Create Instruments Manually

Introduction

A platform feature that allows you to add financial instruments when they cannot be automatically fetched from market data sources. This ensures uninterrupted trading and record-keeping for your portfolio.

⚡ Quick Facts:

⏱ Time to Complete: 5-10 minutes

📊 Asset Types: 12 types supported

✓ Process: 7 simple steps

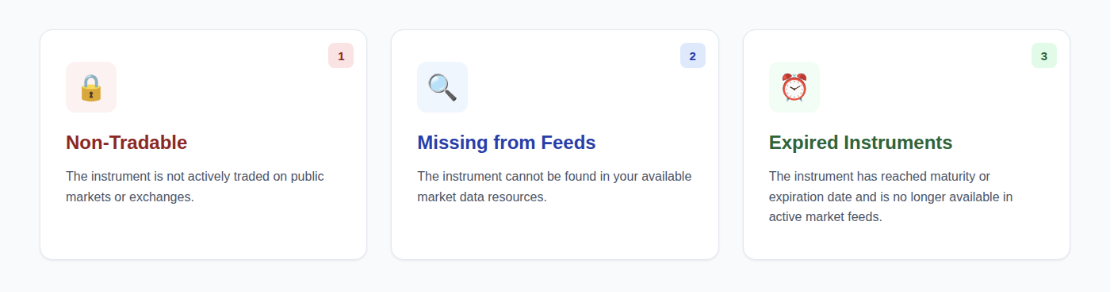

When to Use Manual Creation

Use manual instrument creation in these specific situations:

Corporate actions are not supported for Private instruments

Supported Asset Types and Subtypes

The following Asset Types and Subtypes can be created manually on the platform.

👉 Need help finding an instrument before creating it manually? Check out the Unified Instrument Search Guide to learn how to search using Internal, External and By Ticker options.

3-Minute Setup

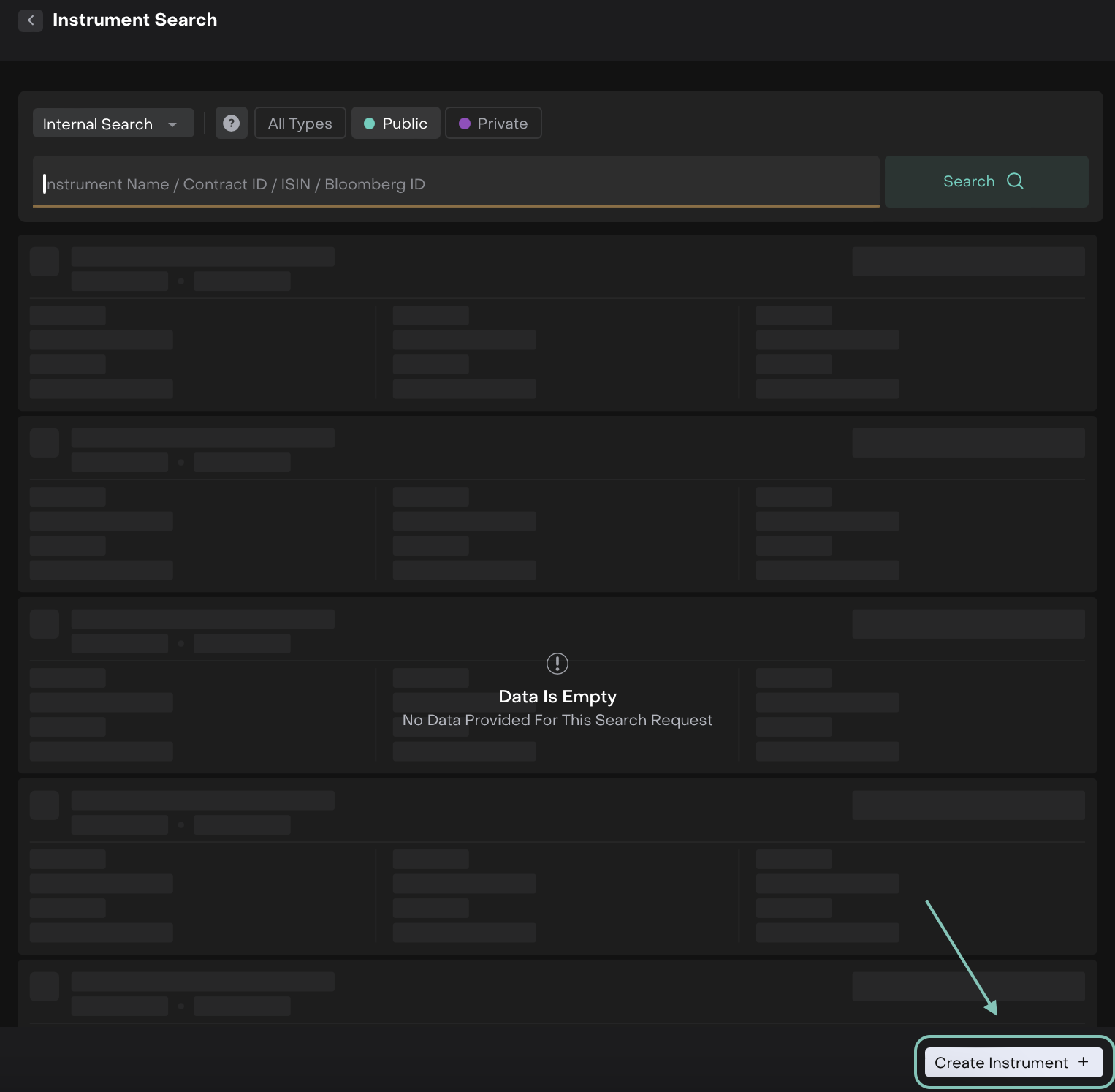

STEP 1: Search First

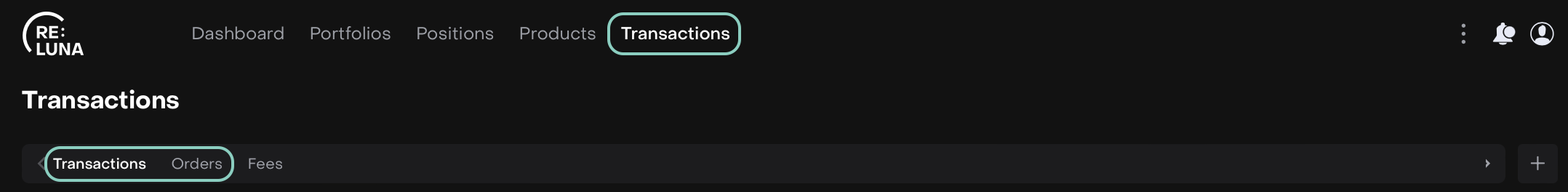

Go to Transactions > Find Orders/Transactions tab

Search Internal, External or By Ticker

If not found > Proceed to Step 2

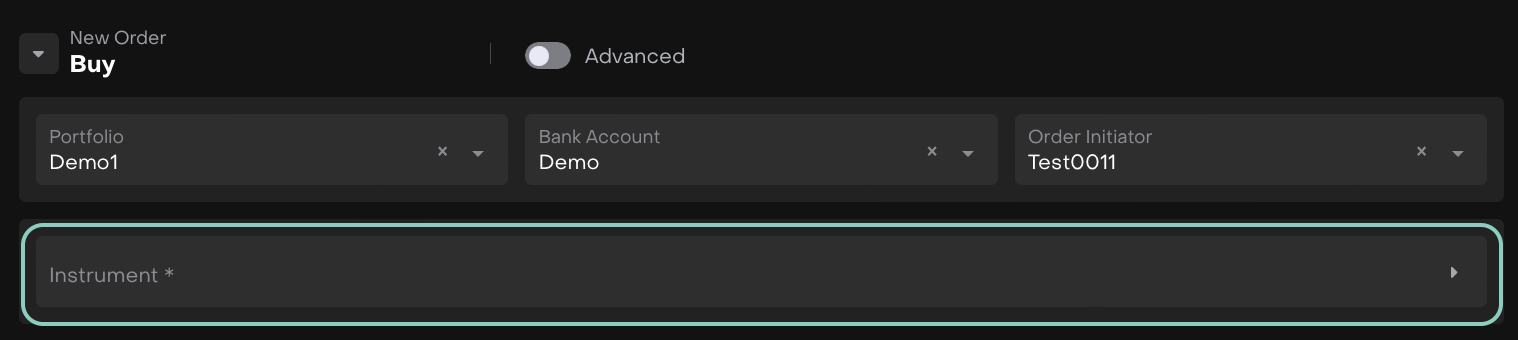

STEP 2: Initiate Creation

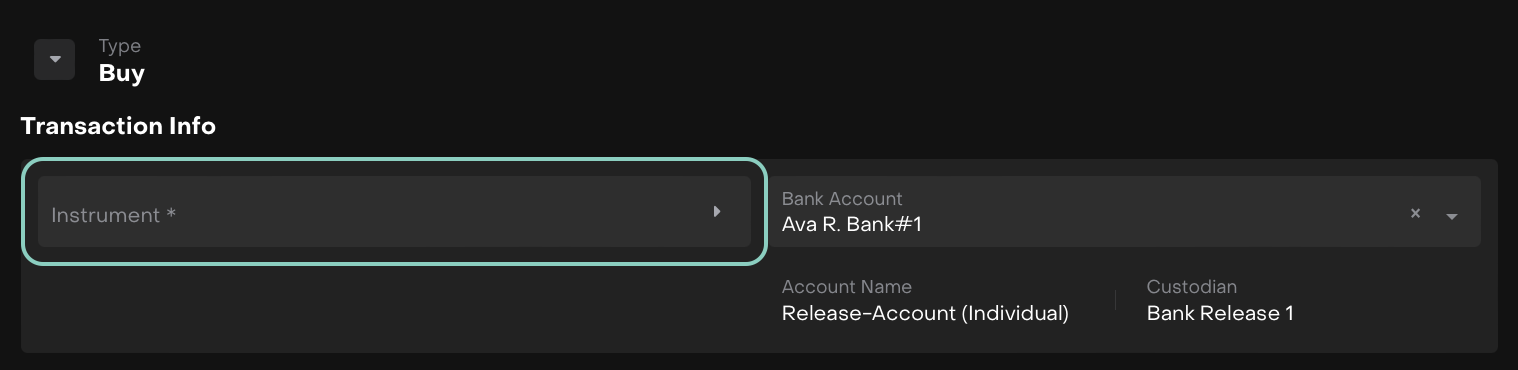

Open Orders/Transactions form

Orders Form

Transactions Form

Click Create Instrument +

👉 Need context on Public vs Private Instruments? Click here to learn how the platform retrieves instruments during all search types.

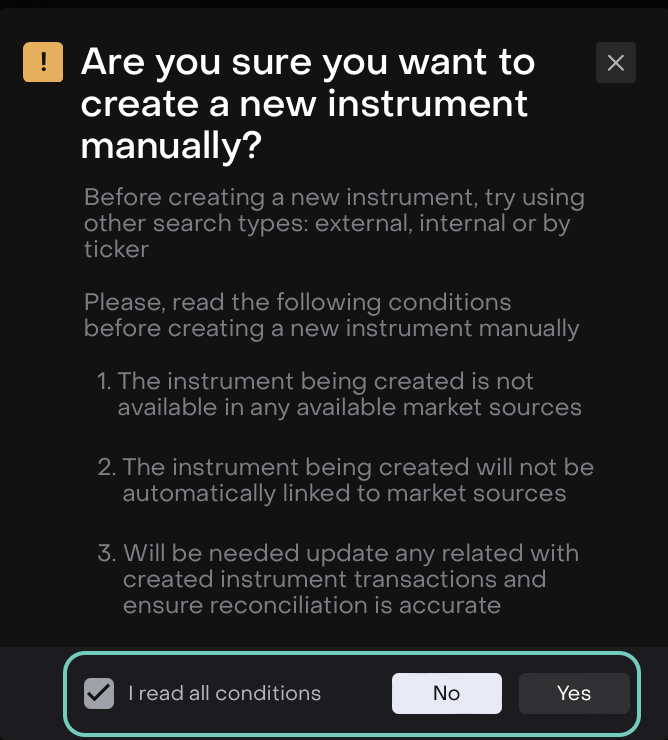

Check the box for “I read all conditions”, then click Yes to proceed.

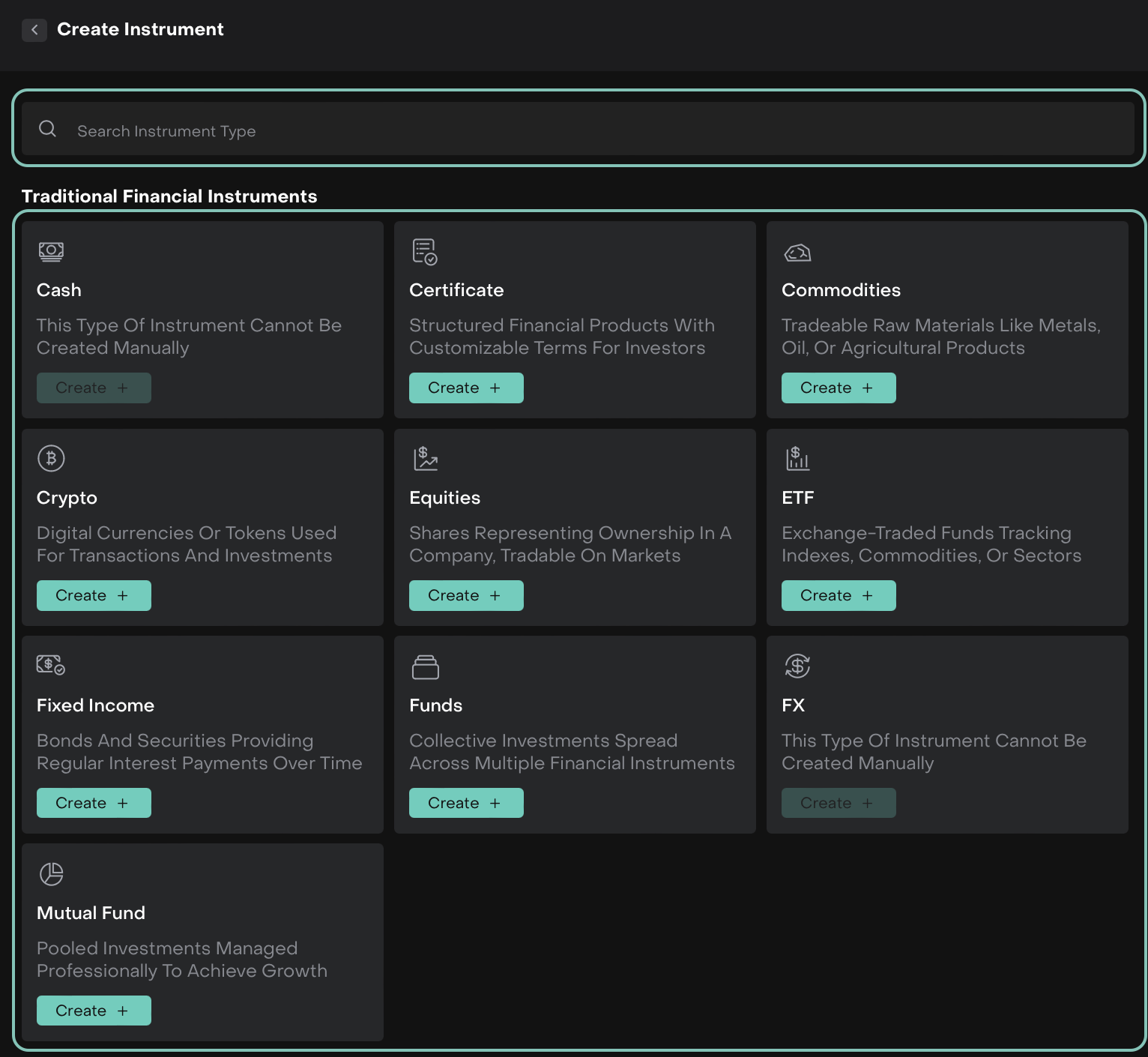

STEP 3: Select Type & Subtype

Choose Asset Type (e.g., Fixed Income, Equities, ETF)

Public instruments cannot be duplicated as Private.

Select Subtype (e.g., Bond, Equity, Mutual Fund)

When you select an Asset Type and its relevant Subtype, the platform automatically suggests the relevant fields required for that combination.

Click Next

Loan/Granted Loan/Deposit instruments can only be created from the Transaction form, not from the Order form.

FX and Cash types are not available.

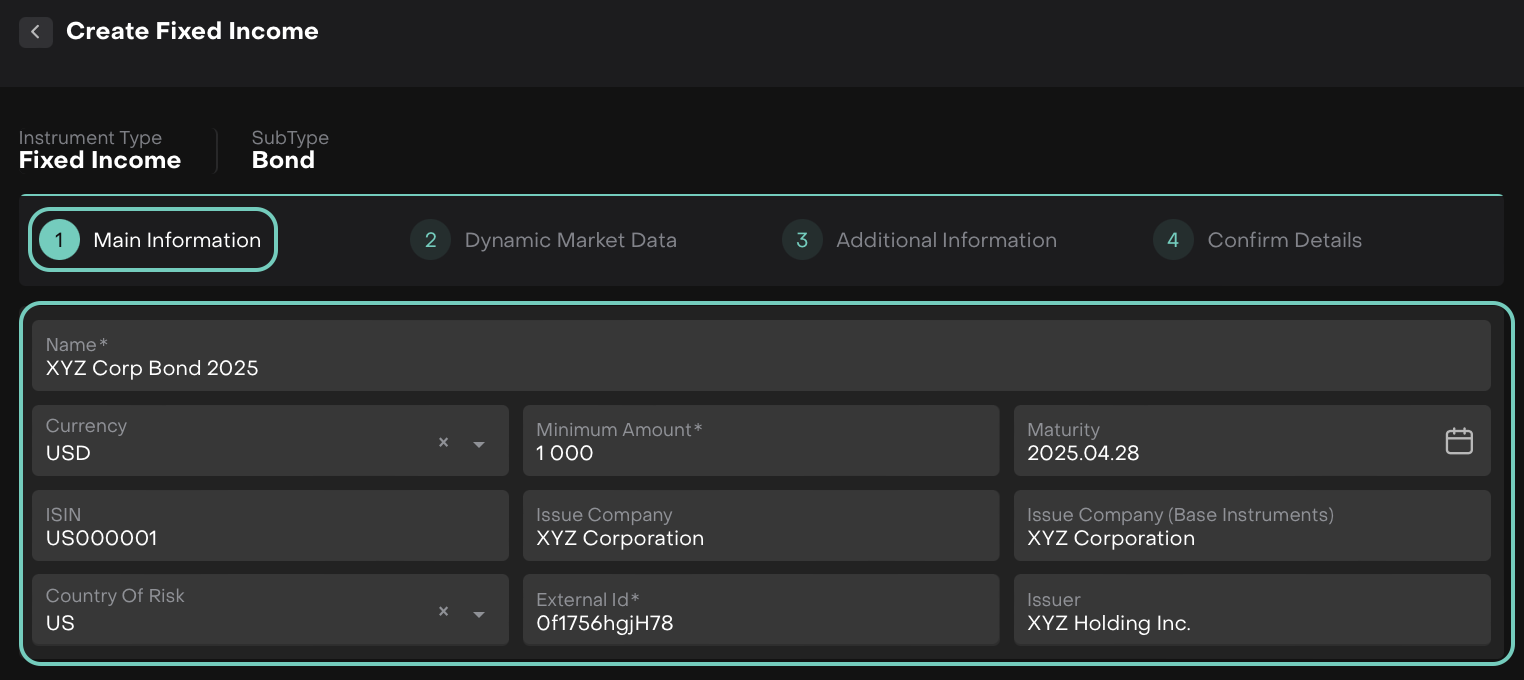

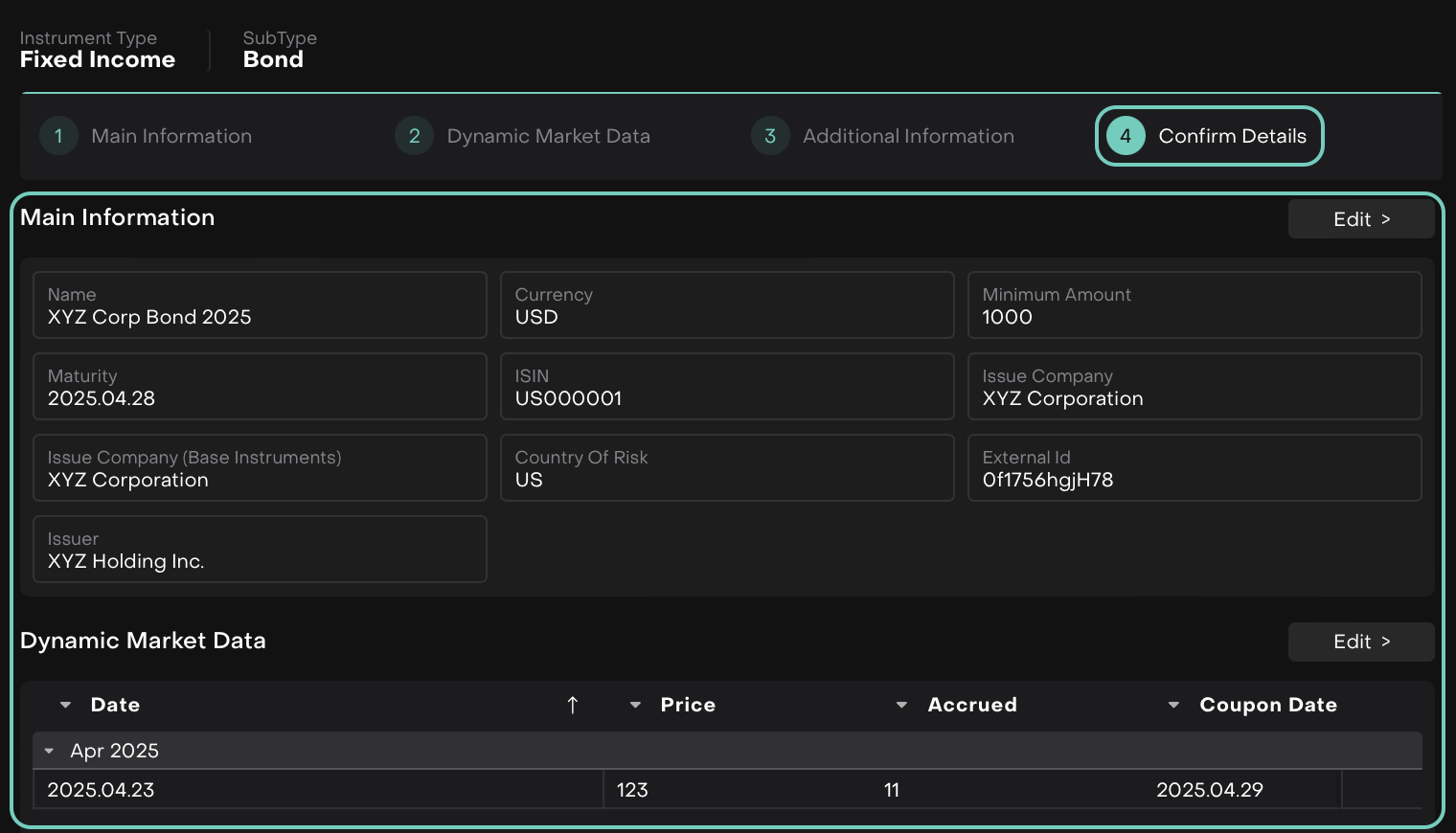

Use Case Example: Creating a Fixed Income Bond

STEP 4: Fill Main Information

Here, fill in the required fields such as:

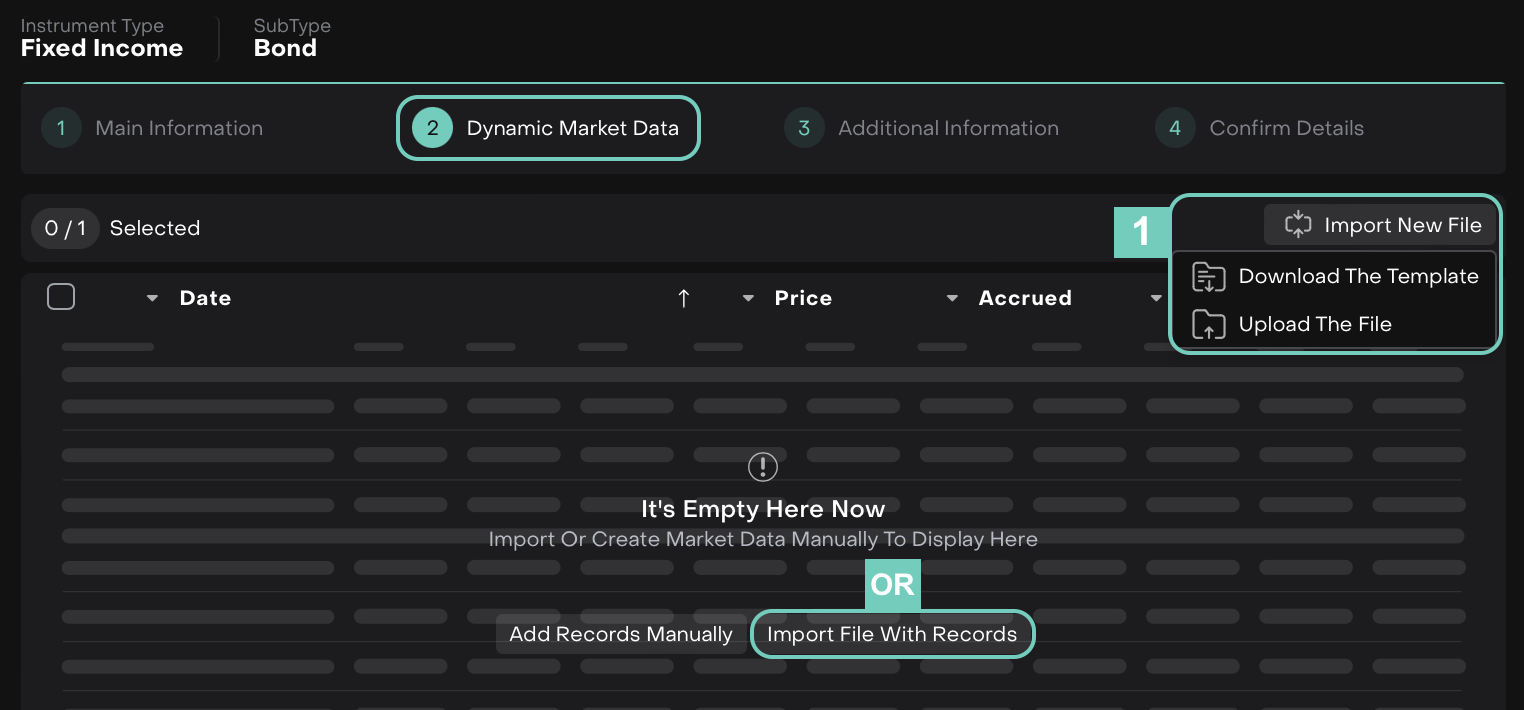

STEP 5: Add Market Data

Option 1: Import Template

Click Import New File > Download Template

Or,

Fill Template > Upload File with Records

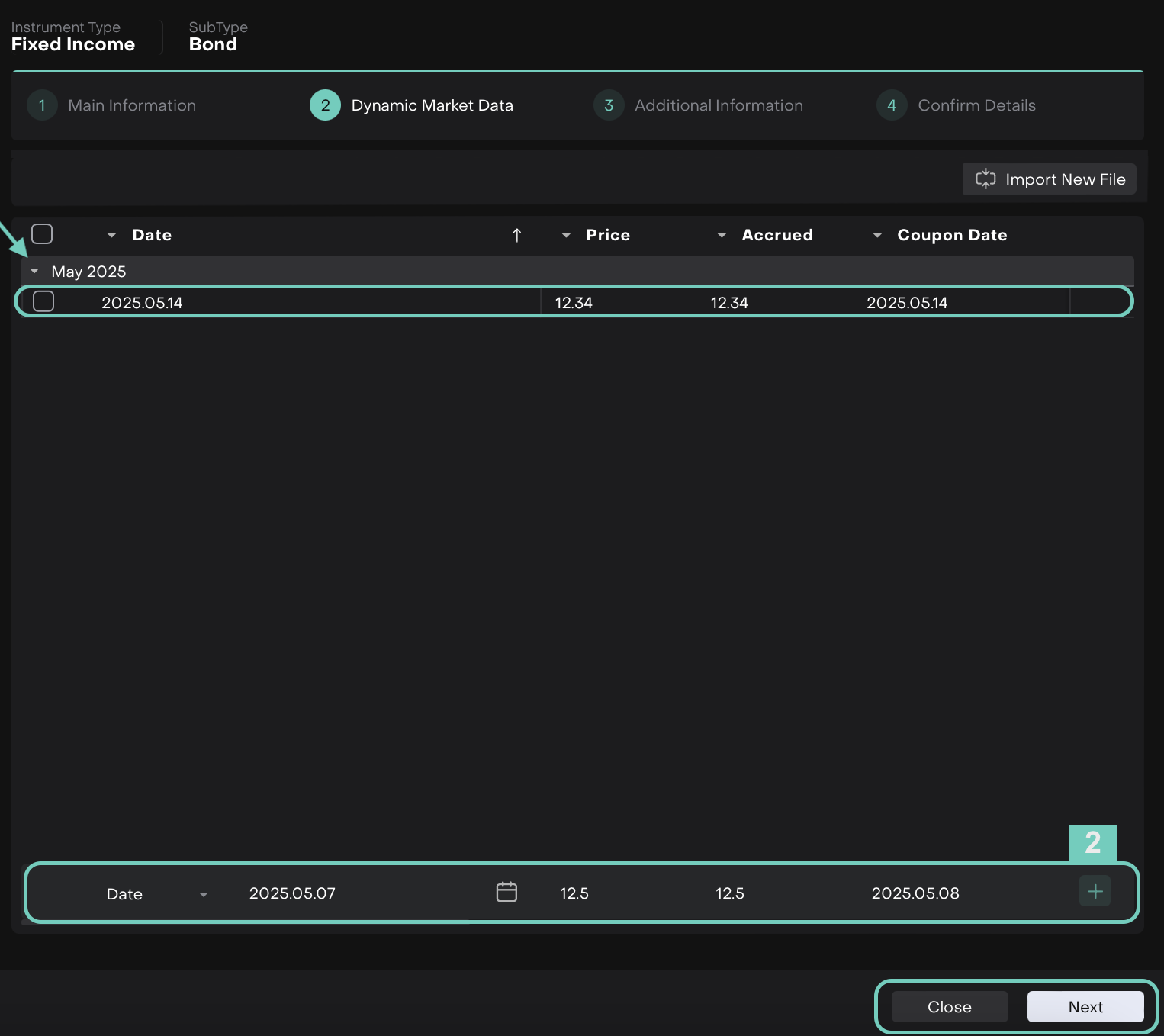

Option 2: Manual Entry

Scroll horizontally to view and complete all columns.

Fill fields (Date, Price, Accrued, etc.)

Click Next or Close.

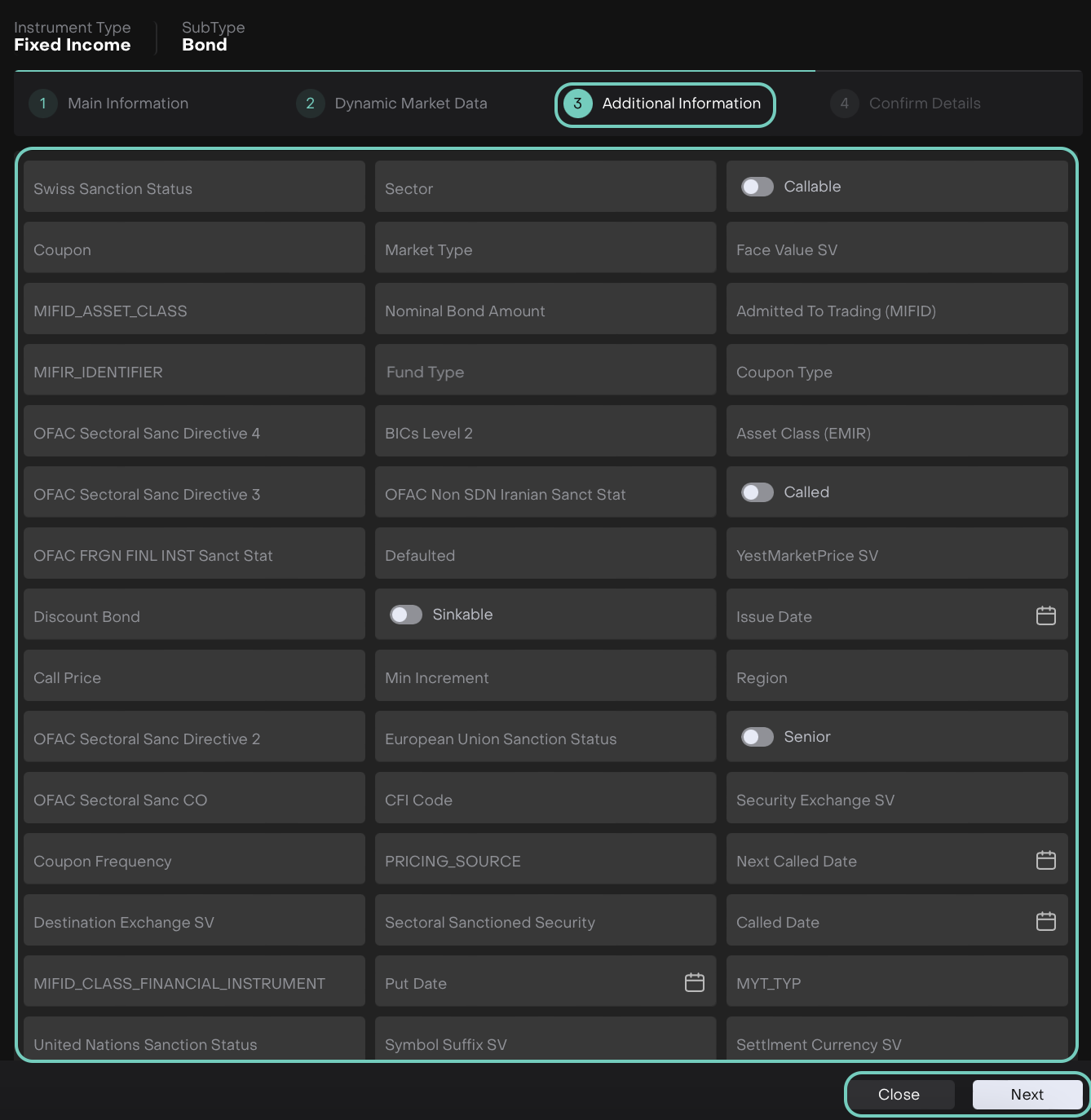

STEP 6: Review & Create

Fill Additional Information (if required)

Review all entered information

Click Create to complete the process

✅ Success message appears.

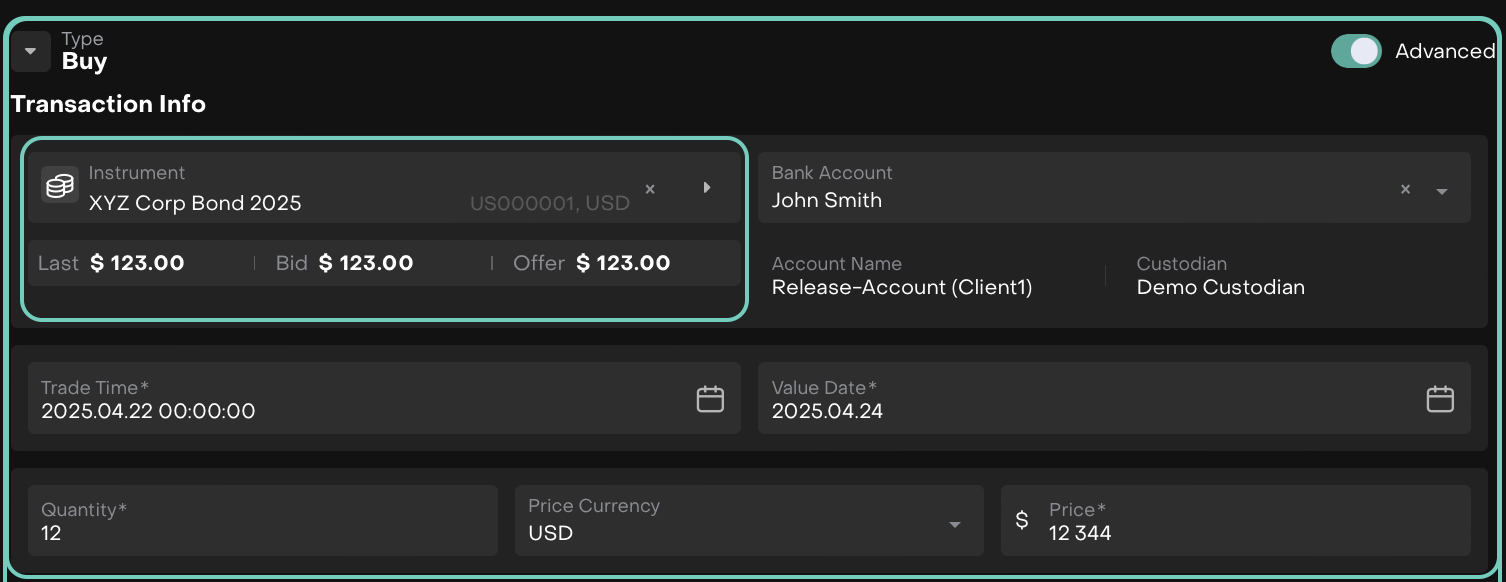

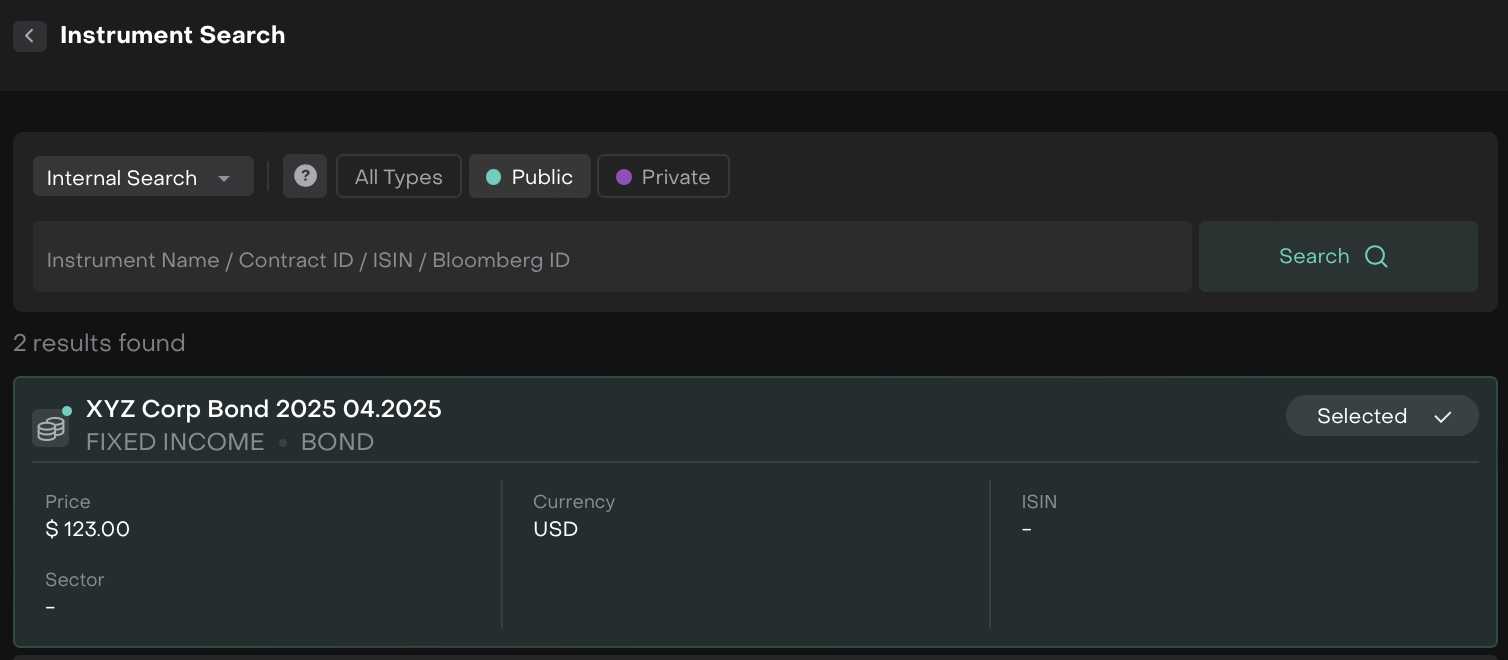

STEP 7: Check Newly Created Instrument

Instantly available in Orders/Transactions form

Name, ISIN, key details, and price auto-filled

Treated as a Private Instrument (visible only within your organization/environment)

Review details and continue to submit the form.