Non-Trading Order

AVAILABLE IN:

Introduction

The Reluna platform enables you to create and manage Non-Trading Orders, designed to facilitate various cash and security movements that are not linked to trading activities. These orders streamline the handling of investments, payments, fees, interest and withdrawals, especially from a Back Office perspective.

Whether you are dealing with a single Bank Account or multiple ones at once, this guide will walk you through every step you need to take.

Permission Requirement

To create, view or modify these orders, you must have the appropriate platform permissions, typically assigned to Back Office users with Orders non trade.

Key Terminologies

Term (A-Z) | Definition |

|---|---|

Adjustment | An order used to fix or correct cash balances in an account by adding or removing amounts without a trade. |

Block | An order to temporarily hold or reserve funds or securities, preventing their use until the block is removed. Often used to secure assets for pending transactions or regulatory requirements. |

Cash Transfer | Instructions to move cash between accounts, whether within the same institution or externally, without involving security trades. |

Fee | An order to debit or credit fees related to account management, service charges, or transaction costs applied by the financial institution. |

Initiator | Entity responsible for creating the order; selectable as Manager or Client linked to the portfolio. |

Interest | Posting of interest income or expense to the account, reflecting accrued interest on cash balances or loans. |

Internal Cash Movement | Movements of cash within the internal system or portfolio accounts that do not involve external transfers. |

Internal Payment | Transfers of cash between bank accounts within the same portfolio or entity, often for administrative or reallocation purposes. |

Internal Security Movement | Transfers of securities between accounts within the same portfolio or institution, reflecting internal reallocation without market trades. |

Internal Switch | Switching or rebalancing assets within the portfolio, like converting one security to another internally without market transactions. |

Internal Transfer | Movement of securities between accounts under the same ownership or portfolio, usually for administrative purposes. |

Investment | Deployment of cash to purchase securities or investment products, increasing the holdings in investments. |

Mass Order | Order created from a single form for two or more bank accounts, processed simultaneously. |

Open Deposit | Establishment of a new cash deposit account or certificate of deposit, moving funds into a deposit instrument. |

Open Loan | Borrowing cash through a loan, which increases cash available and records a liability. |

Security Transfer | Moving securities in or out of the account, typically related to account funding, withdrawals, or custody transfers. |

Single Order | Order created for an individual bank account. |

Tax | Deduction or adjustment for taxes owed on income, transactions, or holdings, including withholding and sales tax. |

Withdrawal | Request to remove cash or securities from an account, reducing the respective balances. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

Understanding Order Types

The table below explains each Non-Trading Order types, what it does on the platform and how it affects your cash or security positions.

Create Non-Trading Orders

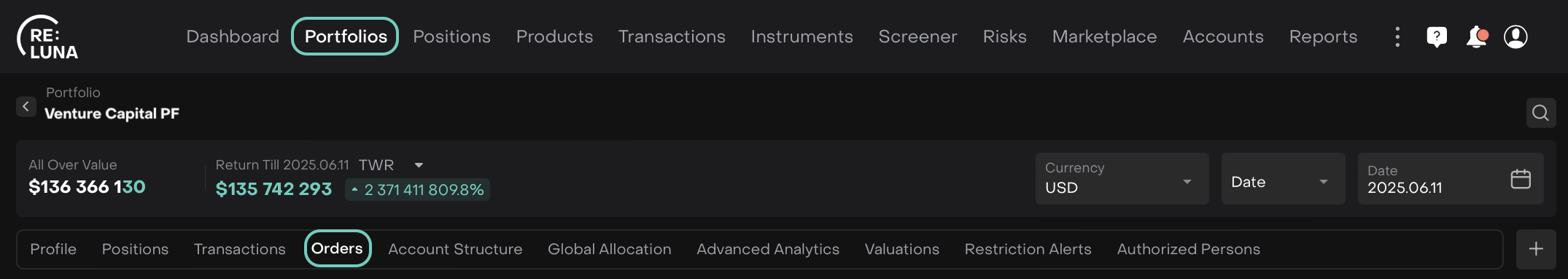

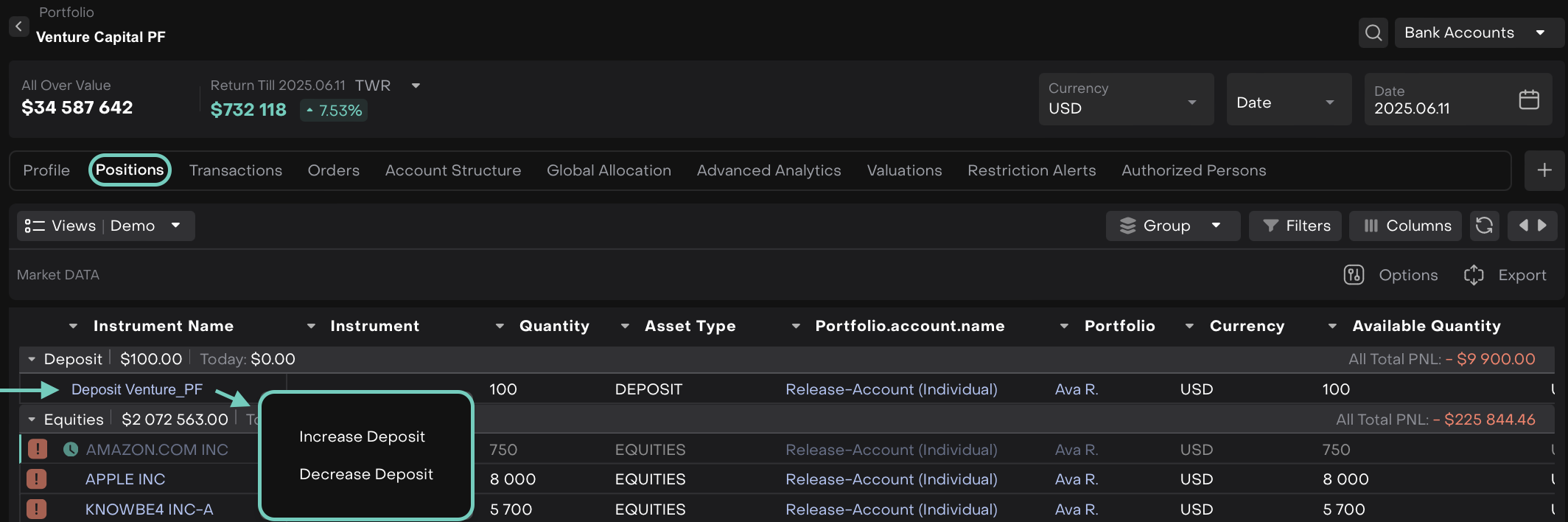

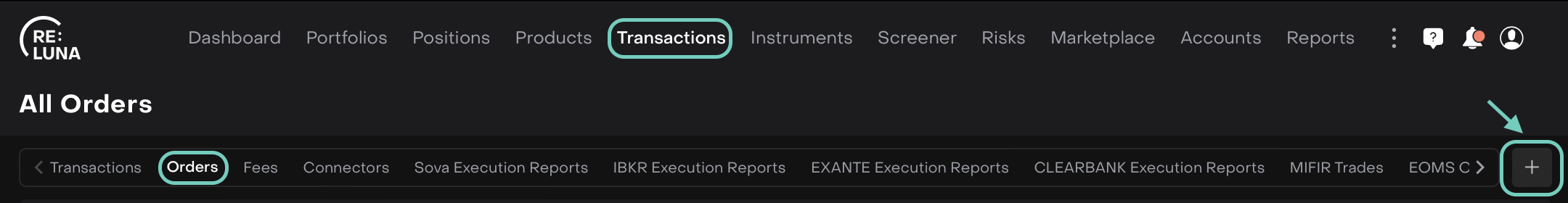

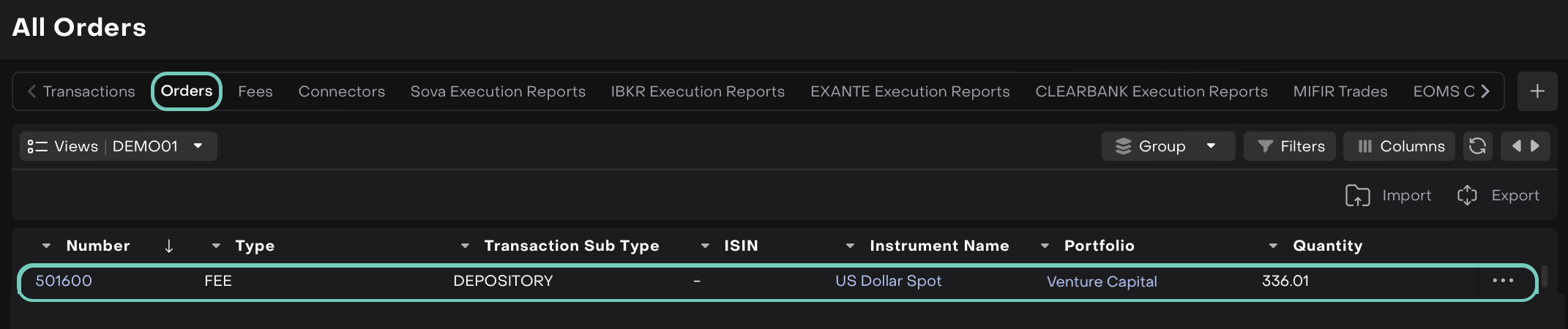

Go to Transactions on dashboard > Order tab > click on “+” icon to create.

Or,

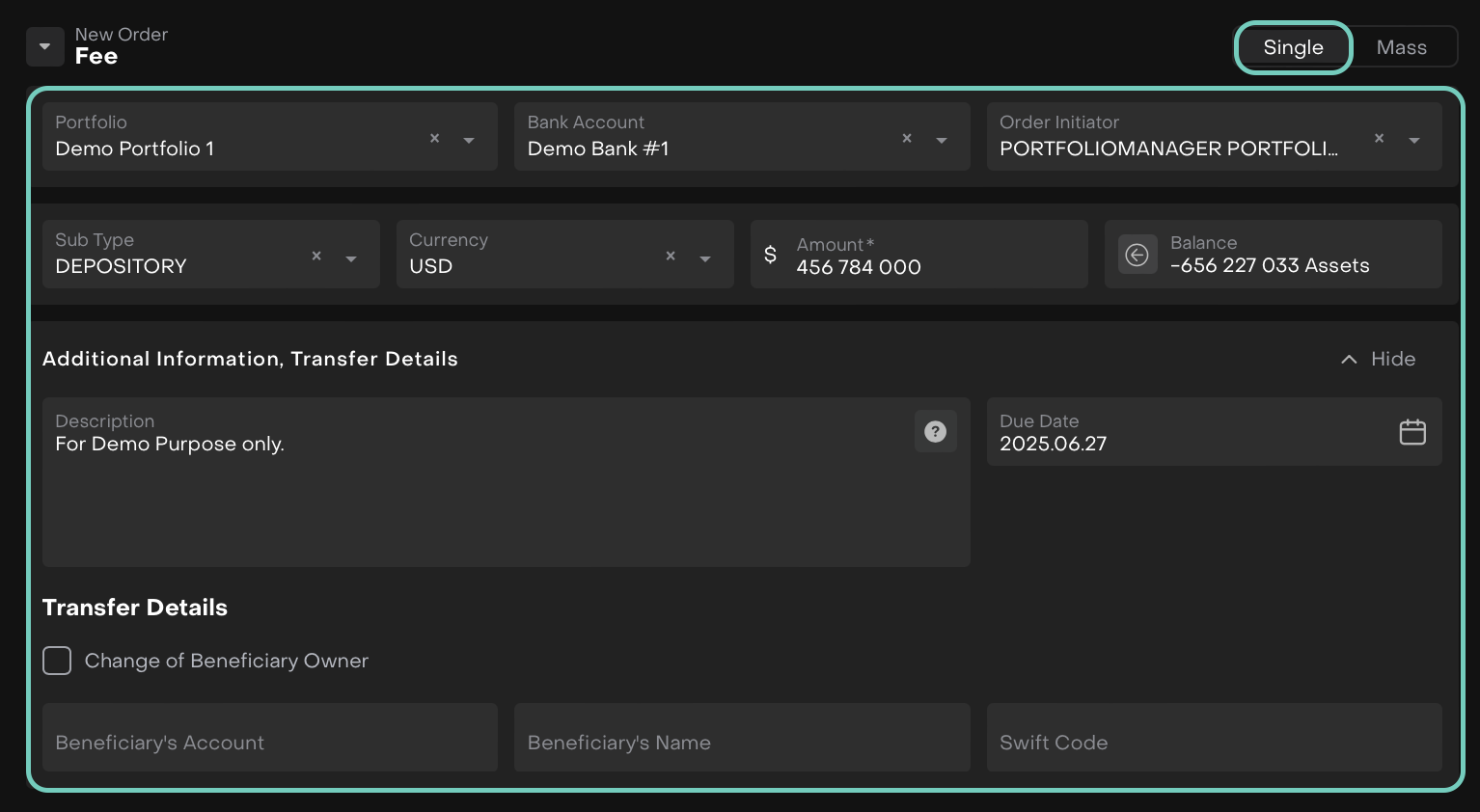

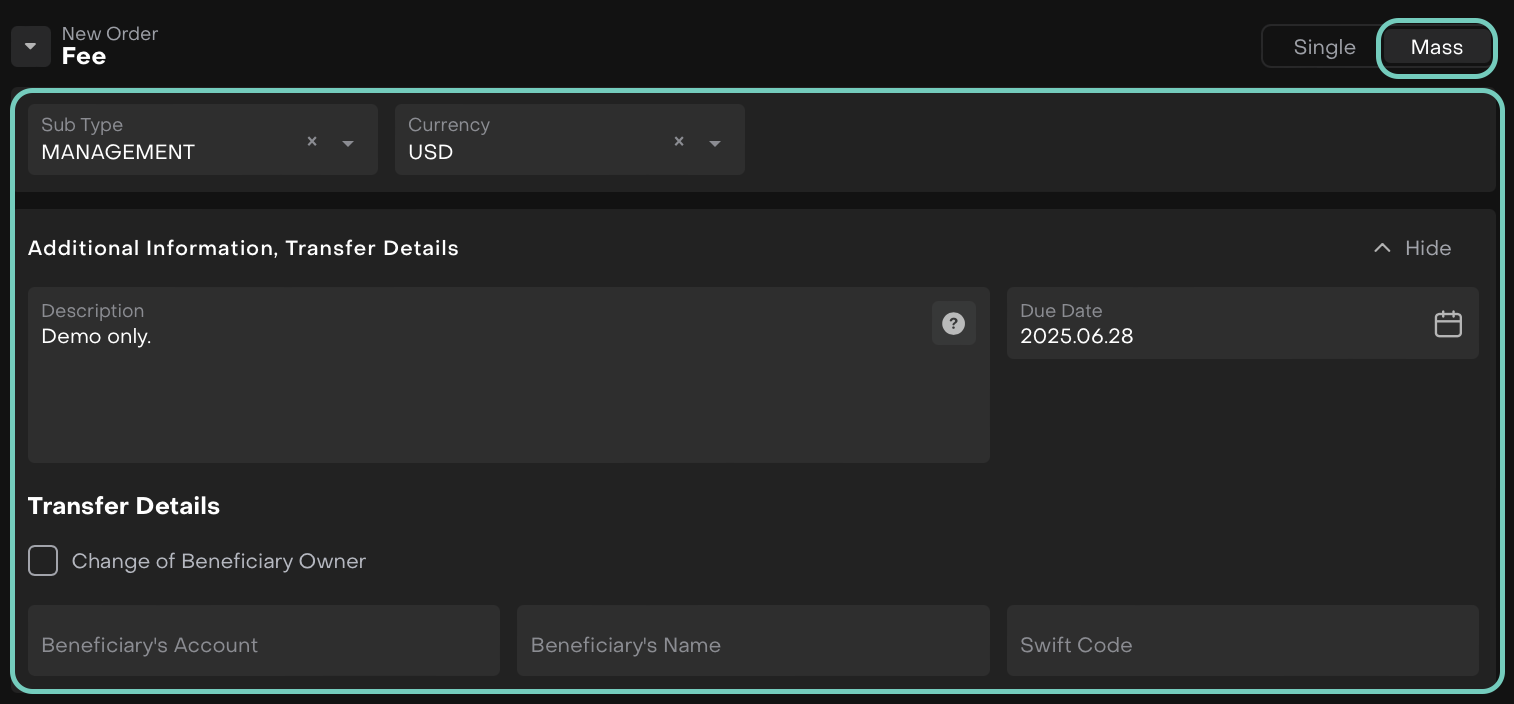

A form opens, select the type of Non-Trading Order you need from the dropdown option (here, example is taken of Fee).

To switch to Mass Order, use the Single | Mass toggle in the top-right corner.

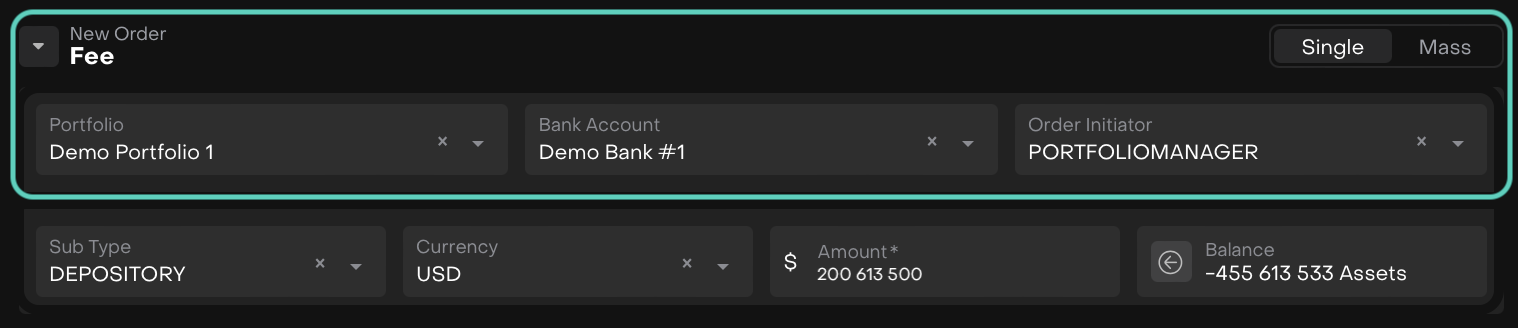

Single Form

Mass Form

The Single order form opens by default.

Fill in the required fields such as:

Portfolio, Bank Account and Initiator: Choose these from the dropdown options.

These fields are filled when the order is initiated from a specific Portfolio, but you can modify them as required.

To change the Initiator, click the switcher to choose between Manager or Client.

Use the list to select the correct Initiator linked to the Portfolio.

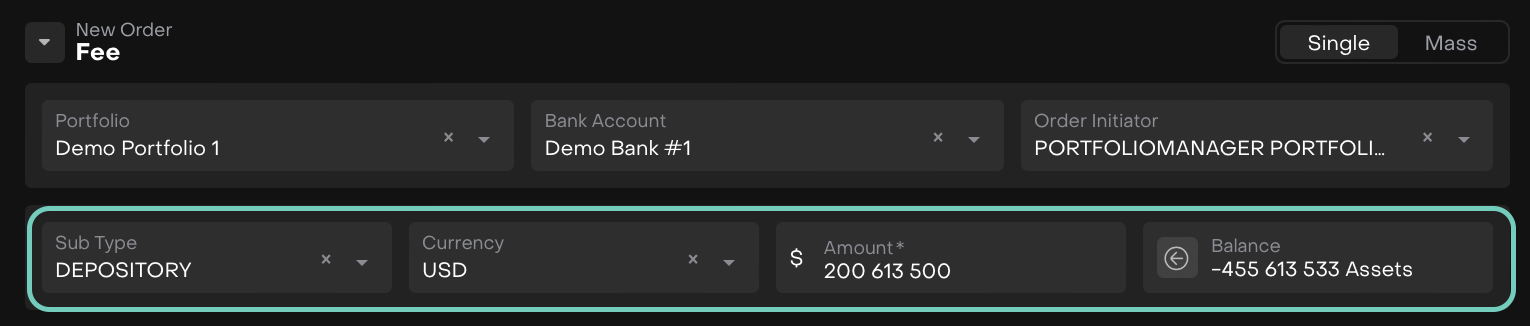

Define Order Details such as:

Sub Type: use the search bar or scroll to find the correct Sub Type.

Currency: choose the currency for the order.

Amount(*): Enter the desired amount, manually.

The platform displays the relevant Balance for applicable order types, only.

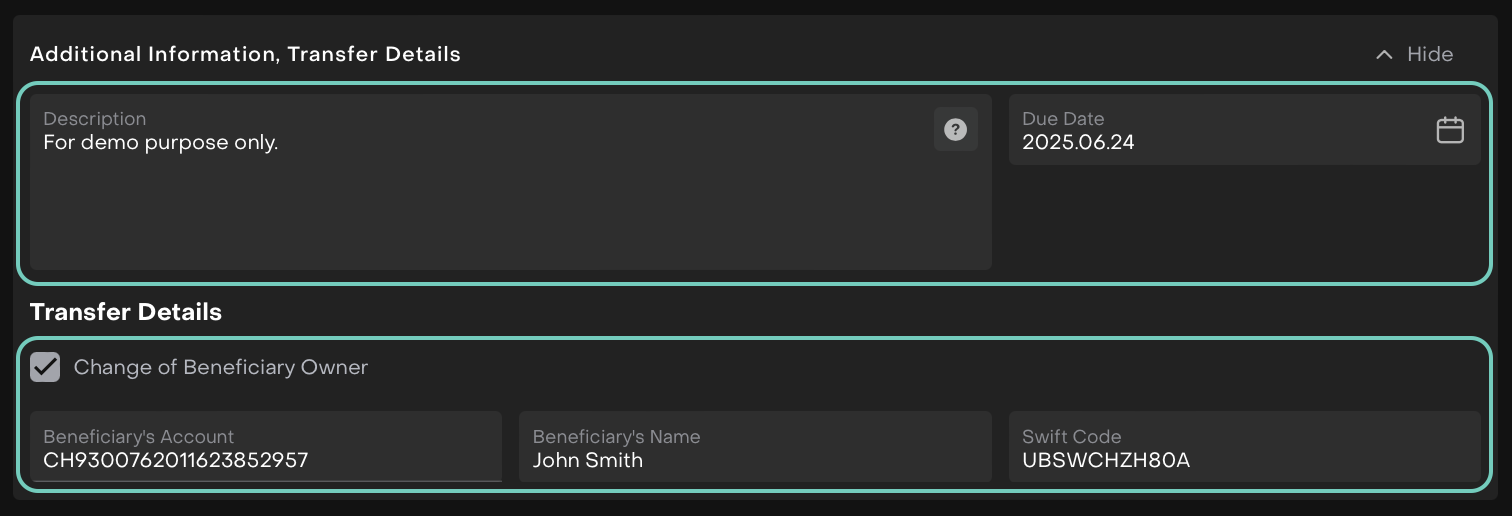

Fill in required fields such as:

Enter Description: Enter a short explanation or note about the order.

This will be automatically copied to the related transaction’s "Description" field after the order is Executed.

Due Date: Automatically calculated as Order Date + 2 weeks.

If the due date is reached and the order has not been executed, the platform will automatically update its status to Expired.

Transfer Details (if applicable):

To provide beneficiary information, check the box Change of Beneficiary Owner.

Once selected, the following fields become mandatory(*):

Beneficiary’s Account

Beneficiary’s Name

SWIFT Code

These fields become mandatory only if the checkbox is selected. Otherwise, this section can be skipped.

Once filled, review and click Create Order to confirm and submit.

Or,

Click Close to discard your changes.

👉 Learn here on how to Execute the Order.

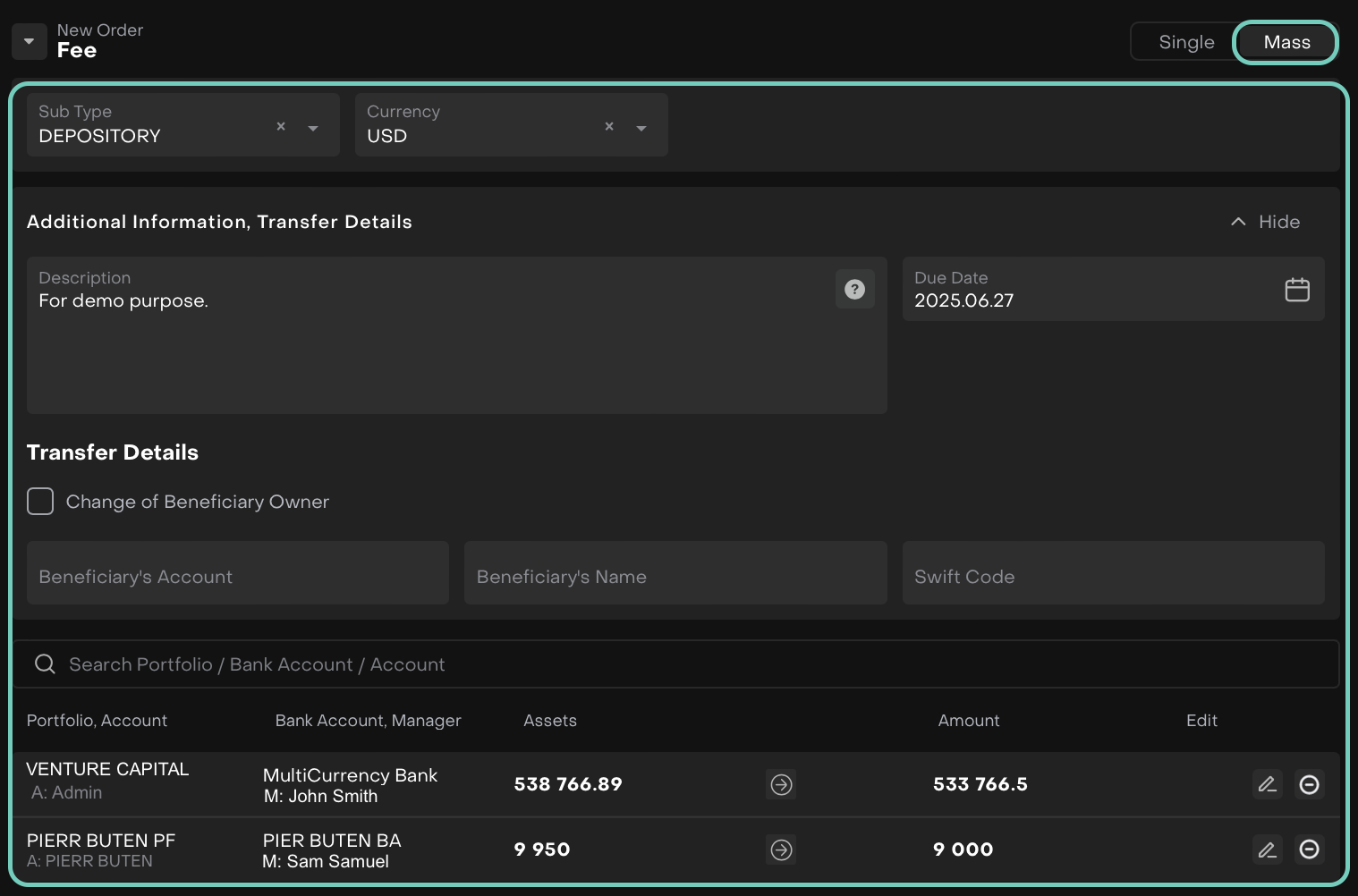

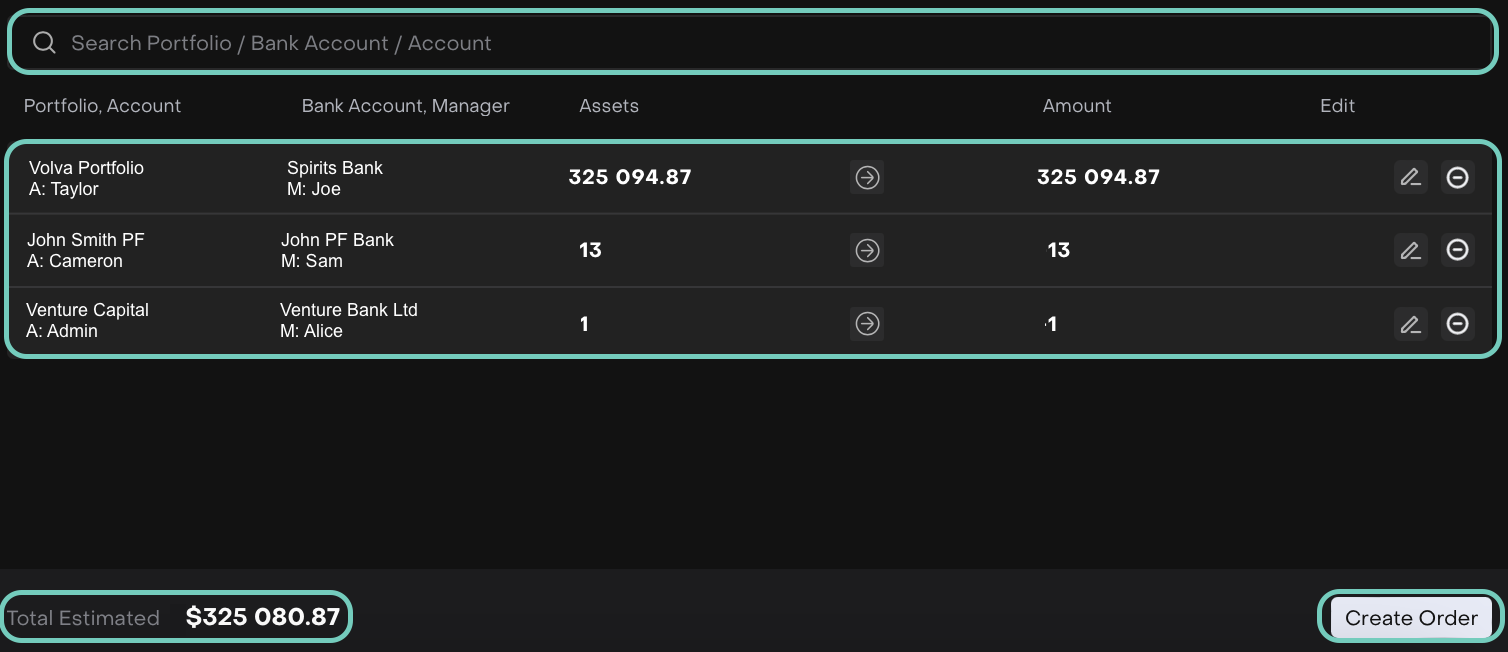

Create a Mass Non-Trading Order

If you are managing multiple Bank Accounts across different Clients, the Mass Order form (where available) helps you save time by processing them all at once.

Not all Non-Trading Order types are available in Mass form.

Switch to Mass Mode using the switch in the top-right.

Use the search bar to find Portfolios or Bank Accounts.

Fill in Sub Type, Currency, Additional Info and Transfer Details as stated above.

Fill in the Amount for each line item and it auto-adjusts based on the selected currency.

To edit a record, use the ✏️ to add or adjust Manager and Amount.

Use the delete icon

to remove unwanted rows next to it.

to remove unwanted rows next to it.

Now, review Total Estimated Value and click Create Order to confirm

The platform auto-calculates the Total Estimated value for the mass order based on all entered amounts.

👉 Learn more on how to Execute the Order