Matching Mechanism

Introduction

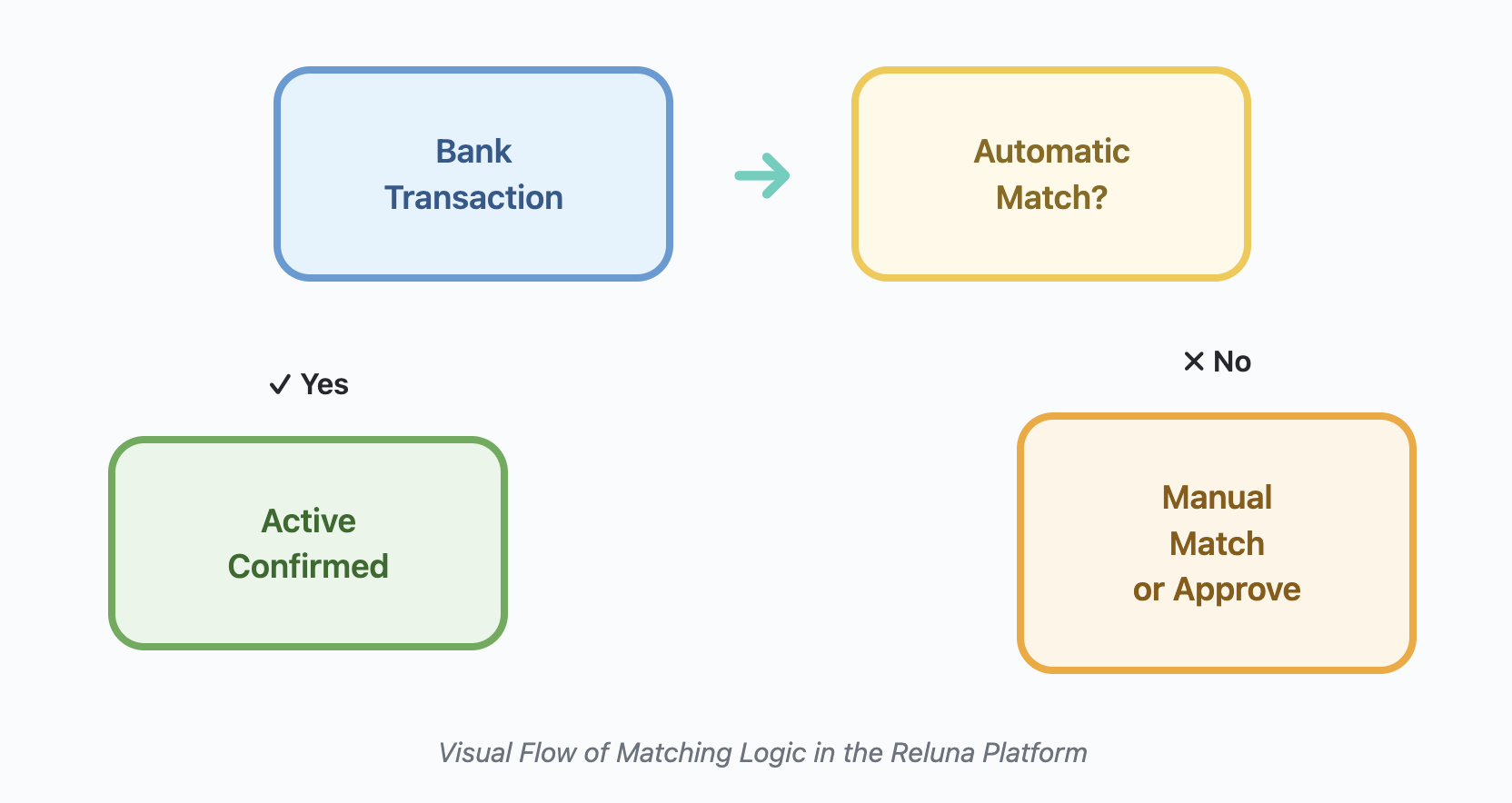

The Reluna platform includes a robust matching mechanism designed to reconcile transactions received from your bank with those generated internally after order execution. This ensures your records remain accurate, your portfolio positions stay updated and your reconciliation process is both efficient and auditable.

Whether transactions are matched automatically by the platform or require manual review, the platform provides clear workflows to help you maintain clean, validated data across all portfolios.

Key Terminologies

Term (A-Z) | Definition |

|---|---|

Automatic Matching | A platform-triggered match based on preset rules and data alignment. |

Bank Transaction | A transaction received from your custodian or bank. |

Confirmed | Final status of a successfully matched bank transaction. |

Manual Matching | A user-performed match when automatic matching is not possible. |

Matching | The process of comparing and reconciling order transactions with bank transactions. |

Omnibus Account | A collective account type holding transactions for multiple clients. |

Order Transaction | A transaction created by the platform once you execute an order. |

Standard Bank Account | A bank account directly linked to a specific client or portfolio. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

Permission Requirements

To perform actions such as Matching/Approving transactions, your profile must have the following:

Platform Label | Permission Levels |

|---|---|

Transactions | View, Modify, Create |

If you do not have the required access, please contact your Administrator.

🔗 Learn more here on how to Match Transactions for Omnibus Bank Accounts.

There are three main types of matching available on the platform:

Matching Scenarios Explained

The platform offers both automatic and manual matching mechanisms depending on data accuracy, integration setup and transaction completeness.

How to Identify Bank vs. Order Transactions

Before you start matching, it’s important to understand which transaction is from your bank and which is generated by the platform after an order is placed.

In Reluna, matching is always initiated from the bank transaction. Here’s how to differentiate them using filters in the Transactions tab:

Transaction Type | Where to Find on Platform? | Used For |

|---|---|---|

Bank Transaction | Transactions tab > Filter | Represents data received from the bank |

Order Transaction | Transactions tab > Filter | Internal transaction generated after you execute an order in the platform |

Bank Transaction

Here's how you can find it:

Go to Transactions tab

Apply filters:

Status = PendingStatus Reason = Not MatchedorNot AllocatedorPending Confirmation

You'll find the filter options at the top of the transactions table.

Order Transaction

Here's how you can find it:

Go to Transactions tab

Apply filters:

Status = ActiveStatus Reason = Order

Once you've identified the bank transaction, you can proceed with matching it to the corresponding order transaction.

Next Steps

Now that you understand the matching mechanism, you can:

Learn how to Match Transactions Manually

Understand Automatic Matching rules

See when to Approve Transactions Without Order

Review Omnibus Account Matching procedures