Manage Deposit and Loan Orders

AVAILABLE IN:

Introduction

The Reluna Platform lets you create and manage Deposit and Loan orders that are not linked to trading activities.

You can create the following types of orders:

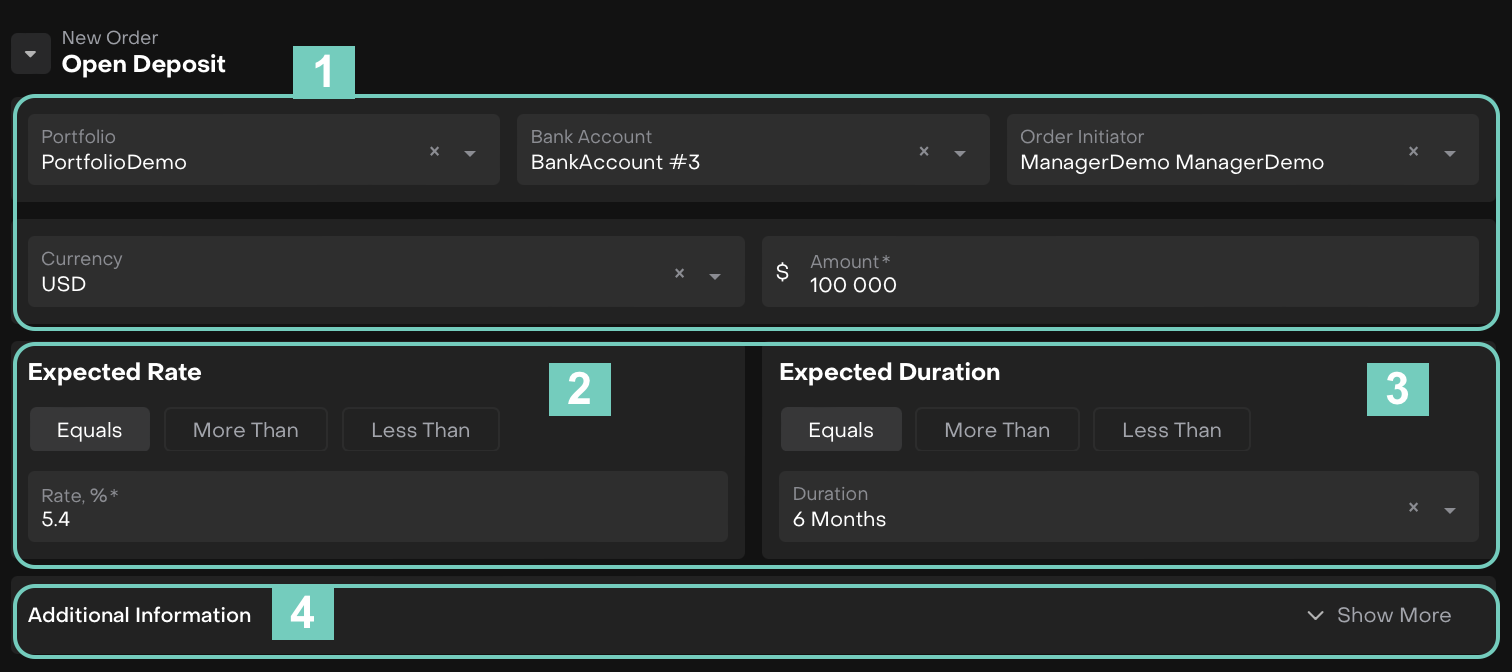

Open Deposit / Open Loan

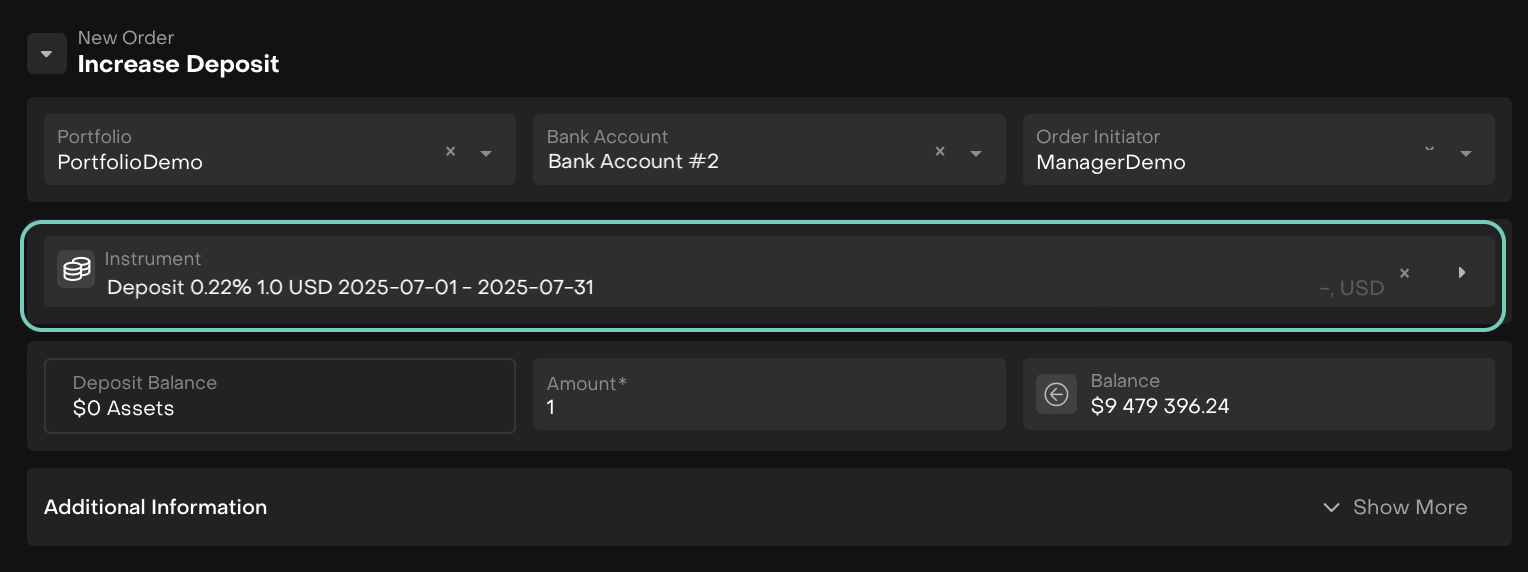

Increase Deposit / Increase Loan

Decrease or Close Deposit / Loan

This guide walks you through the main structure of these orders and provides a detailed example of how to fill in a Loan/Deposit order forms.

Permission Requirement

Label on Platform | Permission ID | Permission |

|---|---|---|

Orders (tab) | Orders | View, Modify, Create, Delete |

Non Trading Orders | Orders non trade | View, Modify, Create, Delete |

Key Terminologies

Term (A-Z) | Definition |

|---|---|

Deposit | Placing money into a bank or financial institution for safekeeping and potential return. |

Loan | Financial arrangement where a lender provides funds to a borrower and the borrower agrees to repay the principal amount along with interest over a specified period. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

Create Deposit or Loan Orders

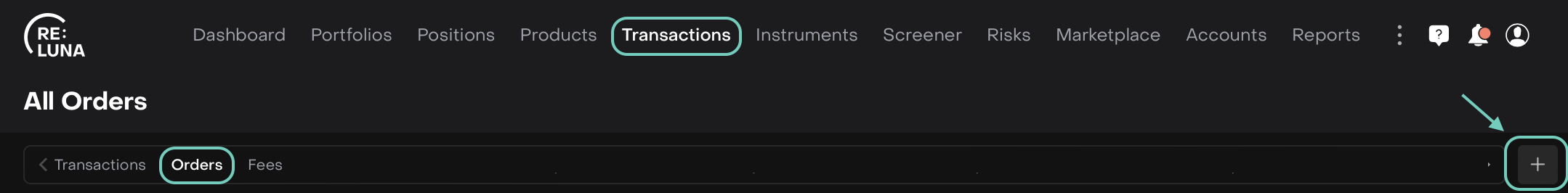

Go to Transactions > Orders tab

Or,

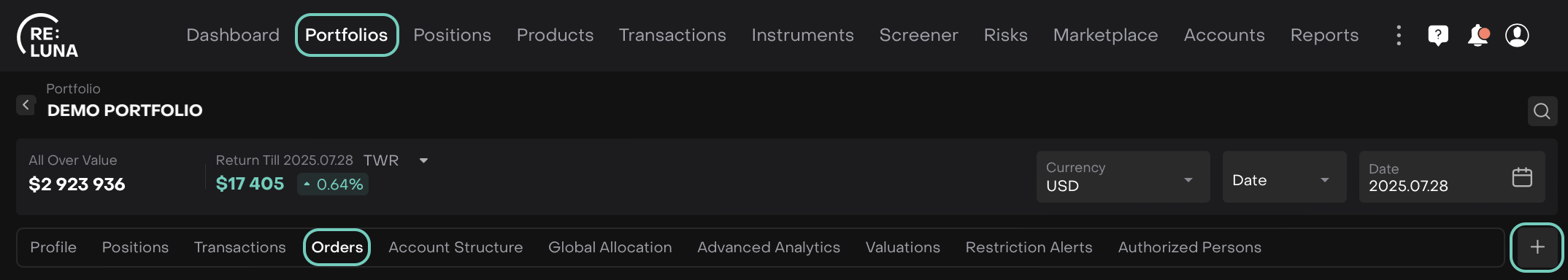

Find your Portfolio > Orders tab

Click + icon.

Then, select New Order Type.

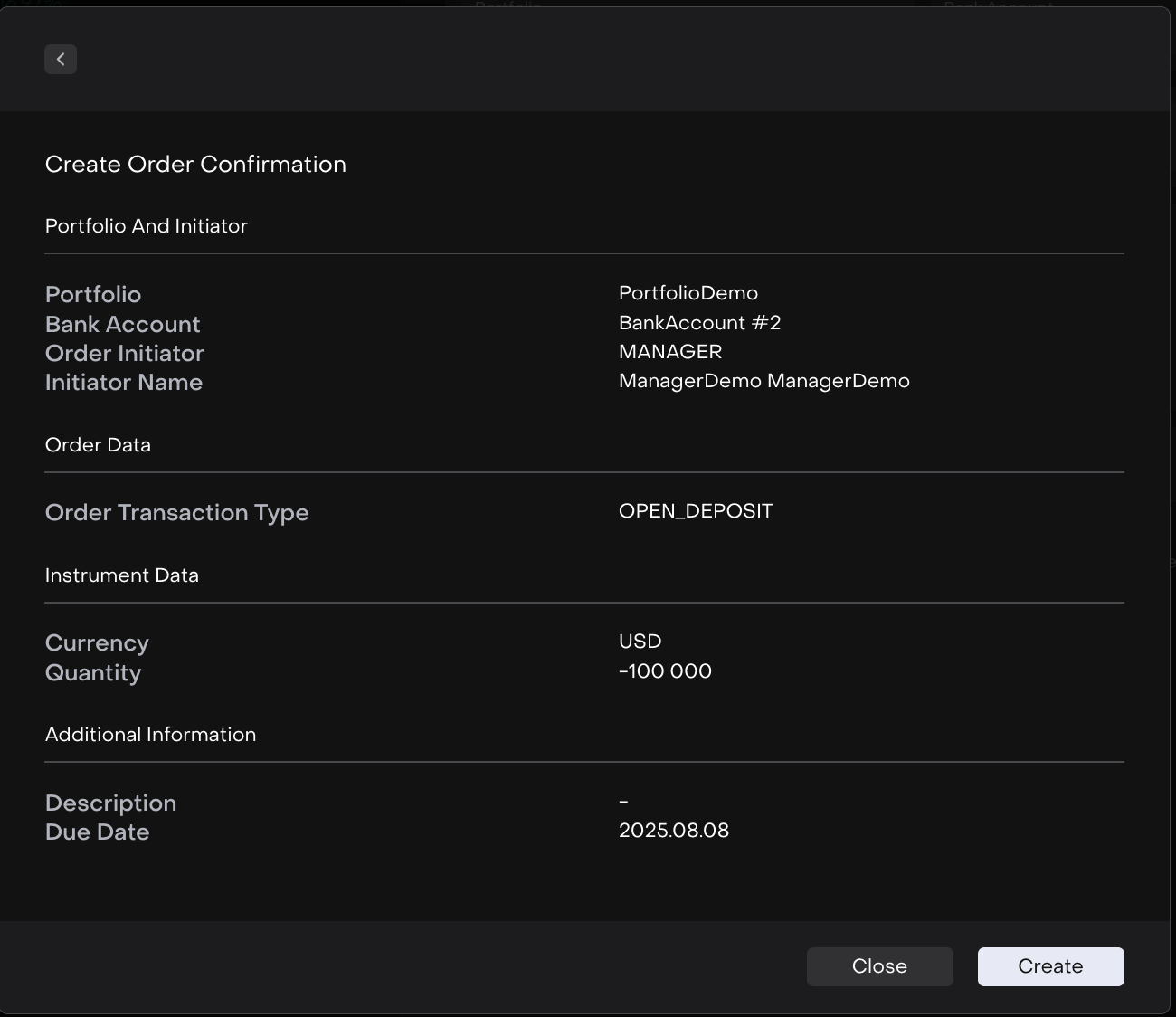

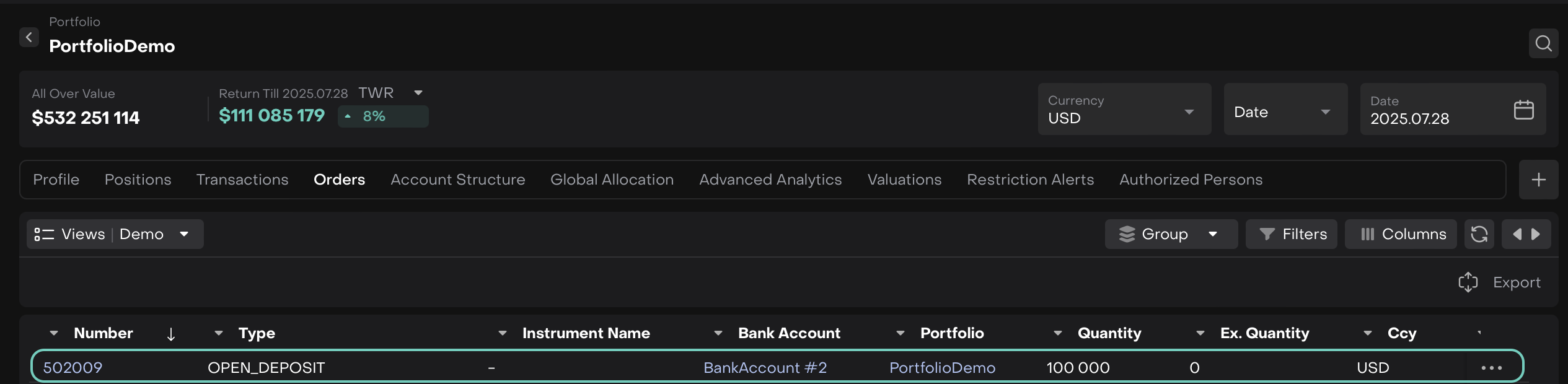

Once filled, click on Create Order and review of confirmation screen. If all data is correct, the created entry will appear on the list.

Execute an Order

Order execution is available to both the order’s assignee and initiator, ensuring that authorized users can handle the process efficiently.

Follow these steps to successfully execute an order in the platform:

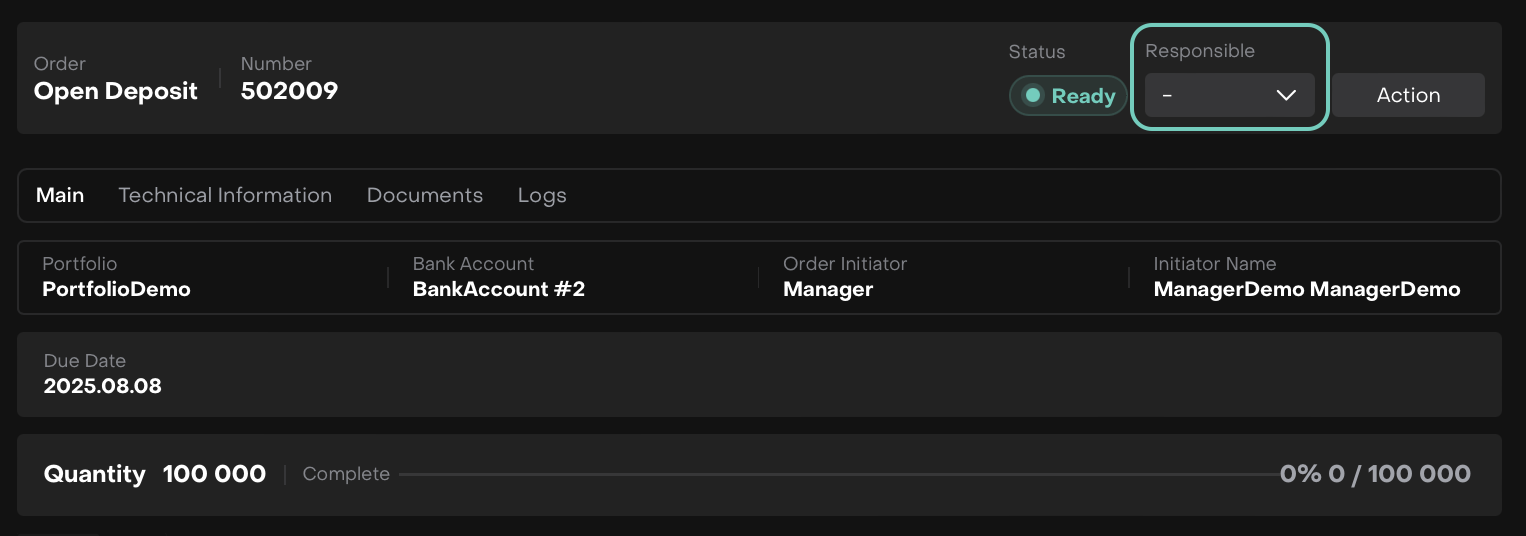

On the list, double click to open to further execute the order or click on … dots to Assign To.

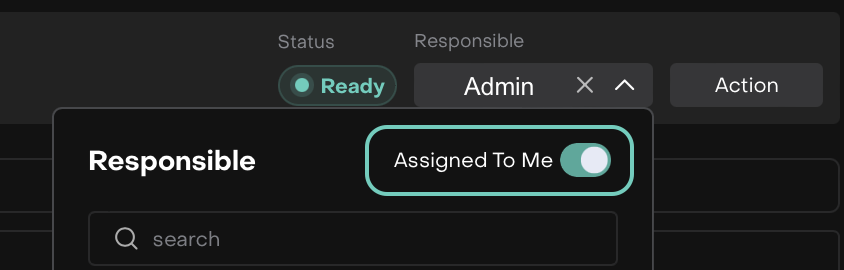

Use the Assigned To Me action to claim the order and take responsibility for its execution.

Once the order is picked up, click the Start Working button to edit the execution form.

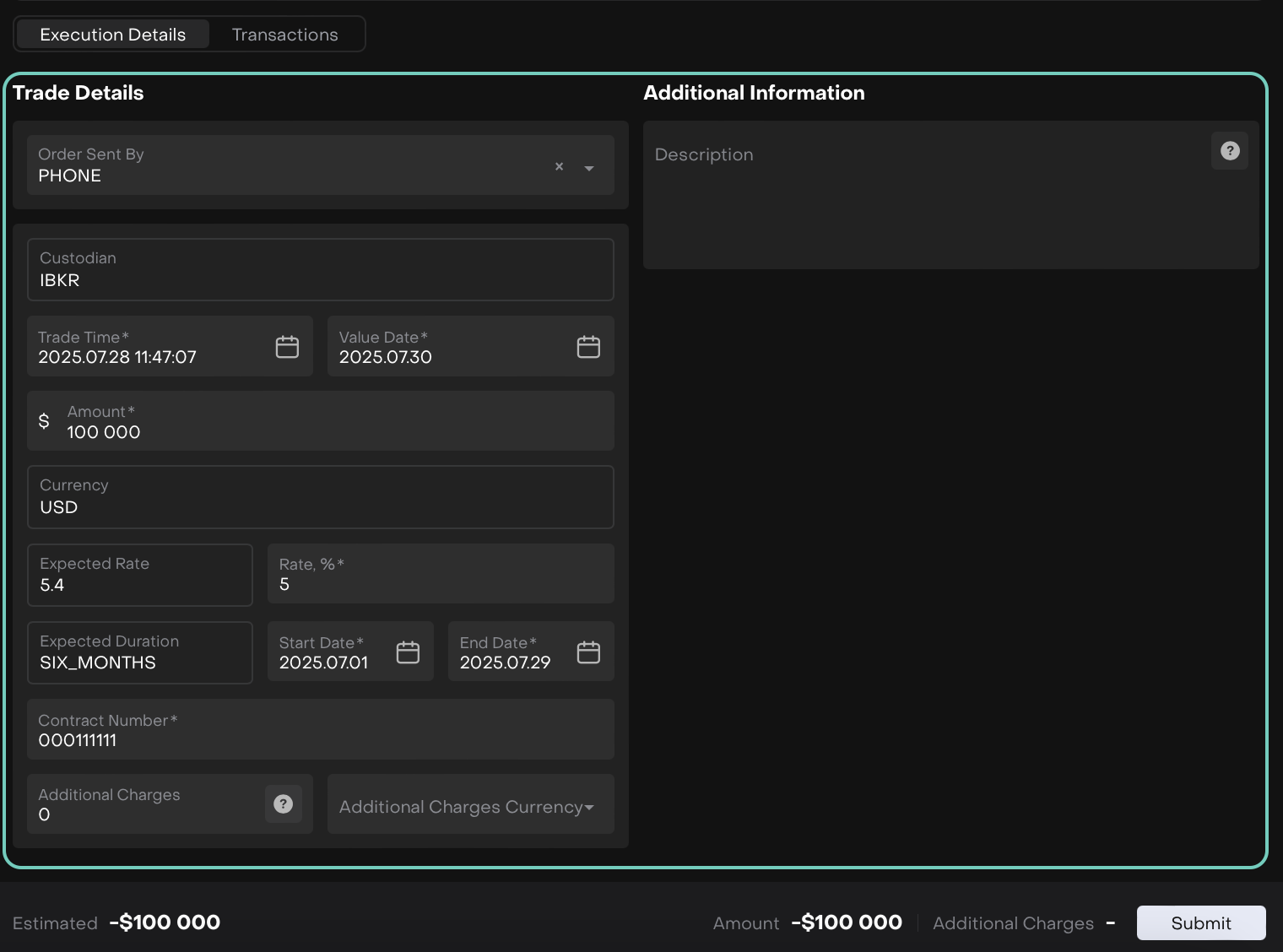

The order execution form opens, fill in the required fields as shown below.

Then, click Submit button to confirm the execution.

Deposit or Loan is created after execution of an order.

User shall add detailed information about deposit or loan from the Bank.

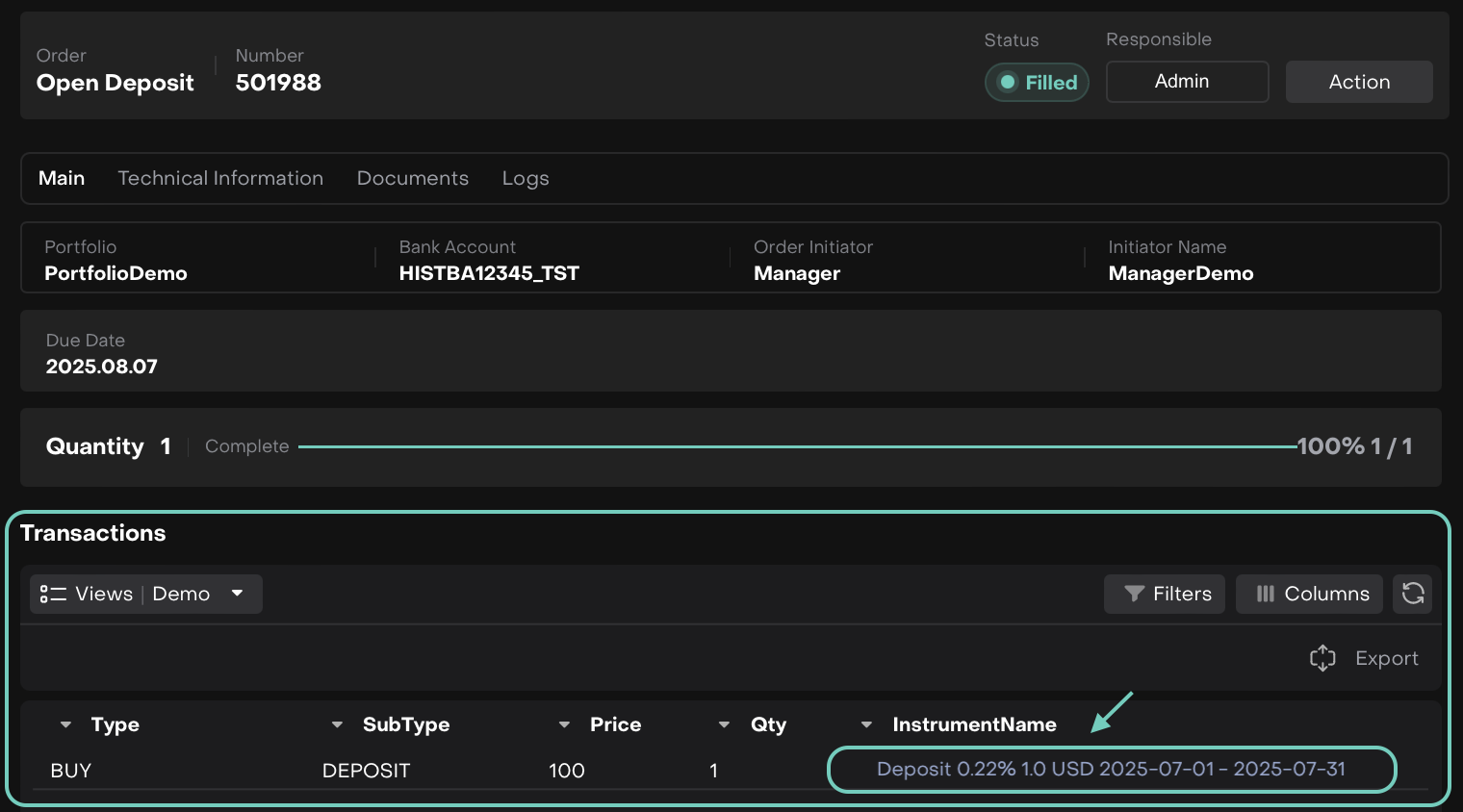

After Order Execution

Once an order is approved and executed:

A transaction is created in status Active with reason Order.

A new or updated instrument is shown in your platform.

The instrument name is auto-generated based on Amount/Rate, %.

Increase or Decrease/Close Deposit or Loan

Effect on Portfolio Positions

To view how your portfolio changes after placing an order, navigate to the Positions tab once the order is executed.

Here’s how cash and positions are affected for different order types:

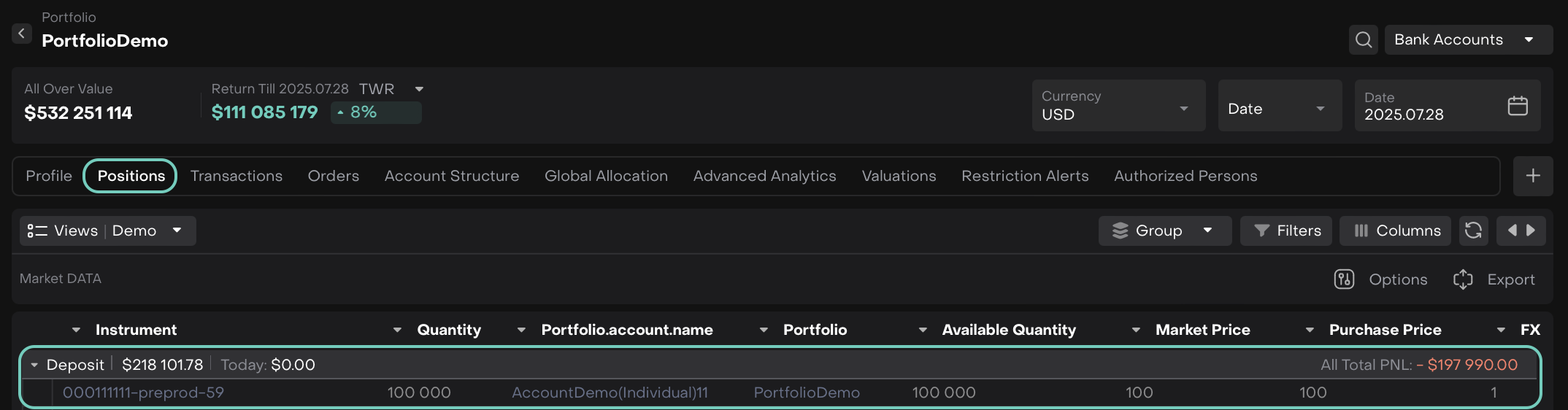

For Deposit Orders

Cash is reduced by the deposit amount.

A Deposit instrument appears in the Positions tab.

The position shows:

Auto-generated instrument name

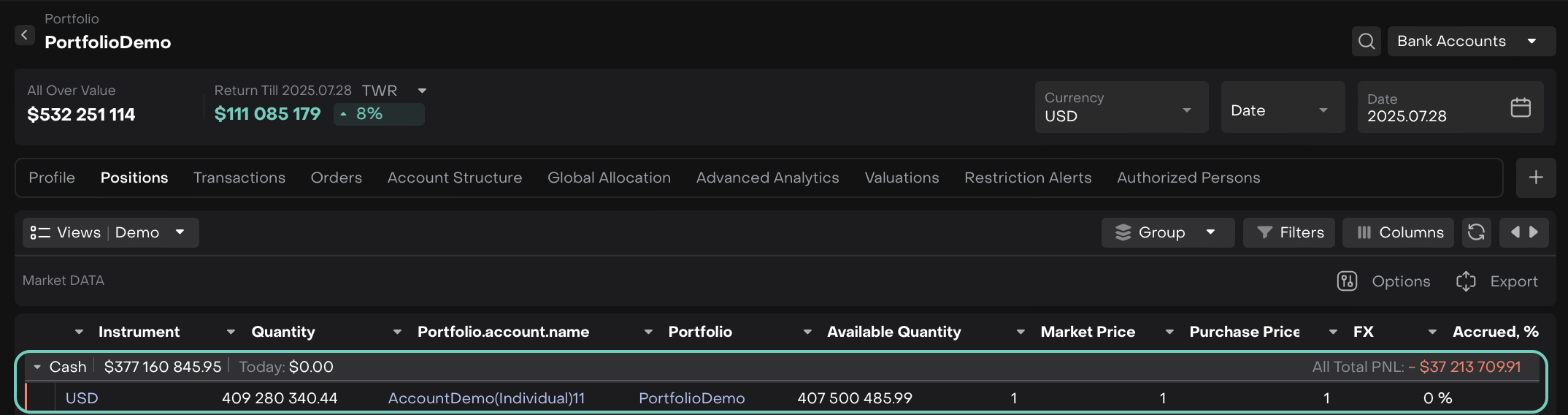

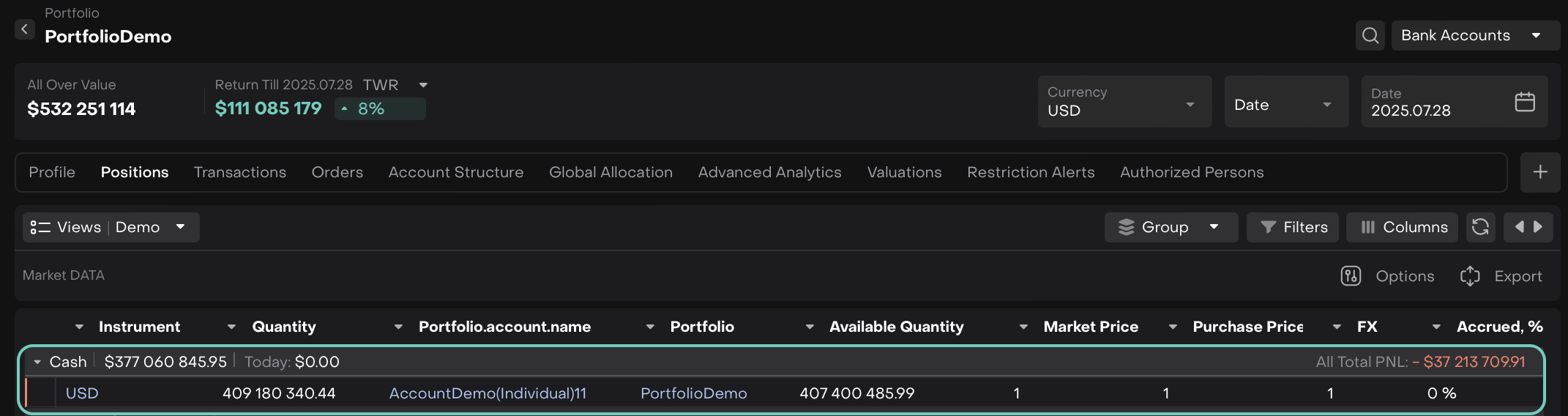

Impact on Cash

This screen shows your available cash balance.

Before Order Execution

After a Deposit order, the available cash balance decreases by the deposit amount.

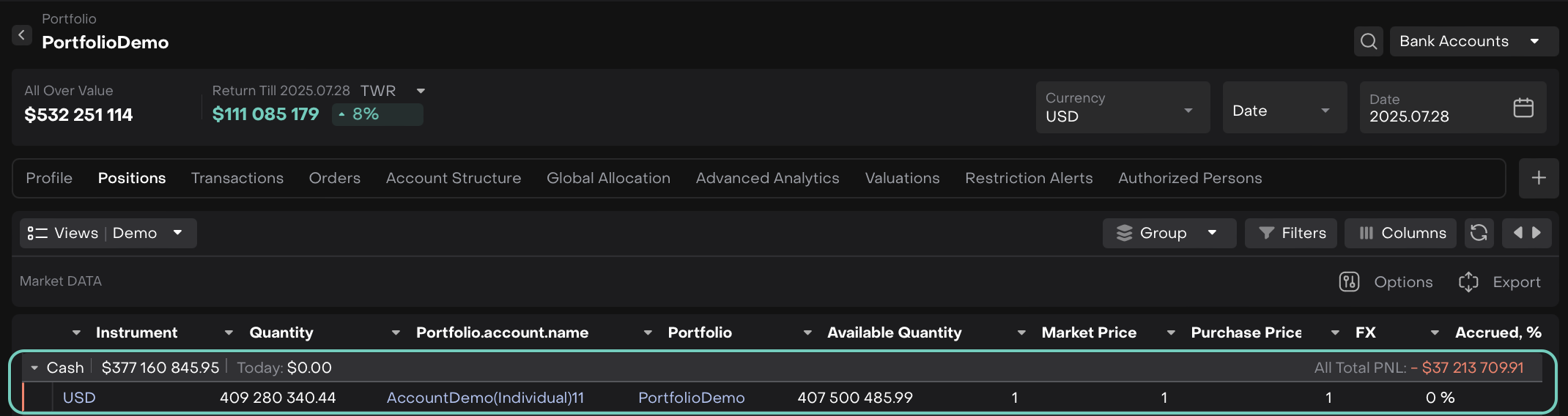

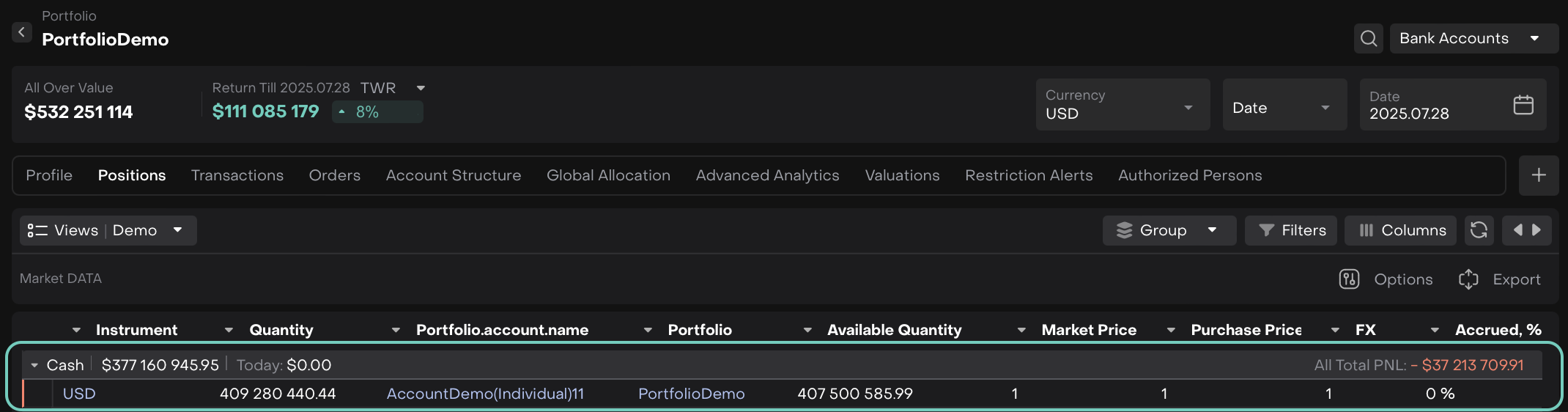

After Order Execution

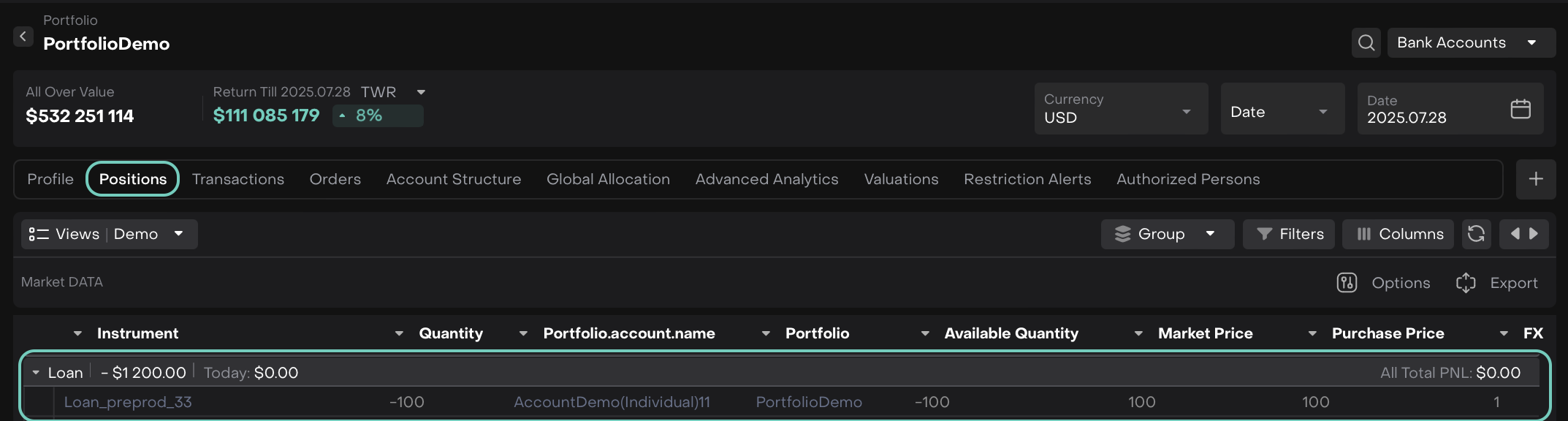

For Loan Orders

Cash is increased (loan proceeds credited to portfolio).

A Loan instrument appears in the Positions tab.

The position shows:

Auto-generated instrument name

The platform adds a loan liability to your positions. This appears with a negative value and quantity to distinguish it from asset-based instruments.

Impact on Cash

This screen shows your available cash balance.

Before Order Execution

After a Loan order, the cash balance increases by the loan proceeds credited to the portfolio.

After Order Execution