Manage Orders via Virtual Bank Account

AVAILABLE IN:

Introduction

Virtual Bank Account(s) are internal sub-account created under an Omnibus Bank Account(s). They act as child account to the main omnibus account, enabling you to simulate custodial segregation for different clients or portfolios without involving a real external custodian.

They are commonly used when managing Virtual Portfolios or in scenarios involving TTCA (Title Transfer Collateral Arrangement), where asset pooling is permitted and asset ownership is not required to be individually recorded by an external custodian.

These accounts are especially useful when:

Orders must be placed per portfolio

Asset allocation and tracking need to happen internally

Execution is performed later by the back office

Virtual Bank Accounts are not real custodian accounts. They are ledger-based structures for internal fund and order management.

This guide helps you understand how to create and manage orders using Virtual Bank Account, including how they differ from standard and omnibus flows.

Key Terminologies

Term (A-Z) | Description |

|---|---|

Available Cash | Simulated cash balance within the virtual account used for order validation and estimation. |

Initiator | The user or member responsible for placing the order. |

Time in Force | Set how long the order should stay active (e.g., GOOD_TILL_CANCEL, DAY, etc.). Learn more in the complete guide, here. |

Virtual Bank Account | An account that is platform-generated and used to track, manage client transactions within an omnibus account, making it easier to monitor financial activities. |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

How to Manage Virtual Orders

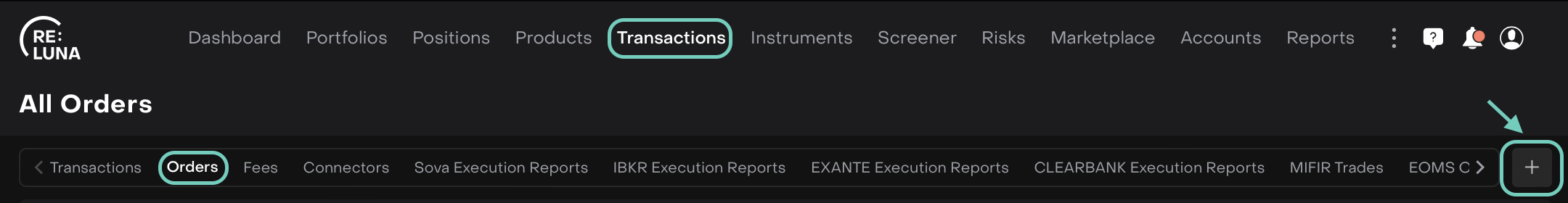

Go to Transactions on dashboard > Order tab > click on

icon to create.

Or,

You can also access the order form:

From a Portfolio

From the Portfolio's Positions view, right-click the position name

🔗 Learn more on how to Manage Omnibus Order.

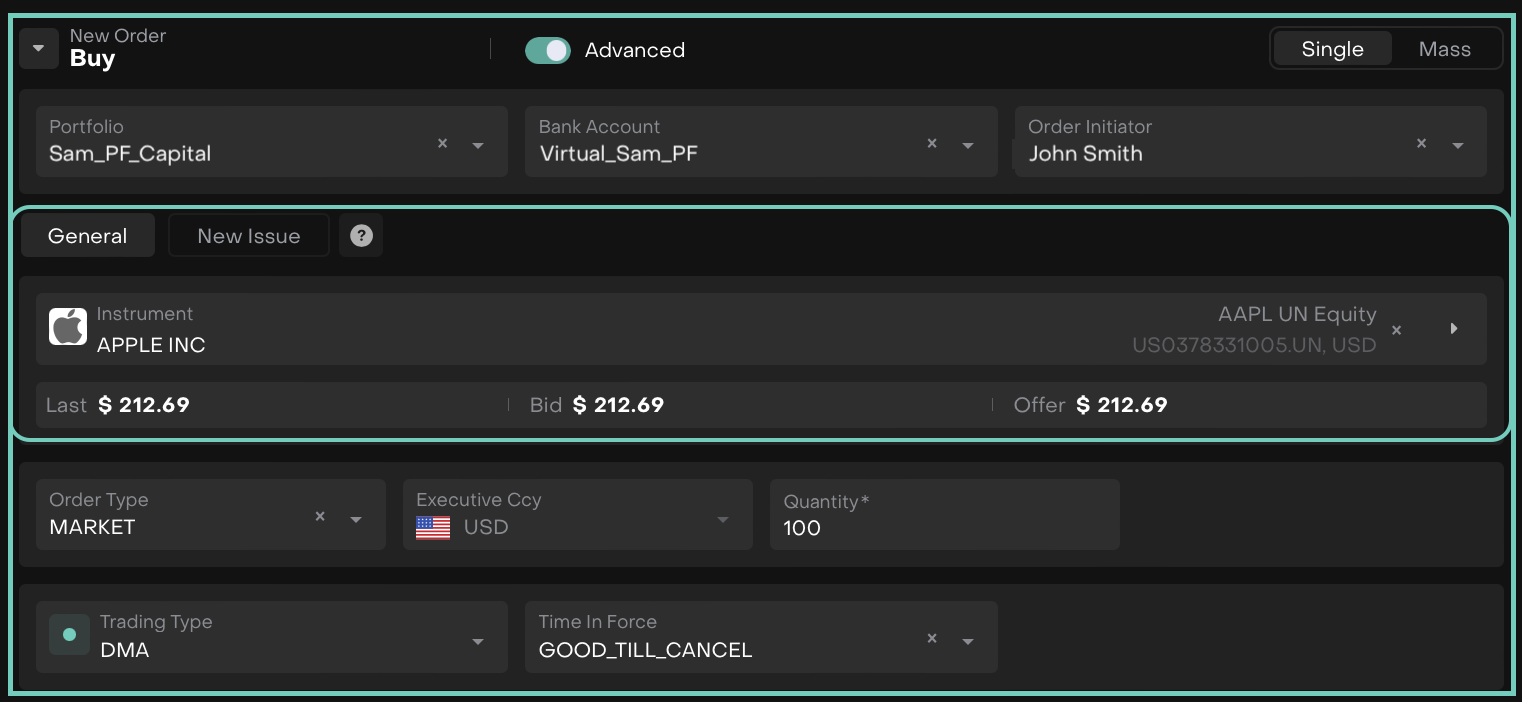

Select New Order Type and choose between Buy, Sell, Cross Trade.

With Advanced form, choose between Single or Mass order modes.

🔗 Learn more on How to Use Advanced Trading Order form

Fill in the required(*) fields such as:

Portfolio: Select the client portfolio that is linked to the Virtual Bank Account (pre-filled if initiated from the Portfolio or Positions view, but can be changed).

Bank Account: Select the appropriate Virtual Bank Account (also pre-filled and editable).

Order Initiator – Choose the person who initiated the order.

Choose the Instrument and when not created from a position, the Instrument field is empty and must be filled in.

When using New Issue Tab

Use this when placing an order for a security that is not yet available in the market, such as an IPO or structured deal.

🔗 Click here to learn how to search for Instruments

Select the Order Type from:

Market – Default type; executed at best available price.

Limit – Set your own price; form shows a Limit field.

Executive Currency: Select the execution currency.

Enter Quantity, manually and define how long the order should remain valid in Time In Force.

Choose the Trading Type (DMA/OTC) — DMA can be selected only if available.

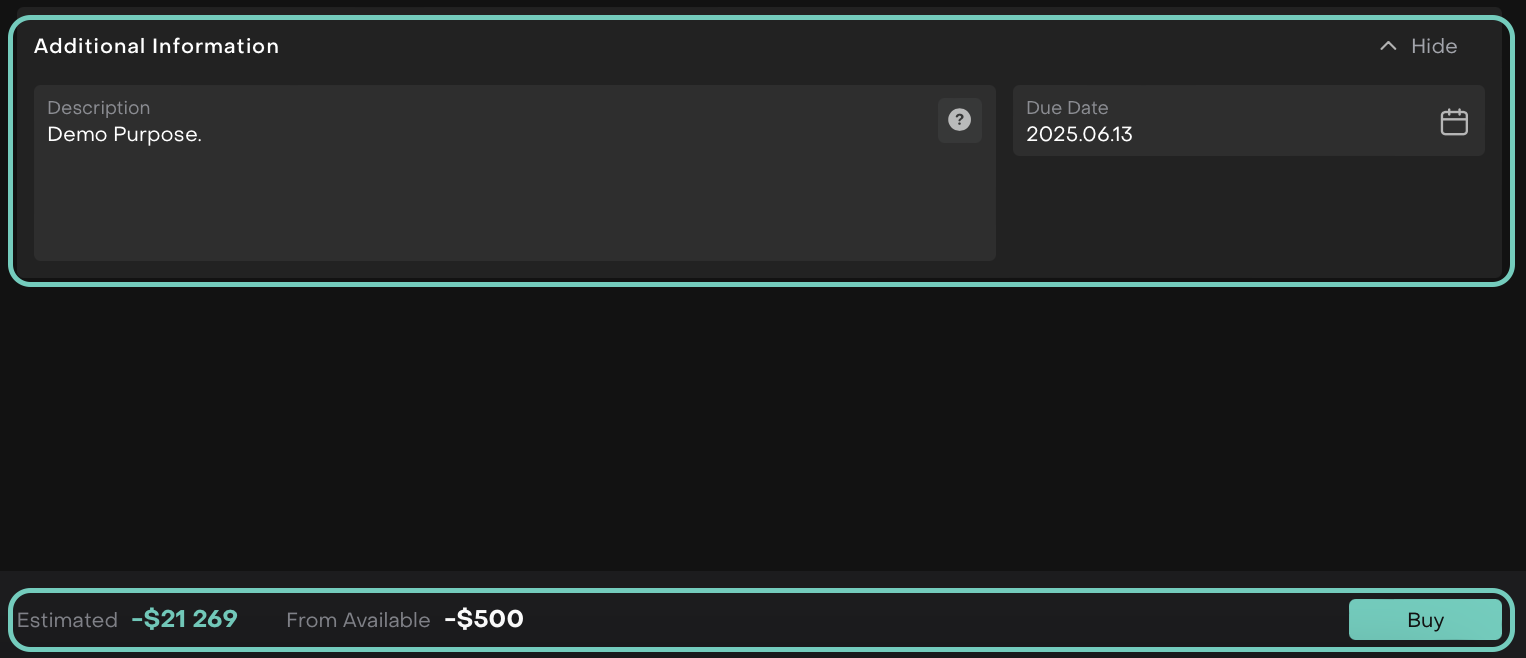

Fill in Additional information, if needed.

Once a Virtual Bank Account is selected, the Available Cash will be simulated based on platform settings.

Input the desired Quantity and review the Estimated Value to ensure it falls within available cash.

Virtual accounts will not restrict you with real custodian rules, but the platform will still validate if the simulated cash is sufficient.

Once all fields are completed, click Buy (or Sell) to submit the order.

The order will be staged in the platform for execution simulation or reconciliation.

After order submission:

The platform will record the order and simulate the impact on the virtual account.

Once a matching transaction is received or uploaded (if real execution occurred outside), you can manually match or automate the reconciliation using the platform’s transaction module.

🔗 Learn about how orders are executed by the back office, visit: How Orders Are Executed on the Reluna Platform