Brokerage Fees

Introduction

You can now easily manage brokerage fees on the platform to ensure accurate fee tracking and reporting.

In this guide, you’ll learn how to:

View Estimated Fees while creating BUY/ SELL orders.

Check automatic calculation of external commission and brokerage markup during transaction matching (visible on the transaction card).

Review platform-generated fees in the Fee object after confirmation of transaction.

Verify how platform marks markup fee during reconciliation.

Key Terminologies

Term (A-Z) | Definition |

|---|---|

Accrued | A platform-assigned status indicating that a fee has been calculated and recognized but not yet paid. |

Awaiting Review | A status reason under Brokerage Fee type, created when the calculated Brokerage Markup is zero or negative, requiring back-office verification before payout. |

Awaiting Payout | A status reason under Brokerage Fee type, indicating that the Brokerage Markup has been approved and ready for payout, but the transfer has not yet been initiated. |

Brokerage Fee | A commission charged by the broker for executing trades on your behalf, expressed as a percentage of the transaction value. |

Brokerage Markup | An additional fee applied on top of the standard brokerage commission. It represents the broker’s earnings or spread and is included during reconciliation to ensure total fees reflect the applied markup. |

External Commission | A fee charged by an external party or counterparty for executing or facilitating a transaction. This fee is separate from the platform’s brokerage fee and is typically calculated as a percentage of the transaction value. |

Fee | A platform-generated record that stores details of calculated charges (such as brokerage or markup) after transaction confirmation. |

Mandate | A contractual agreement between you and your client that defines investment terms, strategies, and applicable fees. |

Order | A trade instruction placed to buy or sell a financial instrument. |

Reconciliation | The process of comparing and validating transactions to ensure that all brokerage/markup fees and commissions are accurately reflected and settled. |

👉 New to some terms? Check out full Glossary for quick descriptions.

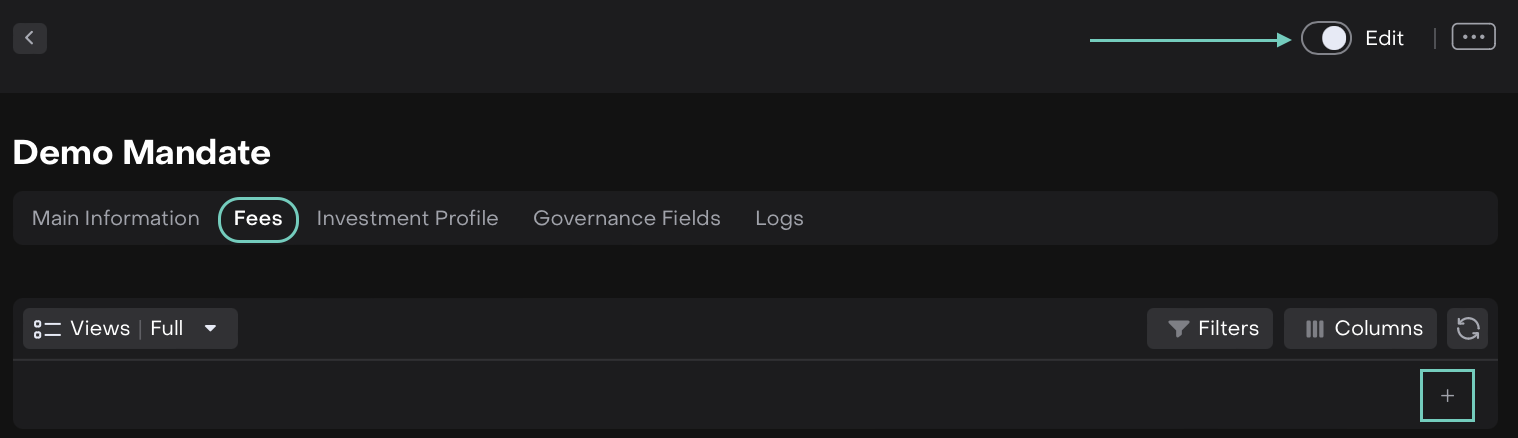

Set Brokerage Fees on Mandate

You can add brokerage fees either when creating a new mandate or by editing an existing one.

🔗 Learn here on how to create or manage Mandate.

To Add or Edit Brokerage Fees:

Go to Accounts > Mandates

Click the + icon to create a new mandate or click an existing mandate to open it.

The Mandate form opens. If you’re editing an existing mandate, you’ll see its details screen.

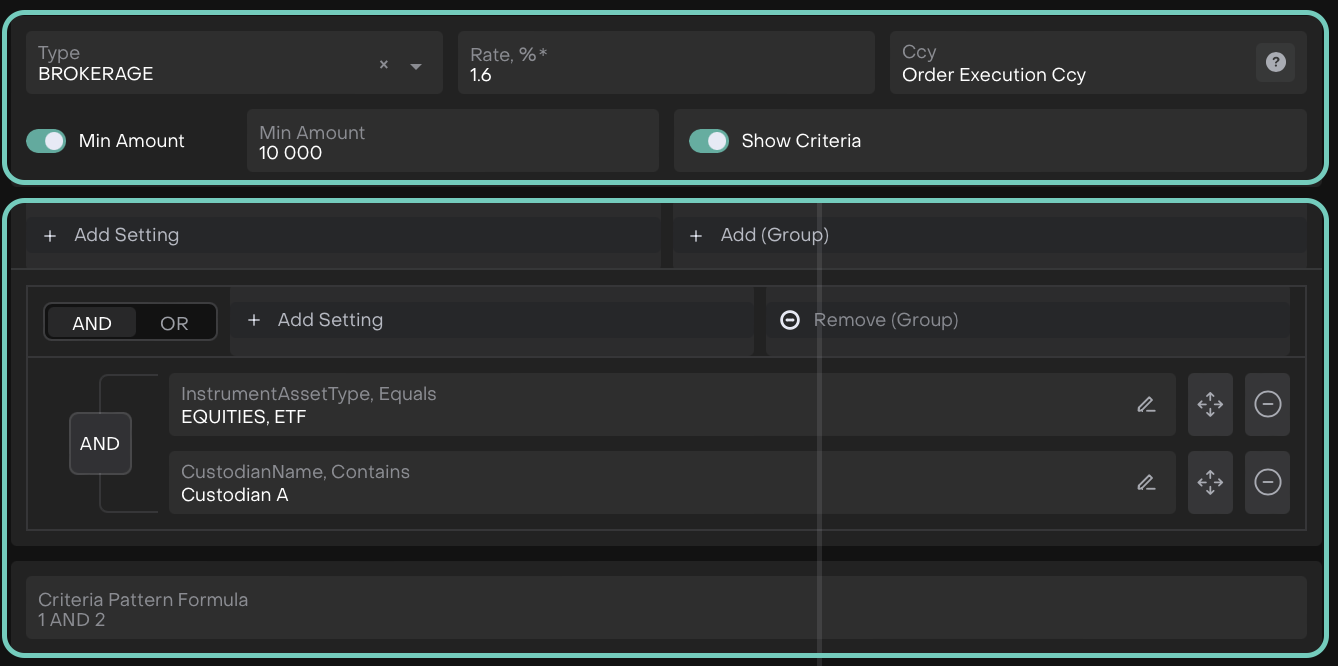

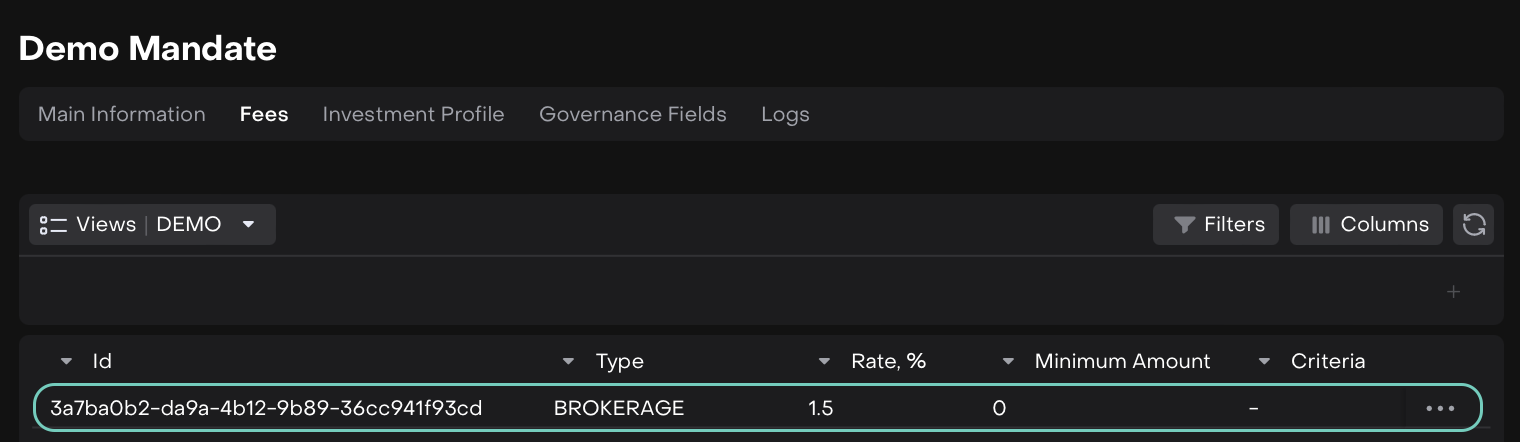

Go to the Fees tab and click the “+” icon to add a new fee entry.

Fill in the required fields on the Fee form.

Click Save and the added fee will appear in the list and you can Edit or Delete it, if needed.

View Estimated Fees on Orders

Go to Transactions > Orders tab and click the + icon.

Select the Buy/Sell order type.

On the order form, after entering the required details, hover over the icon to view more information.

🔗 Learn here on how to Create Orders.

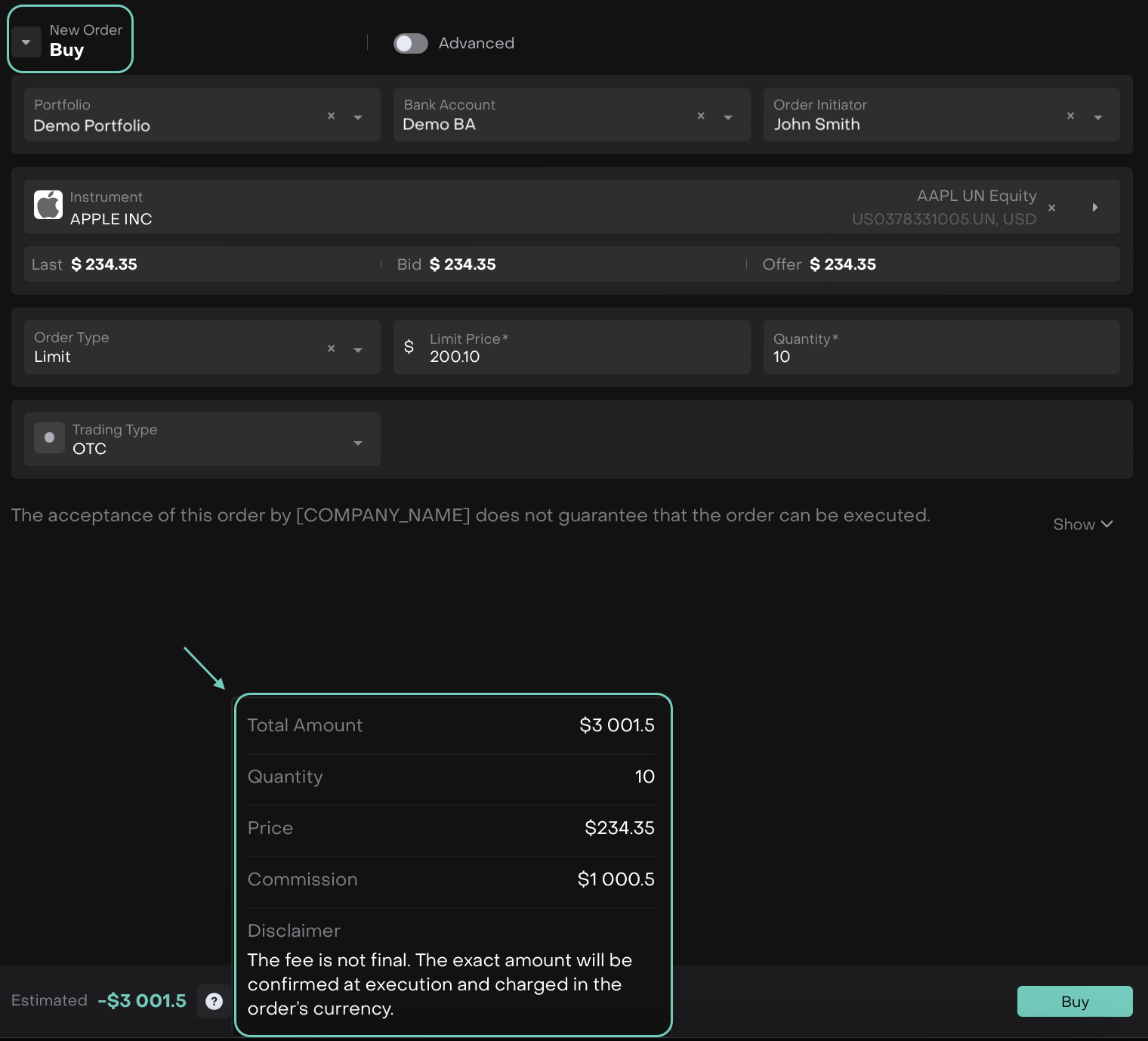

Buy Order

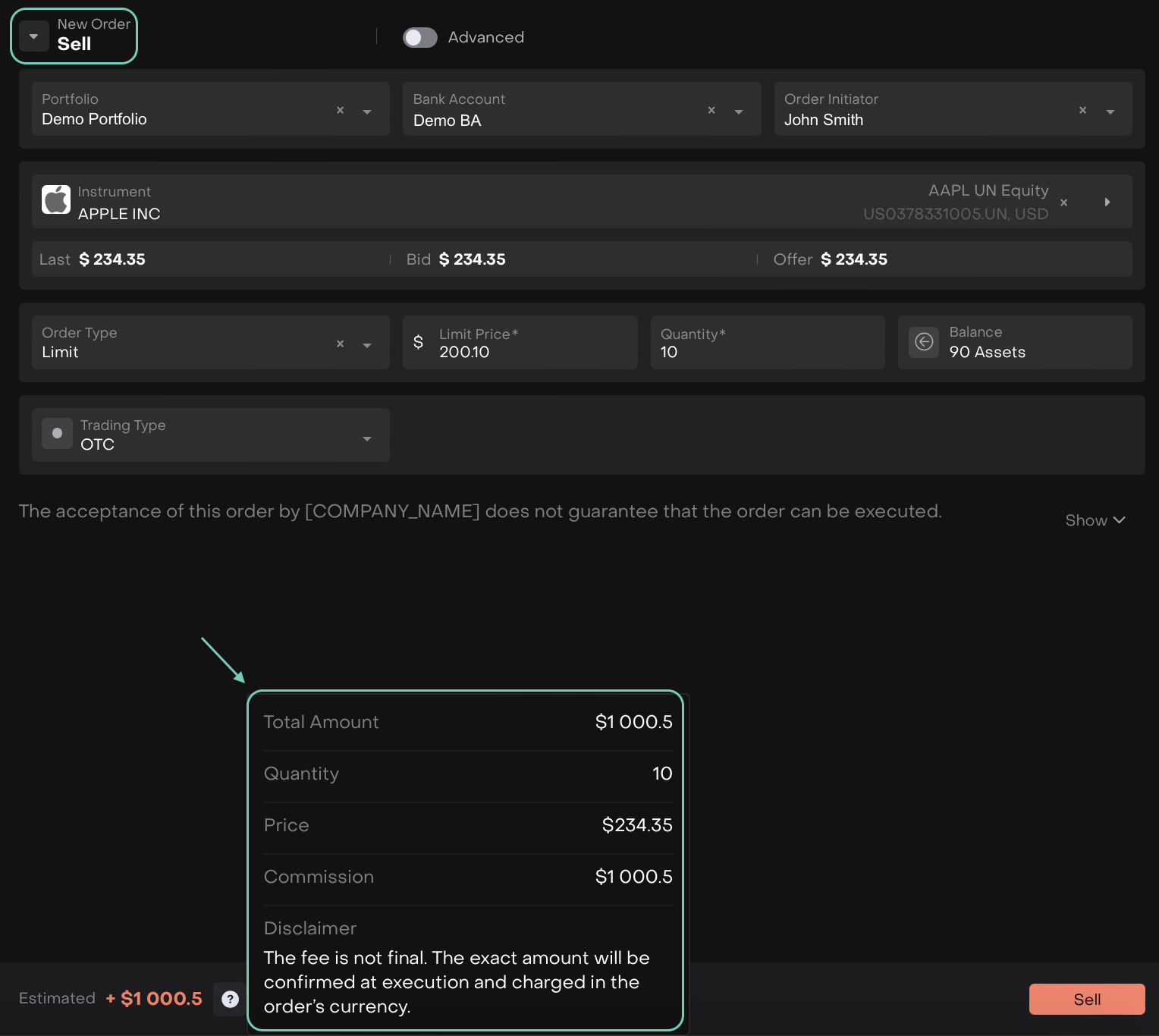

Sell Order

The fee displayed is estimated. The exact amount will be confirmed at execution and charged in the order’s currency.

Automatic Fee Calculation During Transaction Matching

Once your transaction is matched, the platform automatically calculates External Commission and Brokerage Markup.

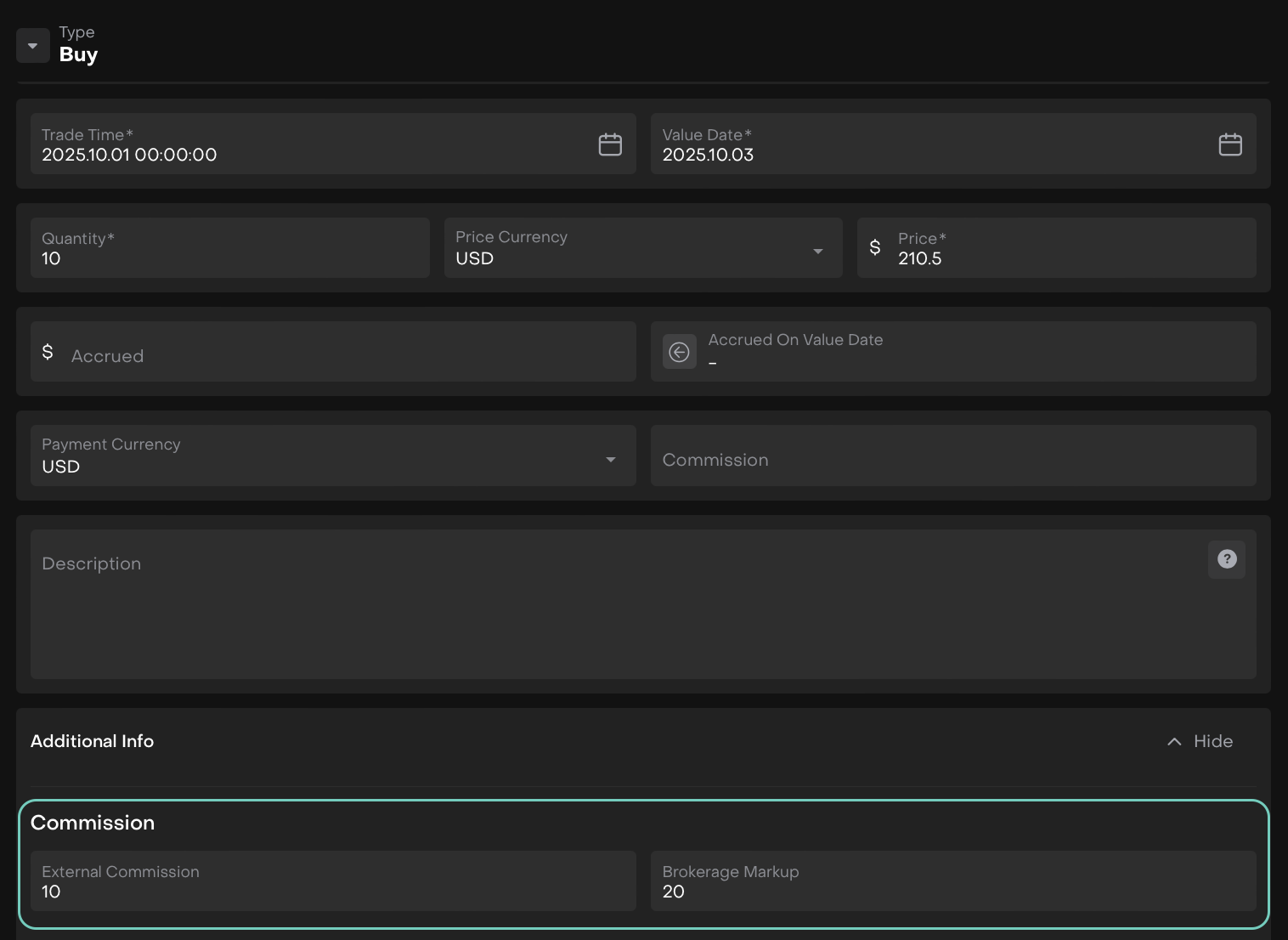

When creating a transaction, you can add the following fields on the order form:

External Commission

Brokerage Markup

Once the order is active and matching occurs, these fields automatically display calculated values.

You don’t need to manually adjust them. The platform applies calculations based on the set brokerage rate and execution currency.

Fees Generated After Confirmation

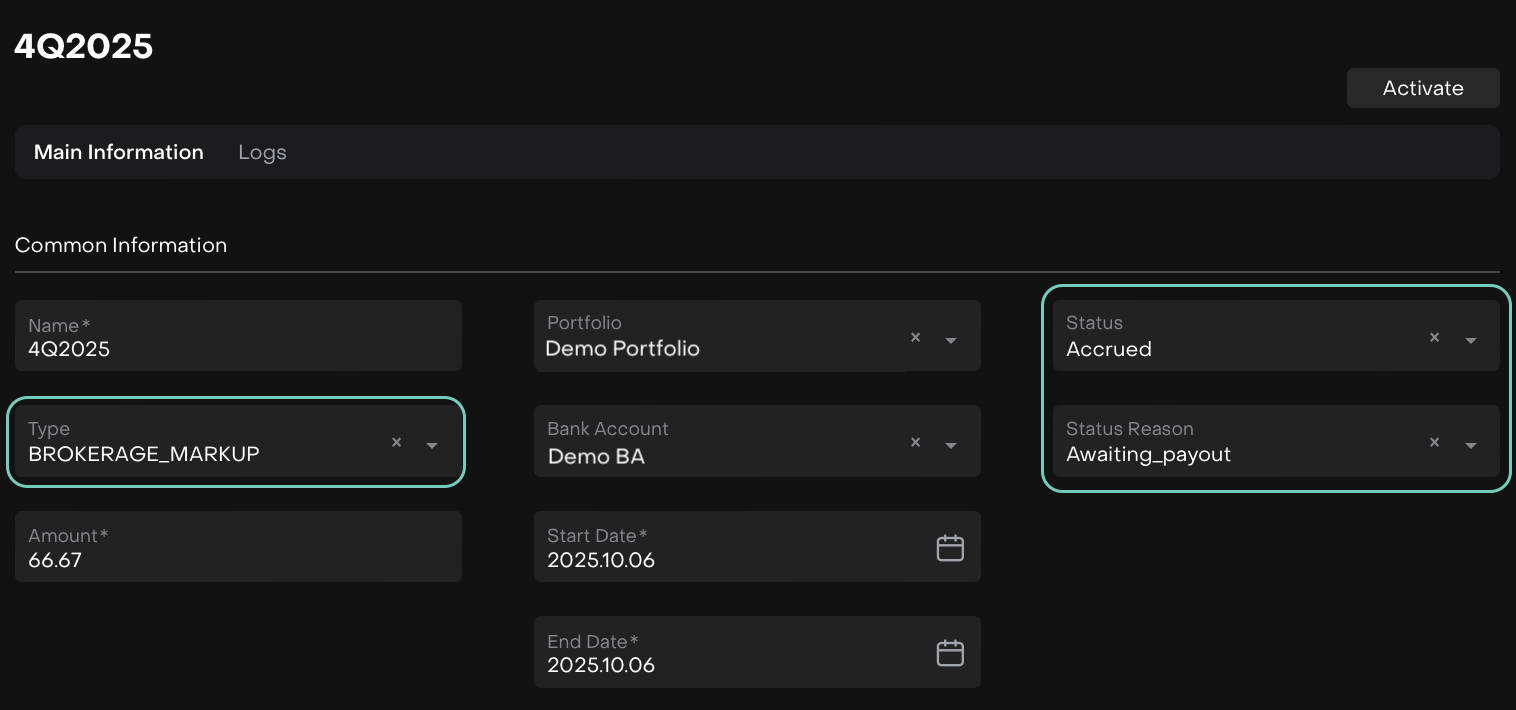

When the transaction is confirmed, the platform automatically generates a Fee record in the Fee object.

Here’s what happens behind the scenes:

The platform captures confirmed transaction data.

It applies the brokerage rate and markup based on mandate rules.

A new Fee object is created to store details such as:

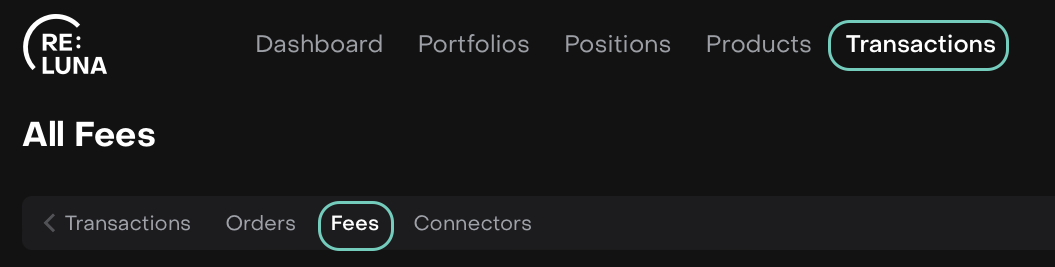

You can review all generated fees by navigating to:

Transactions > Fees tab or via the linked Fee object on the transaction card.

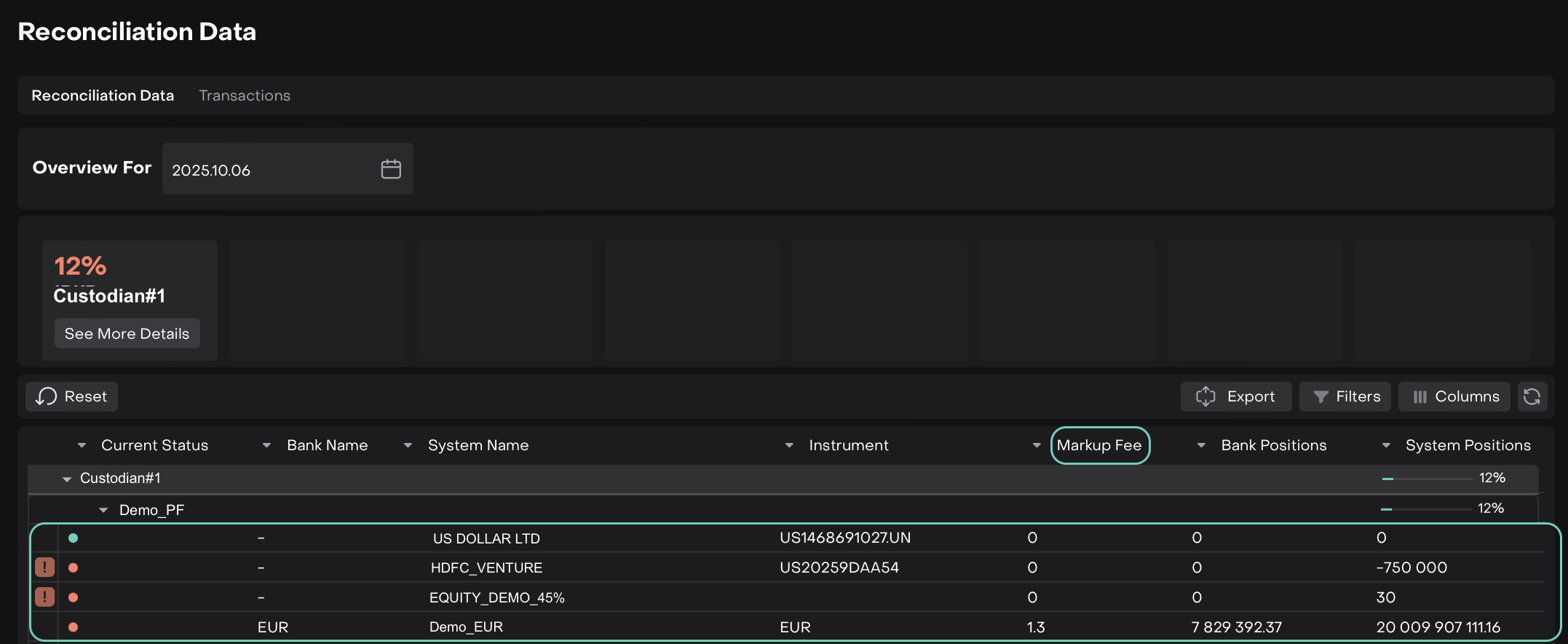

Markup Fee in Reconciliation

During reconciliation, the platform automatically includes the Markup Fee in the Reconciliation Data tab.

The Brokerage Markup Fee must already be generated and accrued (via the confirmed transaction) before it appears in the Reconciliation Data tab.

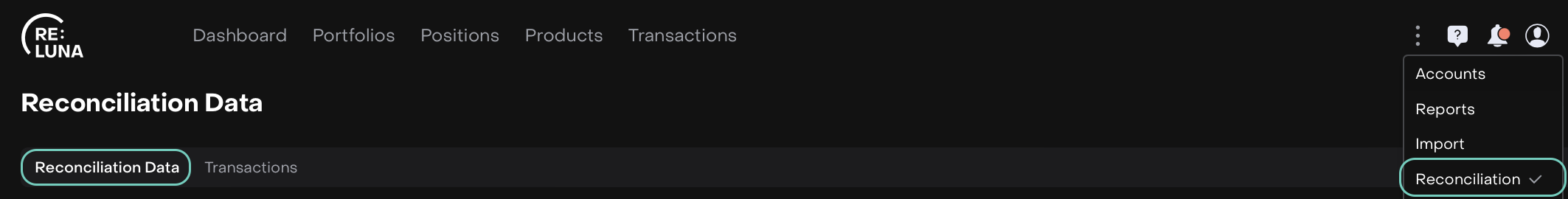

Go to Reconciliation > Reconciliation Data tab

Here’s how it works:

The platform compares and validates executed transactions against custodian or counterparty records.

The Markup Fee — previously accrued under the Fee object — is displayed as part of the reconciliation data.

Ensures the total reflected fee aligns with the executed order’s value.