Manage Omnibus Orders

AVAILABLE IN:

Introduction

In the Reluna Platform, an Omnibus Bank Account is a central account opened at a Bank or Custodian that holds funds or assets for multiple clients. To streamline order handling and transaction processing, the Reluna Platform transforms the Omnibus Bank Account into an Omnibus Portfolio.

This Omnibus Portfolio is linked to individual Client Bank Accounts and Client Portfolios. Managing Omnibus Orders involves allocating transactions received in the Omnibus Bank Account to the appropriate Client Bank Accounts and Portfolios.

Key Terminologies

Term (A-Z) | Description |

|---|---|

Client Portfolio | The individual portfolio associated with a specific client that will receive a portion of the Omnibus Order. |

DMA (Direct Market Access) | A trading type that allows for fast order placement directly to the market. |

Estimated Value | The projected cash requirement for the assigned quantity based on the current price. |

Omnibus Portfolio | A central trading portfolio that holds trades on behalf of multiple clients. |

Time In Force | Instruction on how long the order remains active (e.g., Good Till Cancel). |

👉 New to some terms? Check our full Platform Glossary for quick definitions.

Create an Omnibus Order

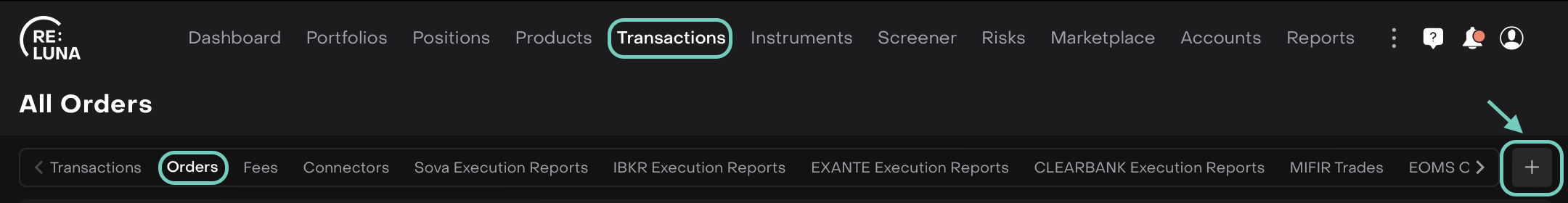

Navigate to the Orders module and click New Order.

Or,

You can also access the order form:

From a Portfolio

From the Portfolio's Positions view, right-click the position name

Select New Order Type and choose between Buy, Sell, Cross Trade.

👉 Learn more on how to Manage Orders via Virtual Bank Accounts

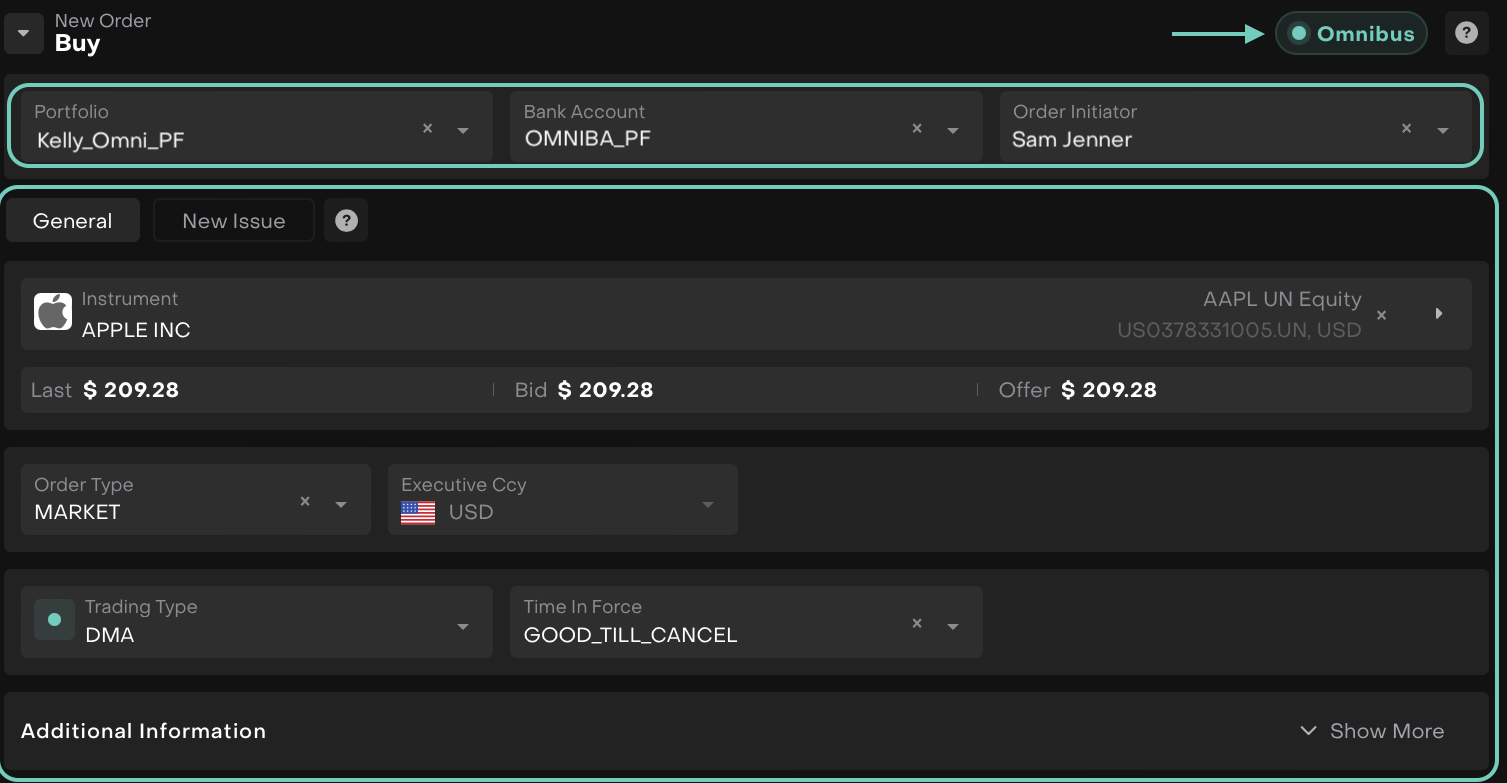

Fill in the required(*) fields such as:

Portfolio – Select the Omnibus Portfolio

Bank Account – Fetched from the portfolio’s main bank or the one linked to the Omnibus Bank Account (also pre-filled and editable).

Order Initiator – Choose the person who initiated the order.

Choose the Instrument and when not created from a position, the Instrument field is empty and must be filled in.

👉 Click here to learn how to search for Instruments.

Select the Order Type from:

Executive Currency: Choose the currency in which the trade will be executed

Choose the Trading Type (DMA/OTC) — DMA can be selected only if available.

Time In Force: Set how long the order should stay active (e.g., GOOD_TILL_CANCEL, DAY, etc.).

Learn more in the complete guide, here.

Fill in Additional information if needed.

When using New Issue Tab

Use this when placing an order for a security that is not yet available in the market, such as an IPO or structured deal.

Follow the same steps as in the New Order Creation form, here

Allocate to Client Portfolios

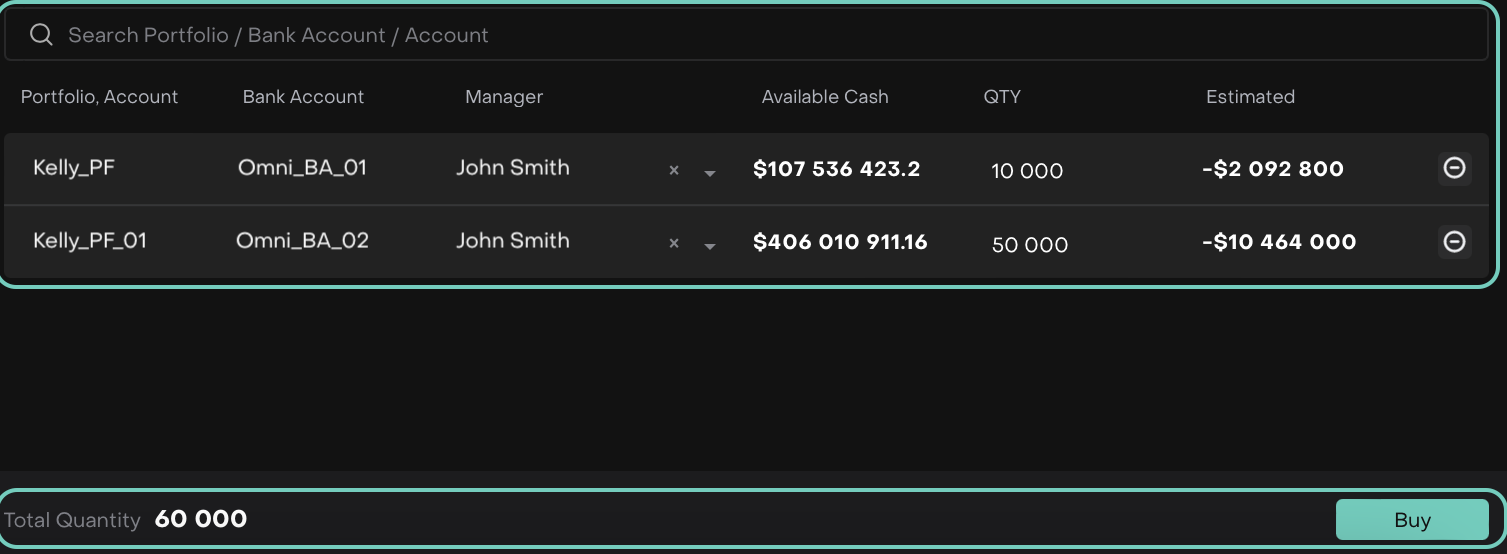

Search and select the Client Portfolios to whom this order will be allocated.

For each selected client:

Confirm the linked Bank Account

Assign a Quantity

Review the Available Cash and Estimated order value

Ensure the total allocated quantity matches your intended total quantity.

At the bottom, the Total Quantity (e.g.,

60,000) will auto-calculate.In this case, click the Buy button to submit the Omnibus Order.

Once submitted:

The order is routed to the Bank/Custodian.

Allocated client portfolios are updated with the respective order details.

The platform tracks the order until execution.

🔗 To complete the execution process, refer to this guide, here