Client Orders

AVAILABLE IN:

Introduction

The Orders tab is where you can view, create and manage all your investment orders within the platform. Whether you're placing a new trade, tracking execution details or reviewing past orders, this tab gives you a complete order activity.

Order creation and management are permission-based features. Please check with your Manager for availability.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Adjustment | A non-trade order type used to correct or align portfolio values or balances. |

Bank Account | The account linked to your portfolio that is used for settlement of the order. |

Block | A non-trade order type used to reserve or allocate securities or cash temporarily. |

Cash Transfer | A non-trade order type used to move cash between accounts. |

Corporate Action Orders | Orders that cause a security or cash movement as a result of a corporate action, such as dividends, mergers, or splits. |

Cross Trade | A trade between two portfolios or accounts under the same management entity. |

DMA (Direct Market Access) | An electronic facility that allows you to place orders directly to financial market exchanges without broker intervention. |

FX (Foreign Exchange) | A transaction involving the exchange of one currency for another. |

FX Product | A product based on foreign exchange, such as currency-linked deposits or FX derivatives. |

Limit Order | Executes only at or better than your specified limit price. |

Marginal Trading | Trading using borrowed funds from a broker to purchase an investment. The margin is the difference between the total value of the investment and the loan amount. |

Market Order | Executes instantly at the current market price. |

Non-Trade Order | An order that does not involve market execution (e.g., fees, adjustments, or transfers). |

Order Status | Indicates the stage of an order, such as Ready for Execution, Partially Filled, Executed, or Cancelled. |

Order Type | Defines how your order is executed (Market, Limit, Stop, Stop Limit). |

OTC (Over the Counter) | The process of trading securities via a broker–dealer network, rather than on an exchange. |

Quantity | The number of units (e.g., shares or bonds) included in the order. |

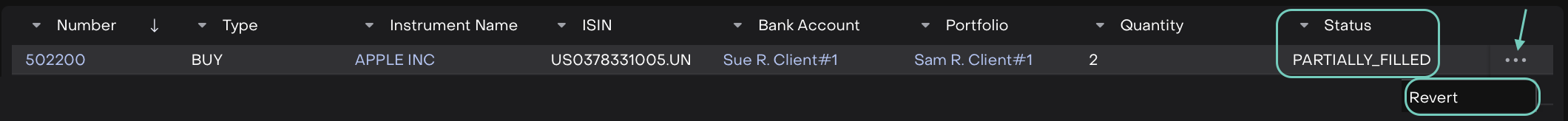

Revert | An action available only when an order is Partially Filled, allowing you to reverse remaining unfilled quantities. |

Stop Limit Order | A combination of stop and limit conditions—triggers at a stop price but executes only at your specified limit price or better. |

Stop Order | Becomes active only when the market reaches your specified stop price. |

Trading Type | Defines whether your order is executed via OTC (Over the Counter) or DMA (Direct Market Access). |

👉 New to some terms? Check out our full Platform Glossary for more.

Orders Tab Overview

The Orders tab acts as your central workspace for all trading-related actions. You can quickly switch between viewing your existing orders, creating new ones, or checking their latest status.

View Orders on Client Portal

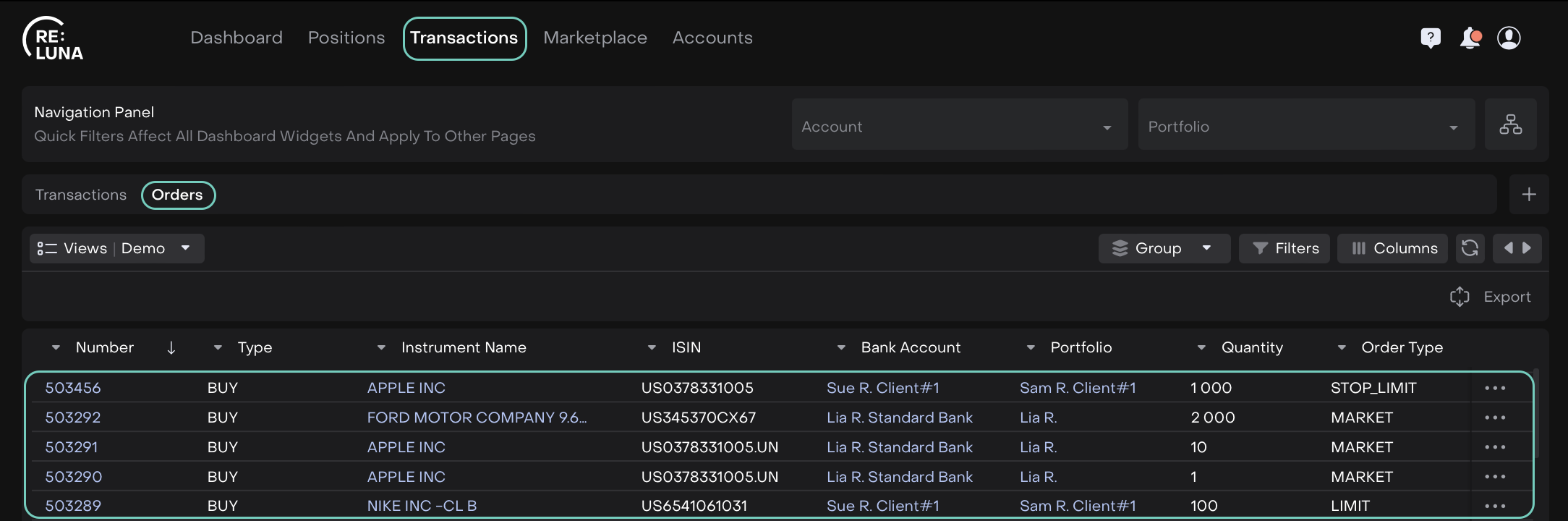

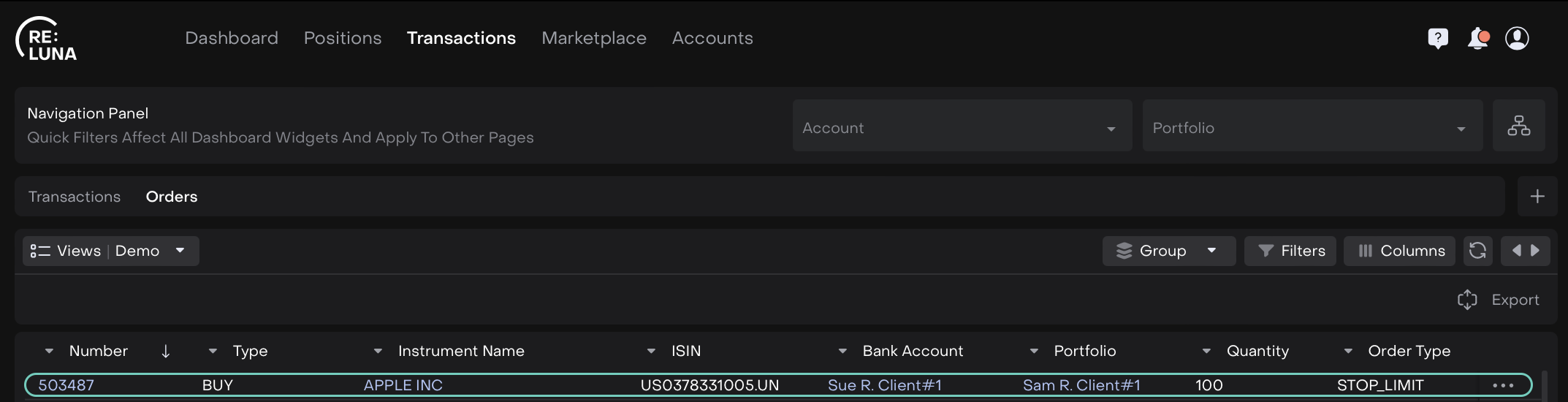

Navigate to Orders tab from Transactions on the dashboard.

You’ll see a table displaying all orders created under your account.

Or,

Use filters on the Navigation Panel to refine your view.

Filter Orders Using Navigation Panel

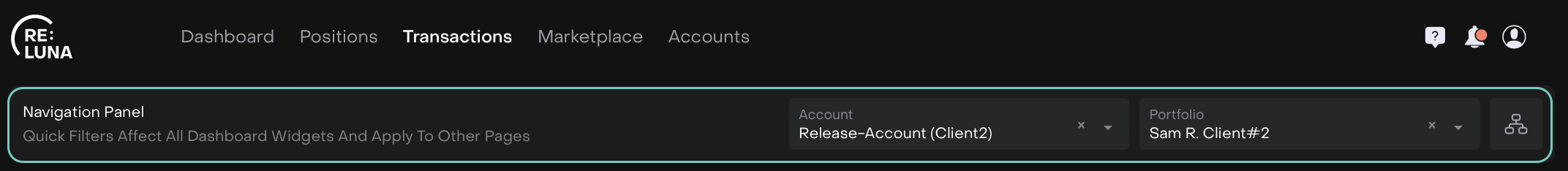

At the top of the Orders page, you will see the Navigation Panel. This panel helps you quickly find the orders you want to see:

Select Account: choose the account you want to view orders for.

Select Portfolio: pick the portfolio whose orders you want to review.

Account Structure

Icon – Click to jump directly to the full Account Structure tab.

Once you make a selection, the orders table automatically updates to show only the relevant orders for your chosen account and portfolio.

Create an Order

If your role includes order creation rights, you can easily create new orders directly from the Orders tab.

Click + icon at the top of the page.

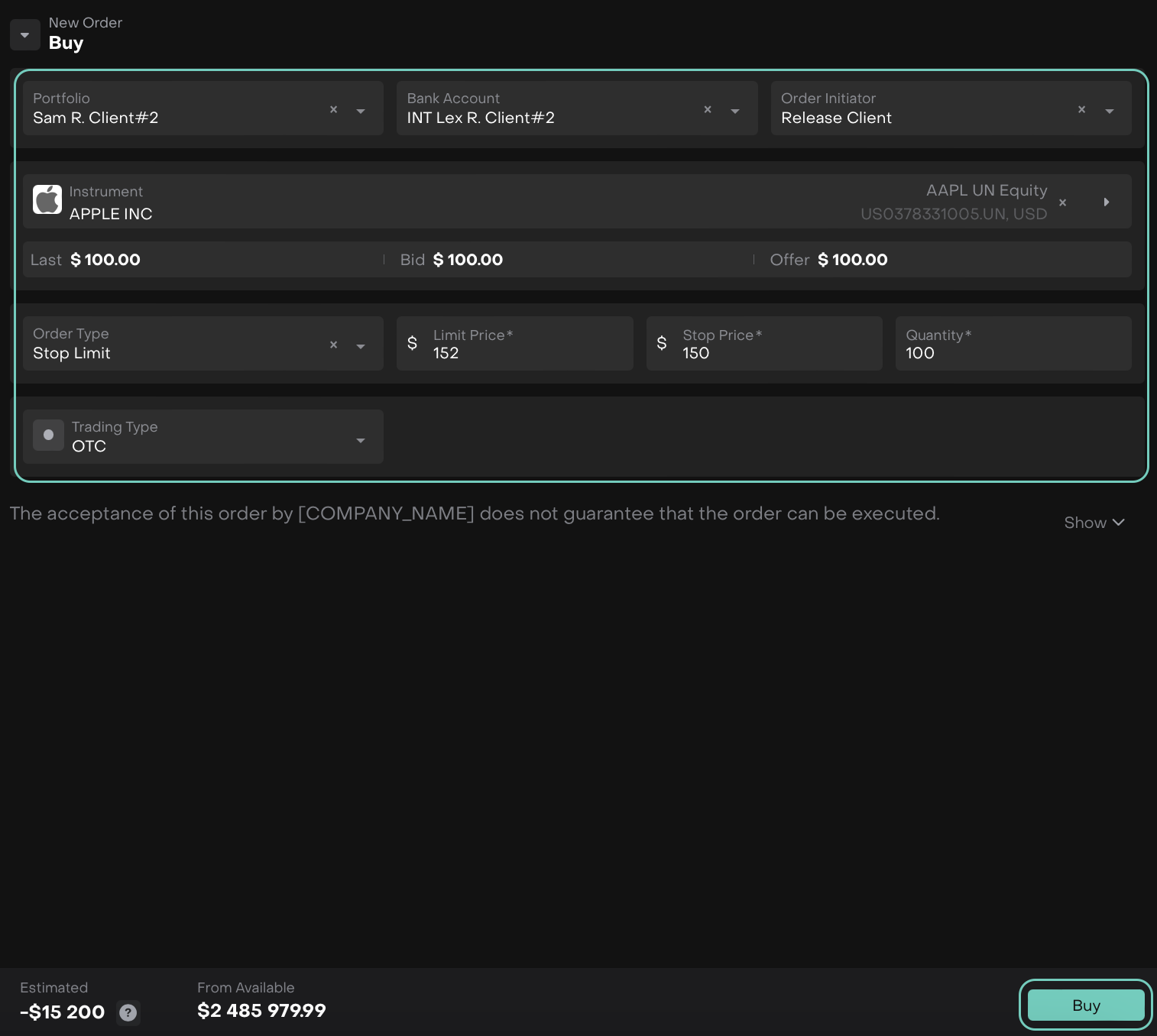

In the Order Form, fill in the following mandatory fields and click on action button (Buy).

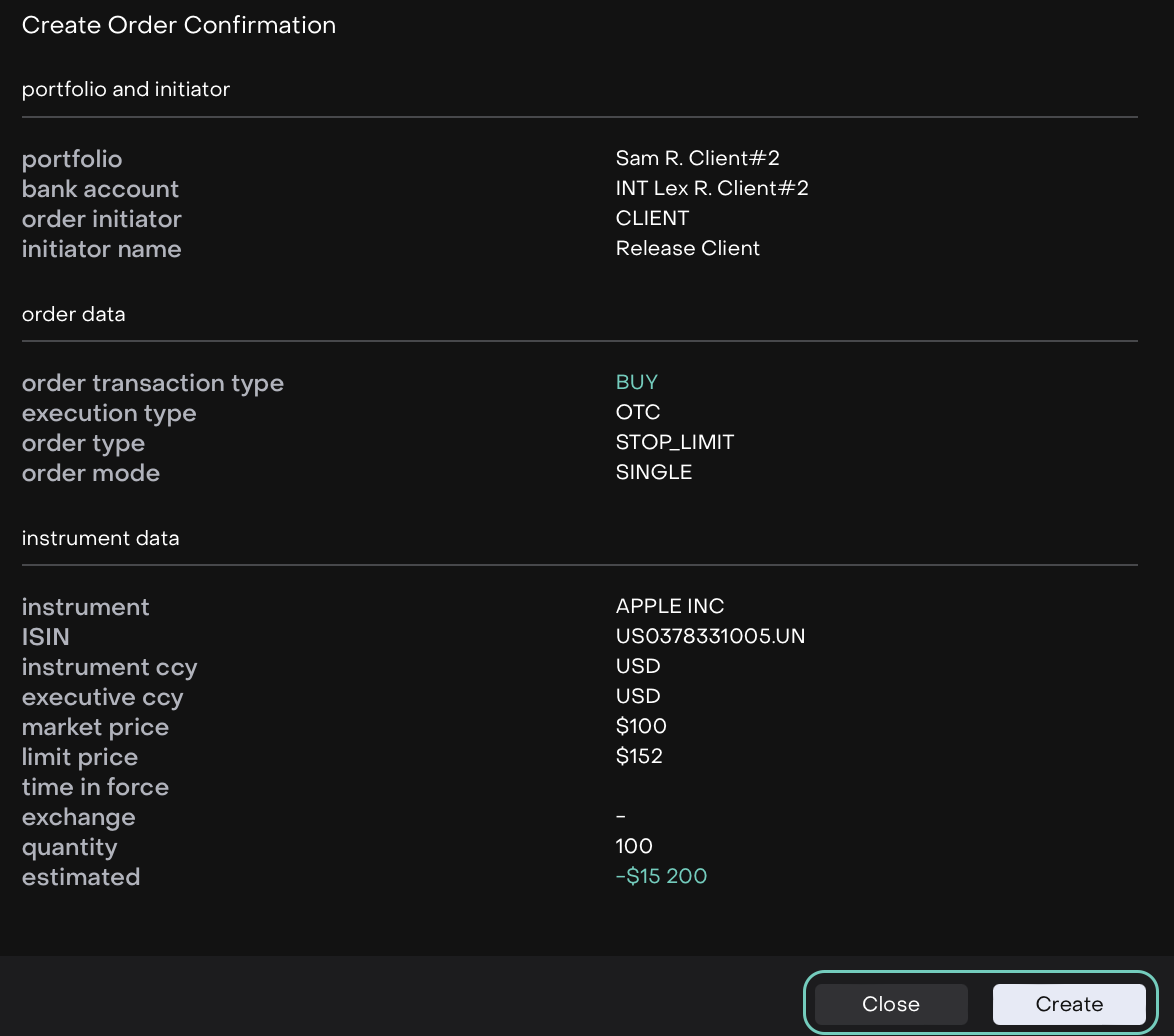

Review your order summary and Confirm creation or click Close to go back.

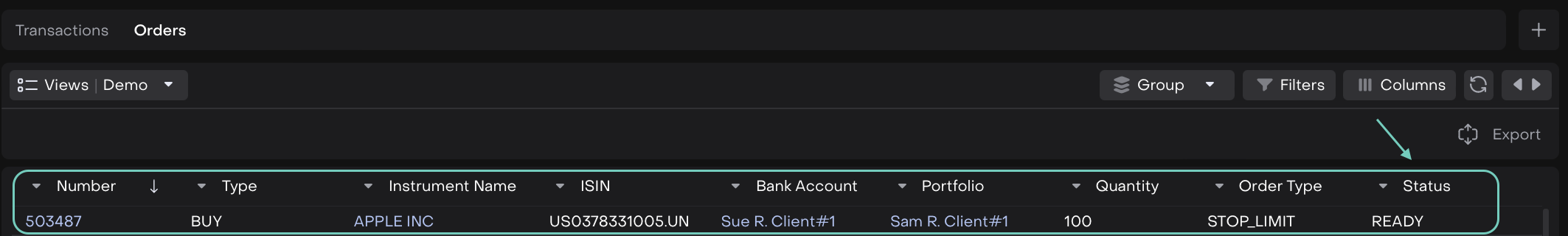

Once submitted, your order appears in the Orders list with the status Ready for execution.

Manage Orders

You can manage your orders directly from the Orders tab — provided your permissions allow it.

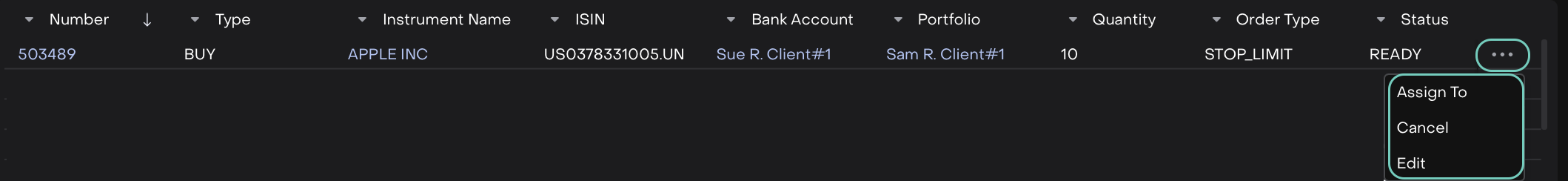

From the list view:

Select the order you wish to update.

Open the Actions Menu (three dots or double-click on the row).

Choose one of the following (as permitted):

Assign To - Select to whom the order is assigned to be for execution.

Cancel - Withdraw the order directly from the list.

Edit - Modify order form details before execution.

Revert option is only available in Partially_Filled Status.

🔗 Learn more here on how to Execute the orders.