Introduction

A process where you review unmatched bank transactions and manually link them to the correct order transactions.

When it’s needed:

When the platform could not automatically match the transaction.

When there are data discrepancy, missing fields, etc.

Key Terminologies

Term (A–Z) | Definition |

|---|

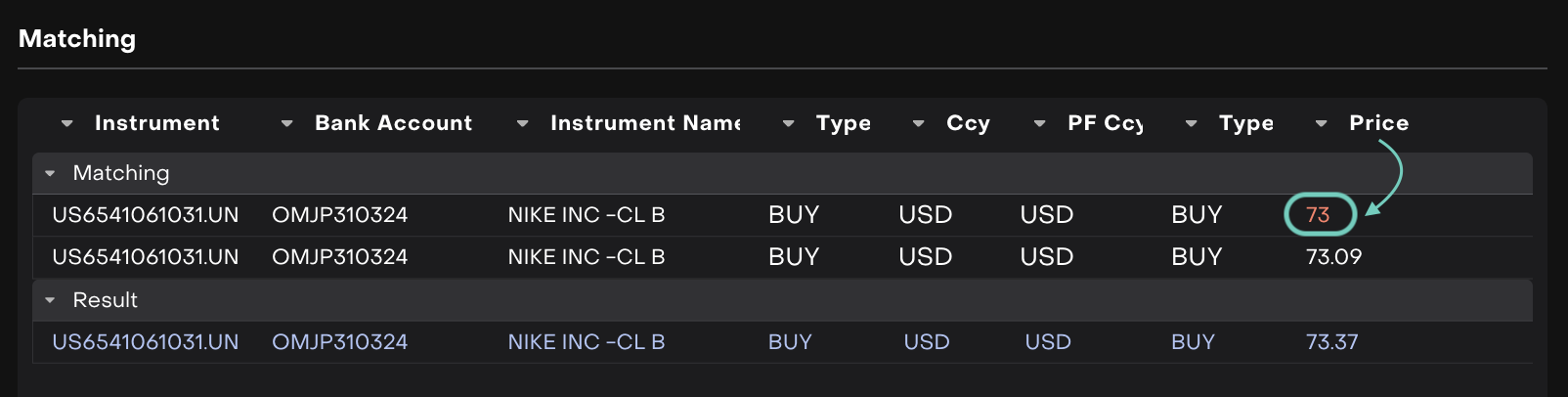

Price | The execution price of the instrument; must match up to 3 decimal places. |

Quantity | The number of instrument units traded; must match exactly between bank and system. |

Value Date | The settlement date of the transaction; must match exactly for certain types. |

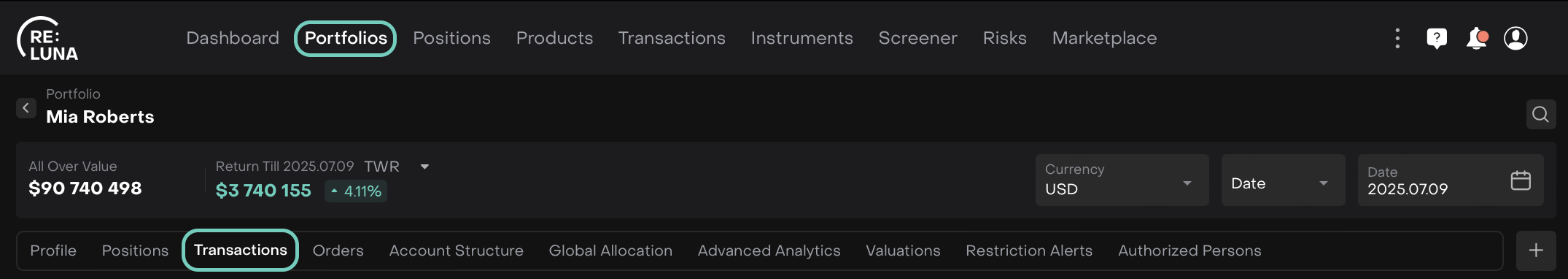

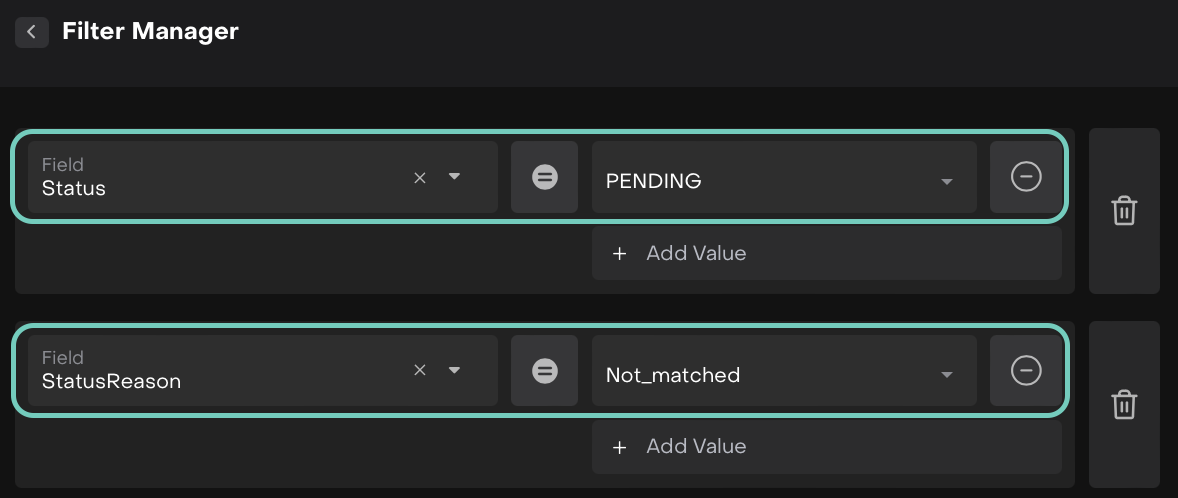

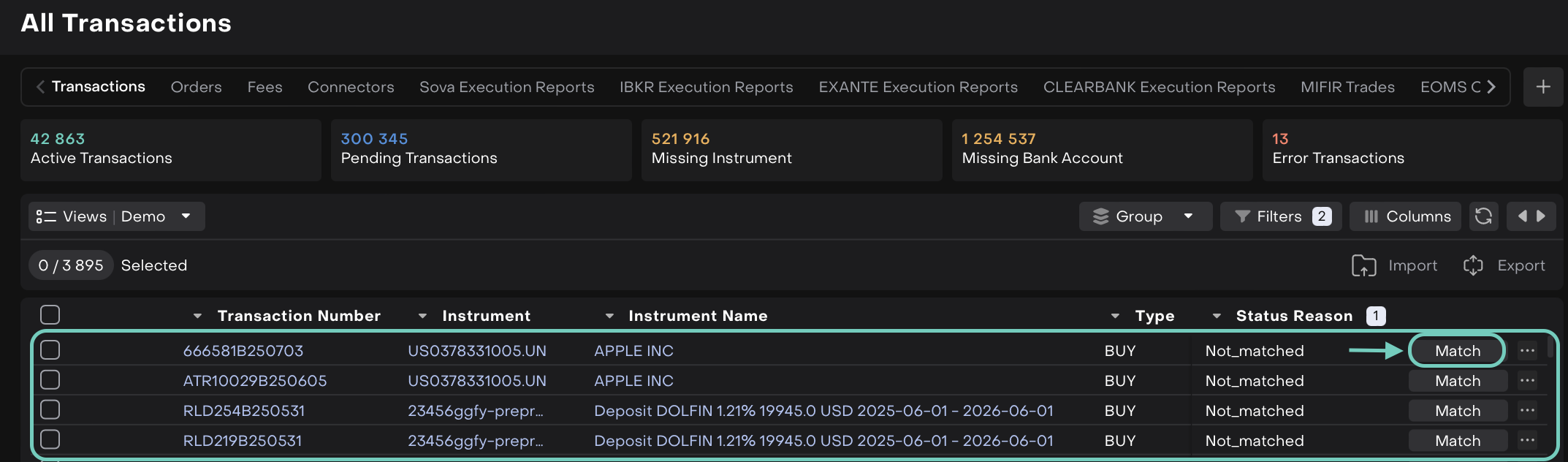

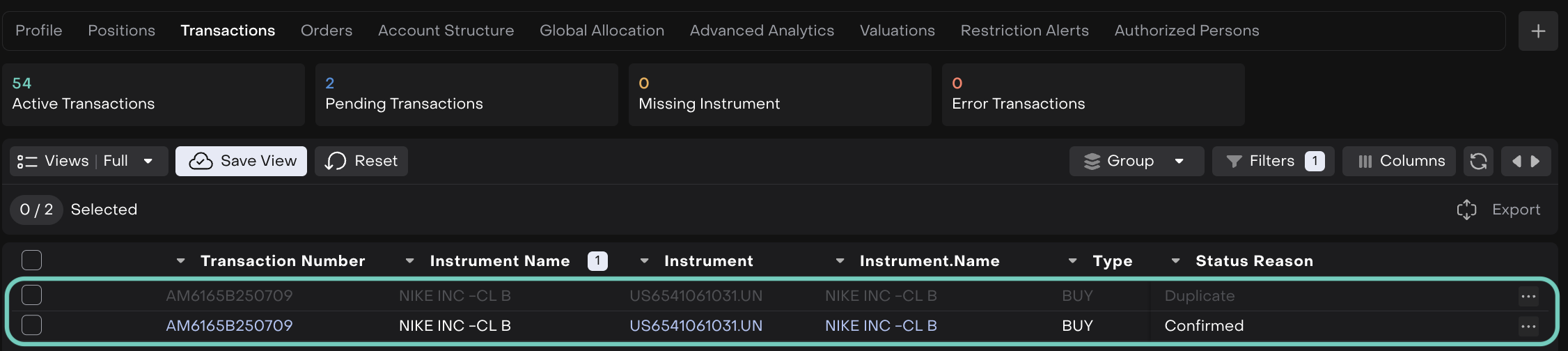

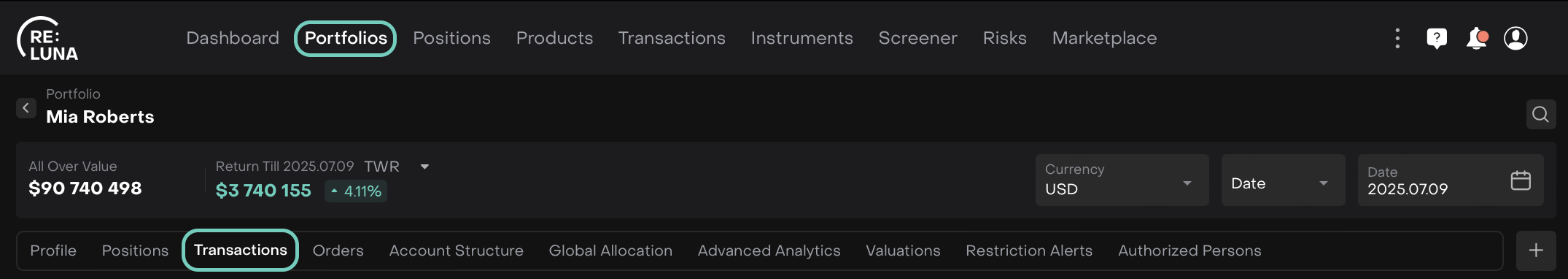

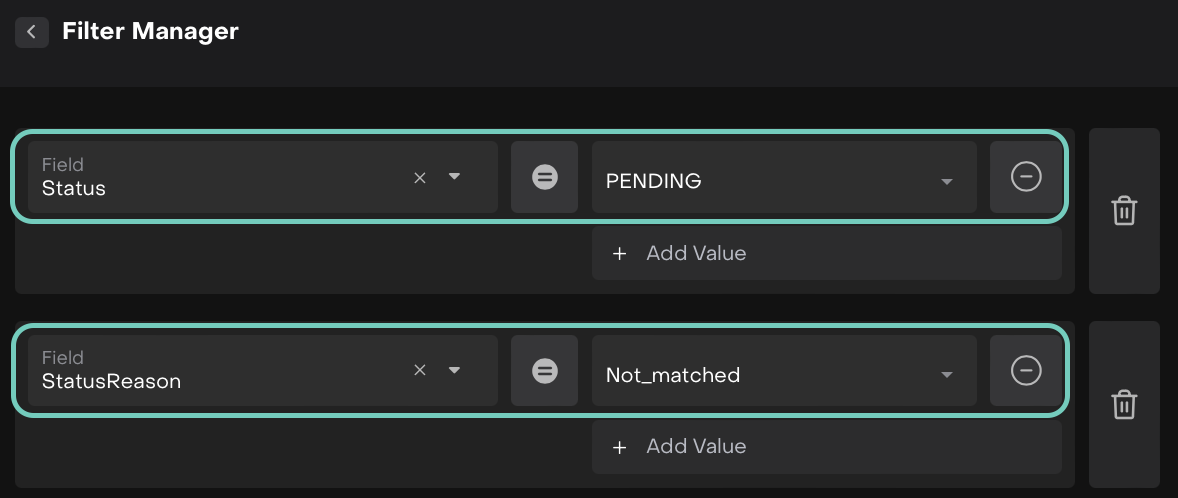

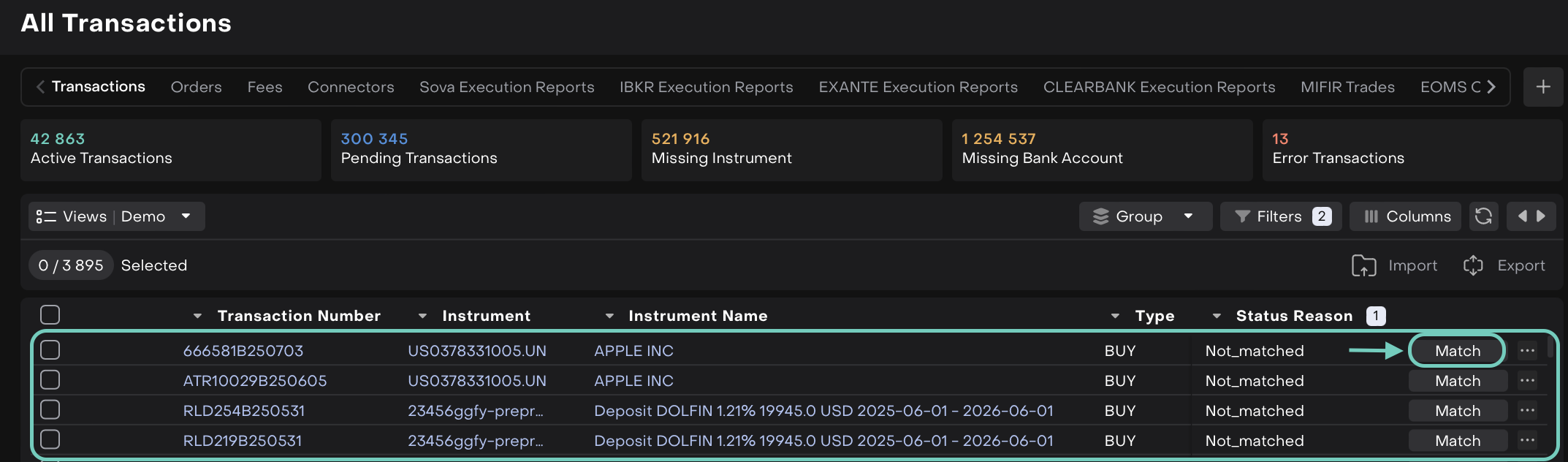

To locate and work with transactions that need to be matched, use these steps:

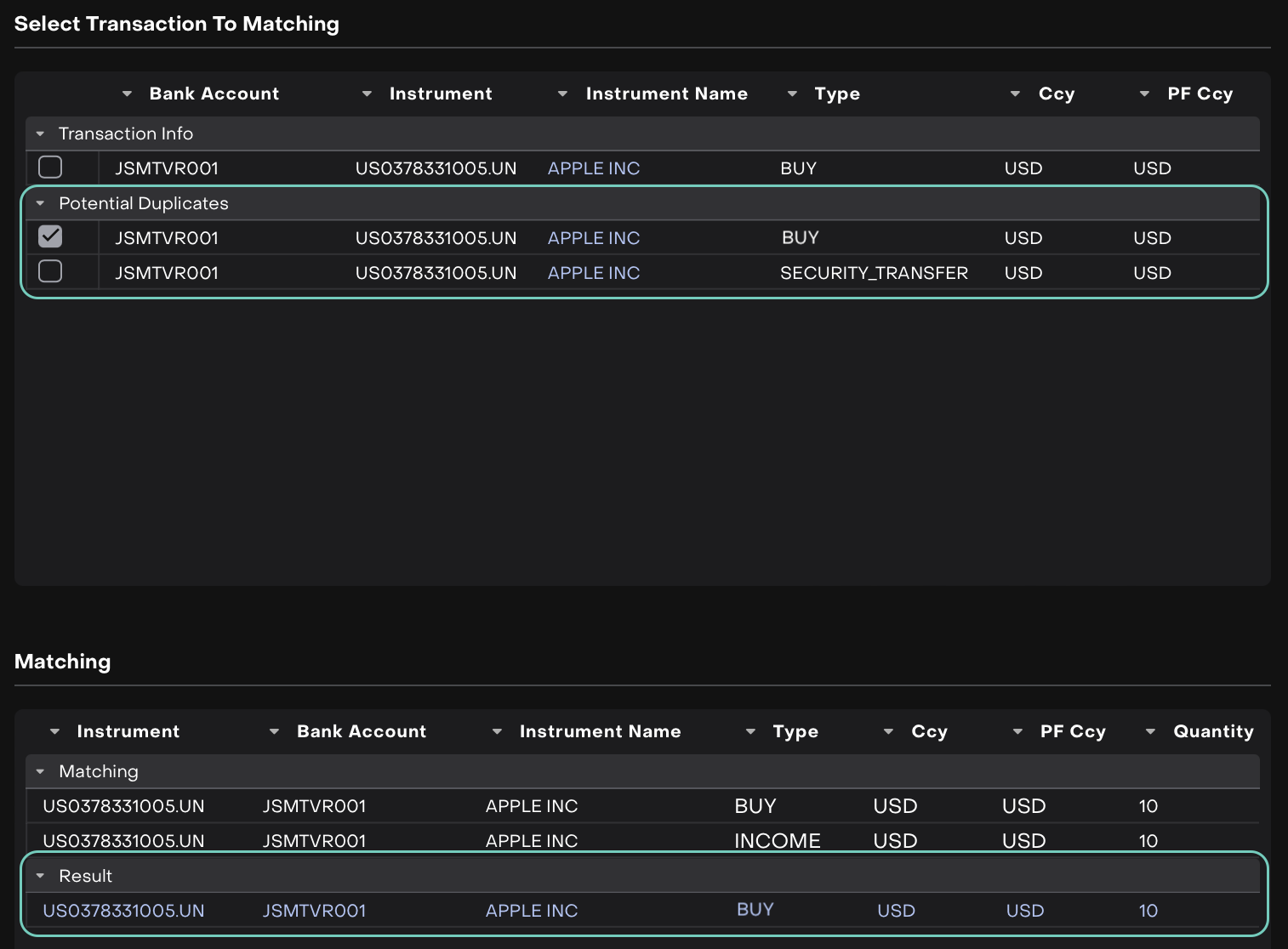

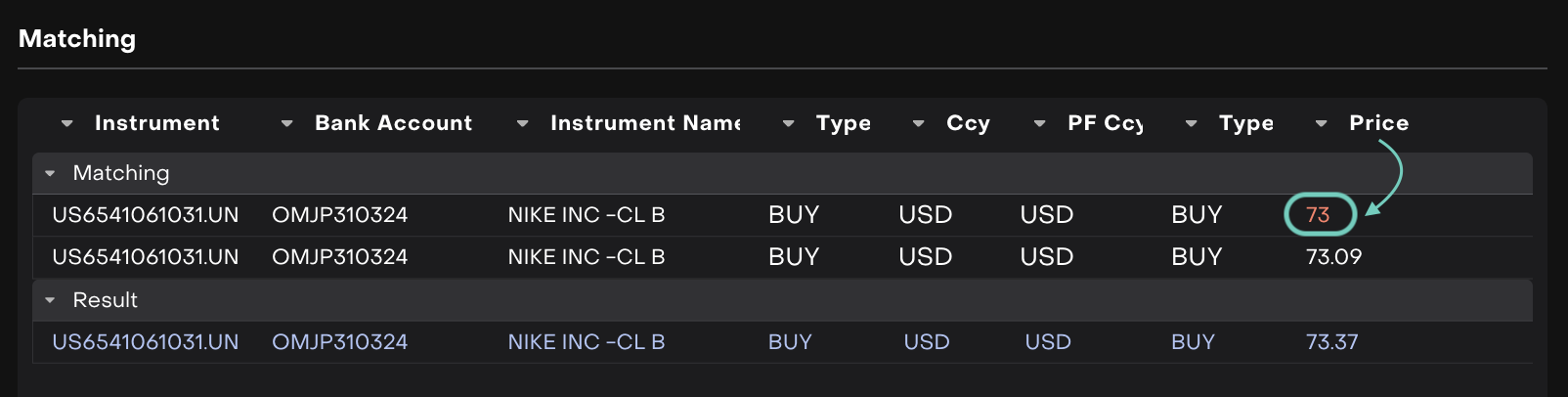

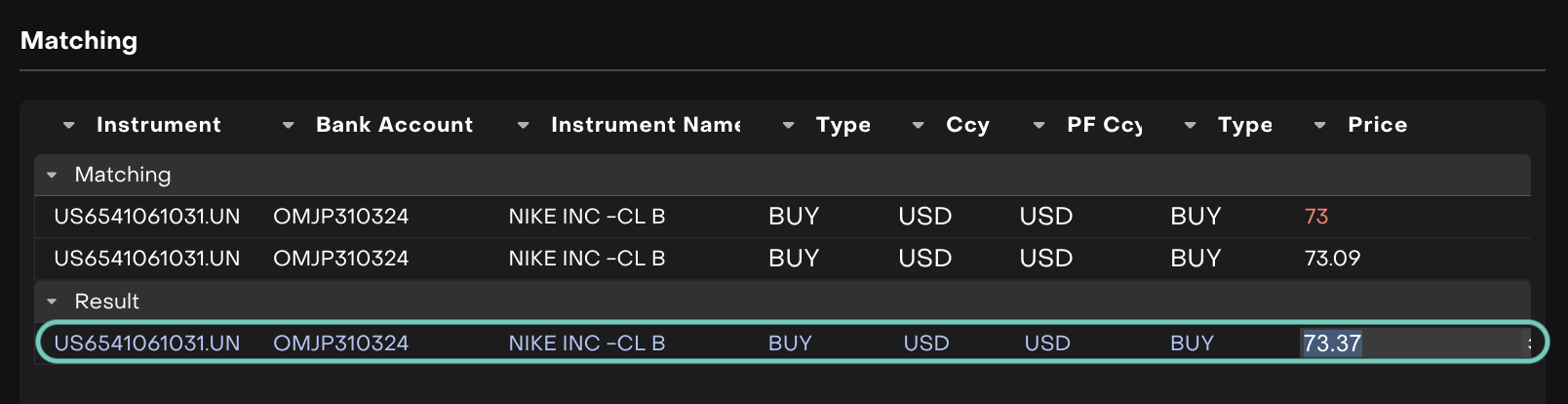

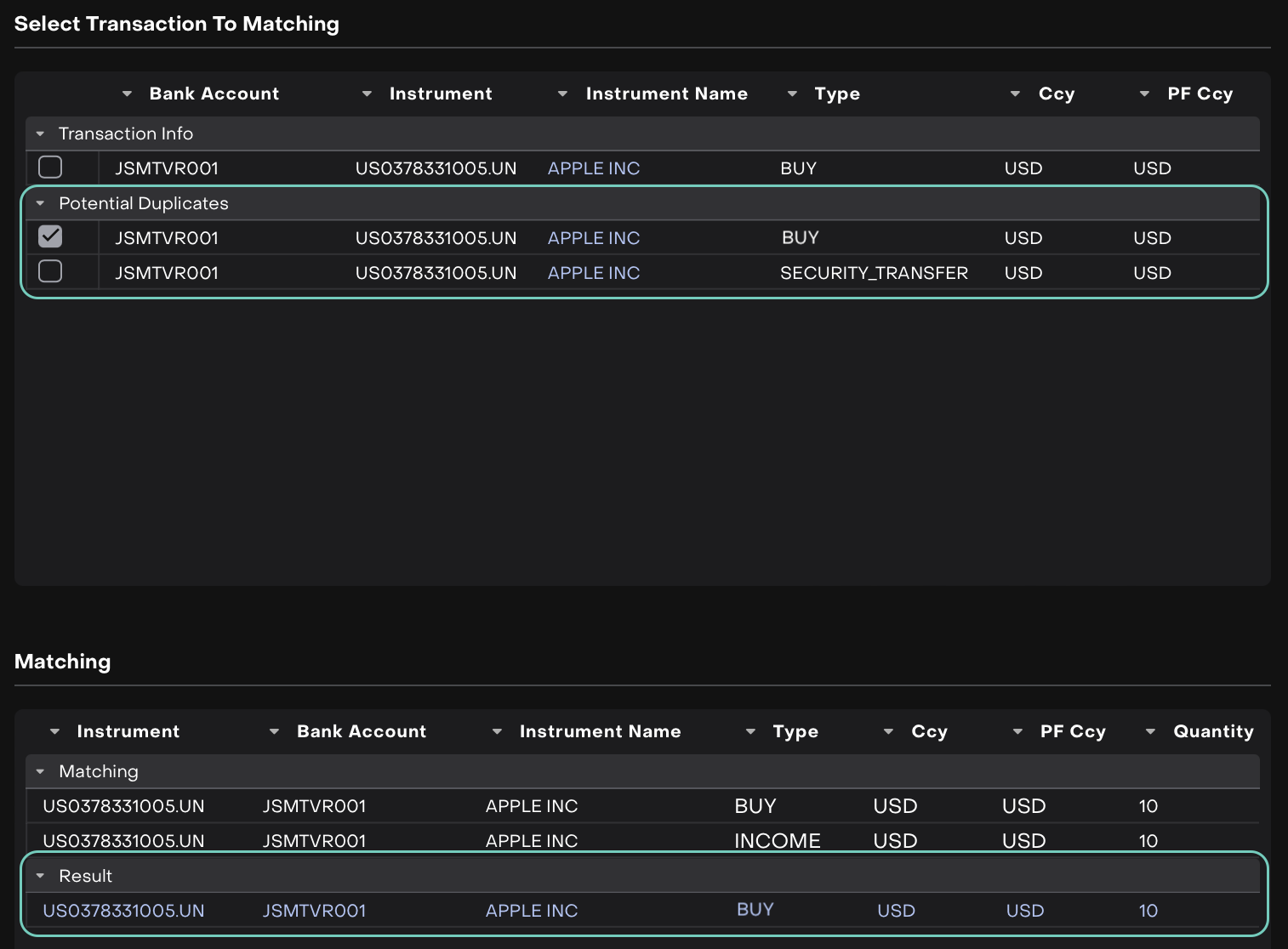

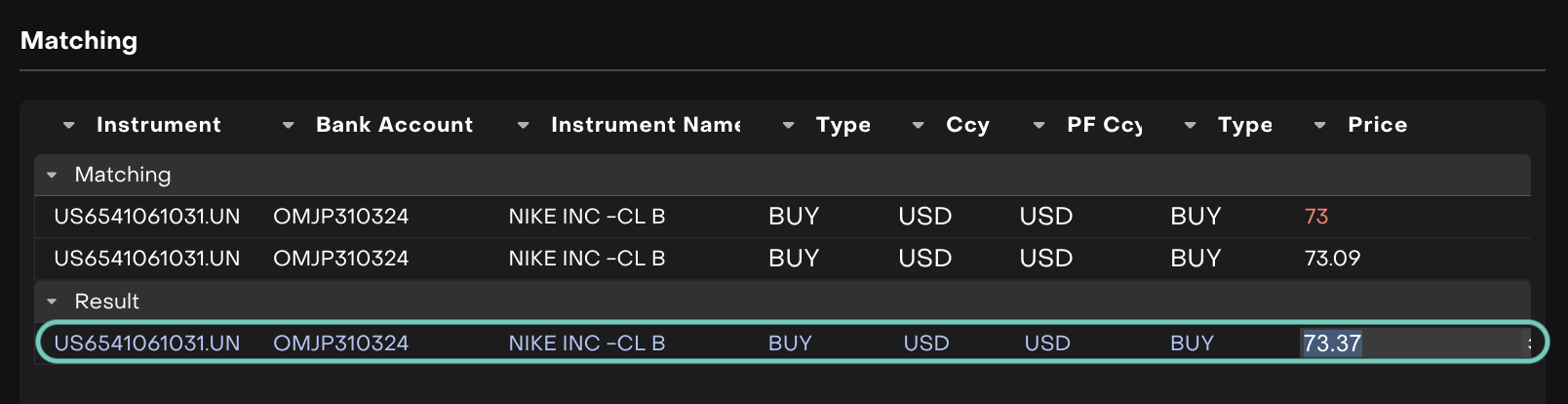

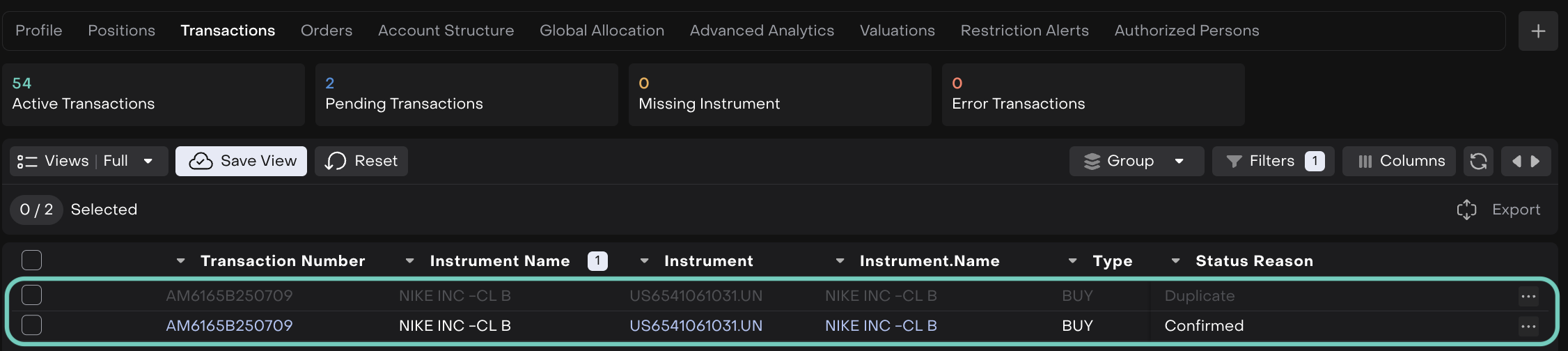

A pop-up window appears, compare the unmatched bank transaction with suggested order transactions.

By clicking on Potential Duplicates, the Result tab appears in the Matching section.

Matching Criteria Between System and Bank Transactions:

Platform Field | Matching Criteria | Note |

|---|

Type | type (system) = type (bank)

| Must match across all supported types: BUY, SELL, FX, FEE, INTEREST, PAYMENT, WITHDRAWAL, EXERCISE_OPTION, etc. |

Bank Account ID | bankAccountId (system) = bankAccountId (bank)

| The associated bank account must match in both system and bank transaction. |

Status Reason | statusReason = Order

| System transaction must be in the correct status to match. |

Quantity | quantity (system) = quantity (bank)

| Quantity must match exactly. |

Multileg | multileg (system) = multileg (bank)

| Multileg flag must match. |

Order ID | Order ID is not empty

| Used as part of the confirmation logic. |

Gross Amount | grossAmount ≈ grossAmount

| Can differ slightly (tolerance: up to 0.05%). |

Instrument / ISIN | instrumentRef = instrumentRef OR isin = isin

| At least one (Instrument Ref or ISIN) must match. |

Value Date | valueDate (system) = valueDate (bank)

| Required for certain types (e.g., Security Transfers). |

Trade Time | tradeTime (system) ≤ tradeTime (bank) OR tradeTime = tradeTime

| Matching logic varies by type — sometimes exact, sometimes less than or equal. |

Price | price (system) = price (bank)

| Price must match up to 3 decimal places. |

Parent ID | parentId is not null

| Required to match child transactions and confirm the parent correctly. |

All active child transactions must be matched and confirmed for the parent transaction to be auto-confirmed.

Special Transaction Types & Matching Conditions:

Transaction Type(s) | Matching Criteria | Note |

|---|

BUY + EXERCISE_OPTION | Price is not equal to 0 | Only matches when price is non-zero. |

EXERCISE_OPTION (price = 0) or EXPIRE_OPTION | Fallback match | Treated as special cases with no price or expiry logic. |

SECURITY_TRANSFER | Type must match exactly | Ensures transaction type is identical. |

Value date must match | Timing must align for accurate settlement. |

WITHDRAWAL / PAYMENT / FEE / INTEREST / TAX / MARGIN | Type must match | Ensures classification is correct. |

Value date must match | Matching is based on value date. |

INVESTMENT / PAYMENT / CASH_TRANSFER / SECURITY_TRANSFER | Type must match | Standard type-based matching logic. |

INCOME / BOND_REDEMPTION (full or partial) | Type must match | Treated under standard type-based matching. |

FEE | Trade time must be earlier than or equal to bank trade time | Fee must post at or before the time seen on the bank side. |

FX | Trade time must be exact match | FX trade time must align exactly. |

Price must match (up to 3 decimals) | Allows slight rounding differences but ensures close precision. |

Editable Fields During Manual Matching:

Platform Field | Description |

|---|

Price | Price at which the instrument was bought or sold. |

Quantity | Quantity of the instrument traded. |

Trade Time | Time when the transaction was executed. |

Value Date | Date when the value of the transaction is settled. |

Value | The transaction’s value before fees or adjustments. |

Gross Amount | Total transaction amount before fees or commissions. |

Net Amount | Final transaction value after fees and charges. |

Net Amount Portfolio Ccy | Net amount converted into the portfolio’s currency. |

The platform will:

Portfolio positions are updated accordingly.