Use Reconciliation

Introduction

The Reconciliation feature is designed to ensure data consistency between bank reports and the platform system. This is a critical process for maintaining accurate records and identifying discrepancies in a timely manner.

The latest update significantly enhances the reconciliation functionality and now includes:

Enhanced statistics for each connector

Three specialized views for different types of analysis

Improved export and filtering tools • Dedicated view for omnibus accounts

What is reconciliation ?

Reconciliation is the process of comparing bank data with platform data to ensure they match, including verifying that bank positions on each bank account align between the bank and the platform.

Accessing Reconciliation

You can access reconciliation data in two ways:

Go to the Reconciliation page from the dashboard.

Use the Connectors tab to check file upload status, identify failed files and reprocess them if needed.

🔗 Check out Using the Connectors guide for more details.

👉 New to some terms? Check out our full Platform Glossary for more.

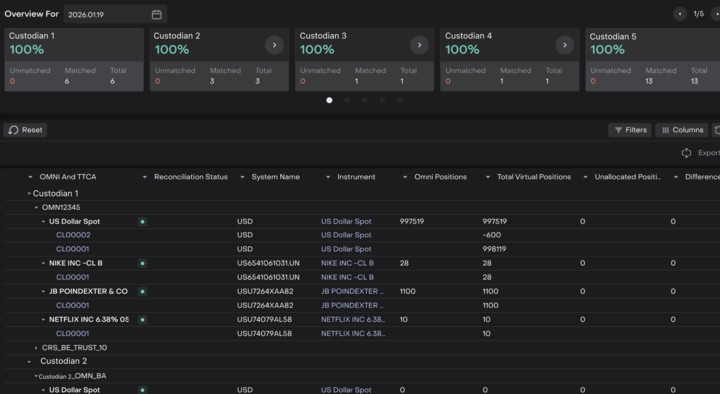

Reconciliation metrics overview

For each connector (bank account), detailed reconciliation statistics are now

displayed in a summary card format:

Reconciliation %- Overall match percentage (e.g., 100%)

Unmatched - Number of positions that did not match

Matched - Number of positions that successfully matched

Total - Total number of positions processed

For the OmnibusTestV3.01 connector, the statistics appear as follows:

Reconciliation Status: 100%

Unmatched: 0 positions

Matched: 13 positions

Total: 13 positions

💡 INTERPRETING RESULTS

A reconciliation percentage of 100% means all positions match perfectly

between the bank and system. Any value below 100% requires investigation.

Reconciliations view

The reconciliation functionality is divided into three independent views,

each serving specific purposes. Switch between views using the tabs at the

top of the page:

Reconciliation By Positions

Reconciliation By Position & Transactions

Reconciliation Omni Vs Virtual Bank Accounts

Transactions

Reconciliation by Positions

PURPOSE: Compares Bank Positions Vs. System Positions for the selected date

This is the standard reconciliation view that directly compares positions

reported by the bank with positions recorded in the platform system. It helps

identify discrepancies in holdings at a specific point in time.

WHEN TO USE:

Daily position verification

End-of-day reconciliation

Identifying missing or extra positions

Quick health check of account balances

WHAT YOU WILL SEE:

All instruments held across connectors

OMNI And TTCA - hierarchical account structure

Reconciliation Status - match status for each position

System Name - instrument name in the system

Instrument - full instrument name

Omni Positions - positions on the omnibus account

Total Virtual Positions - sum of positions on virtual accounts

Unallocated Position - unallocated positions

Dif - difference between positions

💡 KEY POINT

This view shows the current state of positions and serves as the starting

point for daily reconciliation.

Reconciliation By Position & Transactions

PURPOSE: Compares Previous Day (T-1) Positions With Transactions For That

Same Day

This view provides more detailed reconciliation by considering not just

current positions, but also the transactions that affected them. Since

transaction data from the bank is received with a one-day delay, this view

reconciles yesterday's positions with the transactions that occurred on

that day.

WHEN TO USE:

Transaction-level verification

Identifying specific trades or movements that caused discrepancies

Audit trail validation

Investigating sources of position differences

KEY FEATURES:

Reconciles positions from T-1 (previous day)

Includes all transactions that affected positions on that day

Accounts for one-day delay in receiving transaction data from banks

Provides complete audit trail for position changes

💡 IMPORTANT NOTE

Since transaction data is received with a one-day delay, this information

is displayed at the top of the screen: "Compares Previous Day (T-1)

Positions With Transactions For That Same Day. Transaction Data Is Received

From The Bank With A One-Day Delay"

Reconciliation Omni Vs Virtual Bank Accounts

PURPOSE: Compares OMNI/TTCA Accounts With Their Virtual Sub-Accounts

This specialized view is designed exclusively for omnibus accounts. It

verifies that total positions in the omnibus (OMNI) account match the

aggregated sum of all linked virtual sub-accounts. This ensures internal

consistency within the platform's account structure.

WHEN TO USE:

Omnibus account verification

Internal platform consistency checks

Identifying allocation errors across virtual accounts

Ensuring proper position distribution

WHAT YOU WILL SEE:

Statistics for each connector with Omnibus bank accounts

Reconciliation percentage for OMNI bank accounts vs. Virtual bank accounts

Detailed position breakdown showing:

OMNI Positions (positions on the main account)

Total Virtual Positions (aggregated virtual account positions)

Unallocated Position (unallocated positions)

Dif (difference)

Recommended daily process:

Start with Reconciliation By Positions to verify current day positions

Check the reconciliation percentage for each connector:

100% = Everything is reconciled

< 100% = Investigation required

If discrepancies are found (reconciliation % < 100%), switch to

Reconciliation By Position & Transactions for transaction-level analysis

For omnibus accounts, regularly check Reconciliation Omni Vs Virtuals to

ensure internal consistency

Use the Export function when detailed analysis or reporting is needed

Document any findings and actions taken for audit purposes

💡 BEST PRACTICE

Perform reconciliation daily at the same time. This helps you quickly

identify and address issues before they compound.

TIME-SAVING TIPS:

If all connectors show 100%, you can quickly verify everything is correct

Focus your attention on connectors with < 100% reconciliation

Use filters to quickly isolate problematic positions

Set up a regular schedule for omnibus account checks