Manage Tax Transactions

Introduction

Tax Transactions in the platform are used to record, allocate and track all tax-related charges applied to portfolios or specific security positions. This includes statutory taxes such as Withholding Tax, Sales Tax and Other regulatory taxes.

Cash-assigned Tax Transactions reduce the portfolio’s cash balance and impact the Cash PnL.

Security-assigned Tax Transactions are applied to a specific instrument and affect the Security PnL of that position.

Permission Requirement

Platform Name | Permission Level |

|---|---|

Transactions (tab) | View, Modify, Create, Delete |

Manage Tax Transactions

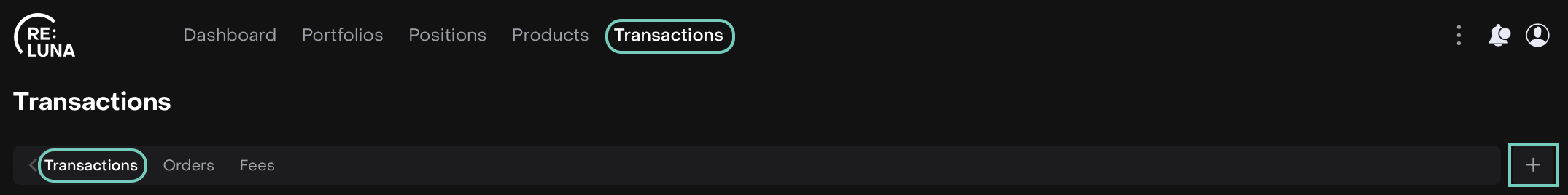

Go to Transactions > Find Transactions tab > Click + Icon

Or,

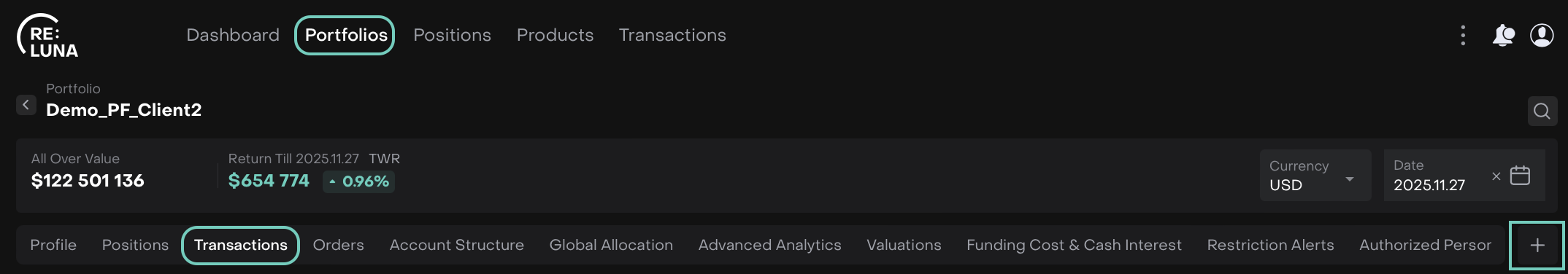

Go to Portfolios > Find Transactions tab > Click + Icon

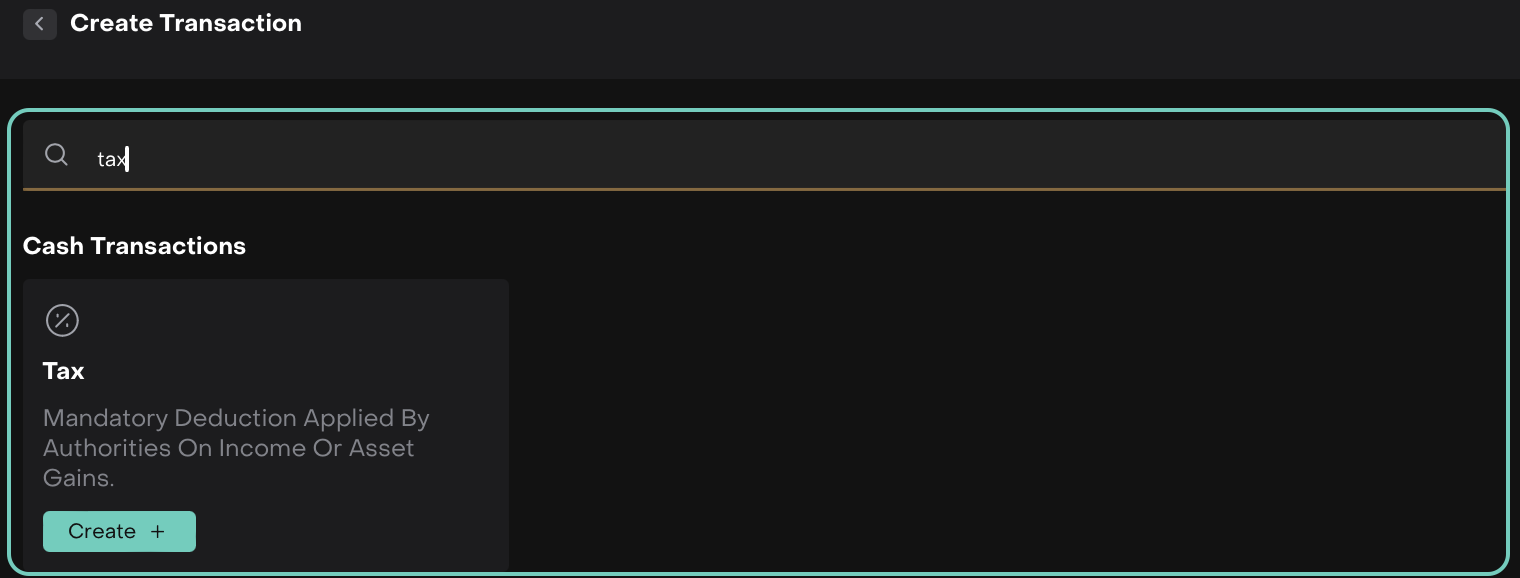

A window appears. Search/Select your Transaction type.

Click Create + to proceed.

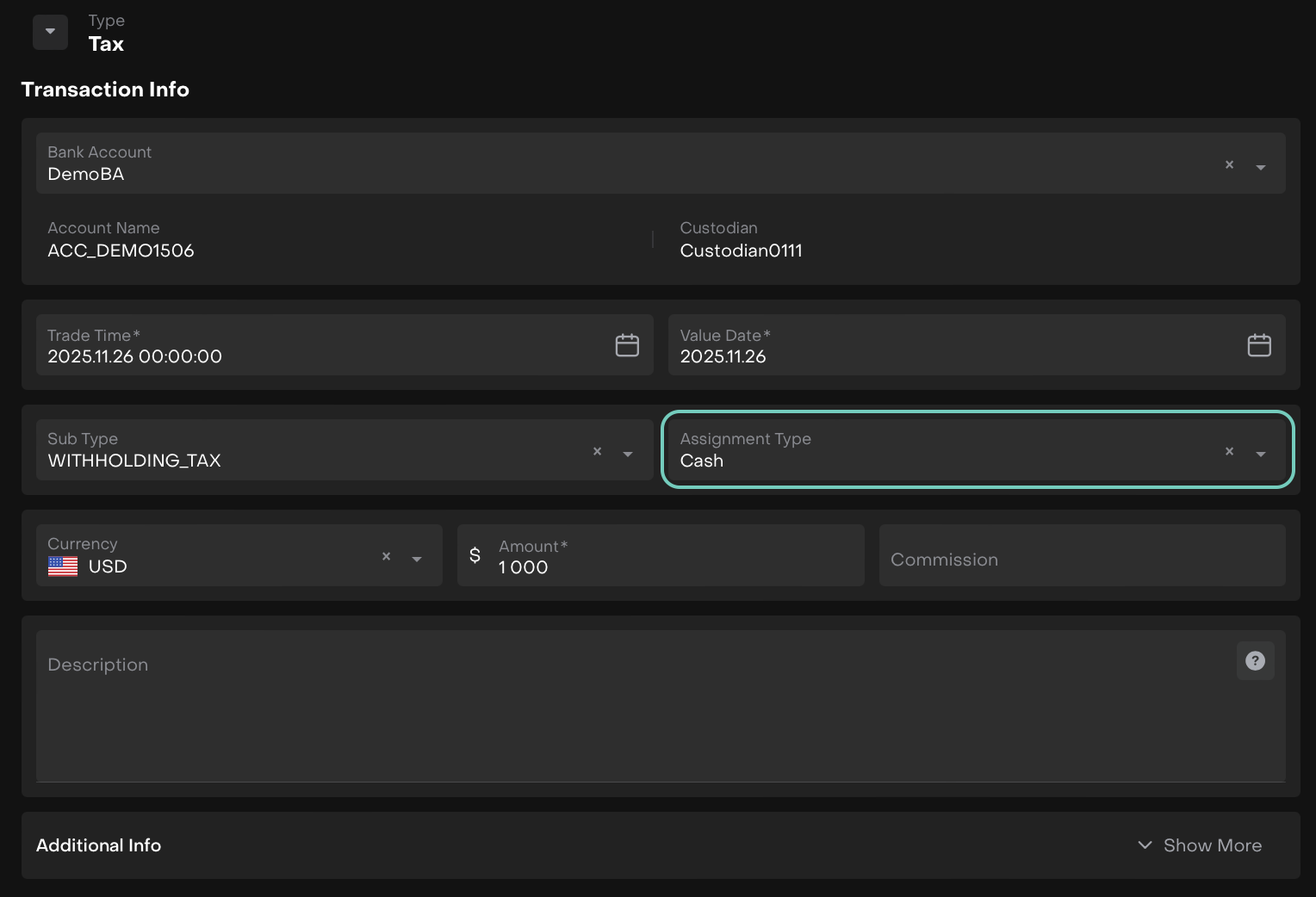

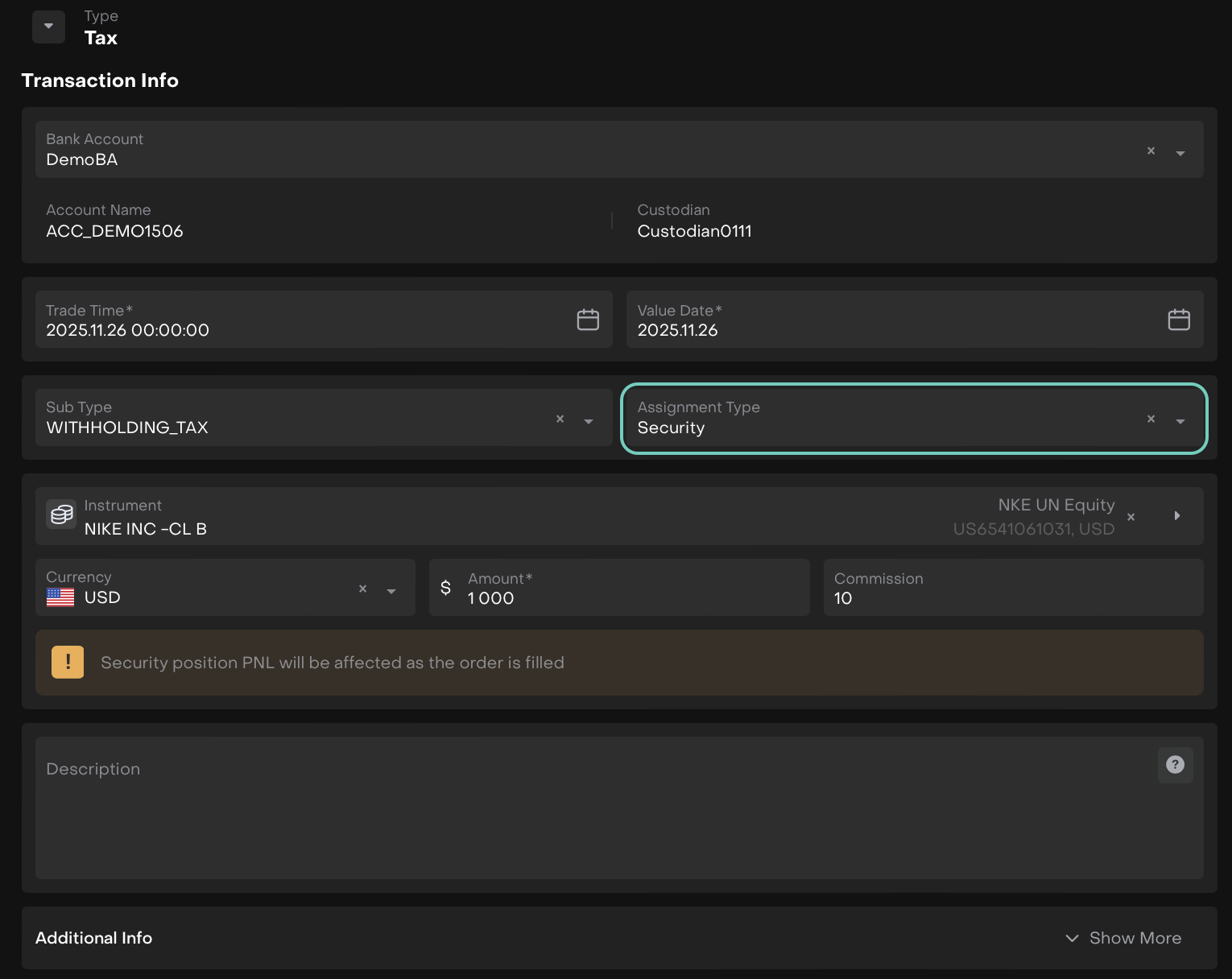

A form opens, fill in all the required fields(*).

When Assignment Type = Cash

When Assignment Type = Security

🔗 Learn here on how to fill in the Additional Info.

Once filled, click Save or to discard click Close.

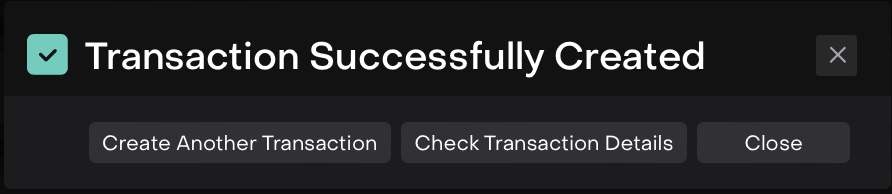

Upon saving, a pop up message appears.

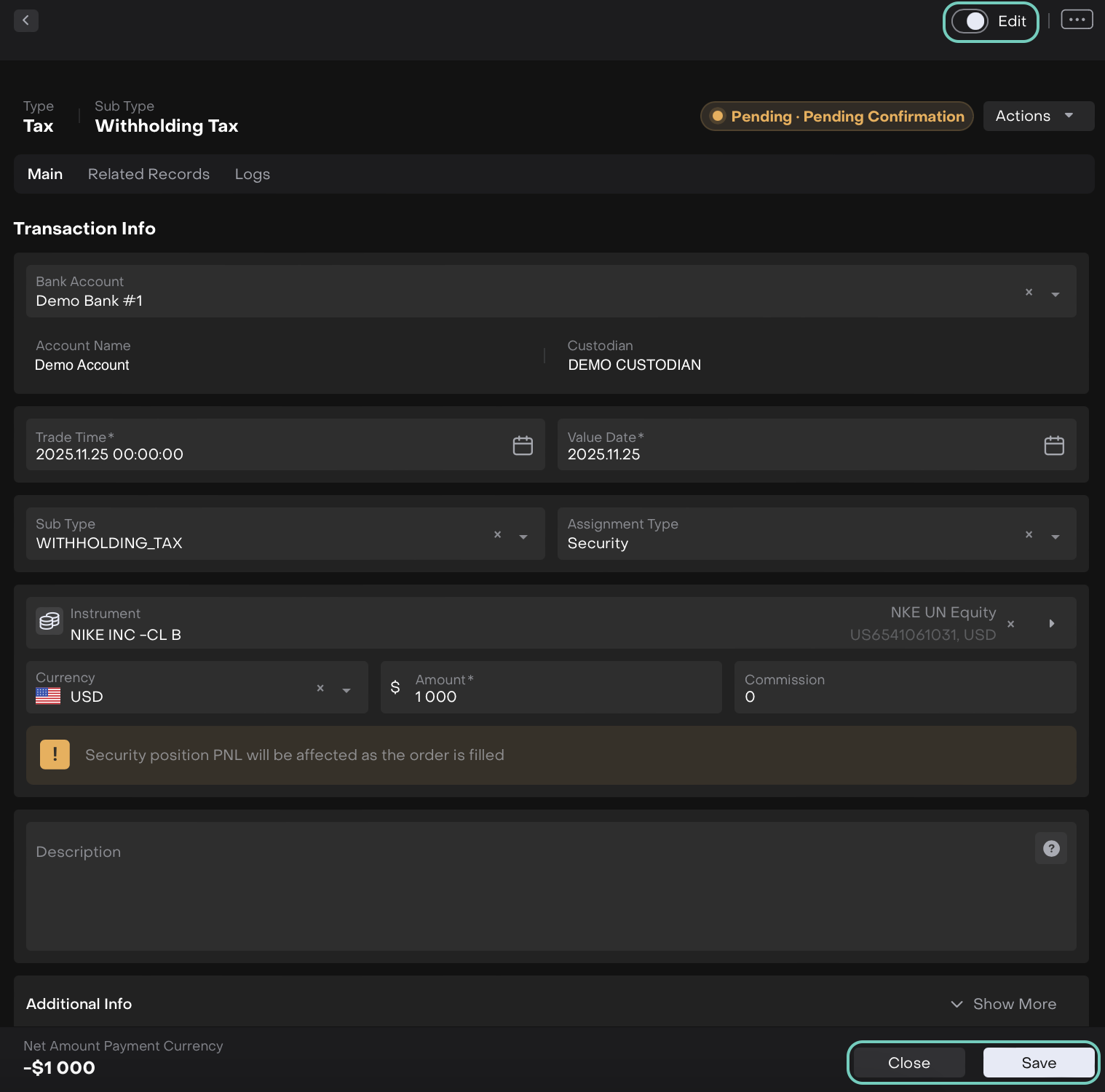

Click on Check Transaction Details to Edit details or click on Create Another Transaction.

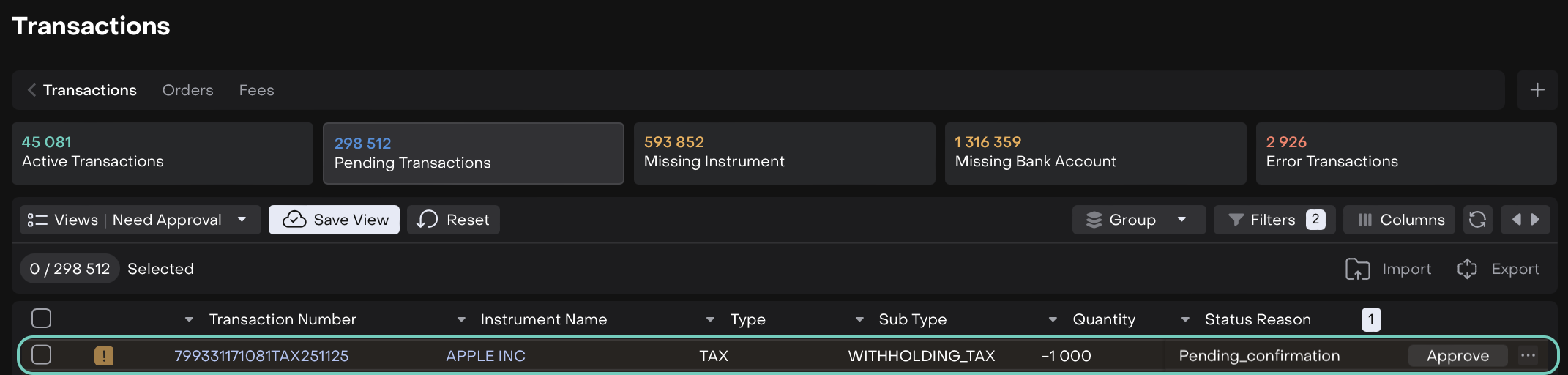

Once saved, the transaction is created and will appear on the list.

To further Edit/Approve/Match the transactions. Click on three-dots menu to proceed or double click on the row.

🔗 Learn more on how to Manage Transactions or Match Transactions.

Post-Matching Behavior for Tax Transactions

PnL Impact

Cash Assignment: Cash PnL is updated to reflect the Tax amount.

Security Assignment: Security PnL is updated for the assigned instrument.

Security balances or positions are updated accordingly.

Portfolio and Cash Updates

Cash balances decrease for cash-assigned Taxs.

Security positions reflect the Tax deduction if assigned to a security.