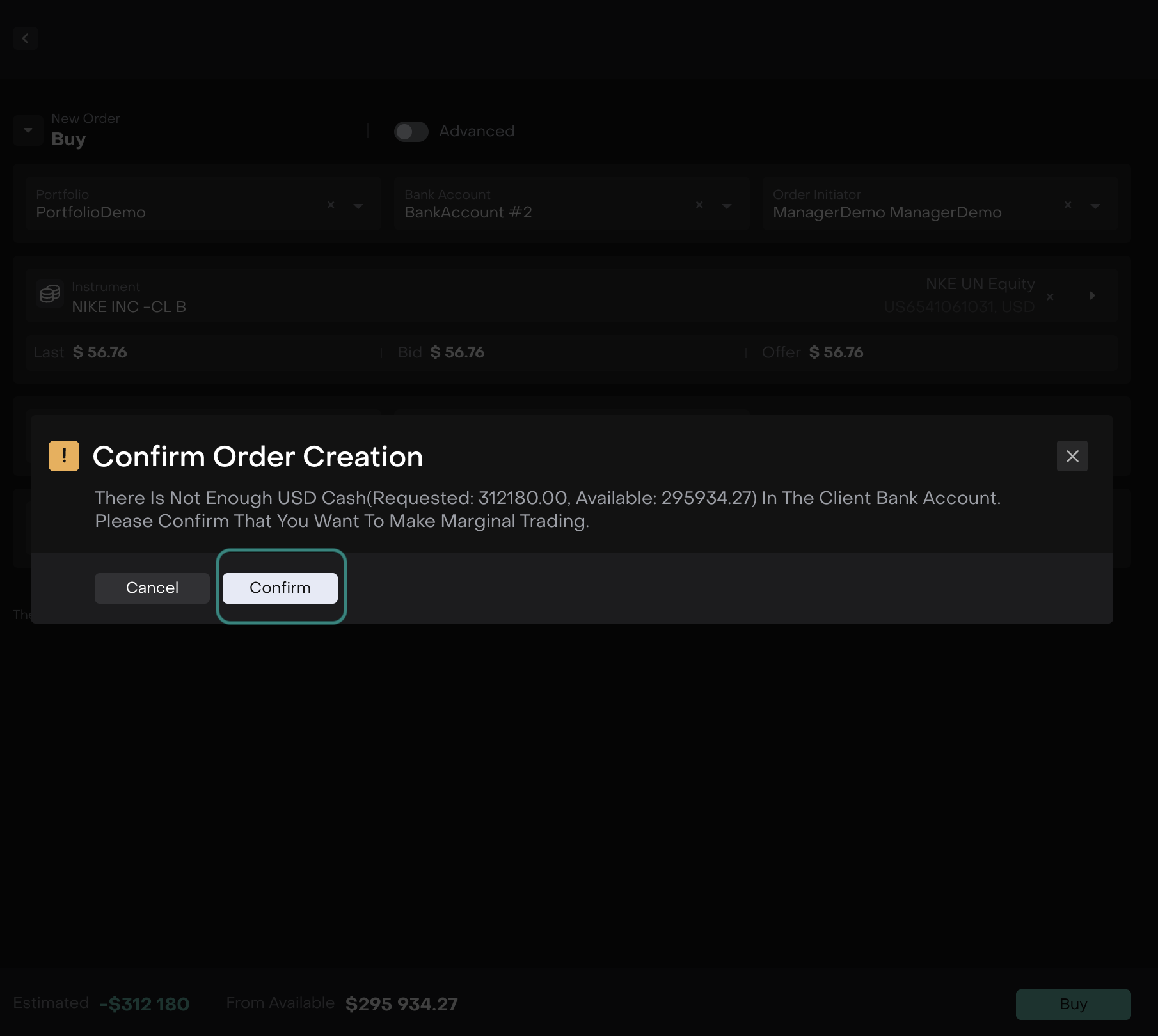

When attempting to place an order that exceeds the available cash balance, the system triggers a confirmation dialog titled "Confirm Order Creation".

There is not enough USD cash (Requested: 312,180.00, Available: 295,934.27) in the client bank account. Please confirm that you want to make marginal trading.

Action Buttons:

Cancel — cancels the operation.

Confirm — proceeds with placing the order using marginal trading.