Trading Orders

AVAILABLE IN:

Introduction

Reluna empowers you to efficiently create, manage and execute trading orders, including BUY, SELL and CROSS TRADE, for a diverse set of asset types. The platform supports various types of trading orders, each with its own functionality and use cases, making it a comprehensive tool for managing your portfolio.

To initiate a trading order, you simply need the necessary permissions. Once granted, you can seamlessly place, update or monitor orders directly from the platform.

The platform also supports Direct Market Access (DMA) for more advanced trading, allowing you to place orders directly onto the order books of exchanges.

DMA functionality is dependent on the Custody API integration.

Key Terminologies

Terms (A-Z Order) | Definition |

|---|---|

Advanced Order Form | Order form with contains additional options and details that are demand additional knowledge to fill in order |

Buy | An order to purchase a security or asset, increasing the quantity held in the portfolio. |

Cross Trade | It is a buy or sell of a security between two different portfolios managed within the same company. These trades can occur between client portfolios or between a client portfolio and the company’s proprietary (PROP) portfolio. |

DMA (Direct Market Access) | A way of placing trades directly onto the order books of exchanges. |

Limit Order Type | Order with a set maximum or minimum price at which you are willing to buy or sell an asset. |

Market Order Type | Order meant to execute as quickly as possible at the current market price. |

Mass Order | Orders created from one form for two or more Bank Accounts. |

New Issue | New issue is an instrument that is not published in Market resource. |

Order on New Issue | Order for participation in an initial offering. |

Orders for BUY/SELL of an Asset | Trading orders placed to buy or sell an asset on a market. |

OTC (Over-the-Counter) | Process of trading securities via a broker-dealer network as opposed to a centralized exchange. |

Sell | An order to sell a security or asset, decreasing the quantity held in the portfolio. |

Time in Force | Determine how long a trading order remains active before it is executed or expires. |

Trading Order | An instruction to buy or sell a security between different Portfolios within the same company, typically a brokerage or asset management firm. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

Create Trading Orders

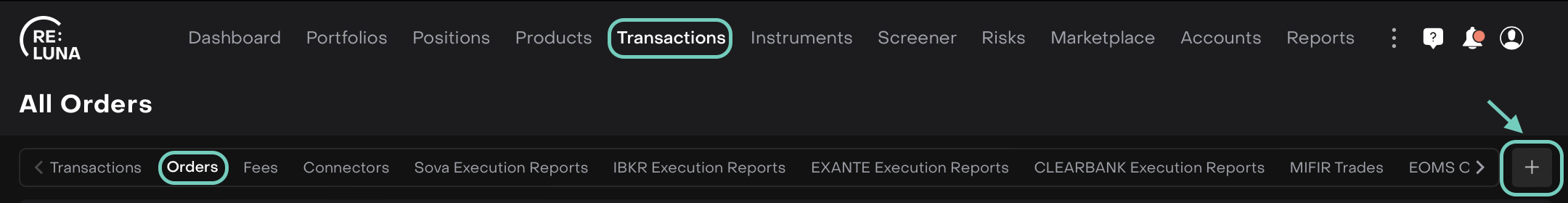

Go to Transactions on dashboard > Order tab > click on

icon to create.

icon to create.

Or,

You can also access the order form:

From a Portfolio

From the Portfolio's Positions view, right-click the position name

🔗 Learn more on how to:

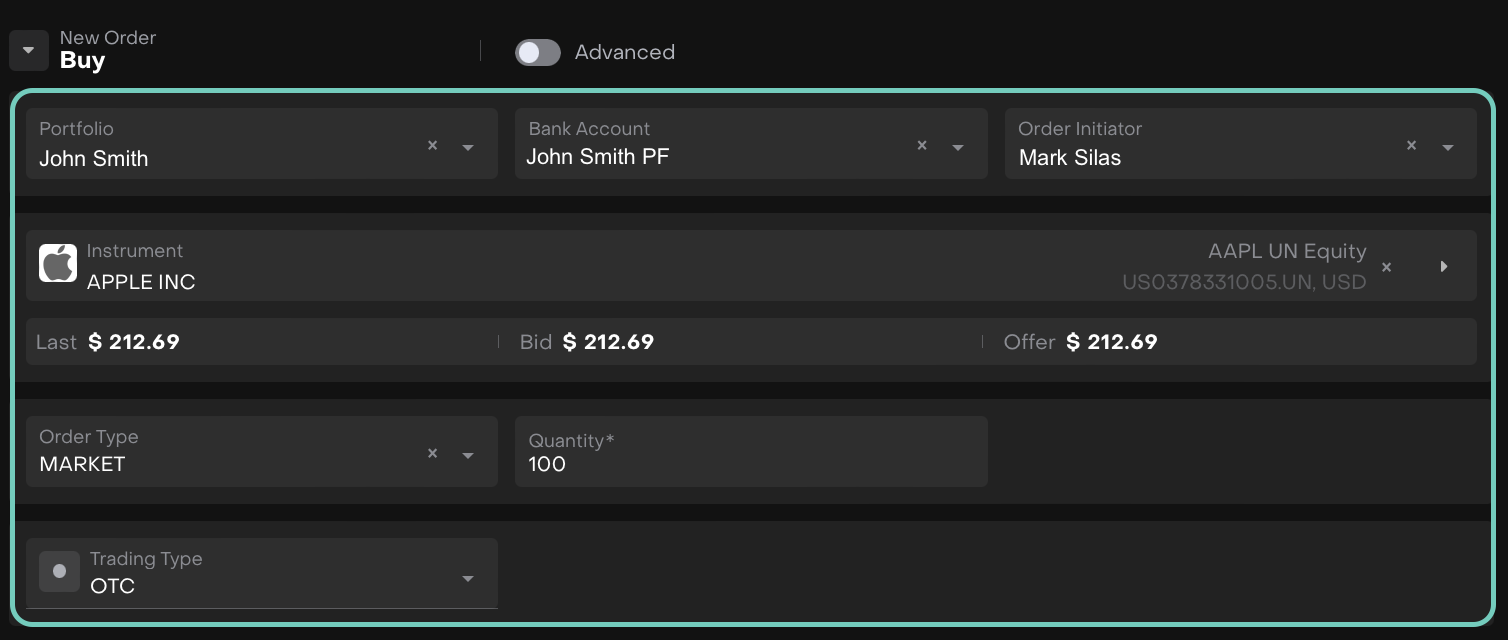

Select New Order Type and choose between Buy, Sell, Cross Trade.

🔗 Click to learn on How to Use Advanced Trading Order form

Fill in the required(*) fields such as:

Portfolio(*) – The one from where you’re placing the order (pre-filled if initiated from the Portfolio or Positions view, but can be changed).

Bank Account(*) – Fetched from the portfolio’s main bank or the one linked to the position (also pre-filled and editable).

Order Initiator(*) – Choose the person who initiated the order.

Choose the Instrument(*) and when not created from a position, the Instrument field is empty and must be filled in.

🔗 Click here to learn how to search for Instruments.

Select the Order Type(*).

Enter Quantity(*), manually.

Always enter a positive number. The platform knows if it's a Buy or Sell, so no minus sign is needed.

Choose the Trading Type (DMA/OTC) — DMA can be selected only if available.

When creating a new order, either through New Order creation or by right-clicking on a Position, the DMA trading type will now be set by default if it’s available.

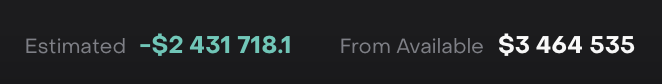

At the bottom of the order form, the platform displays important summary details for your transaction:

Estimated: This is calculated based on the asset type, market price, and quantity of the selected order.

From Available: Shows the balance in the selected Bank Account, helping you ensure sufficient funds are available for the transaction.

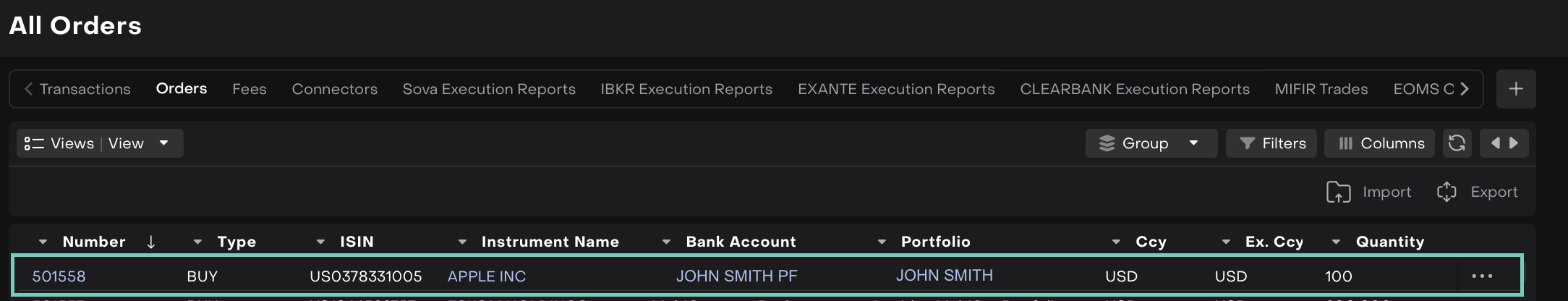

Once filled, confirm the order creation and the Order appears on the list.

You can Assign To, Cancel or Edit the order further.

🔗 Learn here on how to Execute the Order.