Use Bank Connectors

Introduction

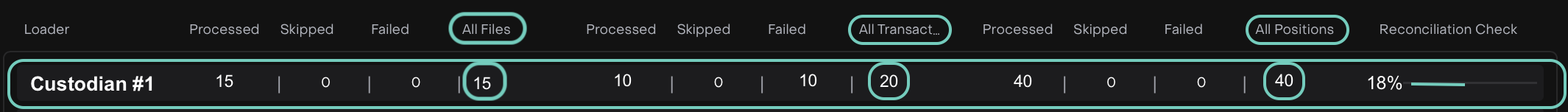

Connectors provide visibility into how custodian files are handled on the platform. It helps you monitor file uploads, track processing status and initiate reprocessing if needed.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Connectors | Interactive reports showing processed, skipped or failed files, transactions, and positions. |

Failed | Files/data that encountered errors during processing. |

Processed | Files/transactions/positions successfully handled and matched. |

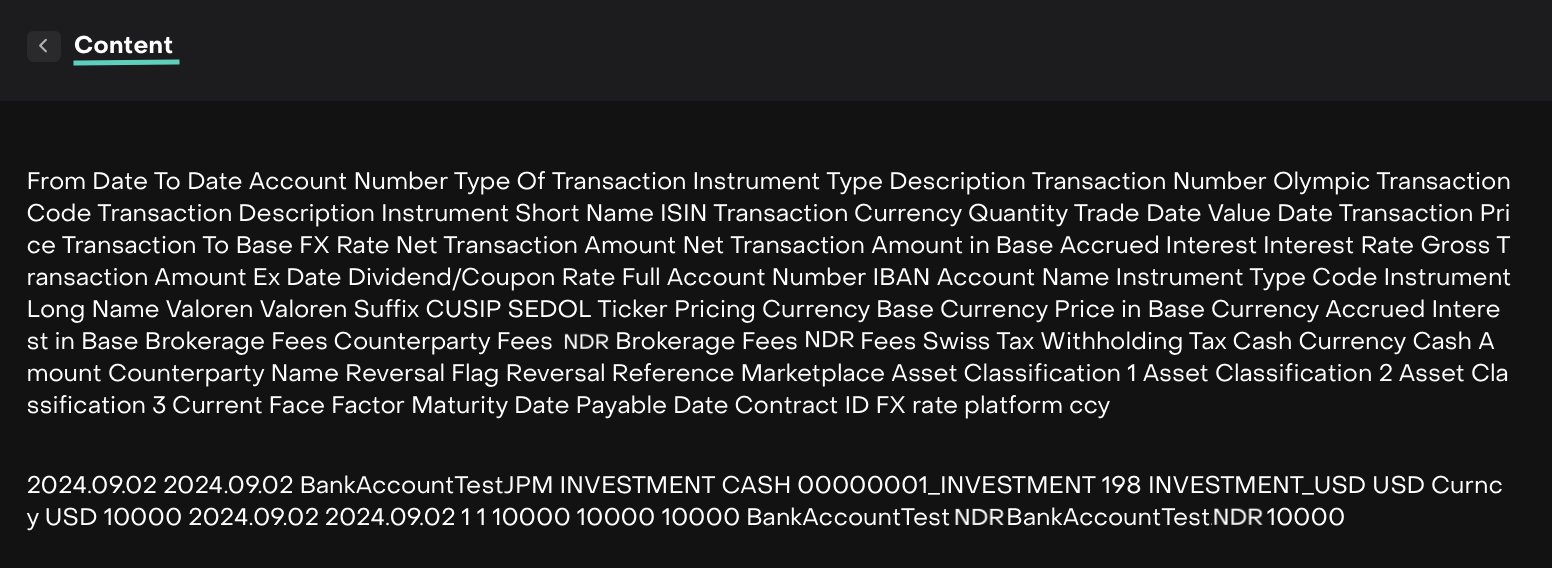

Processing (Reprocessing) | Conversion of custodian files (transactions & positions) to platform's internal data format. |

Reconciliation | Comparing bank data with platform data to identify discrepancies. |

Skipped | Files/data not processed due to irrelevance or invalid format but not marked as error. |

👉 New to some terms? Check out our full Platform Glossary for more.

Accessing Connectors

Go to Transactions from the main menu

Select the Connectors tab

How to Use Connectors

Use the date picker to select a specific date or range.

Reconciliation is typically done for the previous working day, so start by selecting yesterday's date in the date picker.

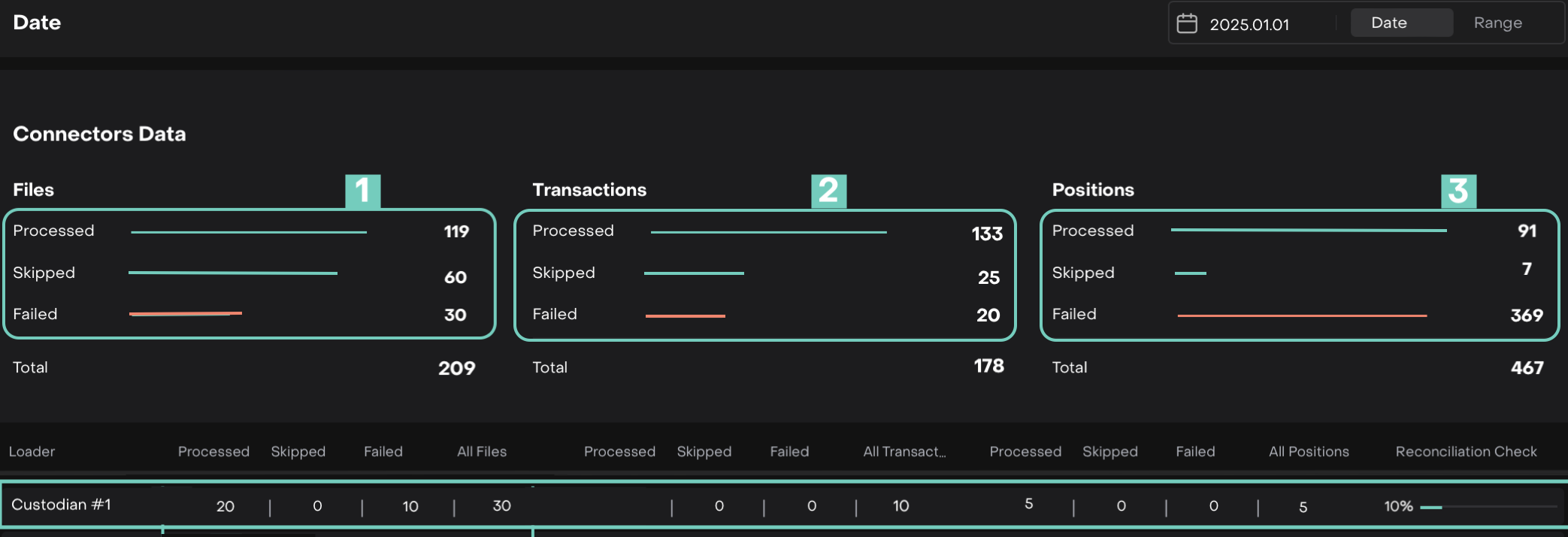

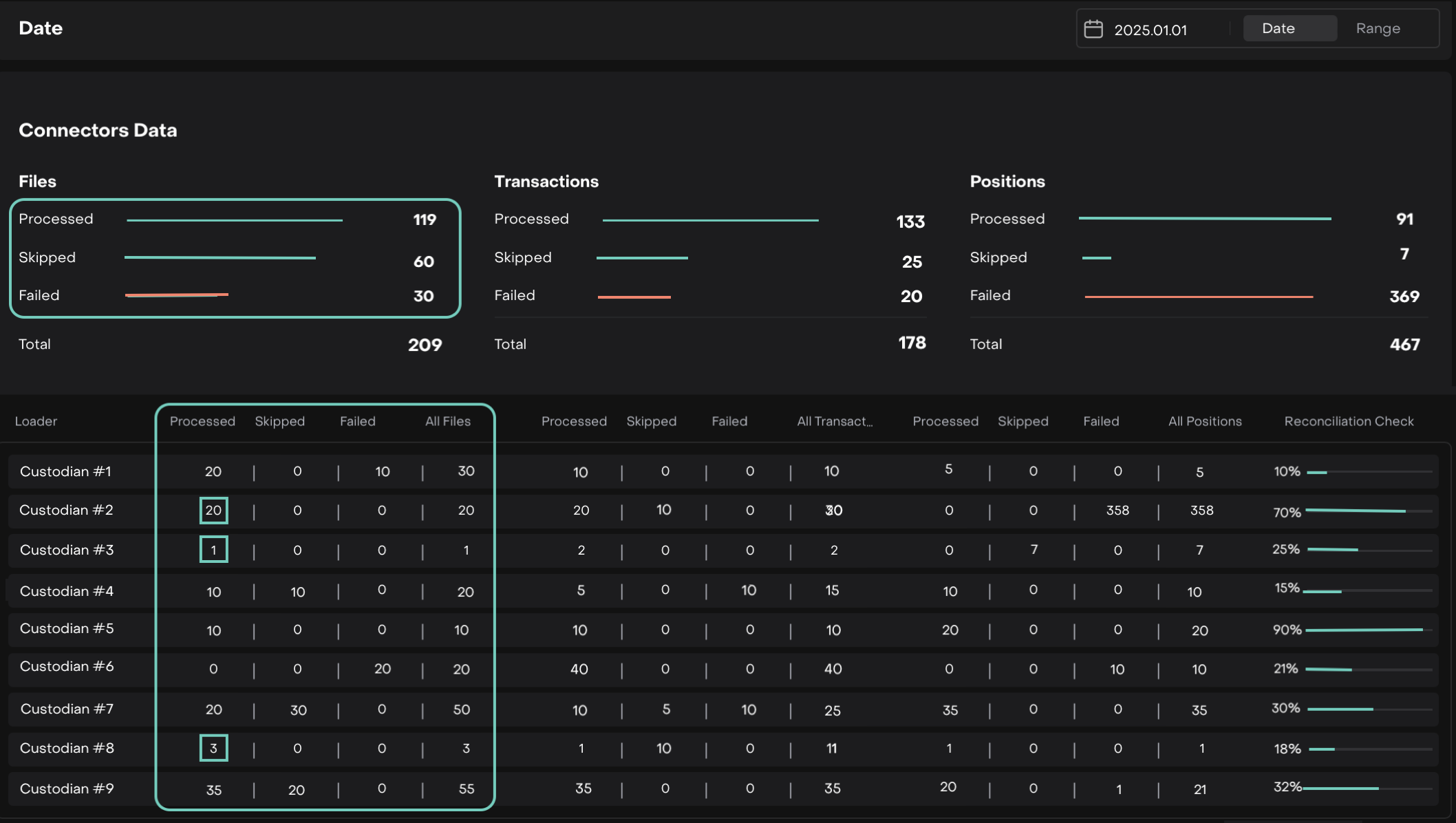

The page is divided into 3 main sections:

Files – Tracks file upload and processing status

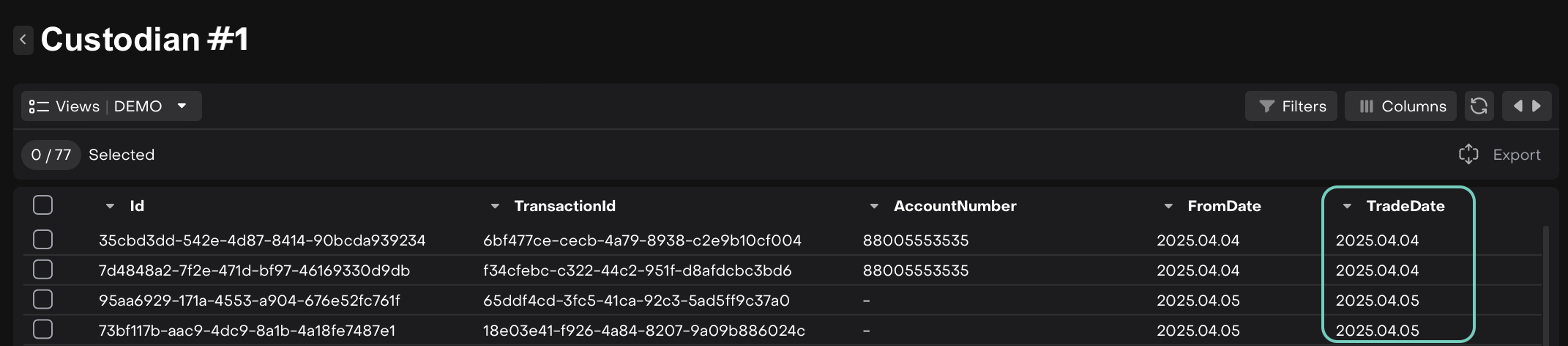

Transactions – Lists transaction-level data extracted and processed

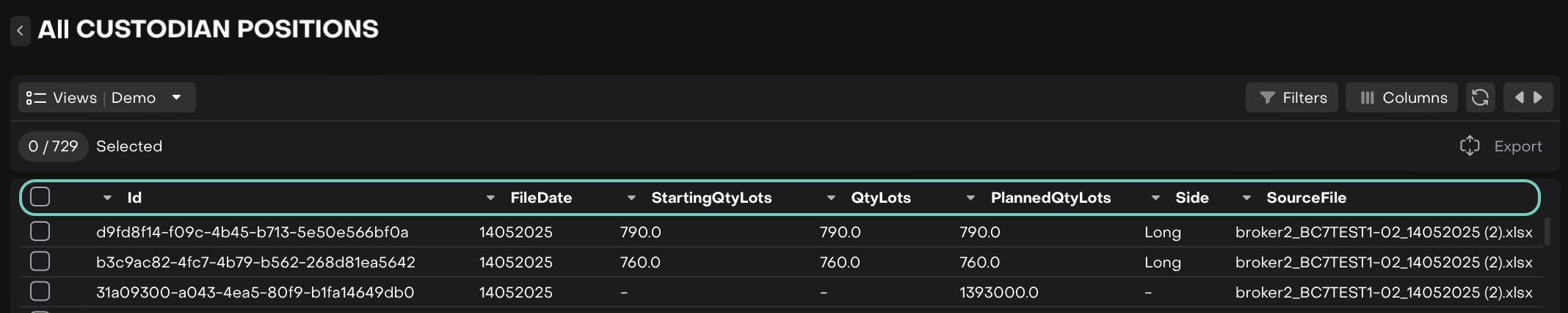

Positions – Shows position-level data for reconciliation

You’ll also see Auto-Reconciliation Checks that show match/mismatch data between bank and platform in percentages.

To access the Connectors tab, you must have:

Permission to view Bank Statistics

Access to the relevant Custodian

Read more here.

Connector Data Blocks Explained

Understanding Connector Data Blocks

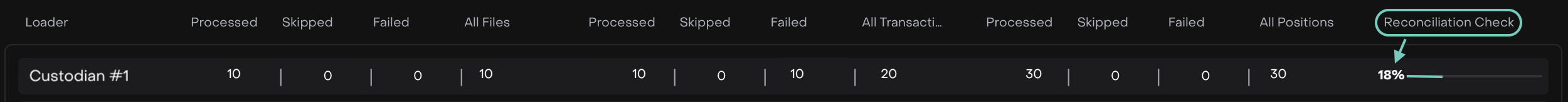

Need to Perform a Reconciliation Check?

From Connectors, click on the Reconciliation Check (%)

Use the table reference below when you're performing it.

See Guide: Using the Reconciliation feature for more.