Fee Management

Introduction

Fee Management on the platform allows you to set up, calculate and manage fees at the mandate level. You can define fee structures, apply them across portfolios and track calculations over selected periods. This ensures consistent and automated fee management across all client accounts, reducing manual effort and improving accuracy.

🔗 Click here to check how fee is configured on Mandate.

Platform Supported Fee Types

Permission Requirement

Feature / Tab | Required Permissions |

|---|---|

Fees | View, Modify, Create |

Mandate (Fees) | View, Modify, Create |

If you do not have the required access, please contact your Business Admin.

👉 New to some terms? Check our full Platform Glossary for quick definitions.

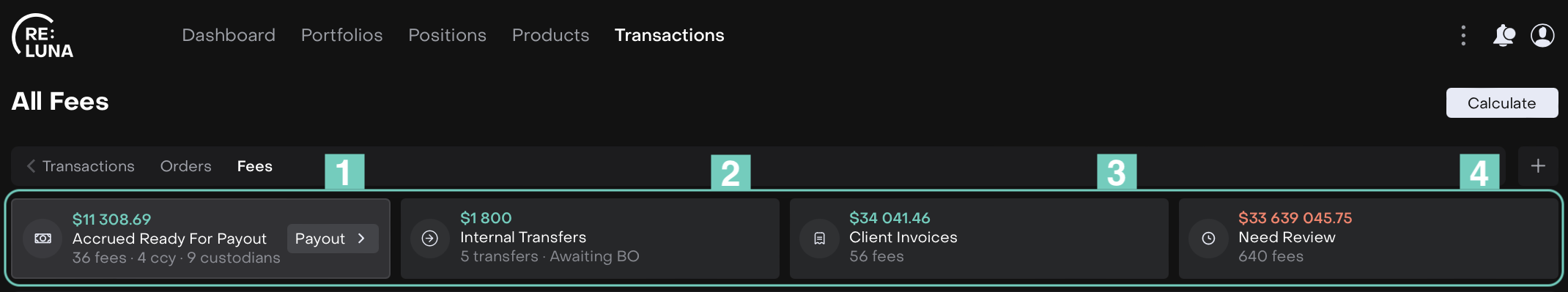

Fees Lifecycle Overview

Automatic fee routing through lifecycle stages:

Fee created → Platform checks conditions → Places into the appropriate "element" (tab)

If fee is accrued and awaiting payment → goes to "Accrued Ready For Payout"

If fee is on a client account and ready for invoicing → "Client Invoices"

If review is needed → "Need Review"

🔗 Click here to learn how to configure/generate Fees.