Match Transactions for Omnibus Bank Accounts

Introduction

If you are working with Omnibus bank accounts, the matching process is slightly different from standard bank accounts.

Unlike standard bank accounts, where each bank transaction matches one order. The Omnibus process involves grouped client-side transactions and the platform helps you reconcile them more efficiently in bulk.

The platform initiates matching automatically for Omnibus accounts when:

A bank transaction is received and is linked to an Omnibus bank account

There are related order transactions to the same Omnibus account, possibly across multiple clients or portfolios

🔗 Click here to learn more on how to Configure Matching Mechanism.

Key Terminologies

Term (A–Z) | Definition |

|---|---|

Commission | Populated automatically if applicable as part of the order’s fee logic. |

Credit | Represents incoming (positive) transaction entries post matching. |

Debit | Represents outgoing (negative) transaction entries post matching. |

Partially Filled Order | An order that has been executed only in part; remaining quantity stays open. |

Quantity | Number of units transacted; sourced from the order and editable in case of mismatch. |

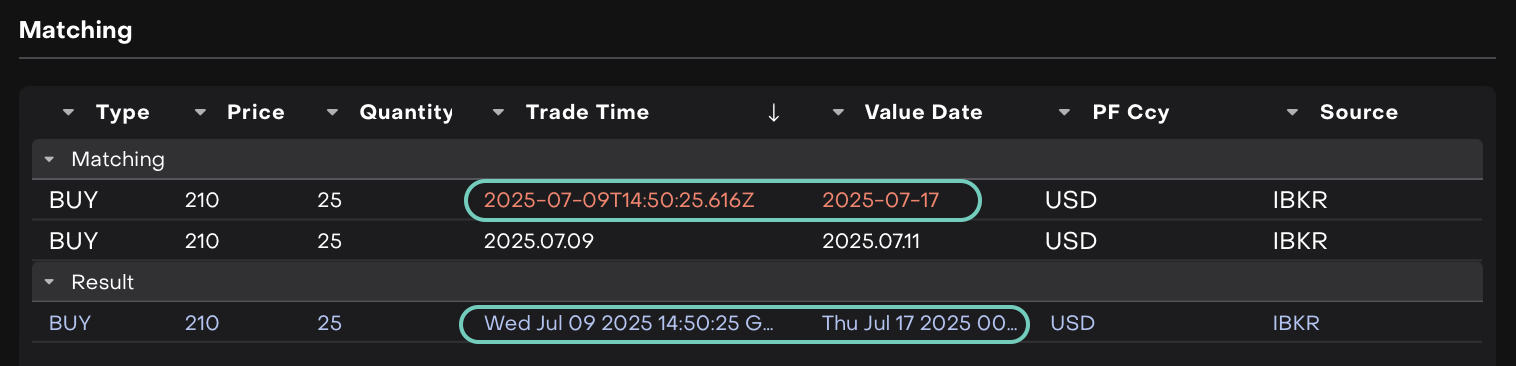

Trade Time | The time of execution; pulled from the order and editable if mismatched. |

Value Date | The settlement date; aligned with the order or manually adjusted if mismatched. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

When to Match Transactions for Omnibus Bank Accounts

Once a matching Omnibus bank transaction is detected:

The platform identifies all related order transactions under that Omnibus account.

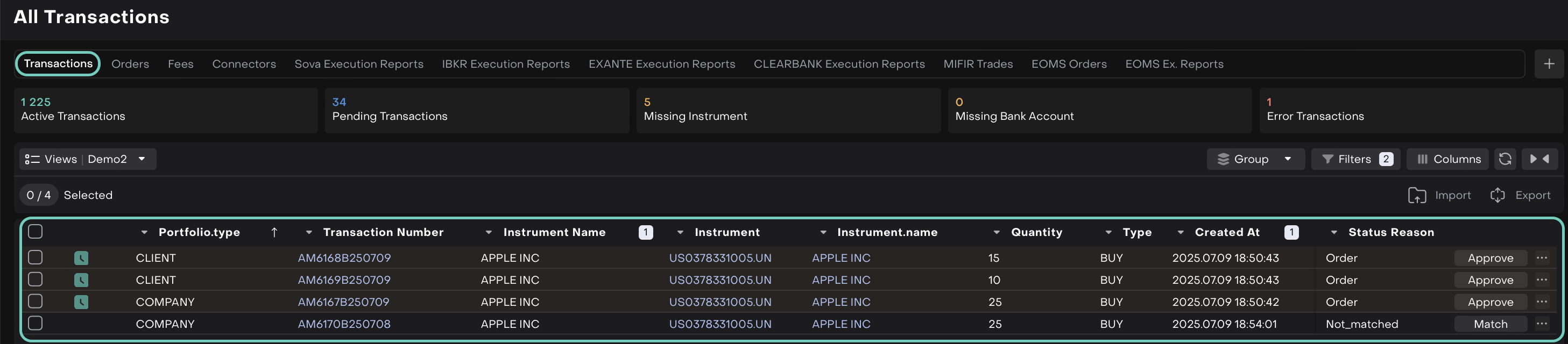

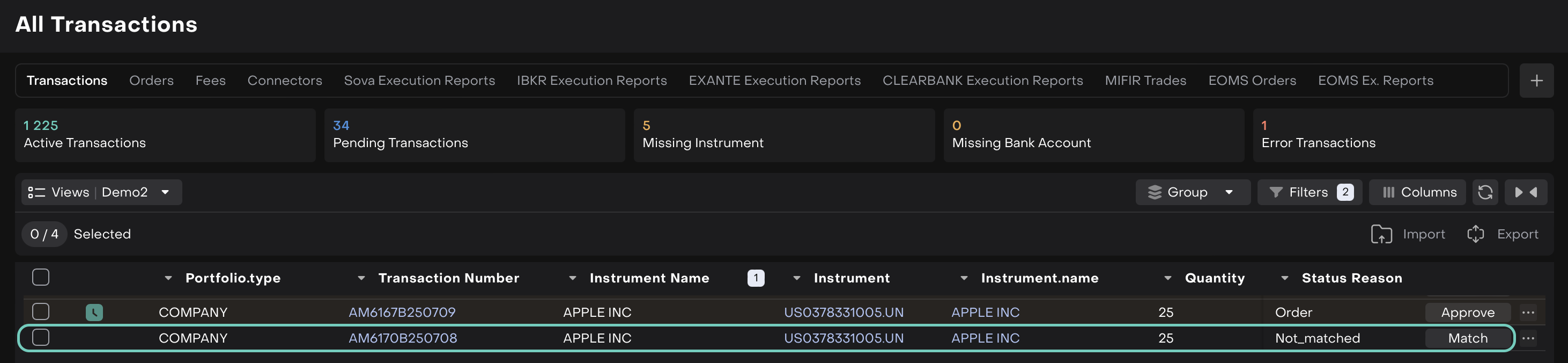

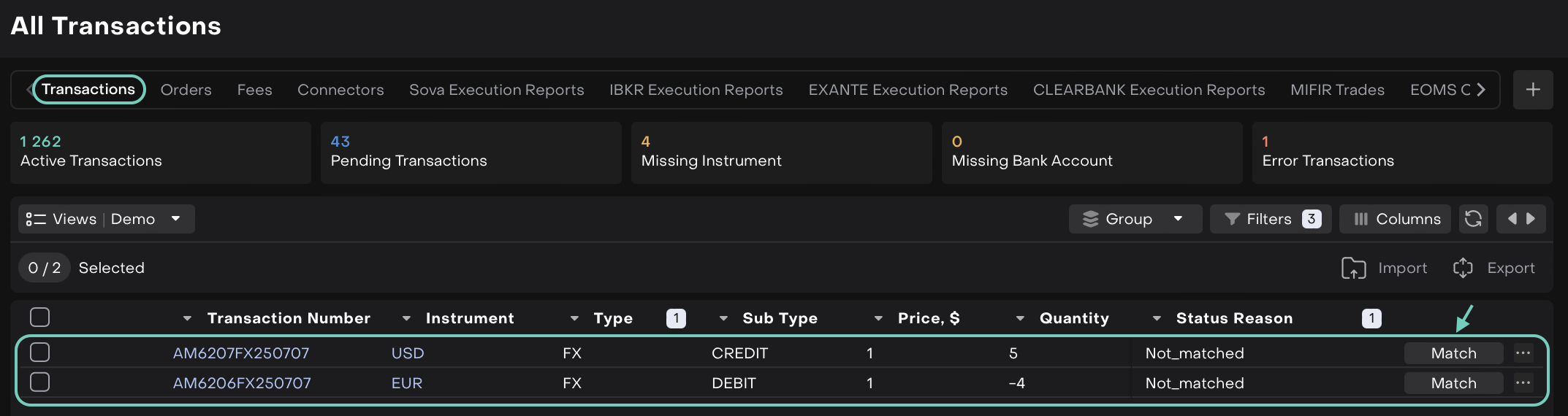

In the Transactions tab, find the Omnibus-linked bank transaction with Not Matched status.

Click the Match button.

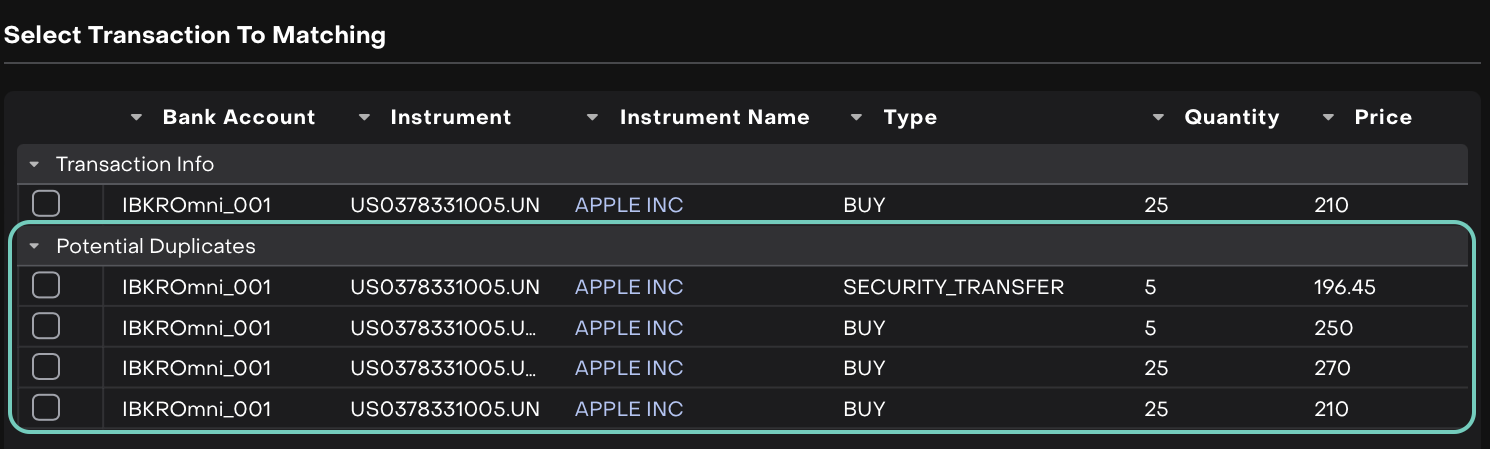

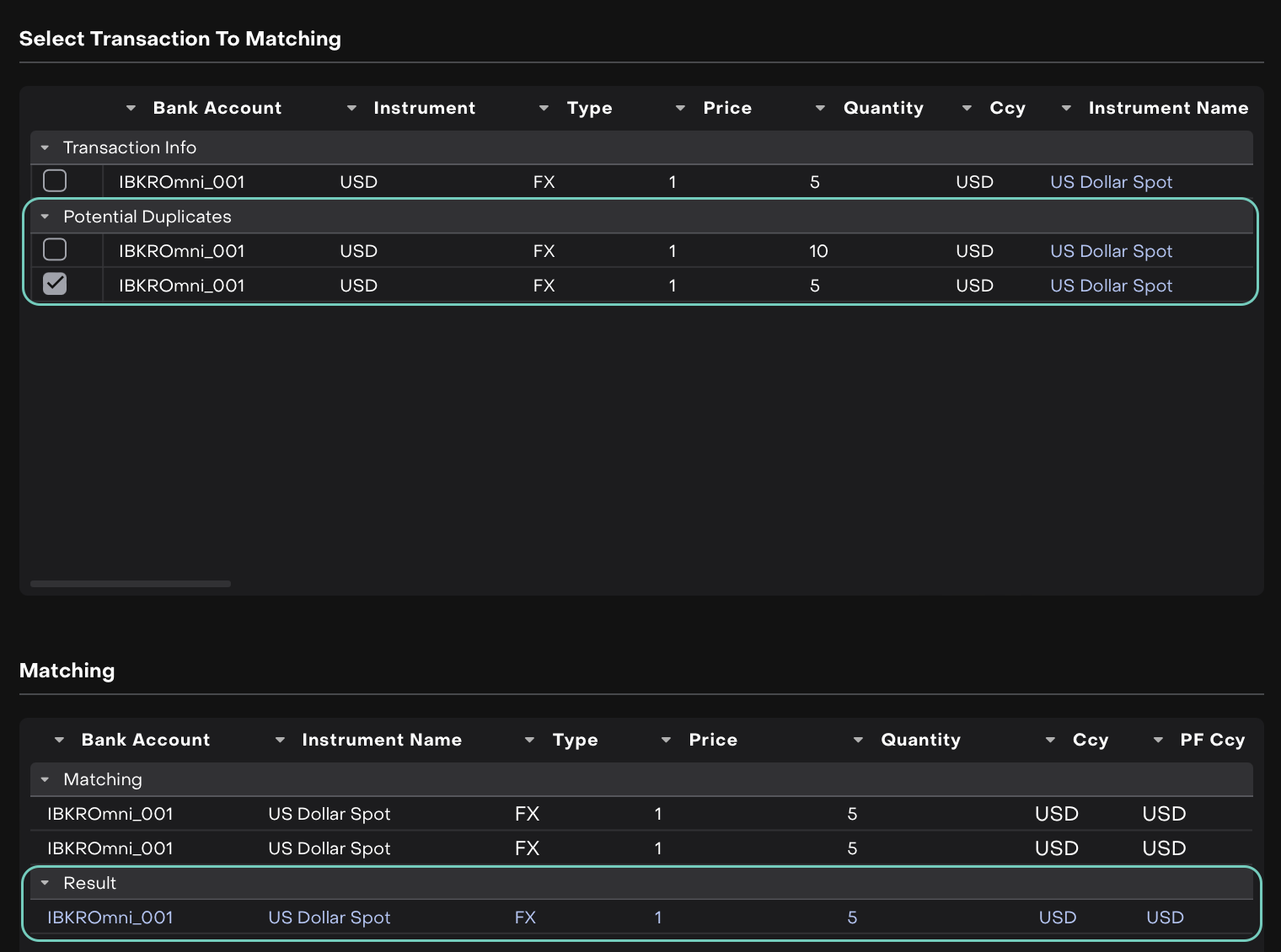

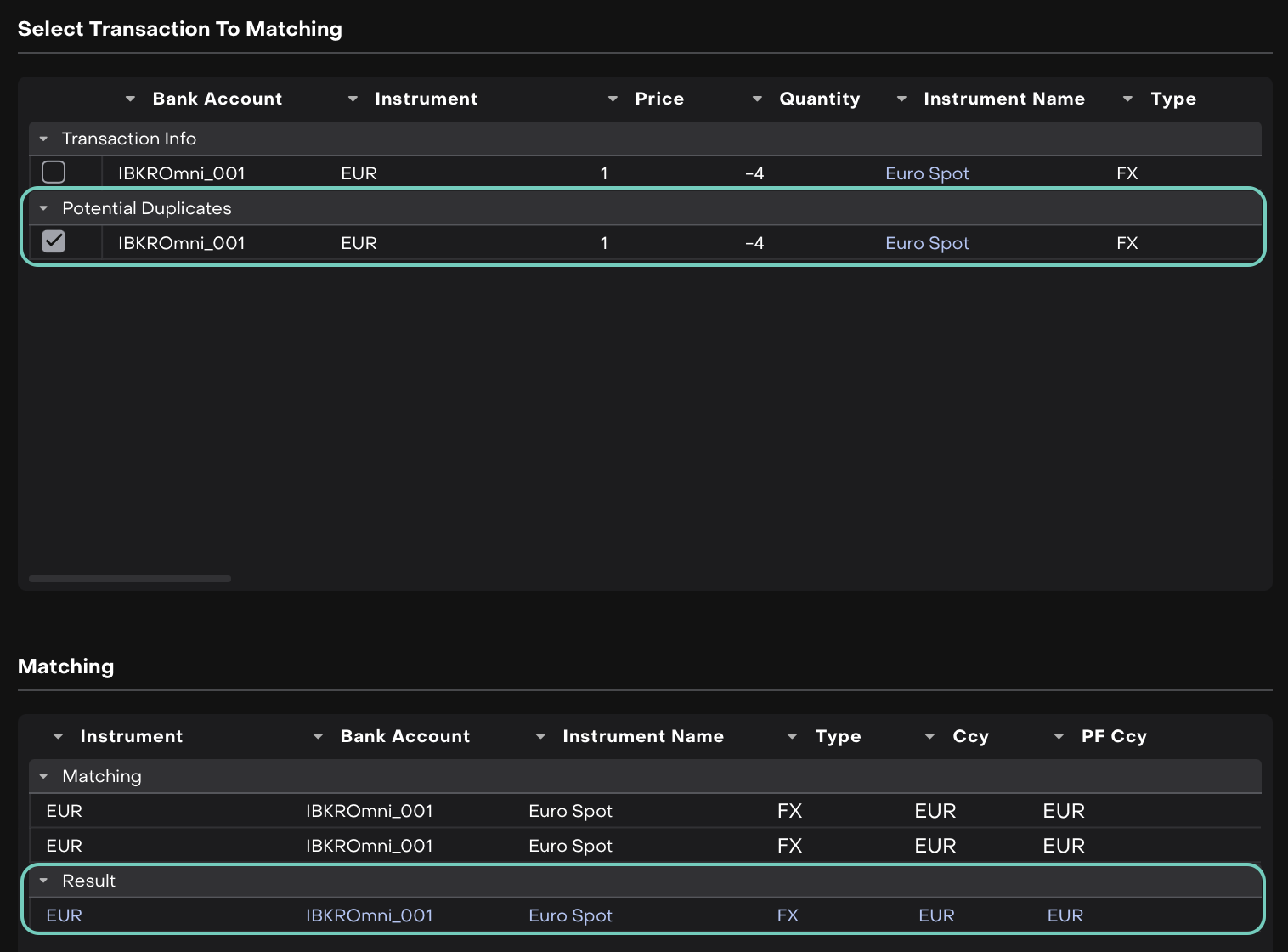

A window opens showing Potential Duplicates.

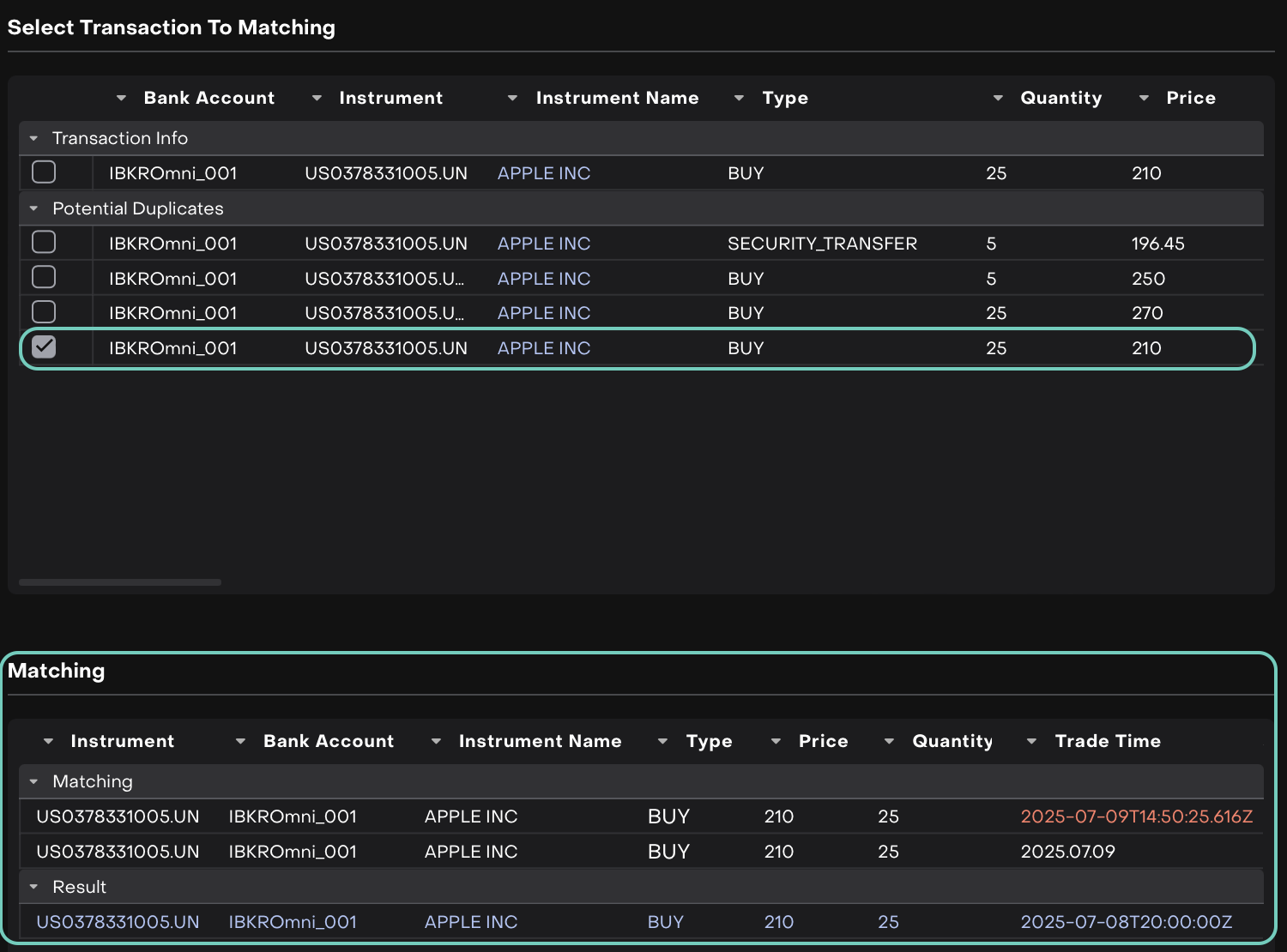

Click on a suggested transaction pair to review the details.

If there are mismatches (e.g., Quantity, Price, TradeTime), the fields will appear in red.

Click on red fields to edit and correct the values as needed.

Once the values are aligned, click Match again to confirm.

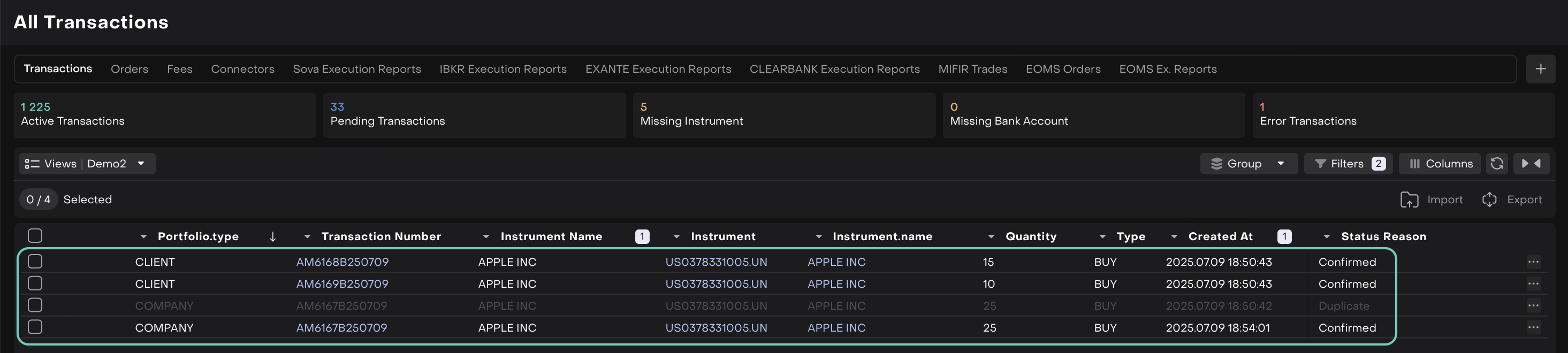

Each transaction is updated with:

Status = Active

Status Reason = Confirmed

You do not need to manually select and match each client transaction under an Omnibus account, the platform handles this in bulk to save time and reduce risk of manual error.

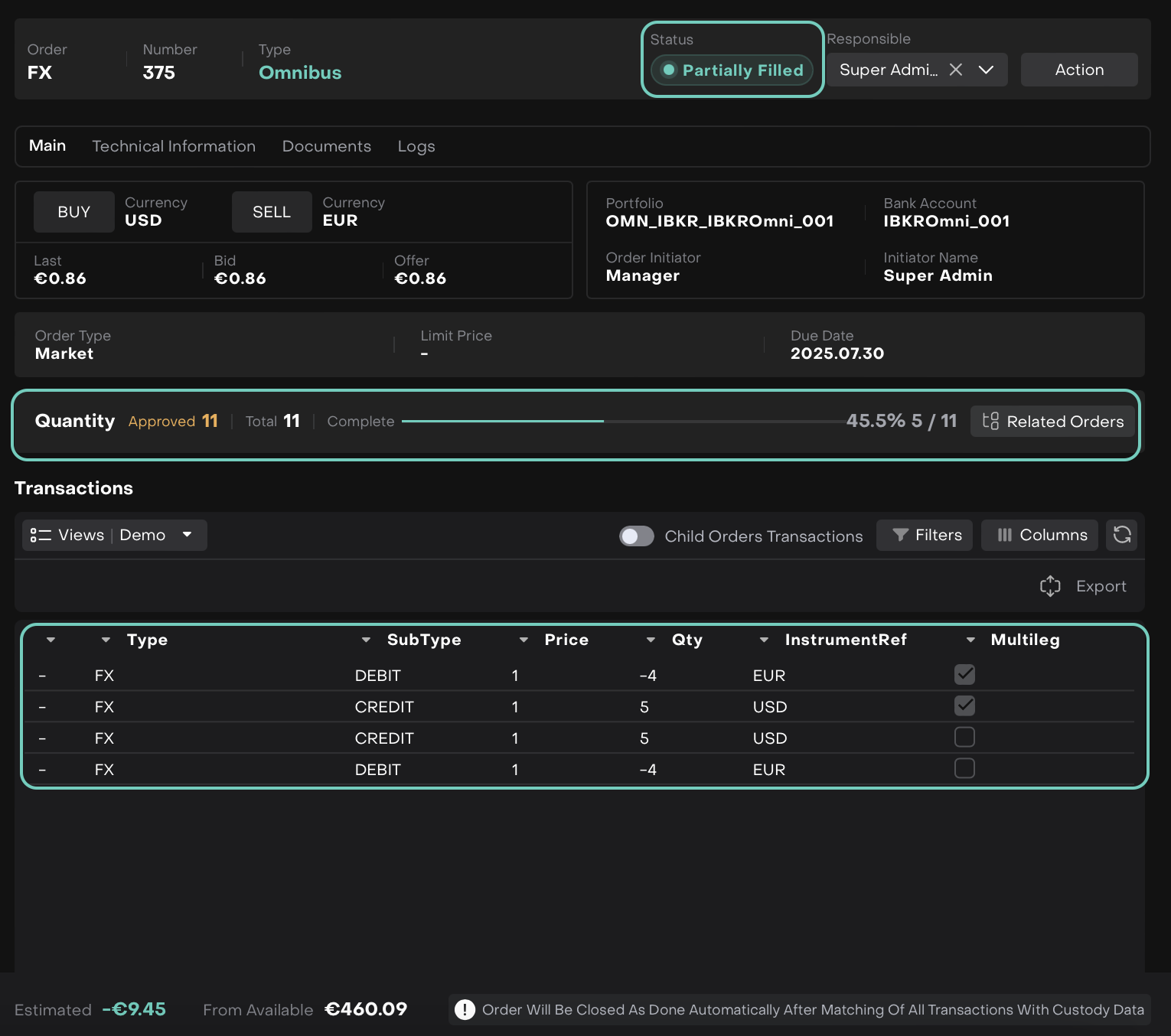

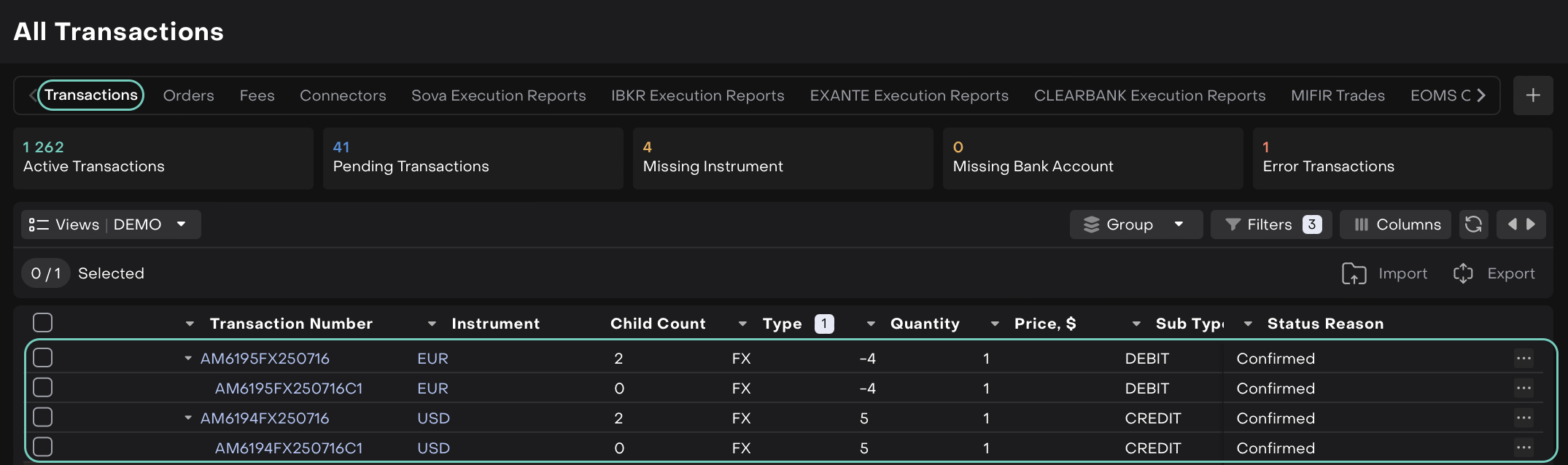

Matching for Partially Filled Orders: Parent vs Child Transactions

When working with Partially Filled Orders, it's important to know what to match, especially if child transactions are involved.

What to Look For:

Parent Order: Shows the overall order status and approved quantity.

Child Order Transactions Toggle: When enabled, this reveals individual execution legs.

Transactions: Will list all DEBIT/CREDIT entries created as part of the execution.

What You Should Match:

Match the executed (filled) part of the Parent Order.

Here, child transactions are shown, you may choose to match those individually, especially when allocations or fills are split.

Click on Match to proceed.

Do not match the full approved quantity unless fully filled/submitted.

When to Match at Parent Level

This is for FX.

If the platform does not split the order into separate child legs — i.e., all partial executions are reflected directly in the main transaction list, match at the parent level for the executed quantity.

When to Match at Child Level

If the order is broken down into child orders and you need to match each separately, based on execution quantity.

Credit

Debit

After successful matching, the transaction will appear with

Status: ActiveandStatus Reason: Confirmed, indicating that this leg of the partially filled order has been reconciled correctly.

Once this leg is matched:

The remaining quantity of the order stays open and can be executed later as needed

A new transaction leg will be generated for the next executed portion

You can repeat the matching process for each newly executed leg