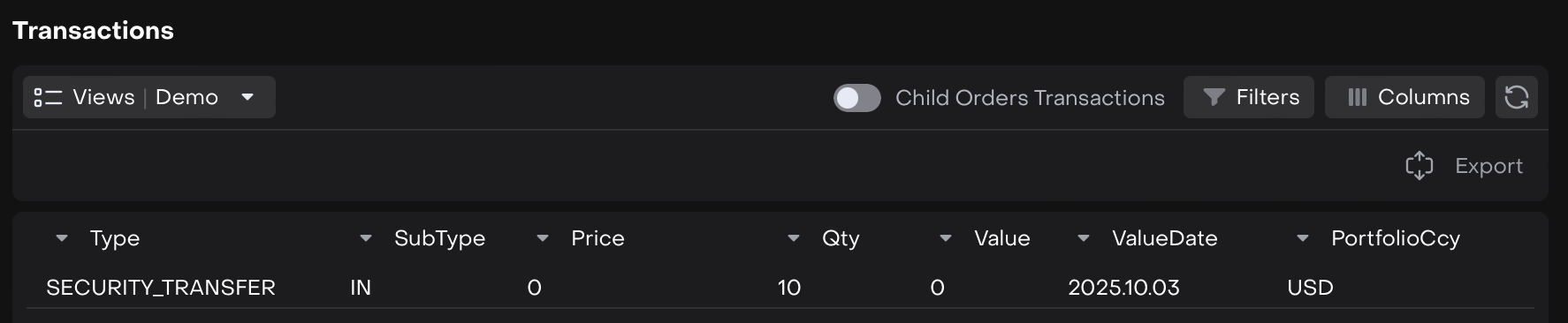

Field Name | Definition | Field Type | What to Fill In |

|---|

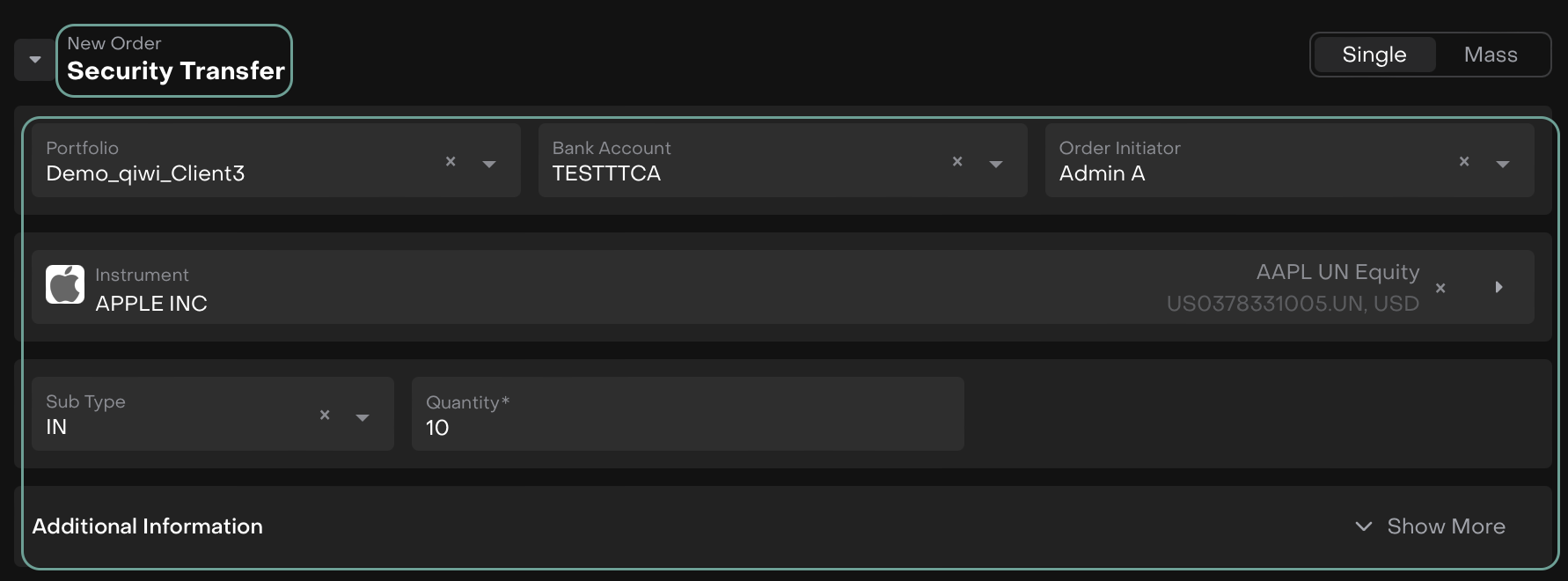

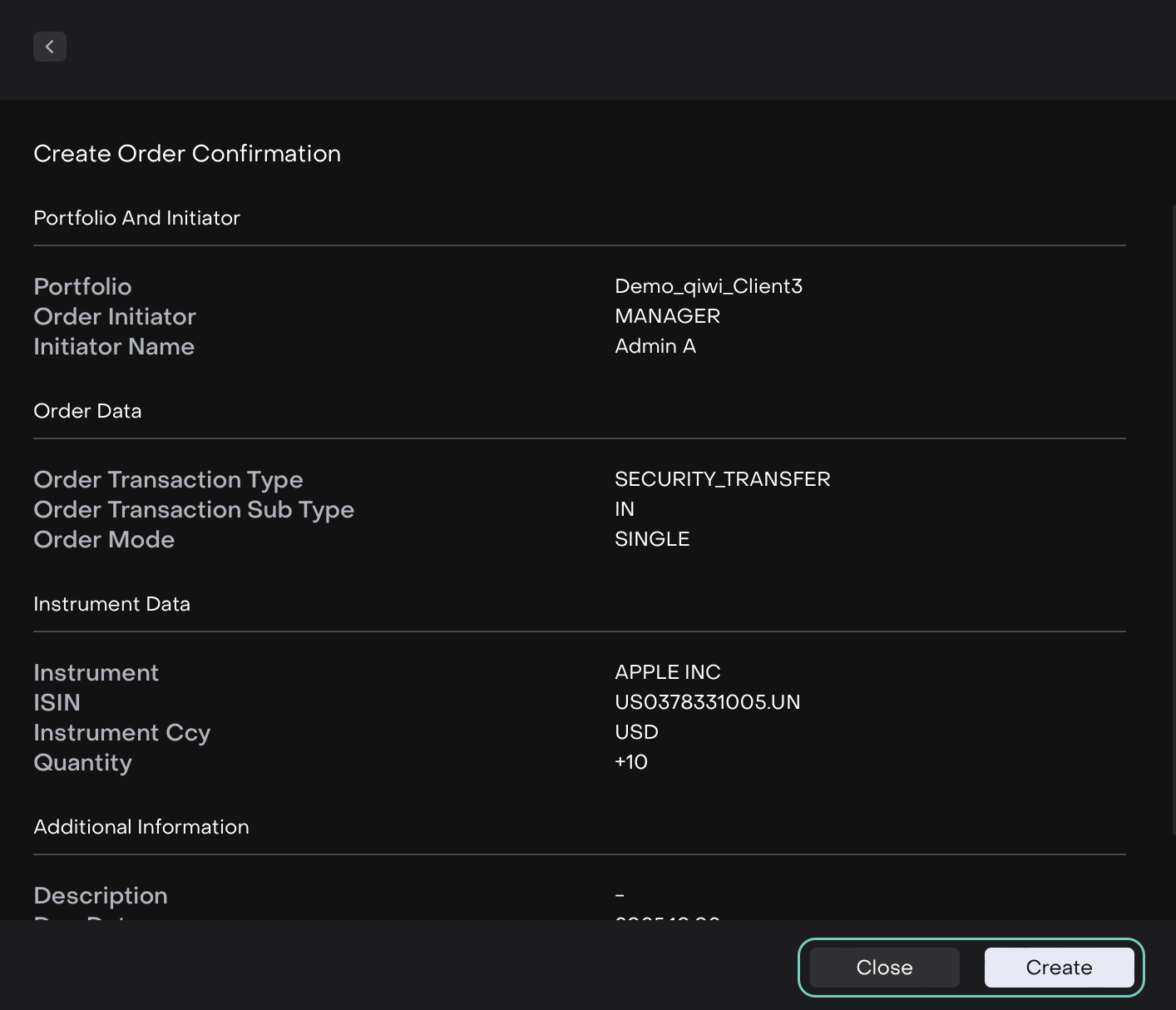

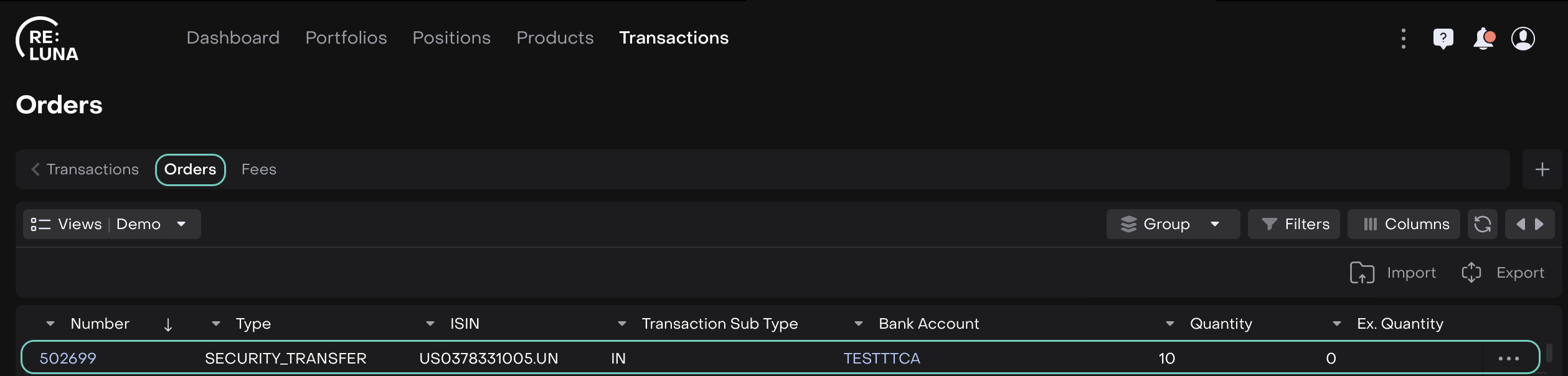

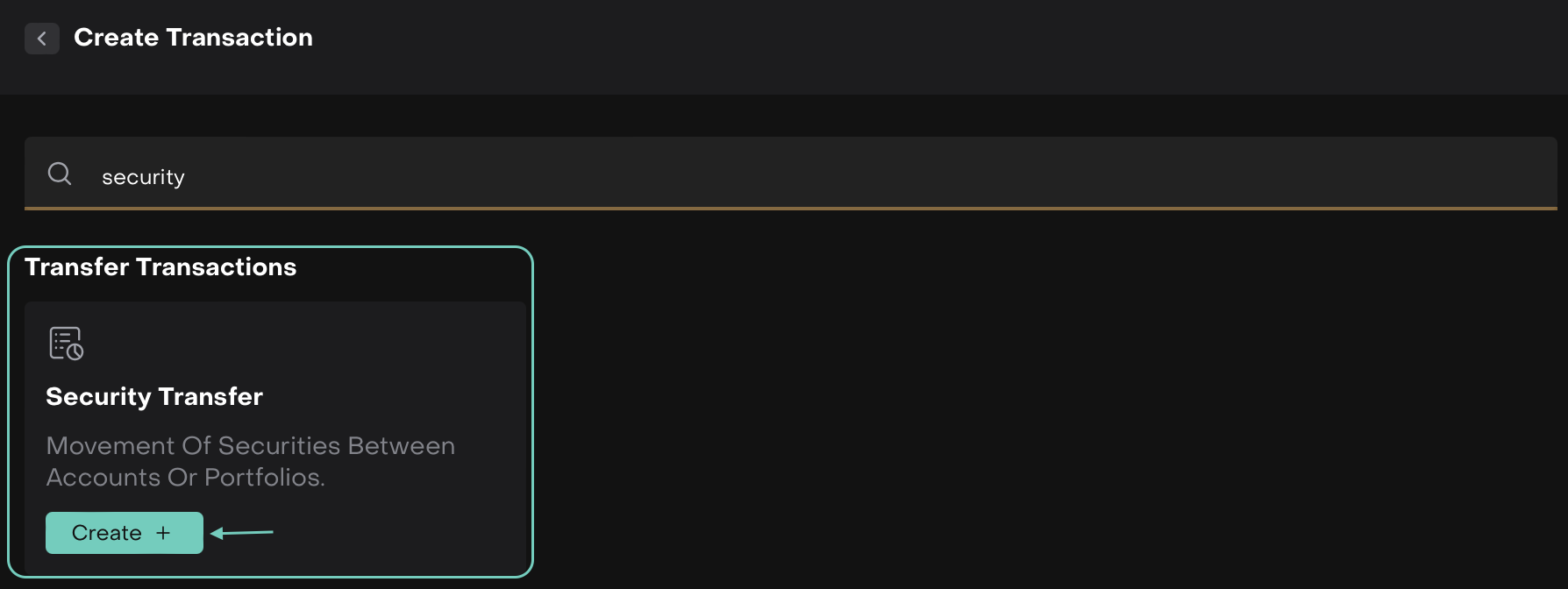

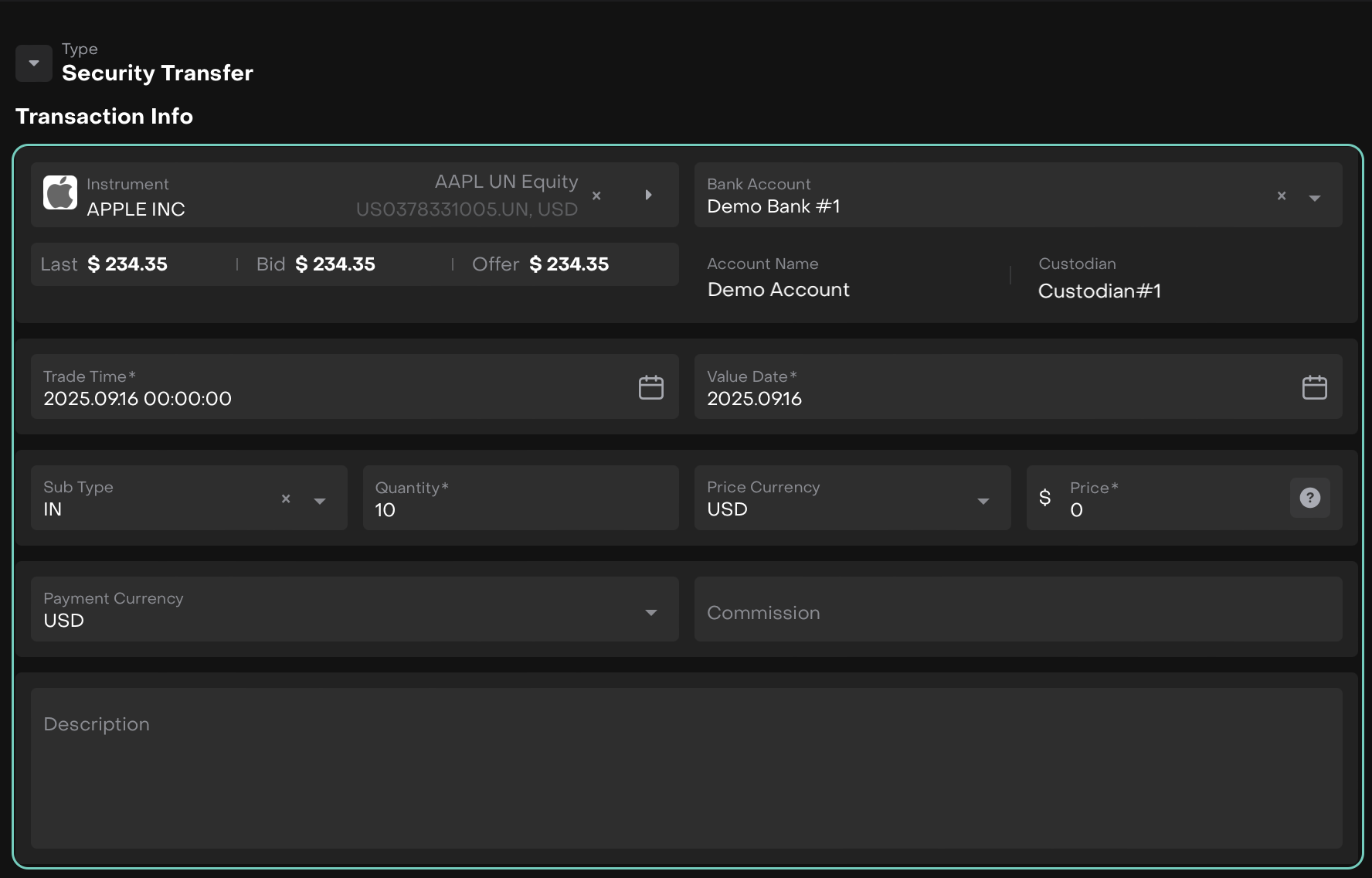

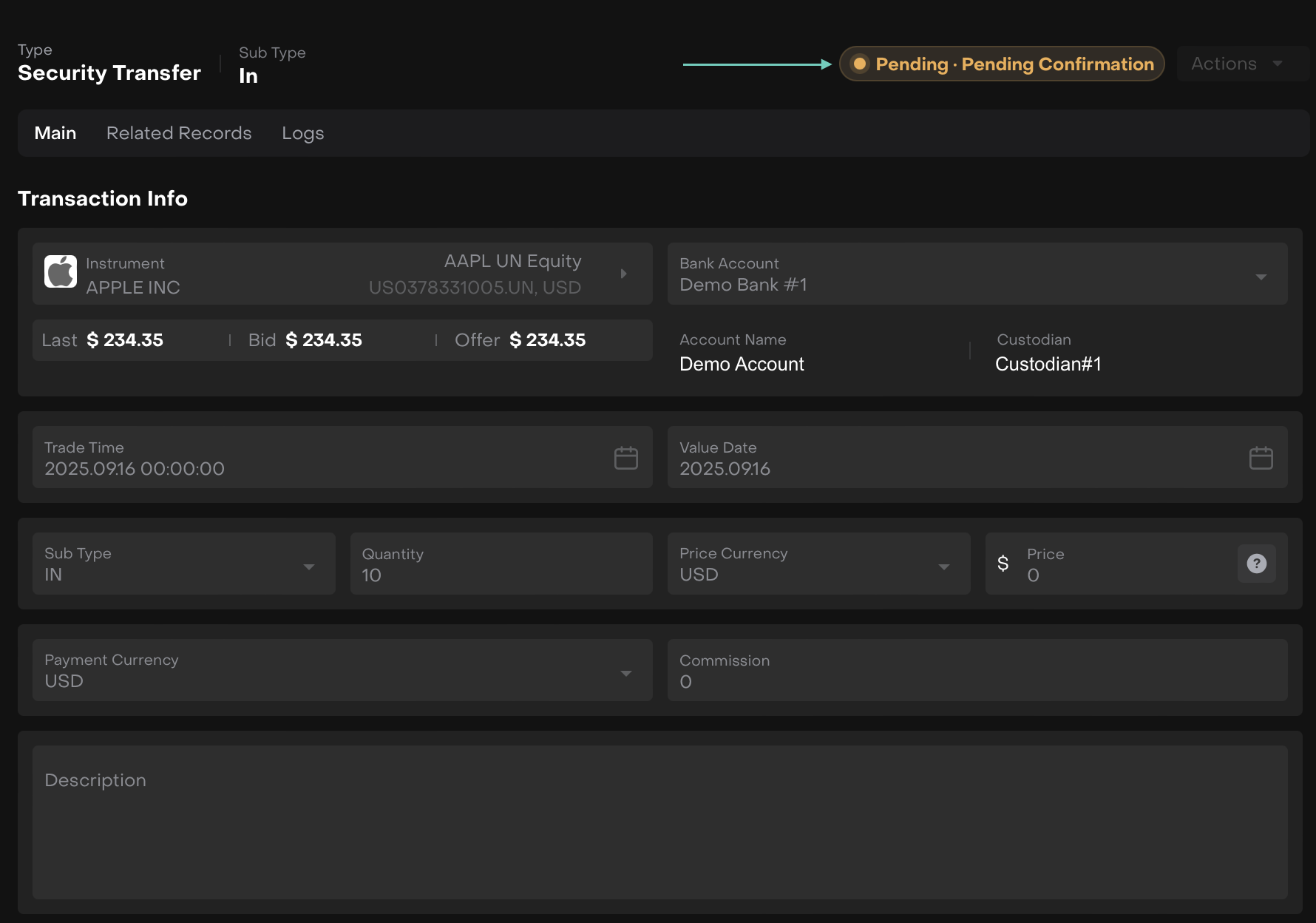

Instrument* | The security (e.g., stock, bond, ETF) being transferred. | Dropdown / Search | Select the instrument from the database |

Bank Account* | The bank account associated with the transfer. | Dropdown | Choose the relevant bank account. |

Account Name* | The account where the securities are being transferred in/out. | Dropdown | Select the correct account |

Custodian* | The custodian holding or releasing the security. | Dropdown | Select the custodian linked to the transfer. |

Trade Time* | The date/time the transfer is effective. | Date & Time Picker | Default: corporate action date. Can be adjusted if needed. |

Value Date | The settlement date when the transfer takes effect. | Date Picker | Default: Trade Date + 2 business days. |

Sub Type | Direction of the transfer. | Dropdown | Choose IN (received) or OUT (sent). |

Quantity* | Number of securities being transferred. | Numeric Field | Positive for IN, negative for OUT. |

Price Currency* | The currency in which the security price is denominated. | Dropdown | Select from dropdown (e.g., USD). |

Price* | Transfer price (not used in transfers).

In some cases, a reference price (e.g., market or book value) may be entered for reporting or valuation, but it does not affect charges or cash.

| Numeric Field | Always enter 0, as security transfers are non-monetary movements. No charges or cash impact are applied, whether the subtype is In/Out. |

Payment Currency* | The settlement currency. | Dropdown | Select from dropdown |

Commission | Fees charged for the transfer. | Numeric Field | Can leave blank or enter 0. |

Description | Free text to describe the transfer. | Text Field | Example: Demo Purpose. |

Additional Info/ Cash Info |

Value | Transaction value. | platform-calculated | platform auto-calculates

(Qty x Price = Value) |

Gross Amount | Gross cash amount of the transaction. | platform-calculated | platform auto-calculates (always 0). |

Net Amount | Net cash amount after deductions. | platform-calculated | platform auto-calculates (always 0). |

Net Amount Payment Ccy | Net cash amount in payment currency. | platform-calculated | platform auto-calculates (always 0). |

Hierarchy |

Parent-Transaction Number | Links to parent transaction. | Dropdown / Text | Select or input reference if applicable. |

Multileg | Indicates if part of a multi-leg transfer. | Checkbox | Check if linked to another transfer (default: checked for IN/OUT pairs). |

Relations |

Order | Links to an order (if applicable). | Dropdown | Optional – select if related. |

Strategy Info | Links to a strategy (if applicable). | Dropdown | Optional – select if related. |

Reporting |

Market Type | Market classification. Choose: DMA, OTC, EOMS | Dropdown | Can leave blank for transfers. |

Trade Type | Classification of trade type. | Dropdown | Can leave blank for transfers. |

Venue | Venue of trade execution. | Dropdown | Can leave blank for transfers. |

MiFIR Reportable | Flag for MiFIR reporting. | Checkbox | Can leave unchecked (not reportable). |

EMIR Reportable | Flag for EMIR reporting. | Checkbox | Can leave unchecked (not reportable). |

Technical Info |

Matched | Indicates if the transaction has been matched with the counterparty or custodian. | Checkbox | Select if matched, leave blank if pending. |

External Reference | Identifier provided by an external platform, custodian, or broker. | String | Enter the reference ID from external source (if available). |

Security Exchange | The exchange or market where the security is listed. | Dropdown | Select the correct exchange (e.g., NYSE, LSE). |

Deal Date | The date when the transfer deal was agreed. | Date Picker | Choose the agreed deal date. |

Error Description | Provides details if the transaction fails or is rejected. | String (multi-line) | Enter platform error or rejection reason (only if error occurs). |

Settled | Shows if the transaction has been successfully settled. | Checkbox | Select once settlement is confirmed. |

Payment Date | Settlement payment date, if applicable. | Date Picker | Enter the confirmed payment date. |

Transaction Number | Unique platform-generated identifier for the transaction. | Auto-generated String | Auto-filled by the platform (no input needed). |

IBAN | Bank account number used for settlement (if required). | String | Enter the IBAN of the settlement account. |

Reversal | Indicates whether the transaction is a reversal of a previous one. | Checkbox | Select if this is a reversal transaction. |

Actual Value Date | The effective date when the transaction value is applied. | Date Picker | Enter the actual value date once confirmed. |