Client Marketplace

AVAILABLE IN:

Introduction

The Marketplace on the platform is a dynamic space where you can explore, compare, and access a wide range of investment products, including Strategies, Recommendations and other instruments. From this tab, you can subscribe to a strategy to invest or unsubscribe to redeem your investment, following the investment amount and terms defined by your Strategy Manager.

Marketplace is permission-based feature. Please check with your Manager for availability.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Allocation | The amount or percentage of an asset assigned to a Model Portfolio. |

Execution | The process of applying a Model Portfolio to a specific client portfolio. |

Holding | The assets included in a Model Portfolio, along with their respective allocation ratios. |

Marketplace | The section that displays all published investment products available on the platform. |

Product | An investment idea presented as a Strategy or Recommendation, managed by professional investment managers. |

Projection | A forecast estimating how a strategy’s holdings may perform in the future based on current market trends. |

Recommendation | Guidance suggesting one or more instruments, often including insights on their current or expected value. |

Strategy | A structured investment plan designed by professionals to help investors reach their goals through a curated basket of assets. |

👉 New to some terms? Check out our full Platform Glossary for more.

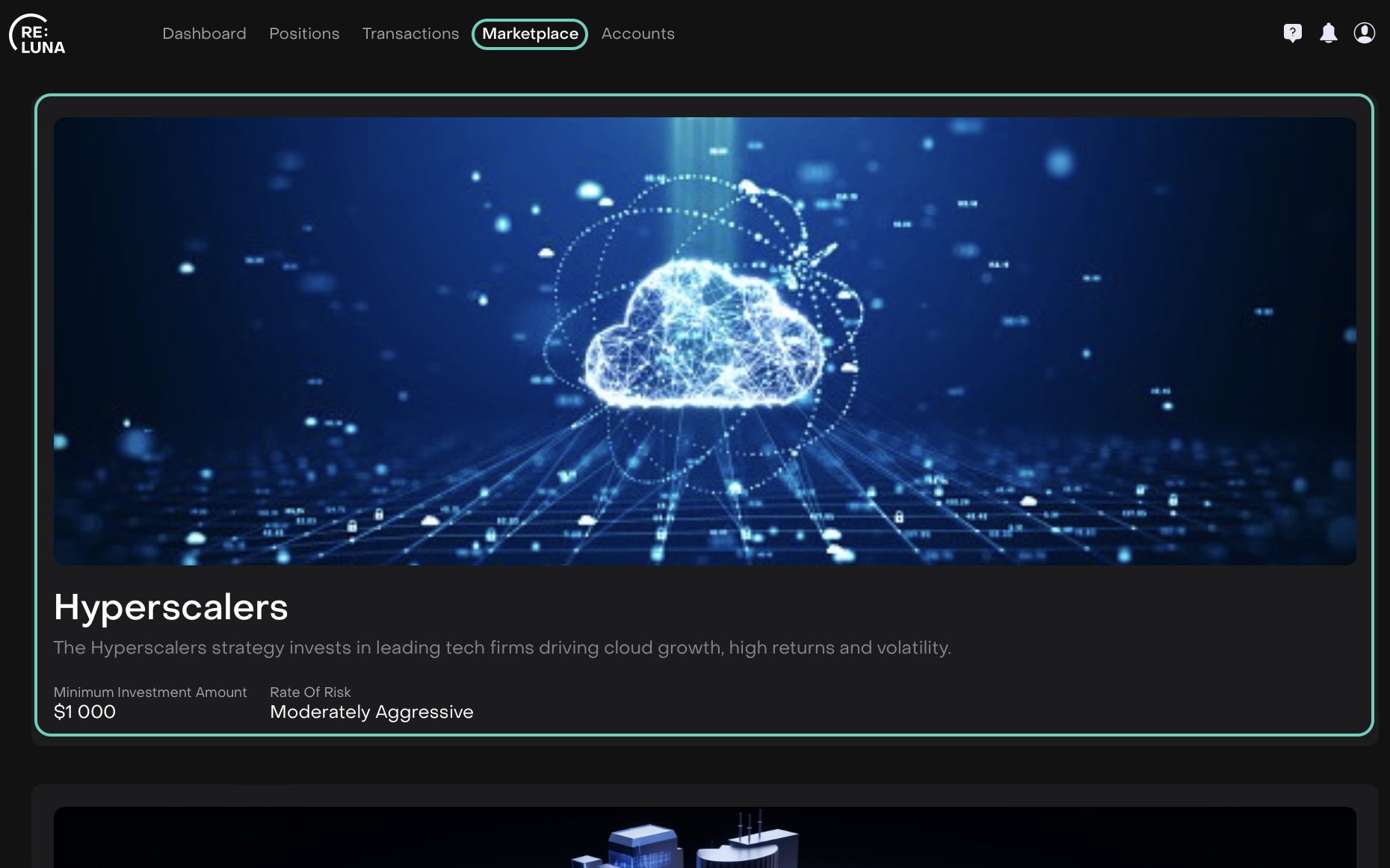

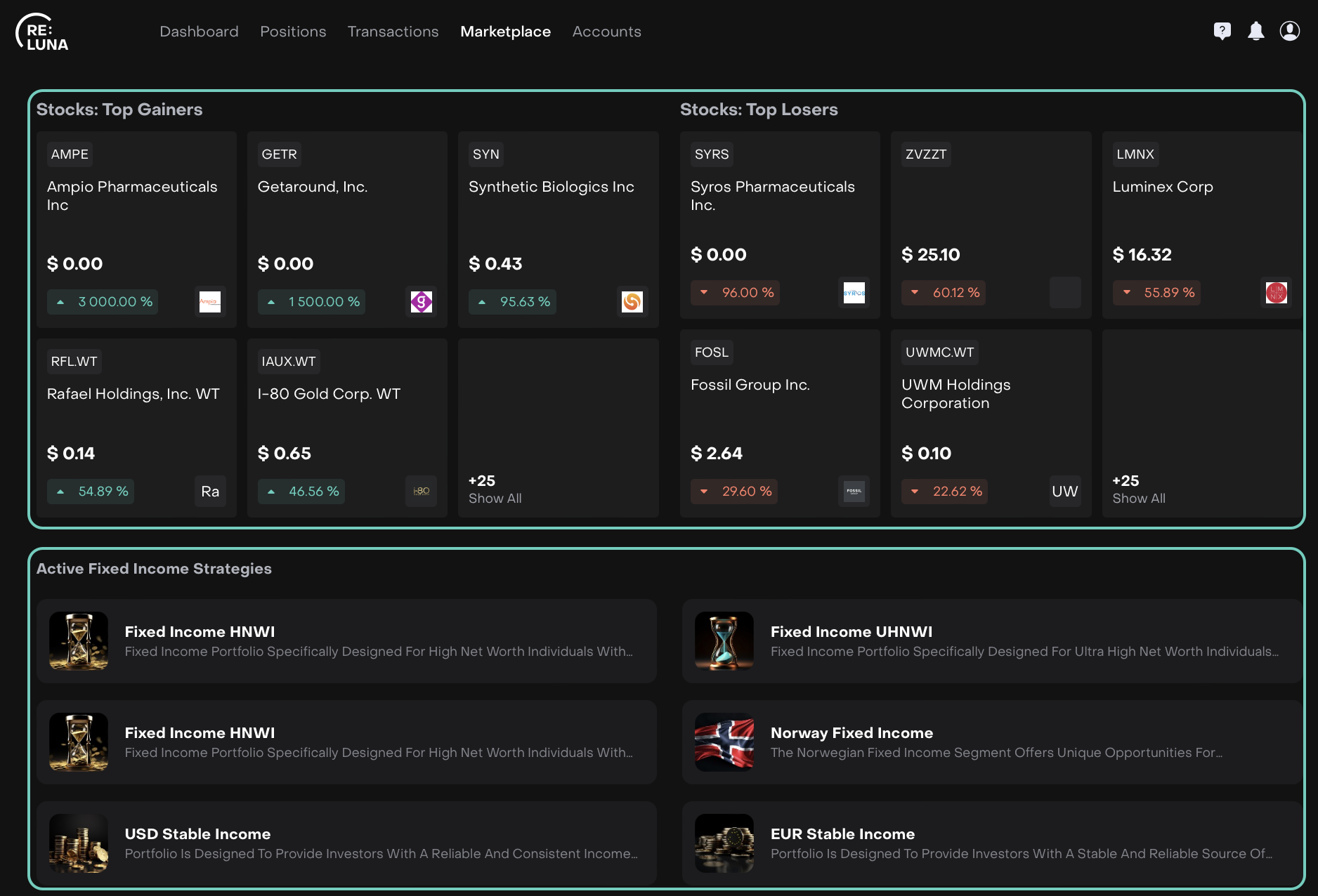

View Marketplace on Client Portal

Navigate to the Marketplace tab from your dashboard.

Browse through the list of available Strategies and Recommendations.

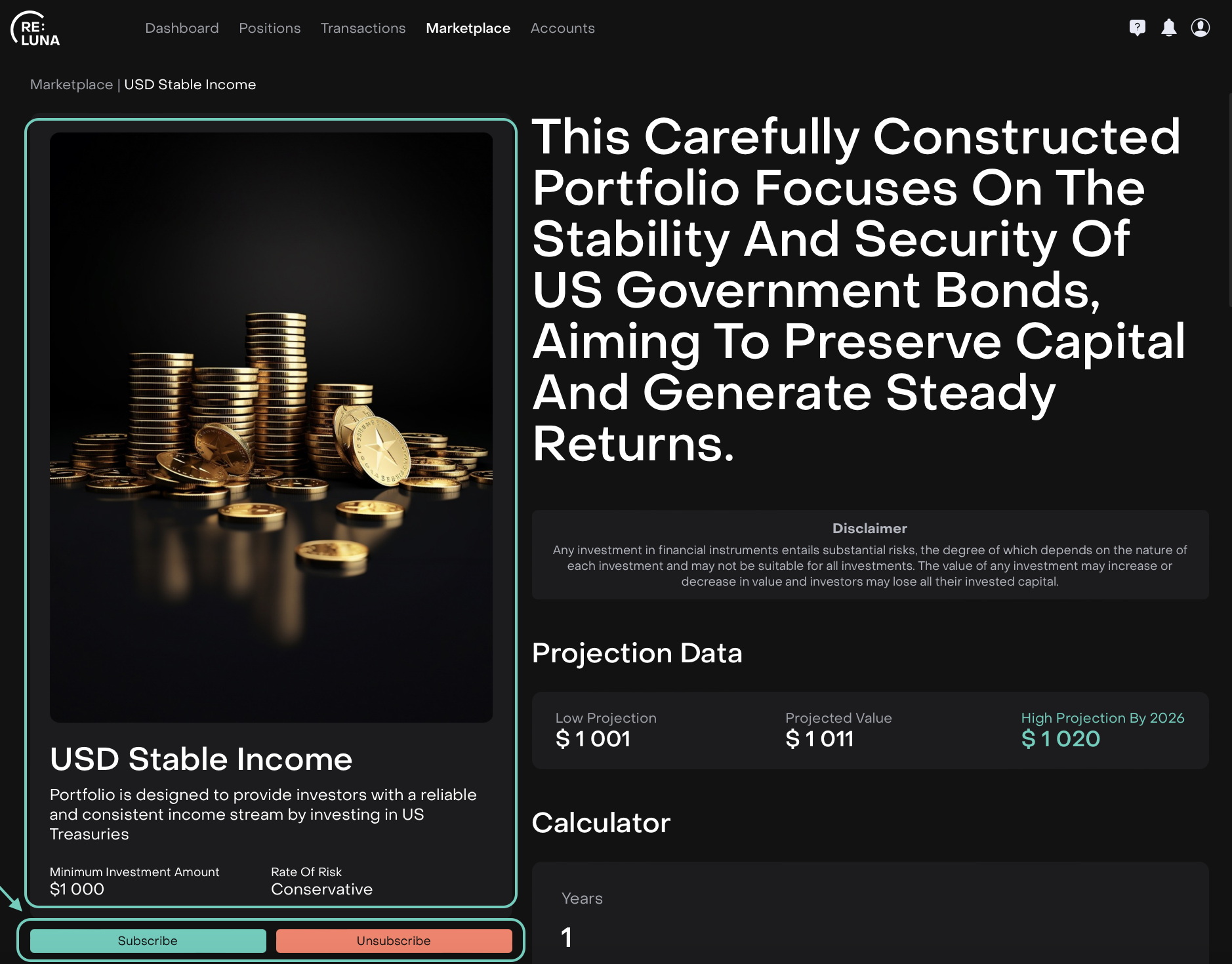

Review key details such as performance trends, minimum investment amount and allocation structure.

Choose the product you wish to Subscribe or Unsubscribe to.

Manage Marketplace

You can invest in a selected Strategy by subscribing to it or redeem your investment by unsubscribing from it.

Subscribe

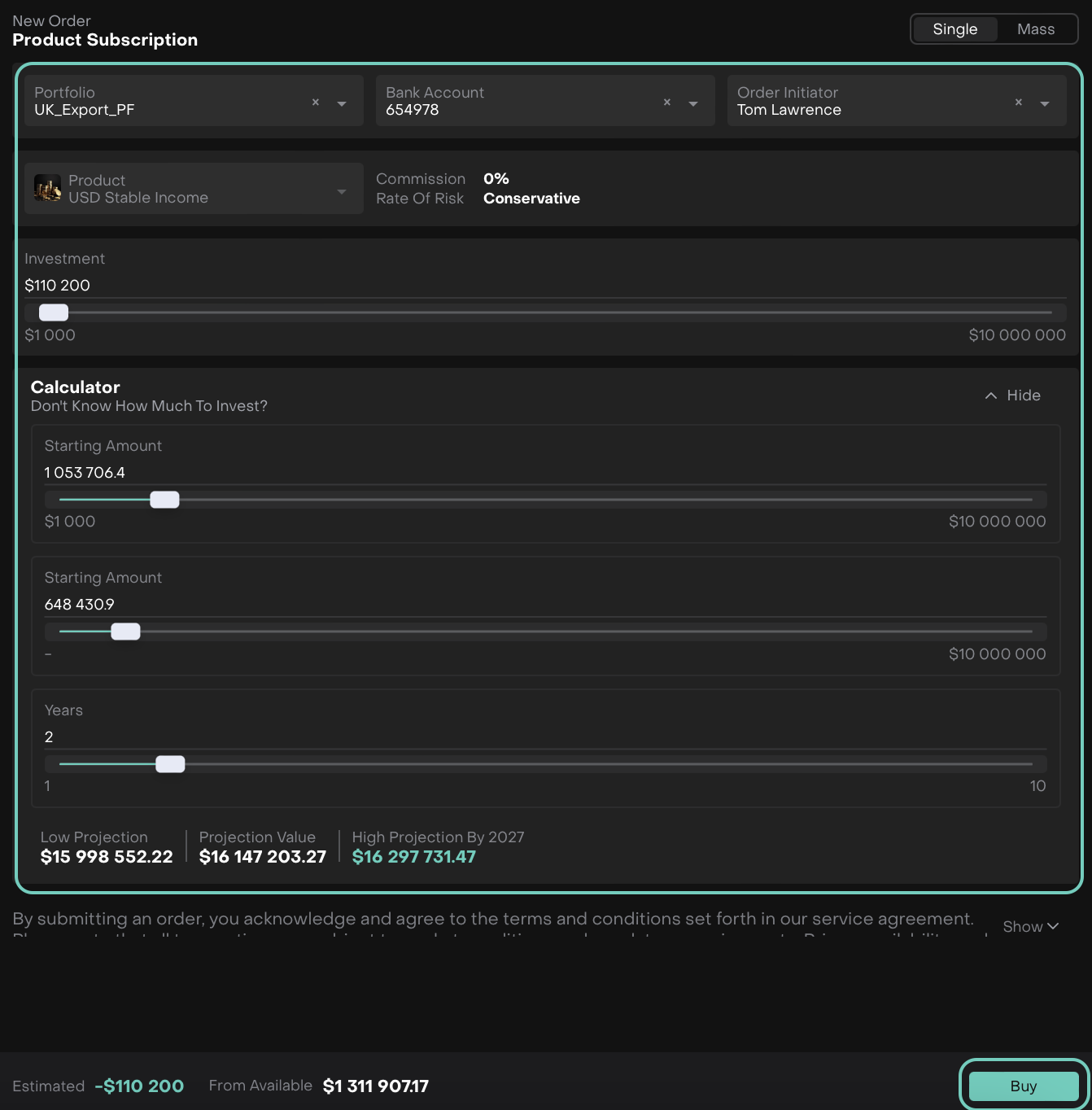

Click Subscribe to open the Product Subscription order form.

Click Buy to confirm the investment to create a Buy order for the strategy.

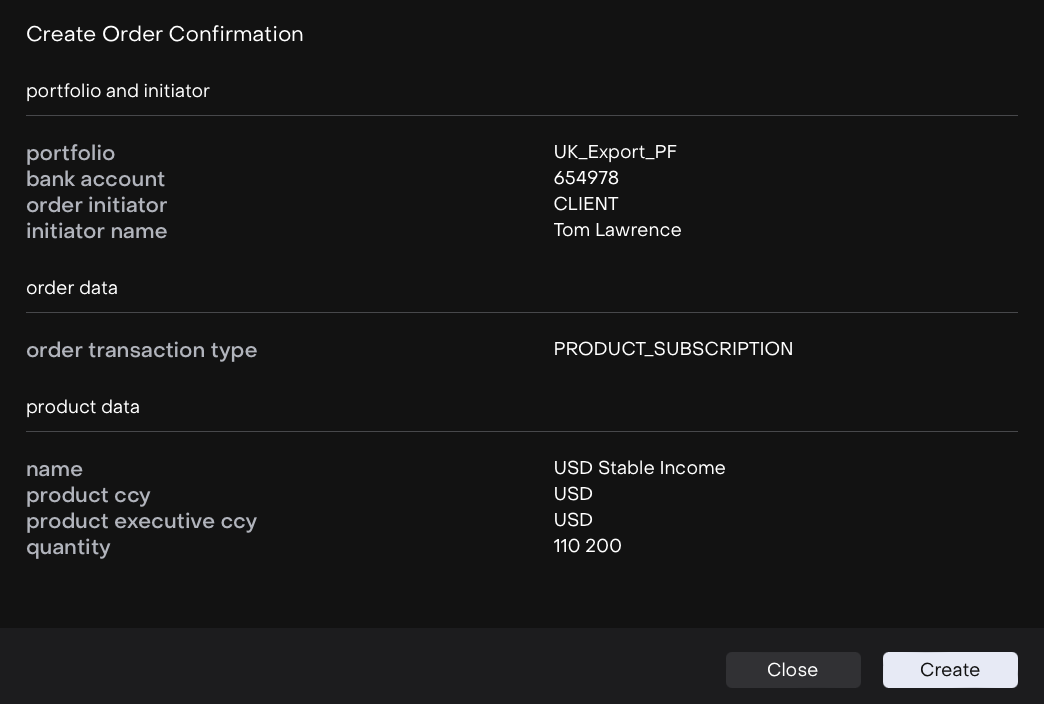

A pop up appears, here reconfirm to Create or Close to cancel.

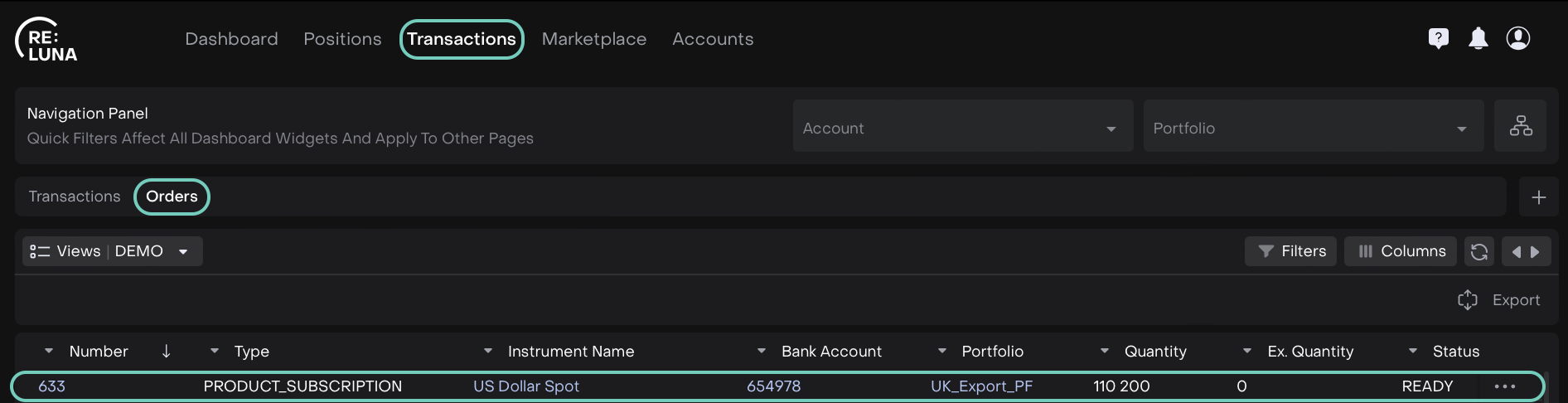

Once the order is created, go to Transactions > Orders tab to view it.

Click the three dots menu to Edit or Execute the order further.

The order is executed according to your portfolio and bank account settings.

🔗 Learn here on how to execute the order.

Unsubscribe

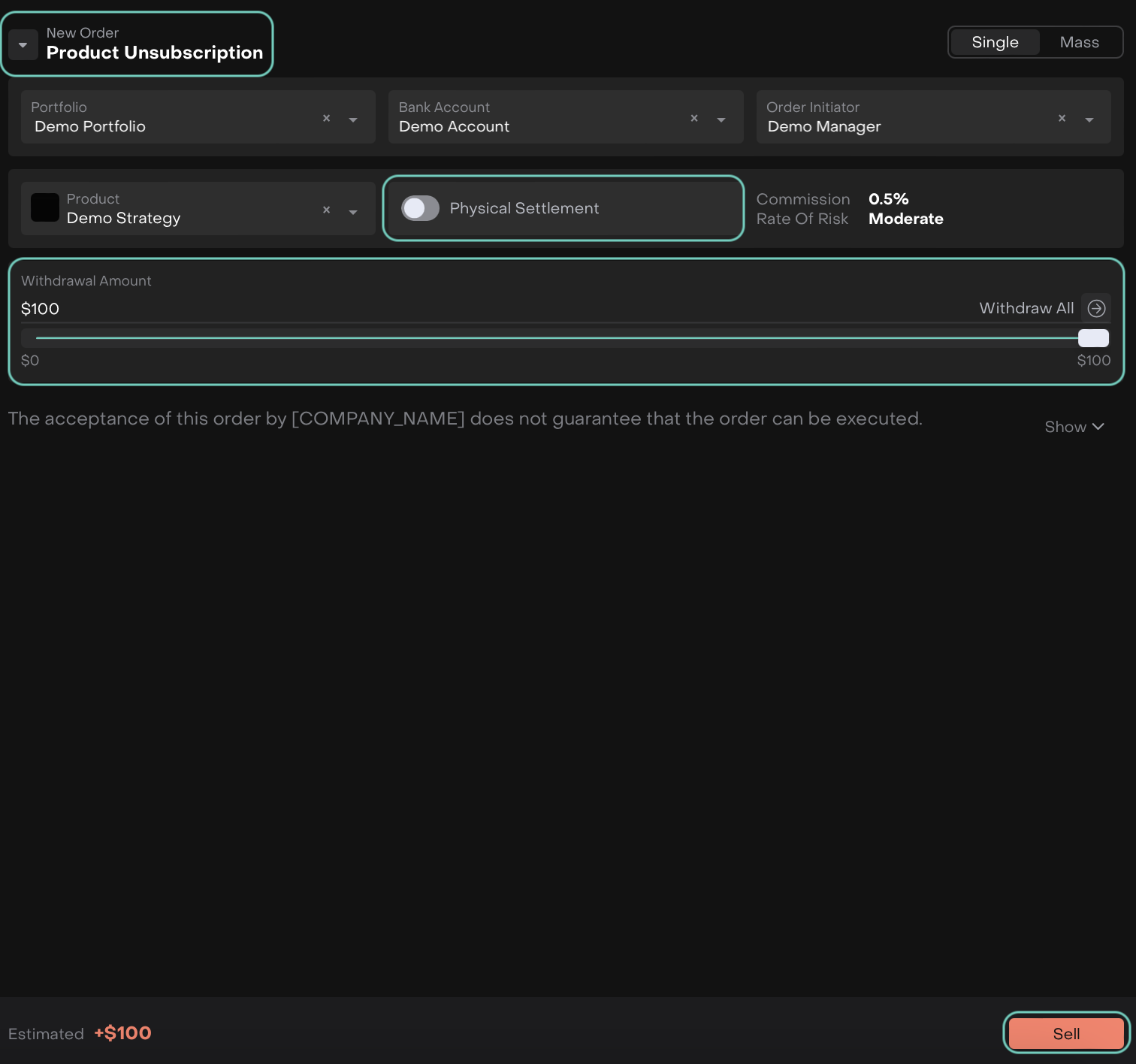

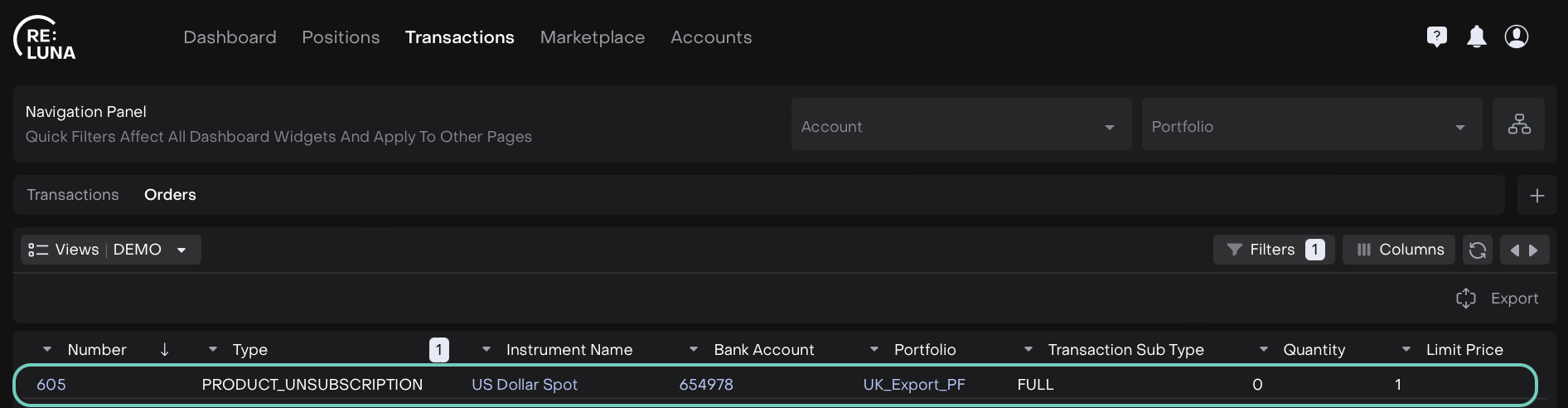

Click Unsubscribe to open the Product Unsubscription order form.

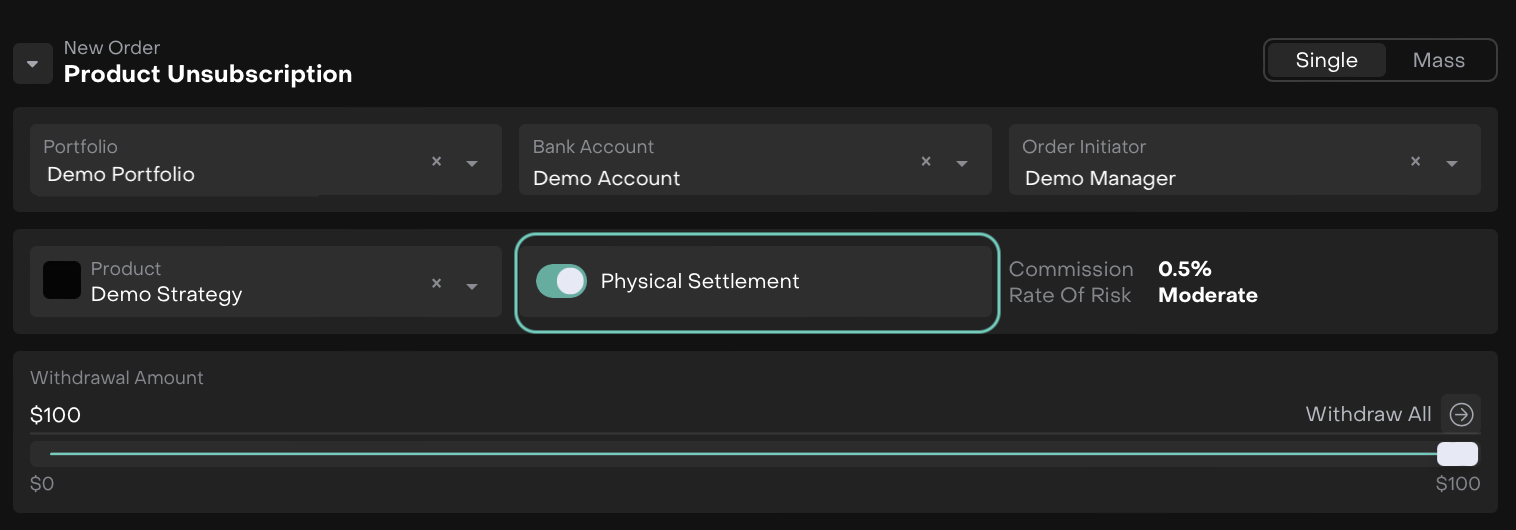

Fill in the required fields as shown in the table.

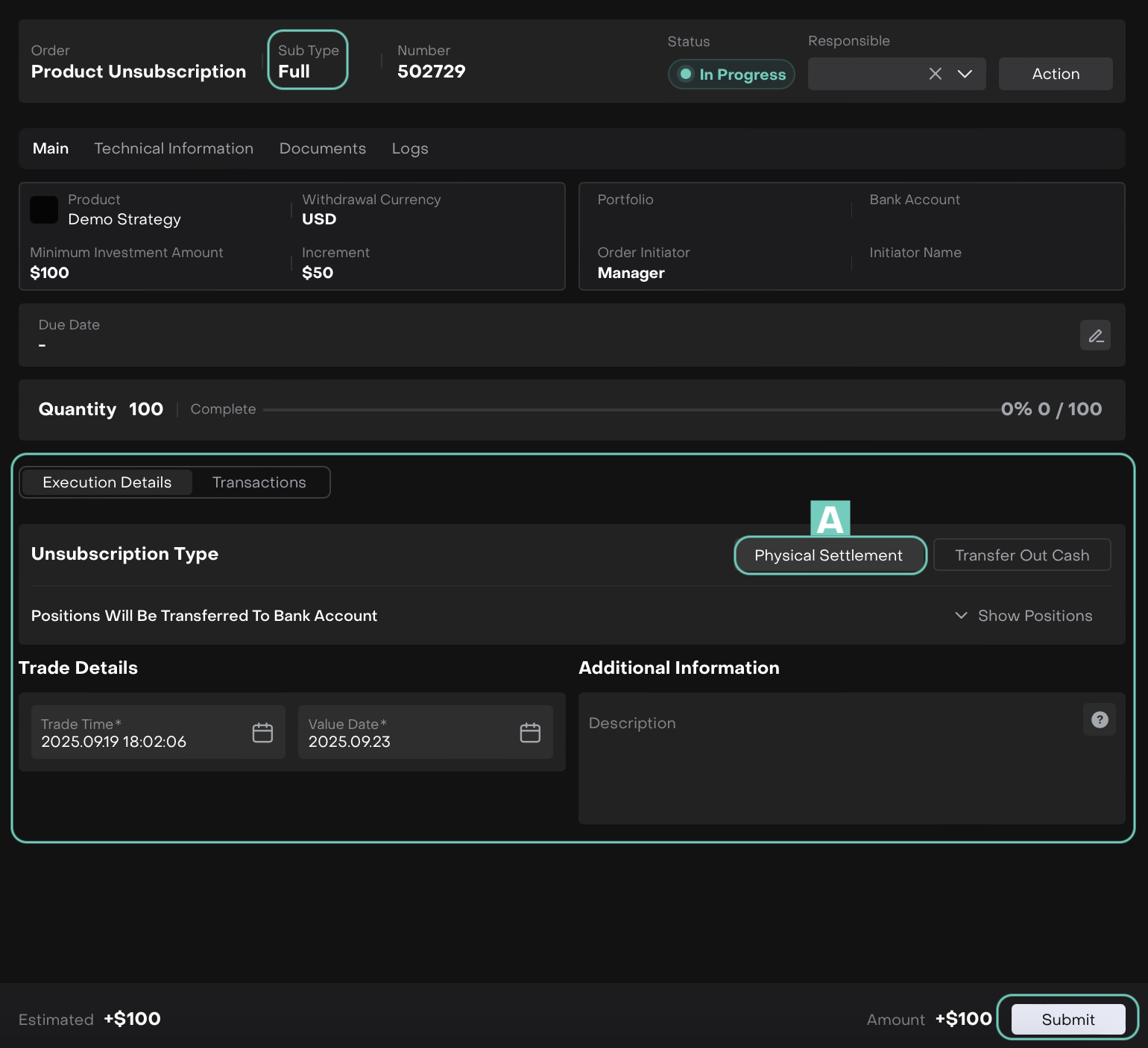

Disabled Physical Settlement Form

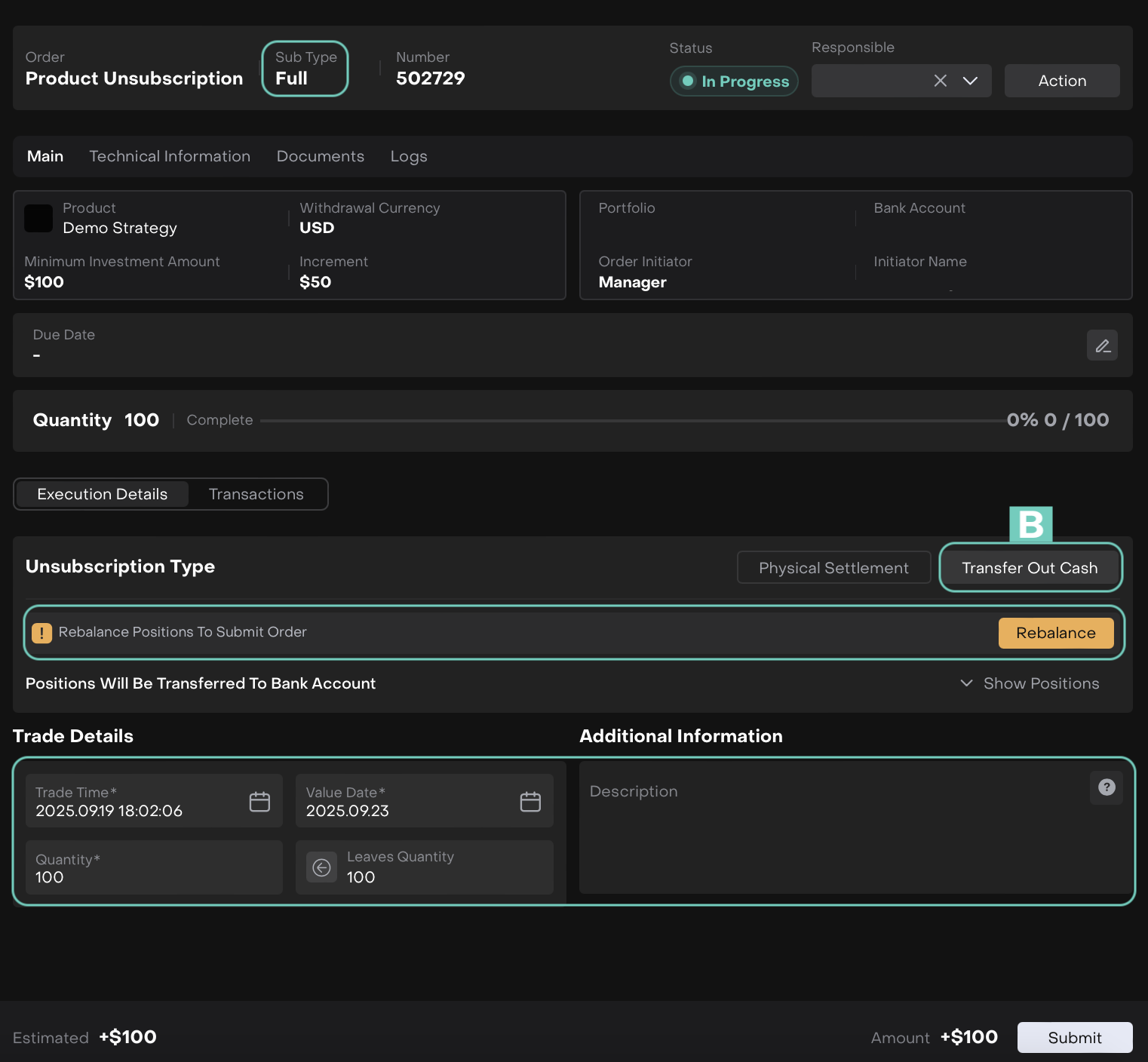

Enabled Physical Settlement Form

Confirm the action to create a Sell order.

Once created, find the order under Transactions > Orders tab.

Click the three dots menu to Edit or Execute the order further.

🔗 Learn here on how to execute the order.

Unsubscription Types

You may encounter two unsubscription types while executing:

A. Physical Settlement

B. Transfer Out Cash

Unsubscribing does not remove your past investment history, it only processes the redemption of your current investment.

Click Submit to finalize and execute the order.

🔗 Learn more here on how to execute Physical Settlement/Transfer Out Cash.