Portfolios & Positions Management

AVAILABLE IN:

Introduction

In any asset management platform, it's important to understand the key concepts used throughout the platform. This guide explains the most important terms and features as they appear in the Reluna Platform, helping you navigate and use it effectively.

Key Terminologies

Term | Definition |

|---|---|

Assets Under Management (AUM) | The total market value of the investments that a person or entity manages on behalf of clients. |

Bank Account | An account opened by the bank/custodian where financial investments are actually held. |

Market Value | The price an asset would fetch in the marketplace. |

Omnibus Account | An account that holds and manages assets of more than one person, while preserving the anonymity of the individual holders. |

Performance | The gain or loss of an investment or of a portfolio. |

Portfolio | A collection of financial investments such as stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). |

Position | The amount and performance of a security, asset, or property that is currently or previously owned by an individual or entity. |

Prop Account | An account containing the company’s own positions. |

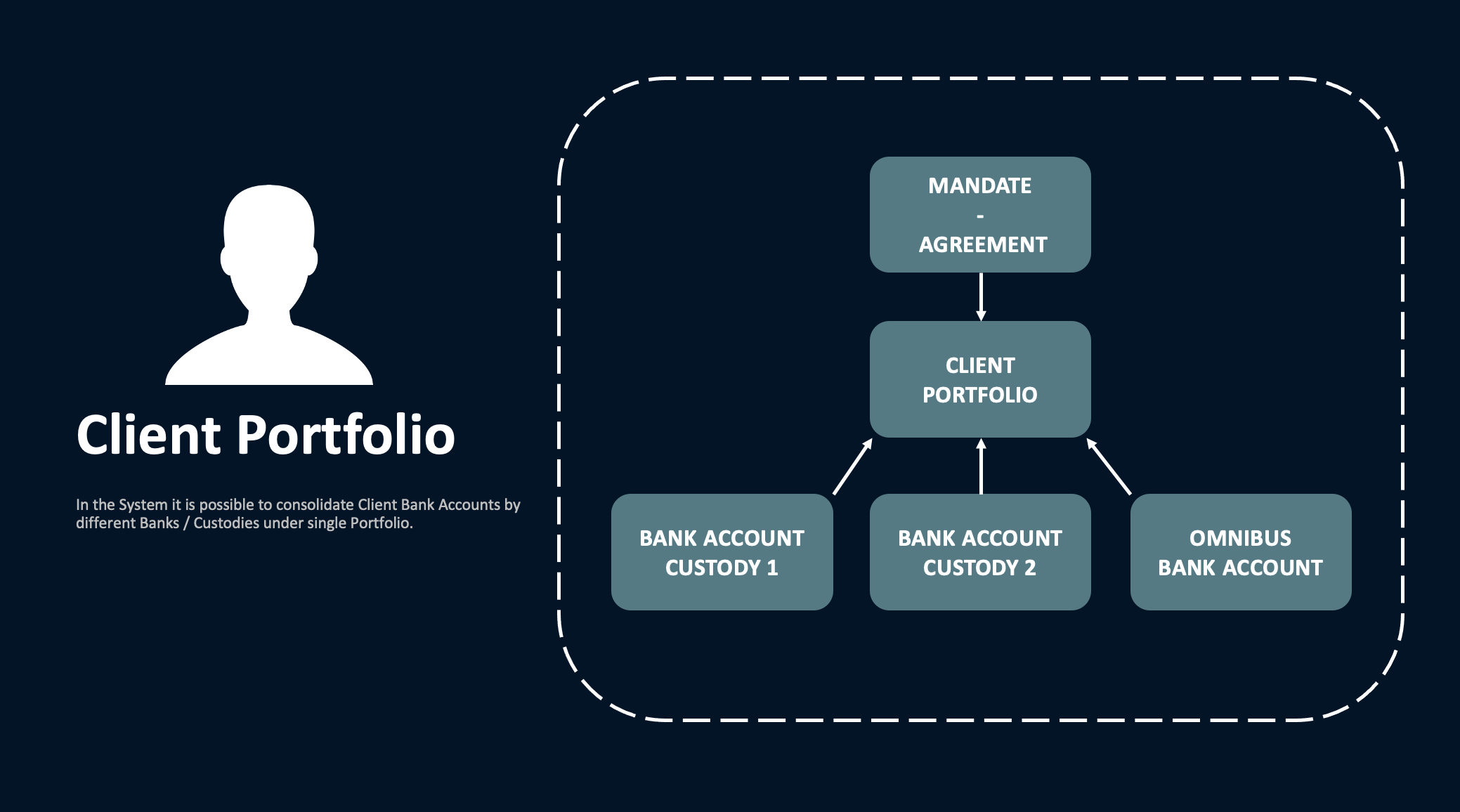

Portfolios Overview

In the Reluna platform, a portfolio consolidates data from all bank accounts linked to a specific client agreement. This allows both the company and its managers to get a global view of all client investments. You can also create and manage Proprietary Portfolios for your company.

Portfolio Scheme

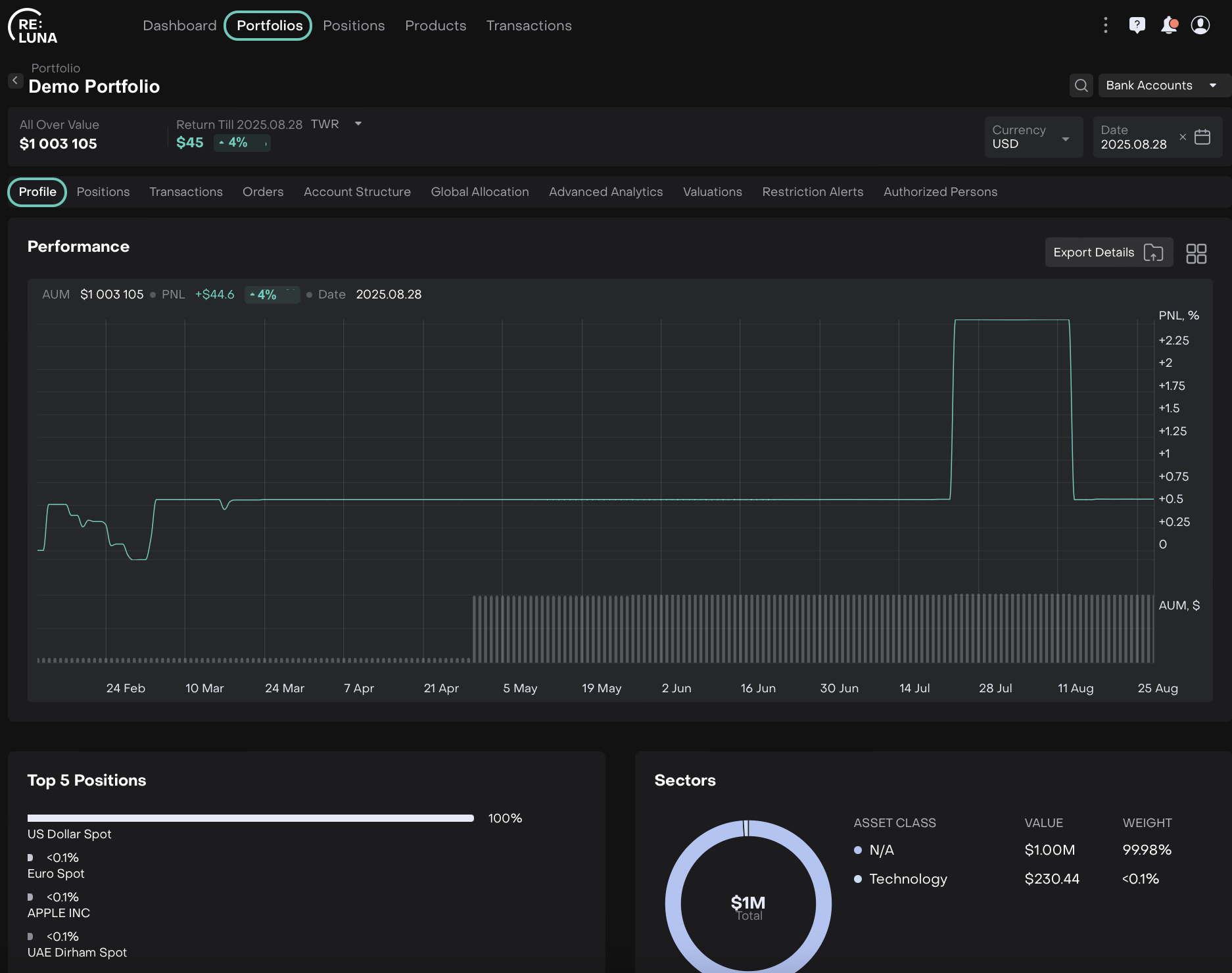

Portfolios Profile (Dashboard)

When you open a portfolio, the first screen you'll see is the Profile tab. This is your dashboard view, offering a quick glance at widgets such as:

Portfolio Performance

Top 5 Positions

Sectors

Fixed Income Monitor

Coupon Payment

Correlation

Strategies

History

Regions

Currencies

Transactions Status Breakdown

Asset Class

Asset Class Performance

Components:

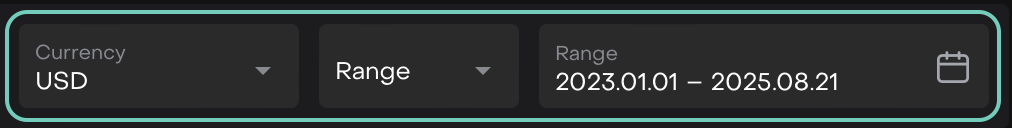

Currency Selector – View portfolio data in your preferred currency.

Date Selector – Choose a specific date or date range.

Dashboard Period Selector – Set a custom period for performance tracking.

Widgets Container – Contains all visual blocks of data (e.g. asset class, history, region, etc.).

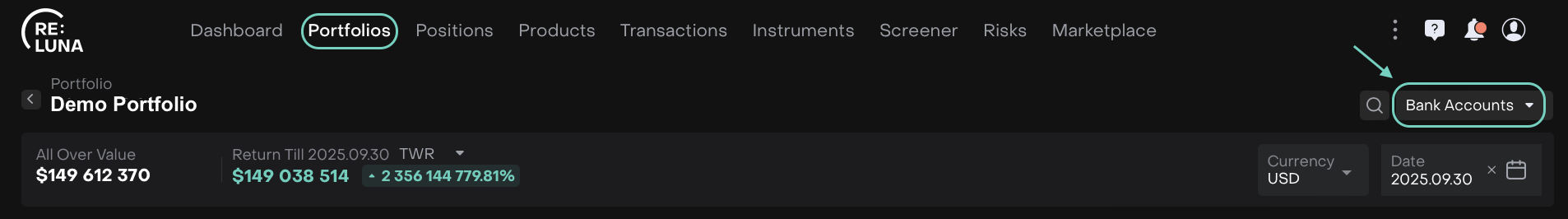

Filtering Portfolios by Bank Accounts

Each Portfolio on the platform can be linked to one or more Bank Accounts. The Bank Accounts filter lets you view portfolio data based on the bank account(s) selected.

By applying this filter, you can see how a specific bank account (or a group of accounts) contributes to your portfolio’s value and performance.

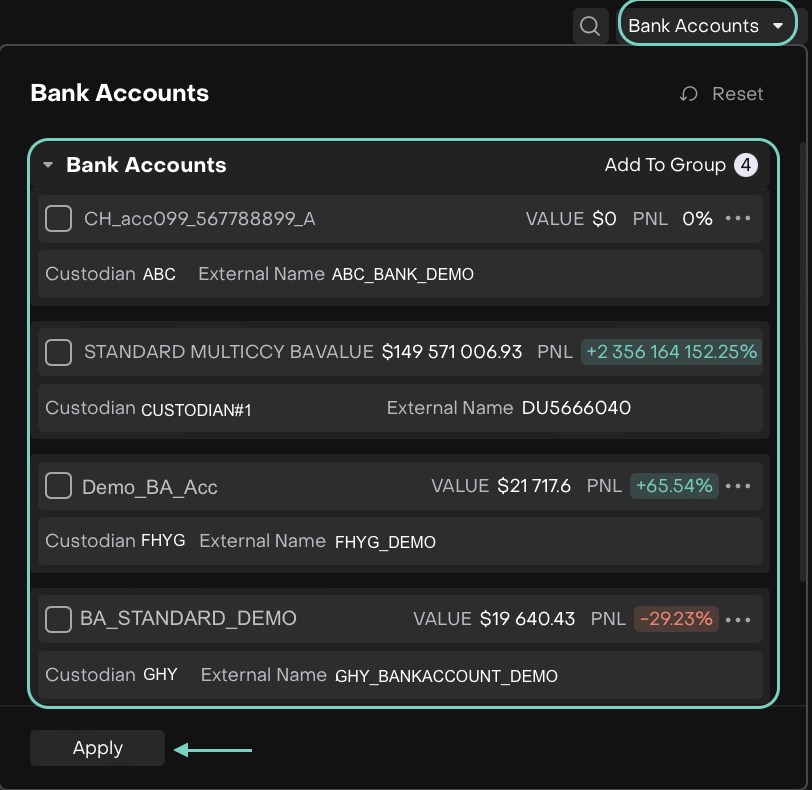

Steps to Filter by Bank Account:

Click on the Bank Account filter option at the top of the page.

On Portfolios > Bank Account (Filter)

Tick one or more bank accounts you want to include.

Click Apply to update the portfolio data.

Select Bank Account(s) by ticking and then Apply

This filter is available for 3 tabs inside the Portfolios: Profile, Positions and Advanced Analytics.

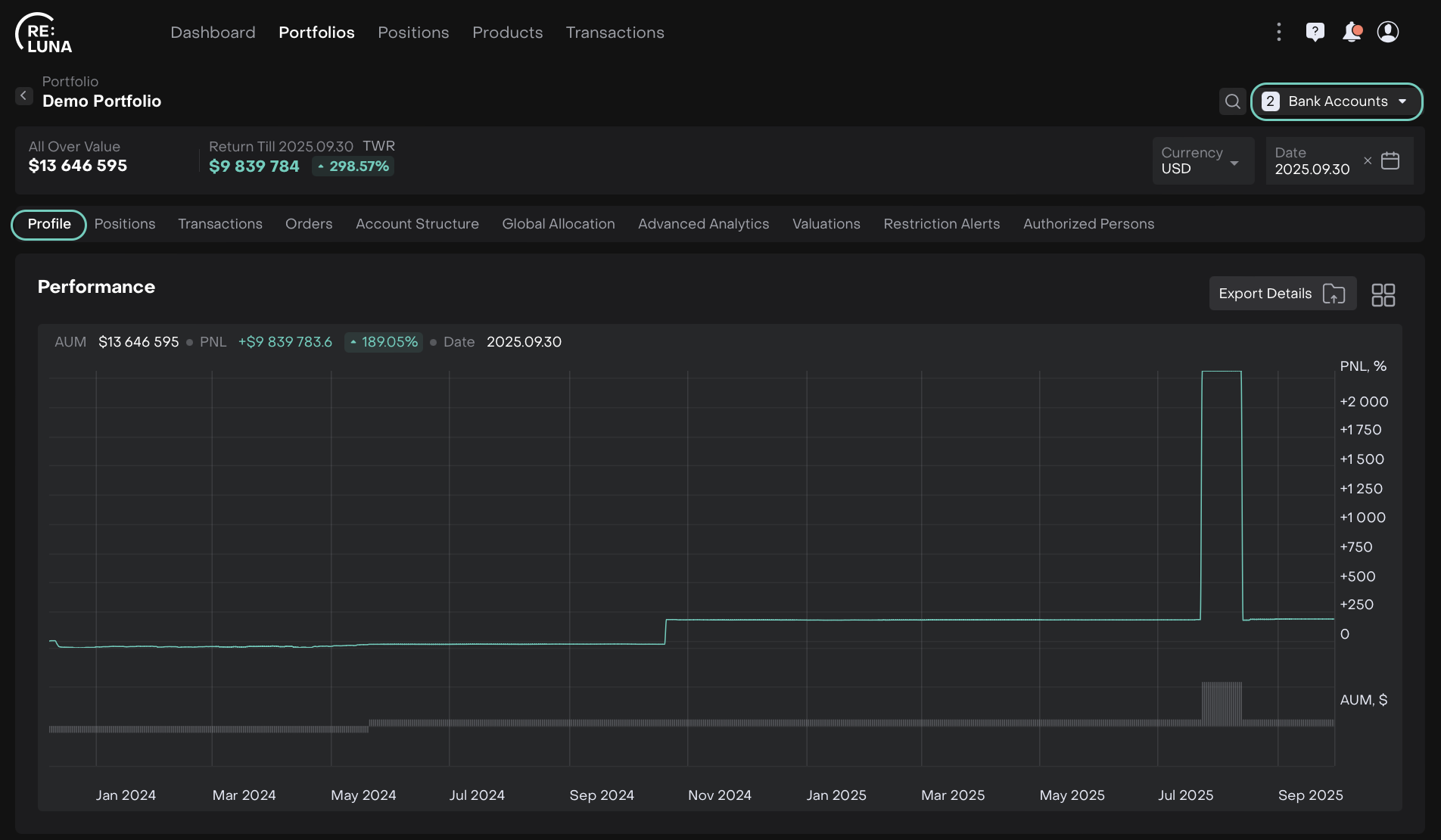

Effect on the Profile Tab (Dashboard view):

When you filter a portfolio by one or more Bank Accounts:

AUM, PnL, Return % and performance graphs update to reflect only selected accounts.

Dashboard becomes a bank-account-specific view.

If you pick one bank account, the profile dashboard becomes a “bank-account-specific view” of the portfolio.

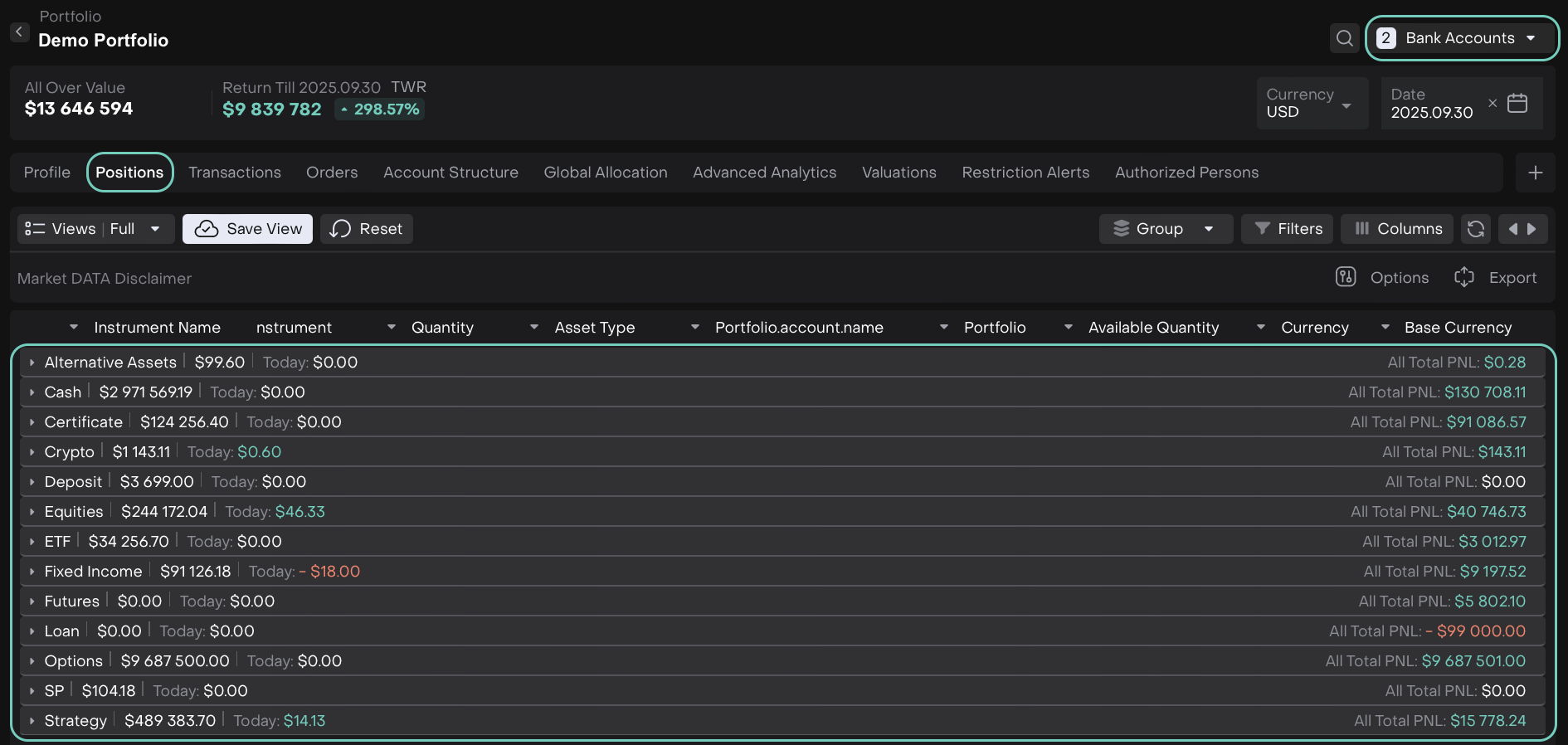

Effect on the Positions Tab:

When you filter a portfolio by one or more Bank Accounts:

Shows only positions linked to the chosen account(s).

Metrics like current value, quantity and unrealized PnL adjust accordingly.

Total PnL, Total Value and other sums update based on filtered accounts.

In multi-account portfolios, this allows you to drill down into each account’s contribution to overall portfolio holdings.

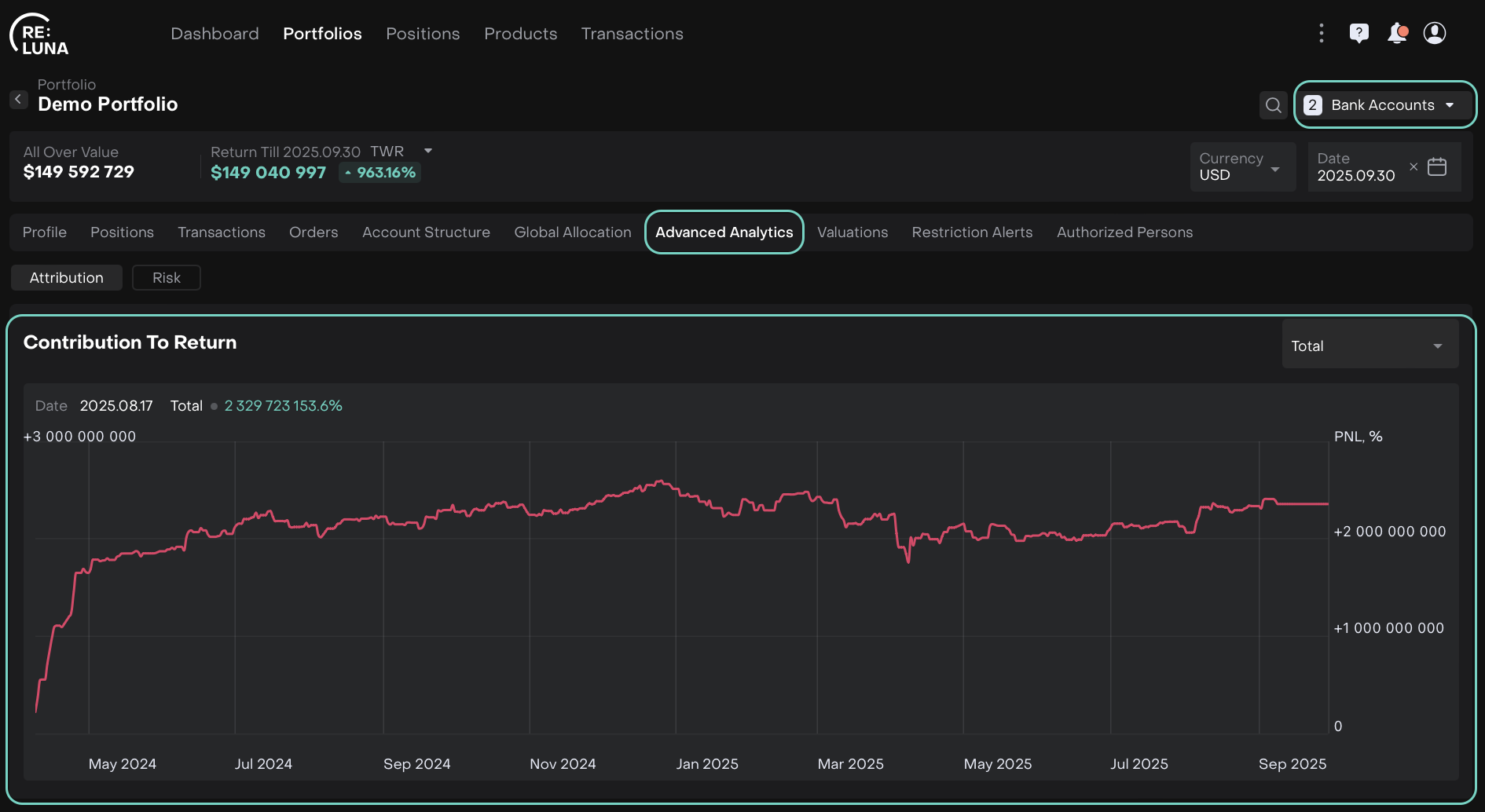

Effect on the Advanced Analytics Tab:

When you filter a portfolio by one or more Bank Accounts:

Total value, PnL and contribution metrics update for the filtered accounts.

Graphs, sector/country contribution, risk and return attribution reflect account-specific data.

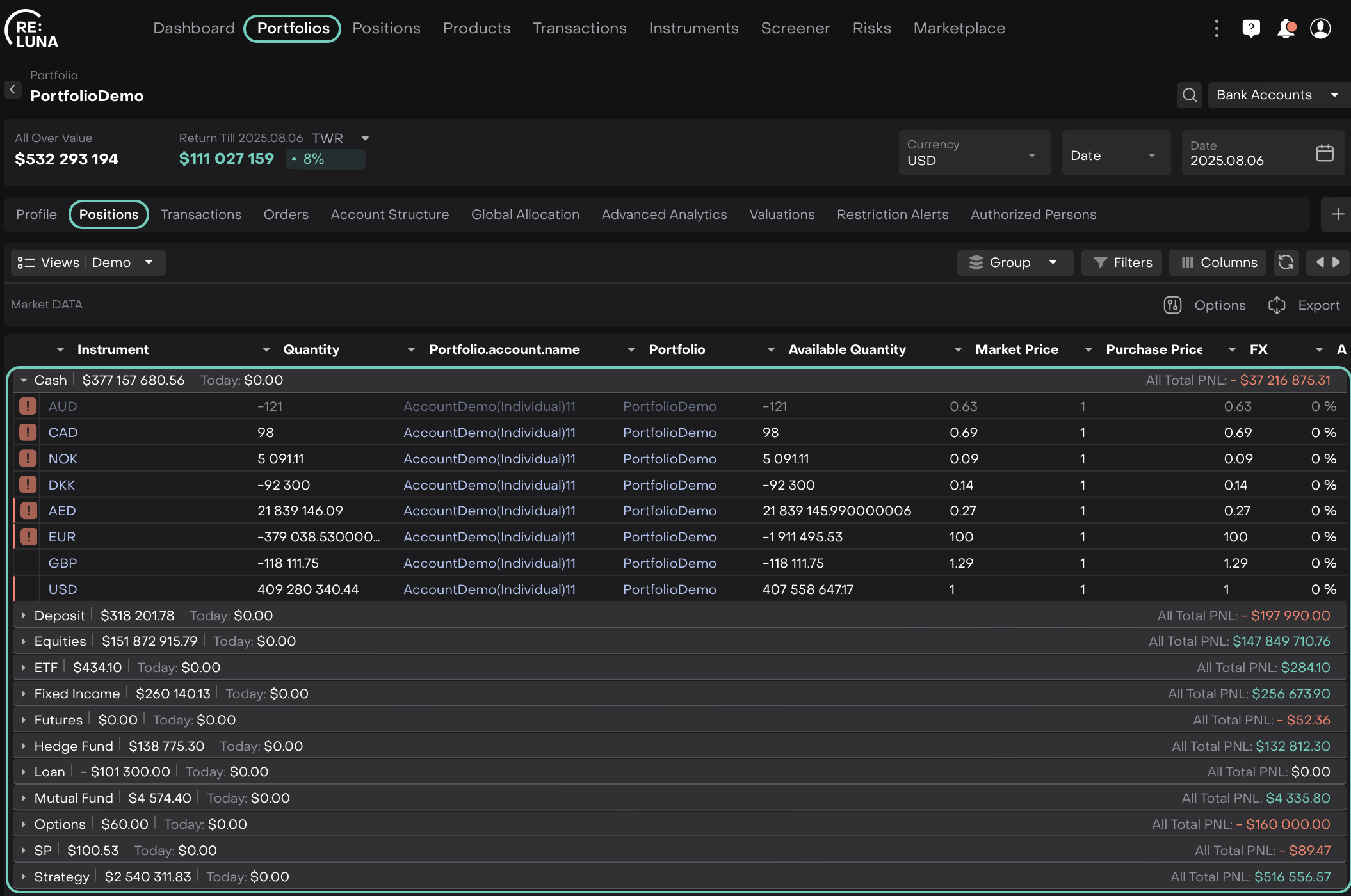

Positions Tab

The Positions tab shows a breakdown of all current holdings in the portfolio.

Features:

Choose different views for tailored data presentation.

Use grouping, filters and custom columns to organize your data.

Export position data to Excel for further analysis.

Learn more here.

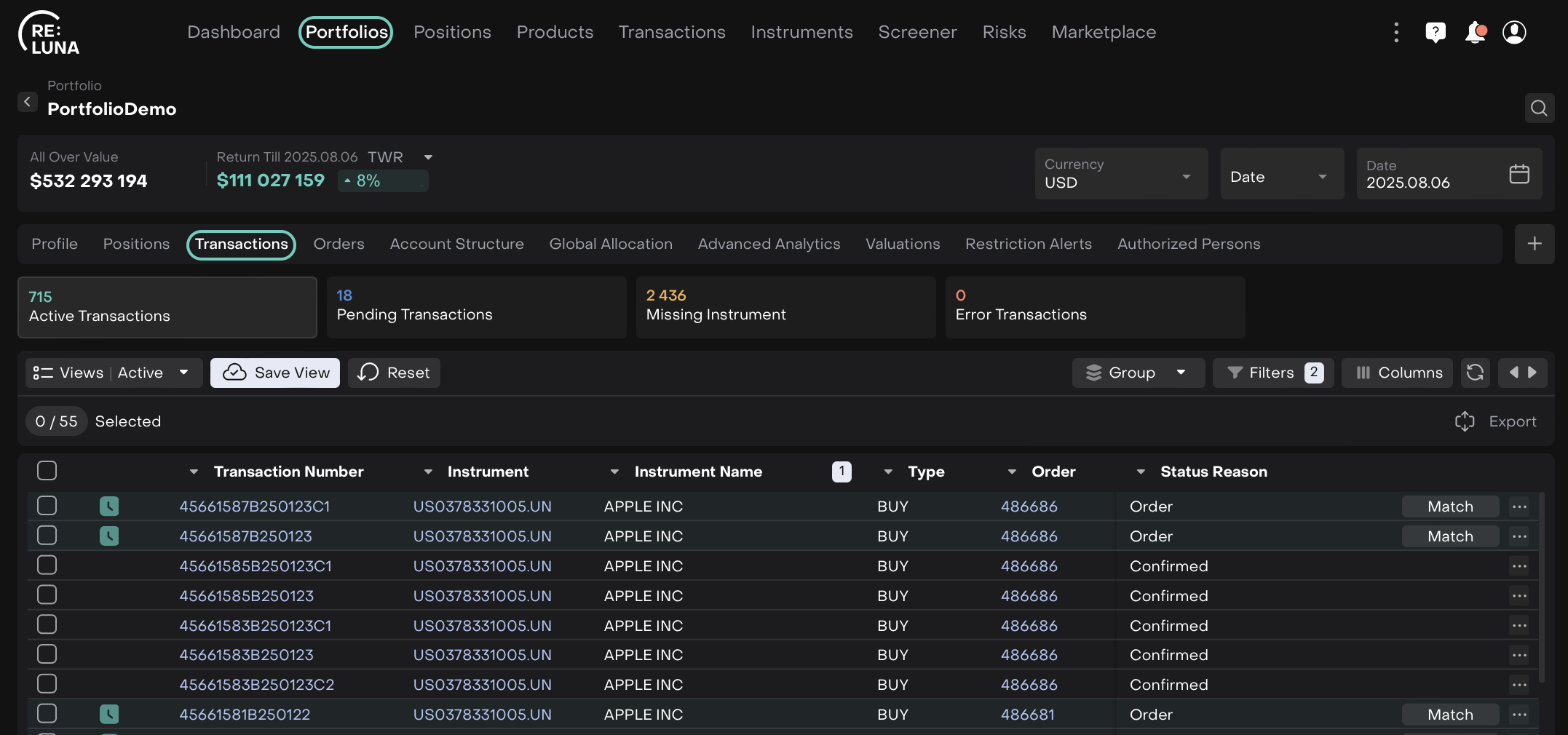

Transactions Tab

The Transactions tab lists all activity related to your bank accounts within the portfolio.

Features:

See both active and (if permitted) inactive transactions.

Group and filter transactions.

Open detailed views for transaction hierarchies like FX, Splits, Info, etc.

Export transactions to Excel.

Learn more here.

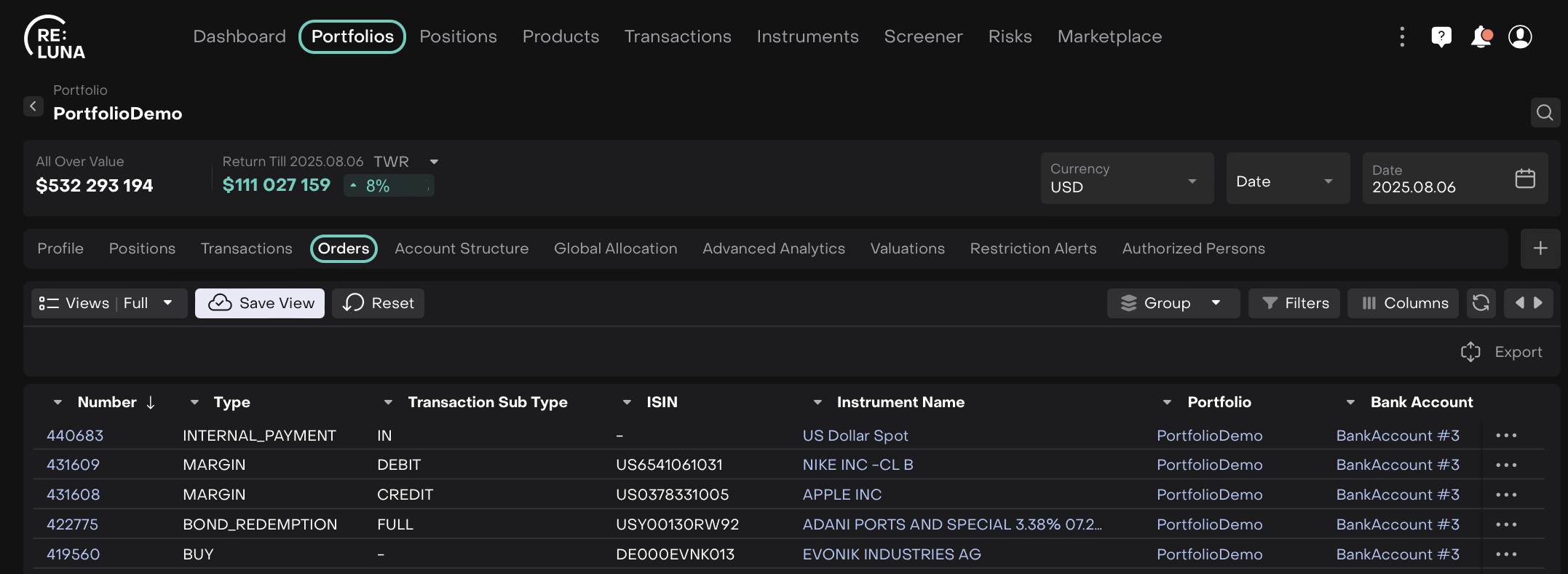

Orders Tab

The Orders tab tracks all trading and non-trading orders related to the portfolio.

Use this tab to:

Monitor order activity.

Track execution and status.

Learn more here.

Portfolio Types

Reluna supports various portfolio types based on ownership and purpose.

Type | Description |

|---|---|

Client | Portfolio owned and managed for a specific client. |

Company | Portfolio owned by the company (e.g. proprietary or omnibus accounts). |

Consolidated | Portfolio that aggregates multiple client portfolios for unified reporting. |

Virtual | Used to store or simulate private assets not actively managed. |

Learn more here.

Portfolio Status

Each portfolio in Reluna has a status that indicates where it stands in the lifecycle.

Status | Description |

|---|---|

Active | Actively managed and invested portfolio. |

Closed | Portfolio has been closed and is no longer active. |

Deactivated | Created by mistake or no longer relevant. |

Draft | Still being created or edited; not yet finalized or activated. |