Release 4.24

🔍Learn What's New:

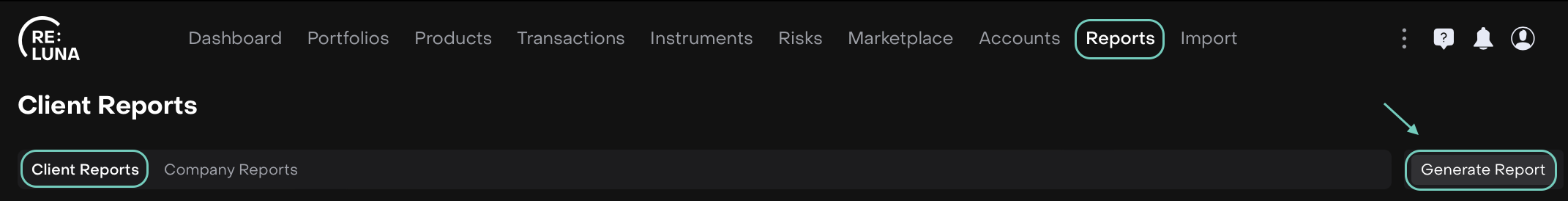

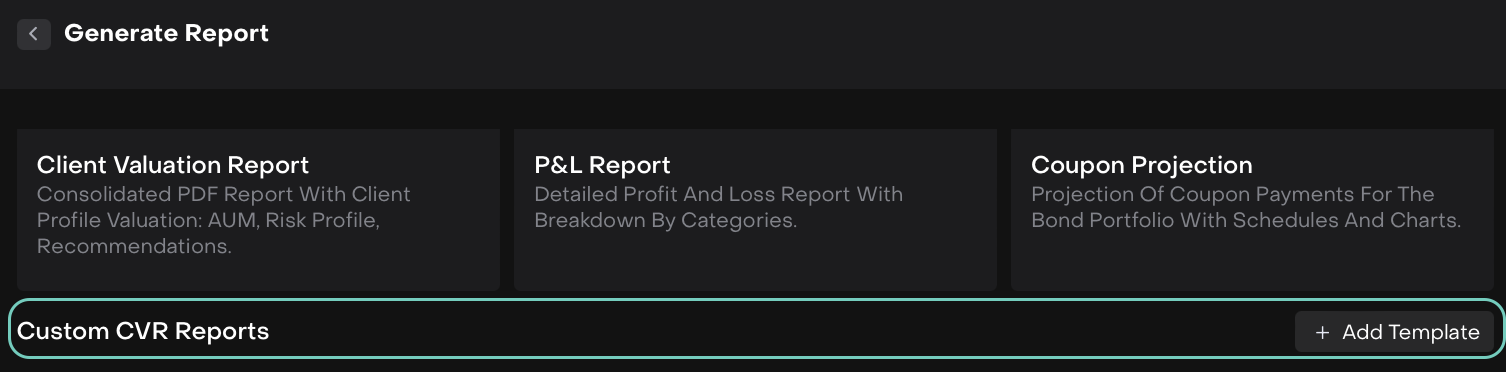

Redesigned Client Valuation Report NEW

CLIENT ADMINISTRATOR

Your Client Valuation Report (CVR) now gives you more control and flexibility:

Find it under Reports > Client Reports > Generate Report

Easily toggle on/off key fields on Title page: Date of Agreement, Client ID and Contact Info.

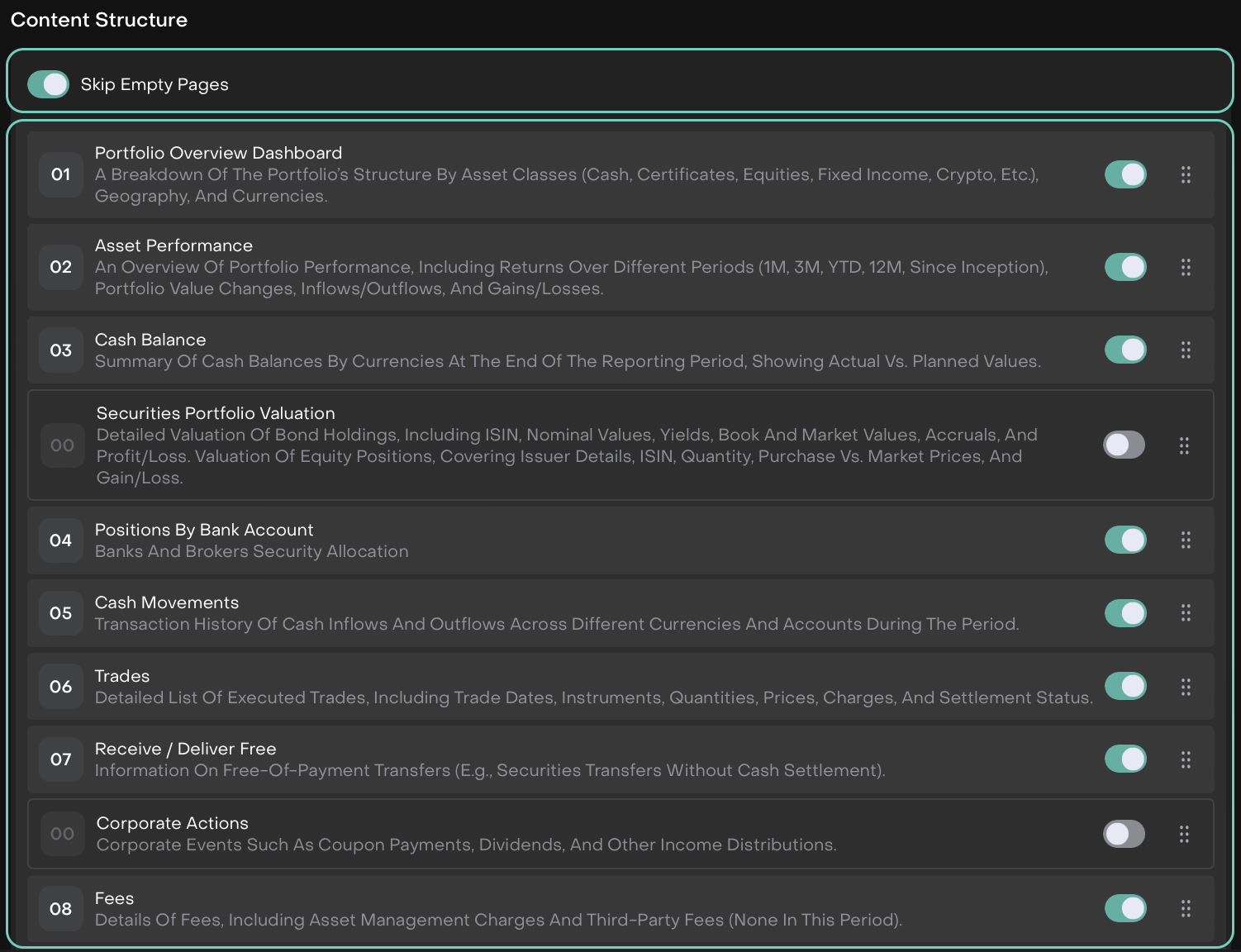

Toggle Skip Empty Pages on/off.

Customize your report layout by turning report blocks on/off and rearranging their order.

Personalize the last page with your own notes.

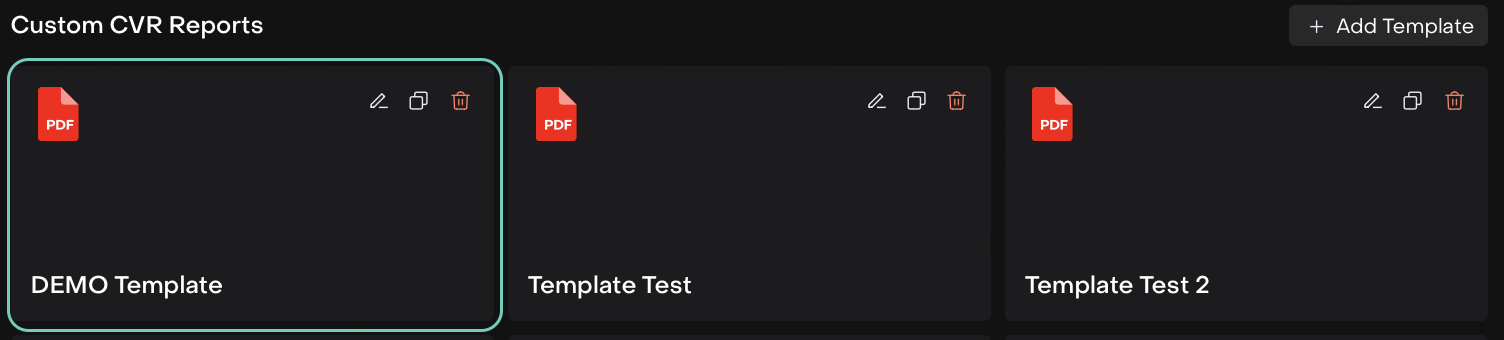

Create Custom CVR Templates NEW

ADMIN

Now, create, edit and manage your own CVR (Client Valuation Report) templates directly on the platform. Define the structure, choose the data you want to include and add or use your saved templates anytime.

Find it under Reports > Client Reports > Generate Report

Also, make edits or download reports based on these templates whenever needed, giving you complete flexibility and control over your CVR reporting.

Custom CVR Template on Platform

👉 For more details, refer to guides below:

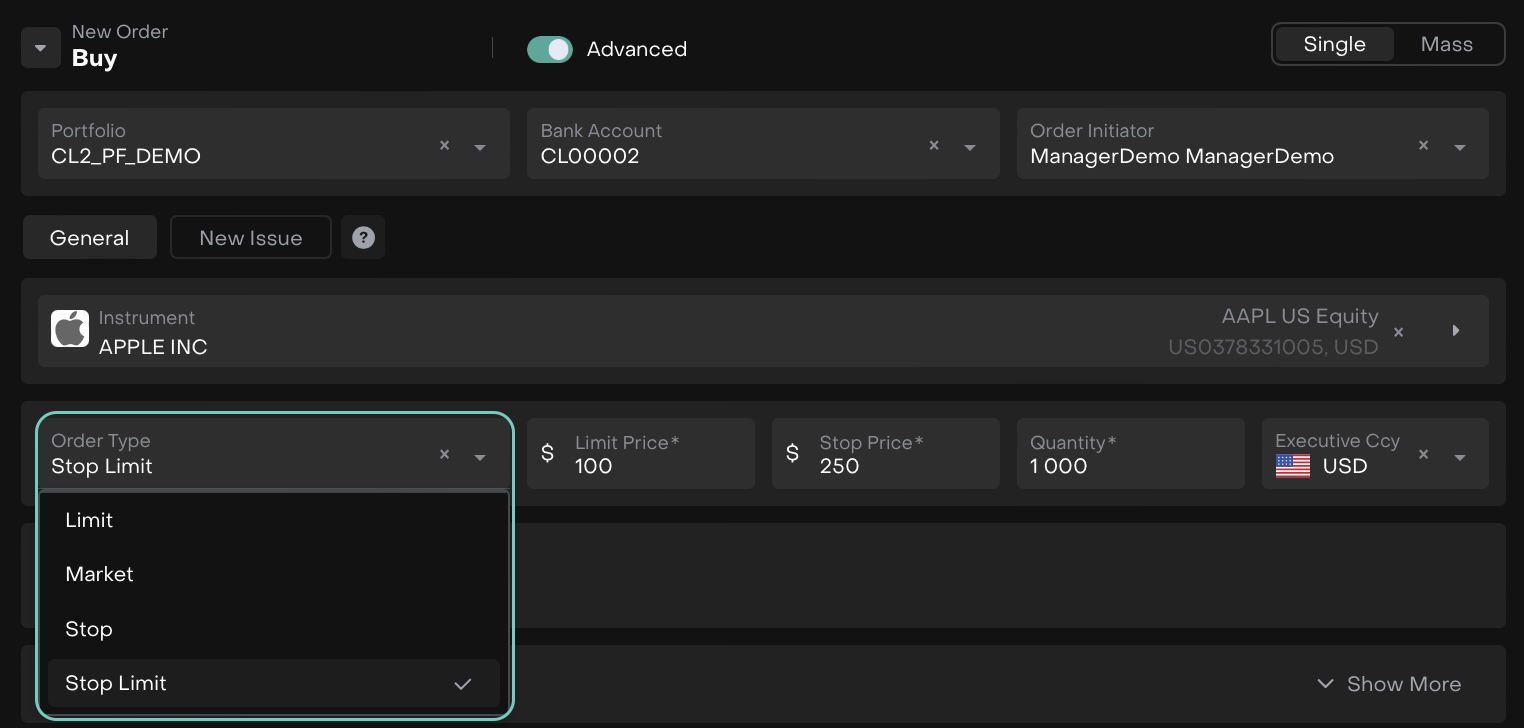

New STOP & STOP LIMIT Order Types Now Live for OTC and DMA ENHANCEMENT

AUTHORIZED USERS ONLY

Now, place STOP and STOP LIMIT orders for both Buy and Sell via OTC and DMA. In addition, explore the new STOP order type for FX.

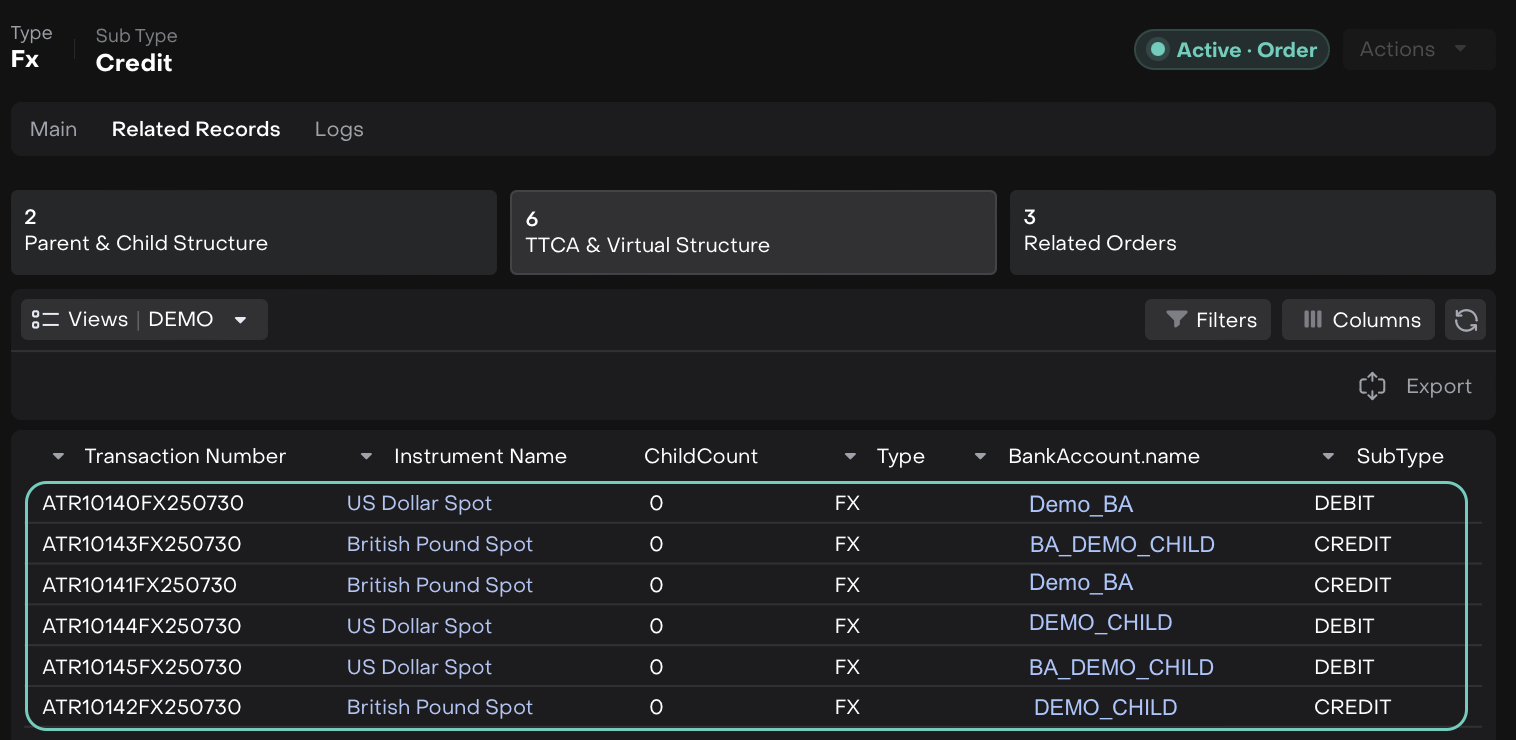

Updated Related Orders for Omnibus FX ENHANCEMENT

TRADER

Now, you can view the breakdown of both buy and sell sides for Omnibus FX orders when you open Related Records, giving you a complete view of the transaction.

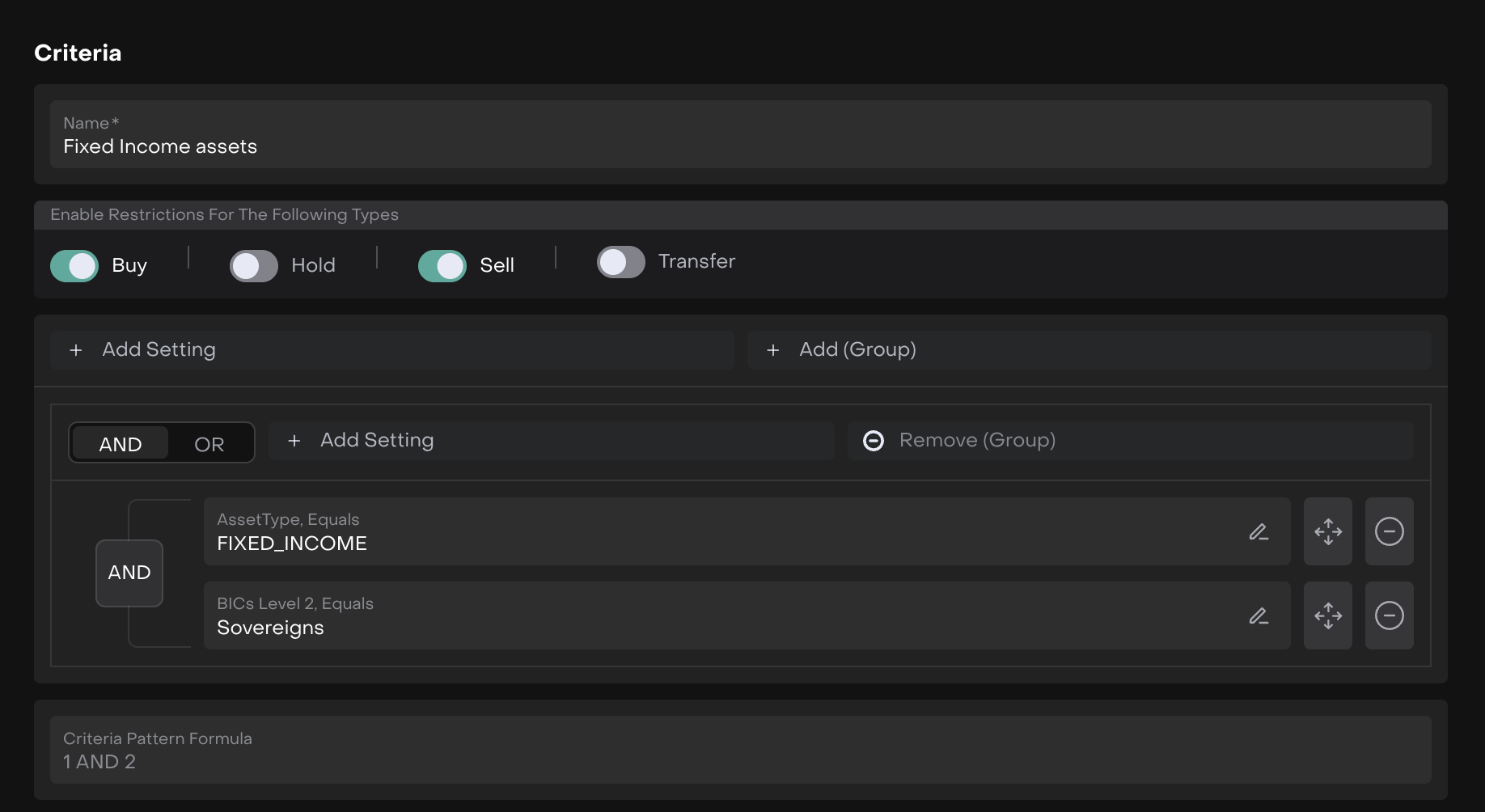

Smarter & More Flexible Investment Profiles ENHANCEMENT

AUTHORIZED USERS ONLY

Managers can now easily create complex rules for investment profiles. Build “AND/OR” conditions, group settings and set restrictions for Buy, Sell, Hold or Transfer actions - all in a more intuitive and flexible way.

Find it under Risks > Investment Profiles > Restrictions

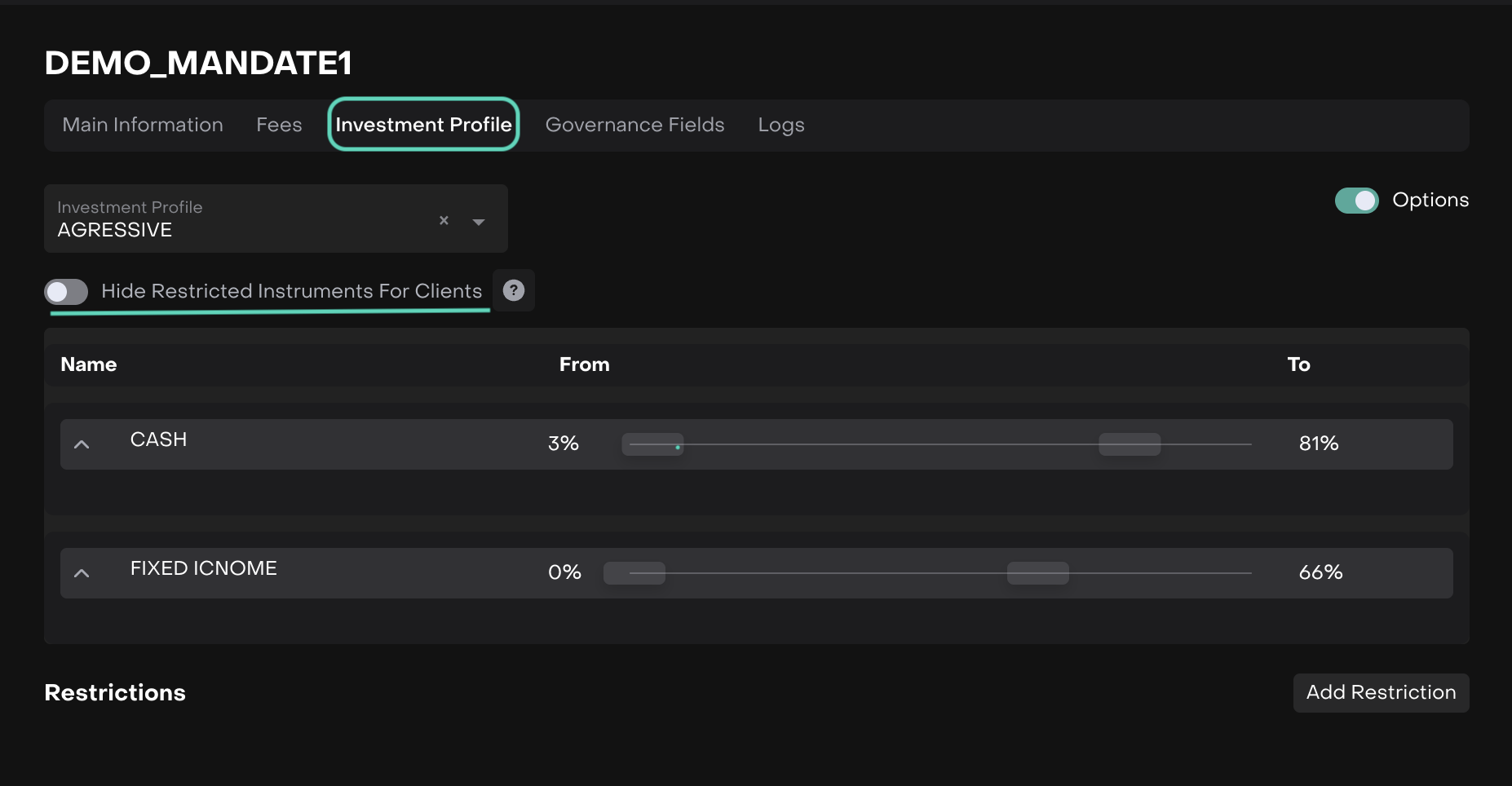

Investment Profile – Hide Restricted Instruments ENHANCEMENT

AUTHORIZED USERS ONLY

New toggle “Hide restricted instruments for clients” added in the Investment Profiles tab.

When enabled, instruments with 0% restriction will be hidden from clients during order creation.

Clients will now see a banner explaining that some instruments may not be visible due to their investment profile or mandate restrictions.

This makes the search process cleaner and ensures clients only see instruments they can actually trade.

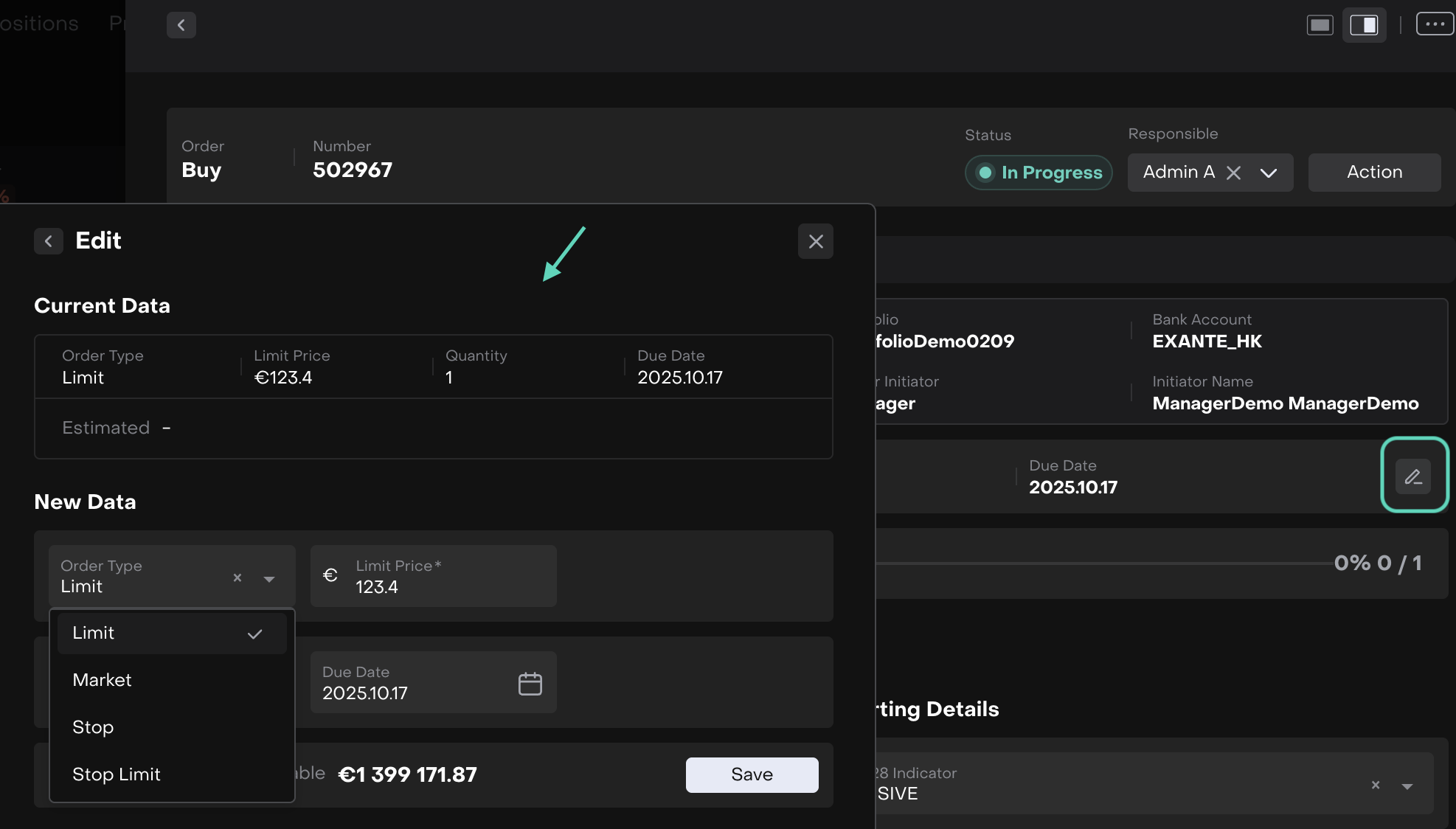

Use Modify Function in Orders ENHANCEMENT

AUTHORIZED USERS ONLY

Modify orders and update fields such as: Quantity, Order Type (Market, Limit, Stop, Stop Limit) and its related Prices. Works for both DMA and OTC Orders.

These changes ensure more accurate FIX communication and a smoother experience when working with different order types.

👉 For more details, refer to the guide here.

Order Forms Made Easier ENHANCEMENT

TRADER

When creating a new order the Bank Account field will now autofill automatically if there is only one available option. For FX orders, the From field will also autofill when only one source is available.

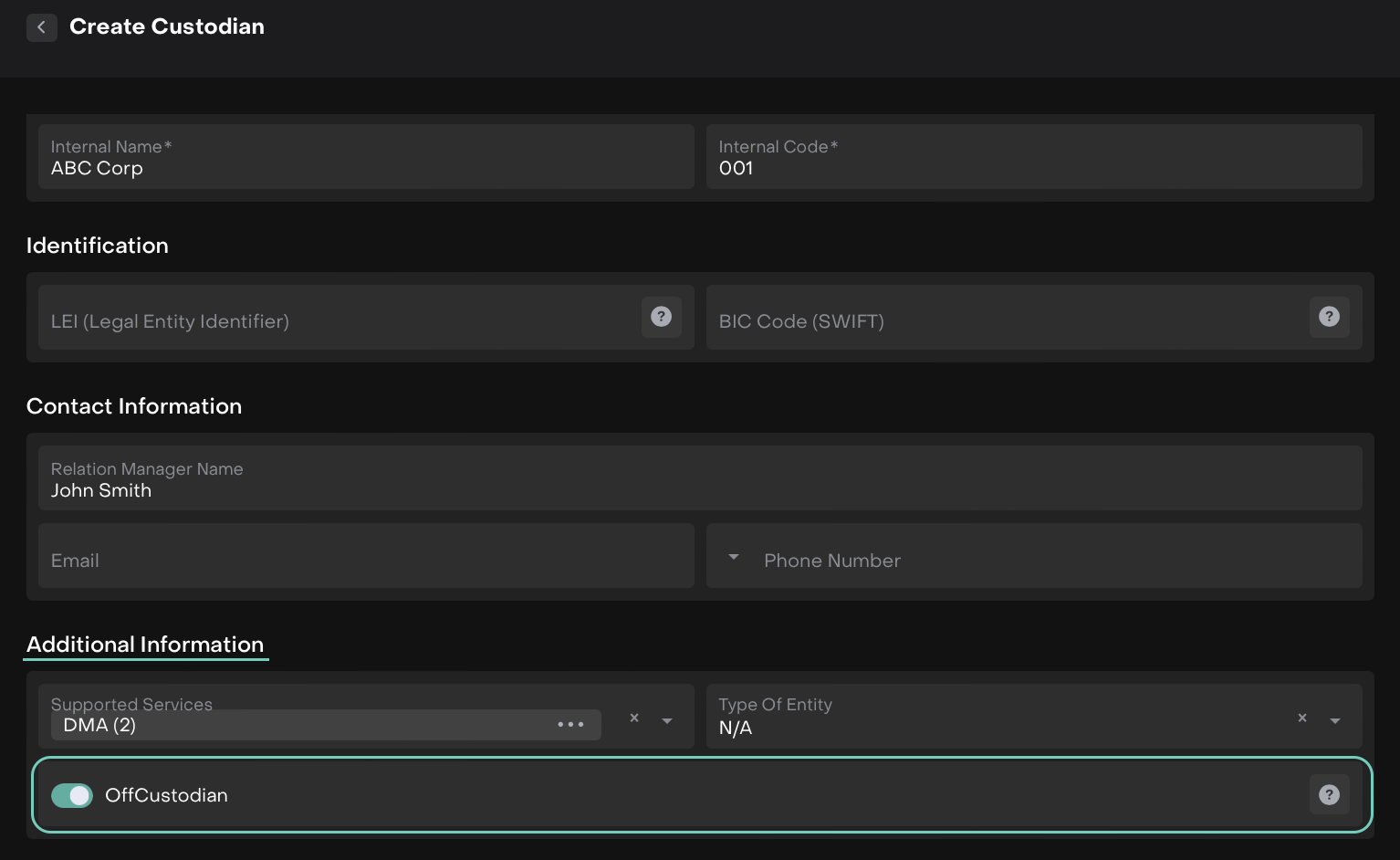

Find offCustodian Toggle on Custodian ENHANCEMENT

TRADER

Use the new offCustodian toggle field in the Custodian to manage your statement setup. Set it to False if integration for receiving custodian statements is configured or True if no integration is set up.

Find it under Accounts > Custodians tab

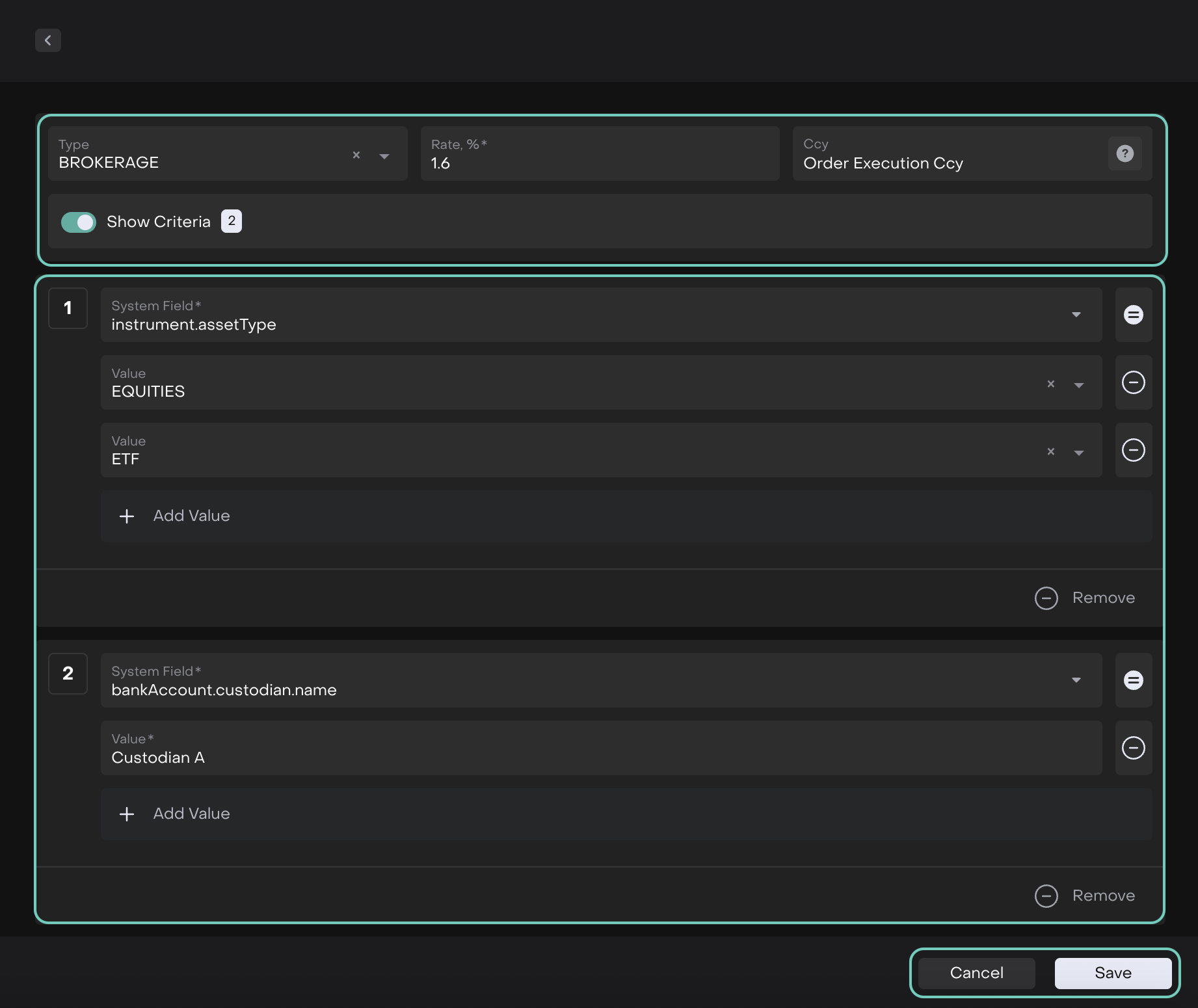

Streamlined Brokerage Fee Calculation MVP ENHANCEMENT

MANAGER BACK OFFICE

You can now define and track brokerage fees directly in the platform.

This is the first version of these features. We’ll be enhancing and refining them step by step based on your needs and feedback.

What’s new:

Set brokerage fees (%) at the Mandate level.

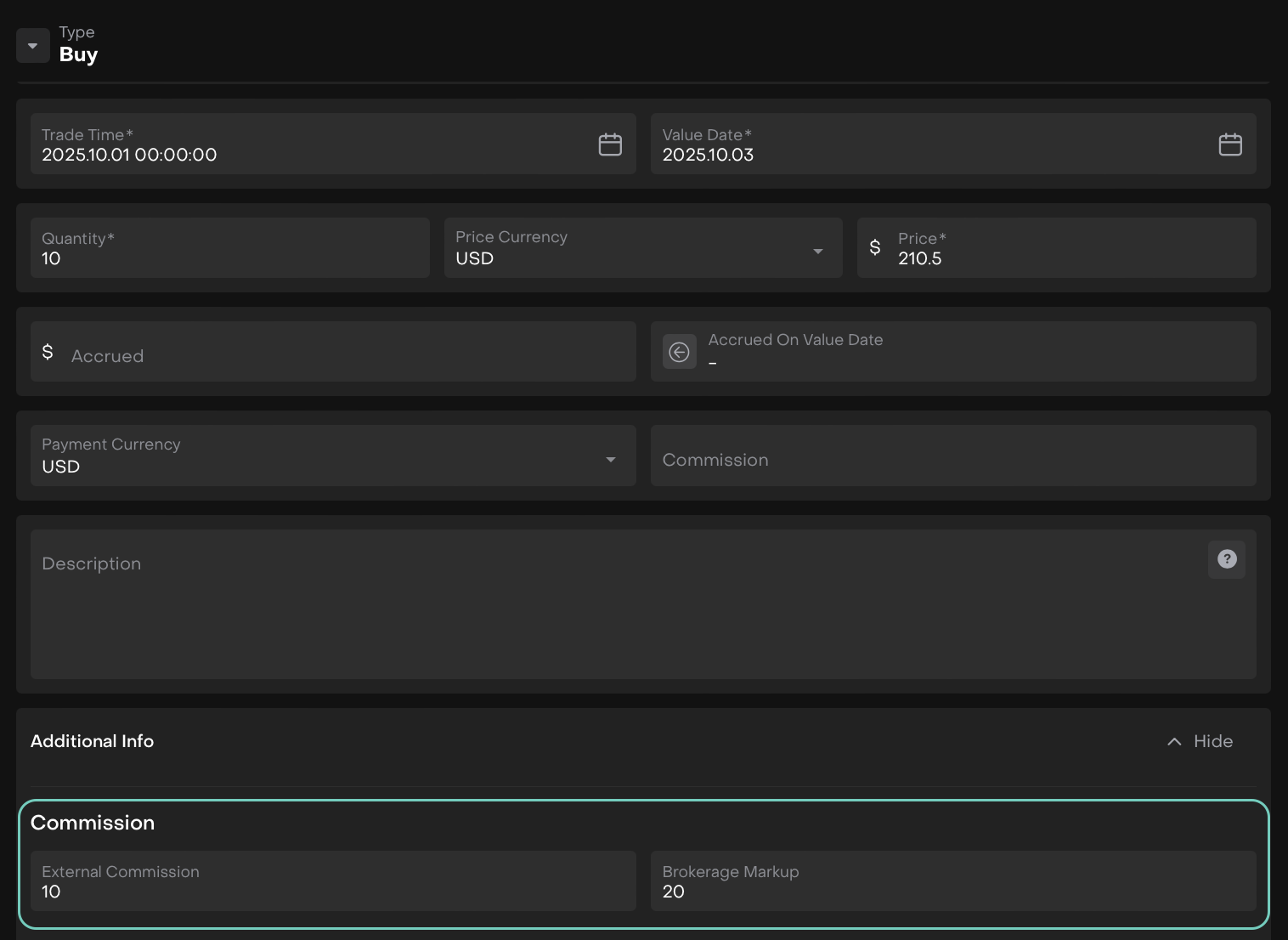

View Estimated Fees while creating BUY/ SELL orders.

Check automatic calculation of External Commission and Brokerage Markup during transaction matching (visible on the transaction card).

Review platform-generated fees in the Fee object after confirmation of transaction.

Check how platform marks Markup Fee during reconciliation.

👉 For more details, refer to the guide here.

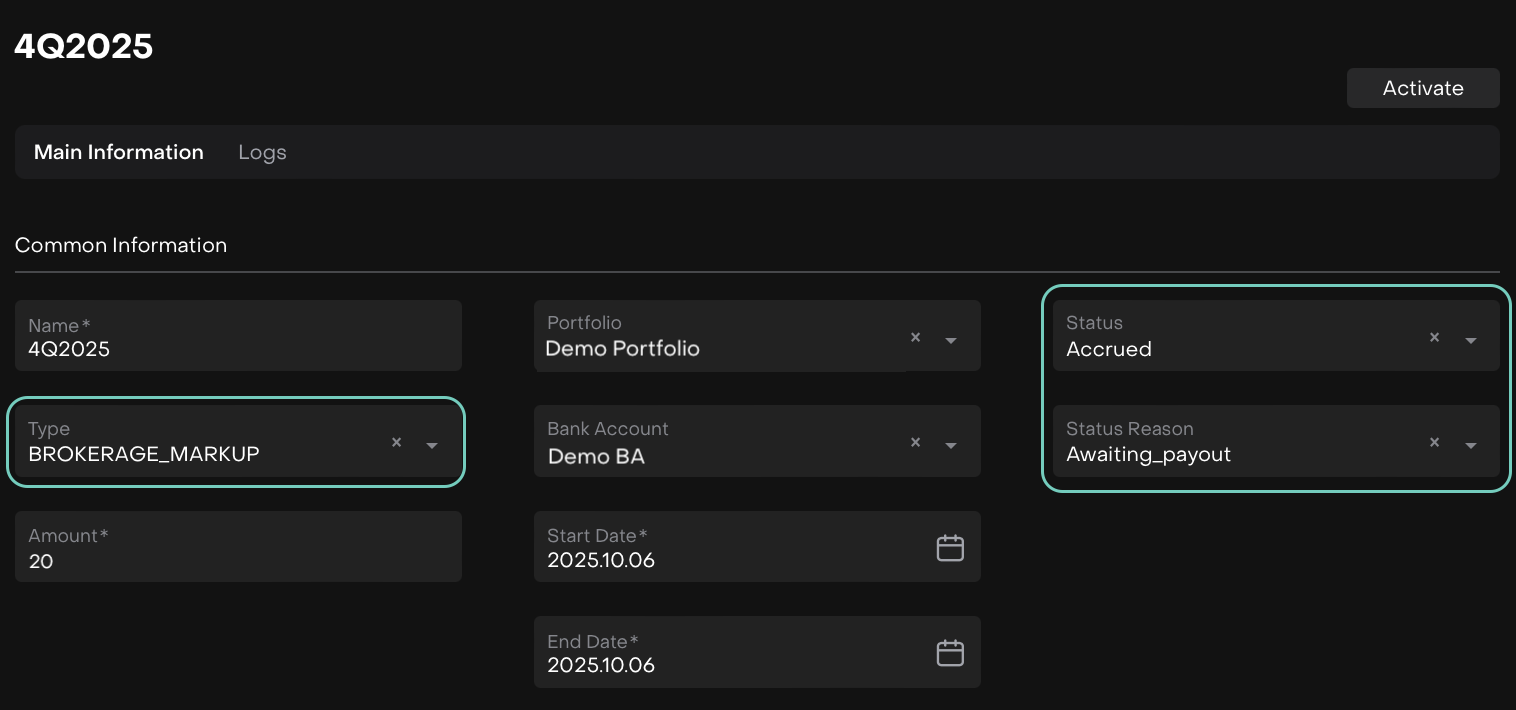

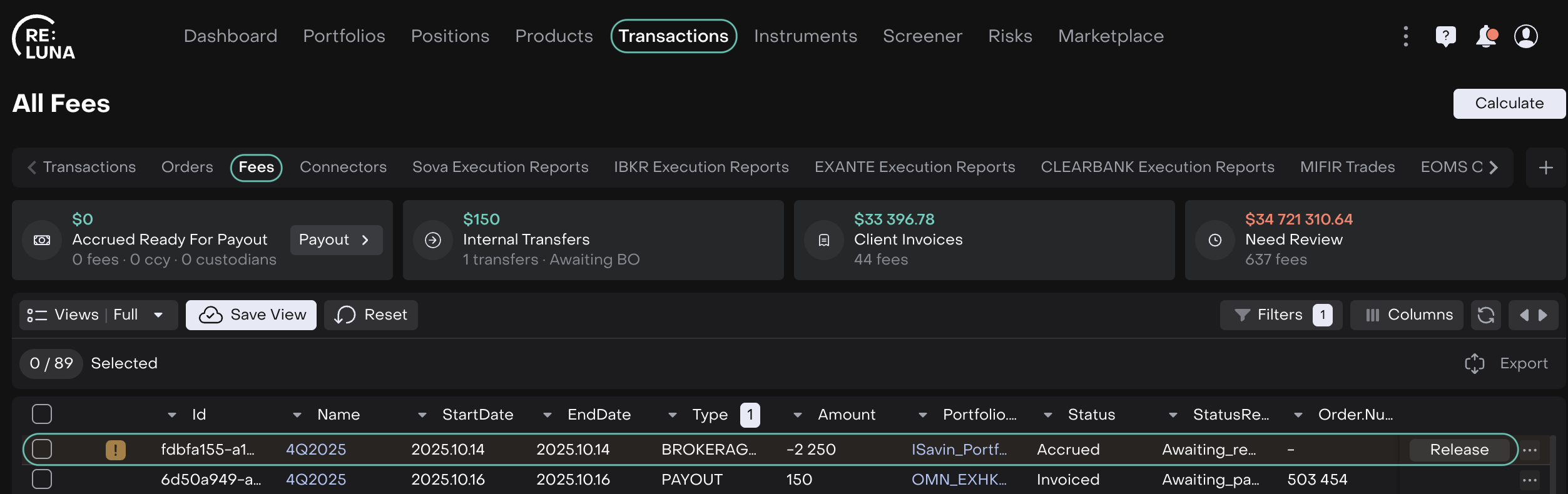

Automate Fee PayoutsMVP ENHANCEMENT

MANAGER BACK OFFICE

You can now automate your brokerage fee payouts directly on the platform.

This is the first version of these features. We’ll be enhancing and refining them step by step based on your needs and feedback.

The Brokerage Fee may have both positive (> 0) and negative (≤ 0) values, reflecting the Amount field:

If Amount > 0: The fee is created with Status = Accrued and Status Reason = Awaiting Payout, allowing you to create a Payout from this fee.

If Amount ≤ 0: The fee is created with Status = Accrued and Status Reason = Awaiting Review. Managers can review and Release it before it becomes available for payout.

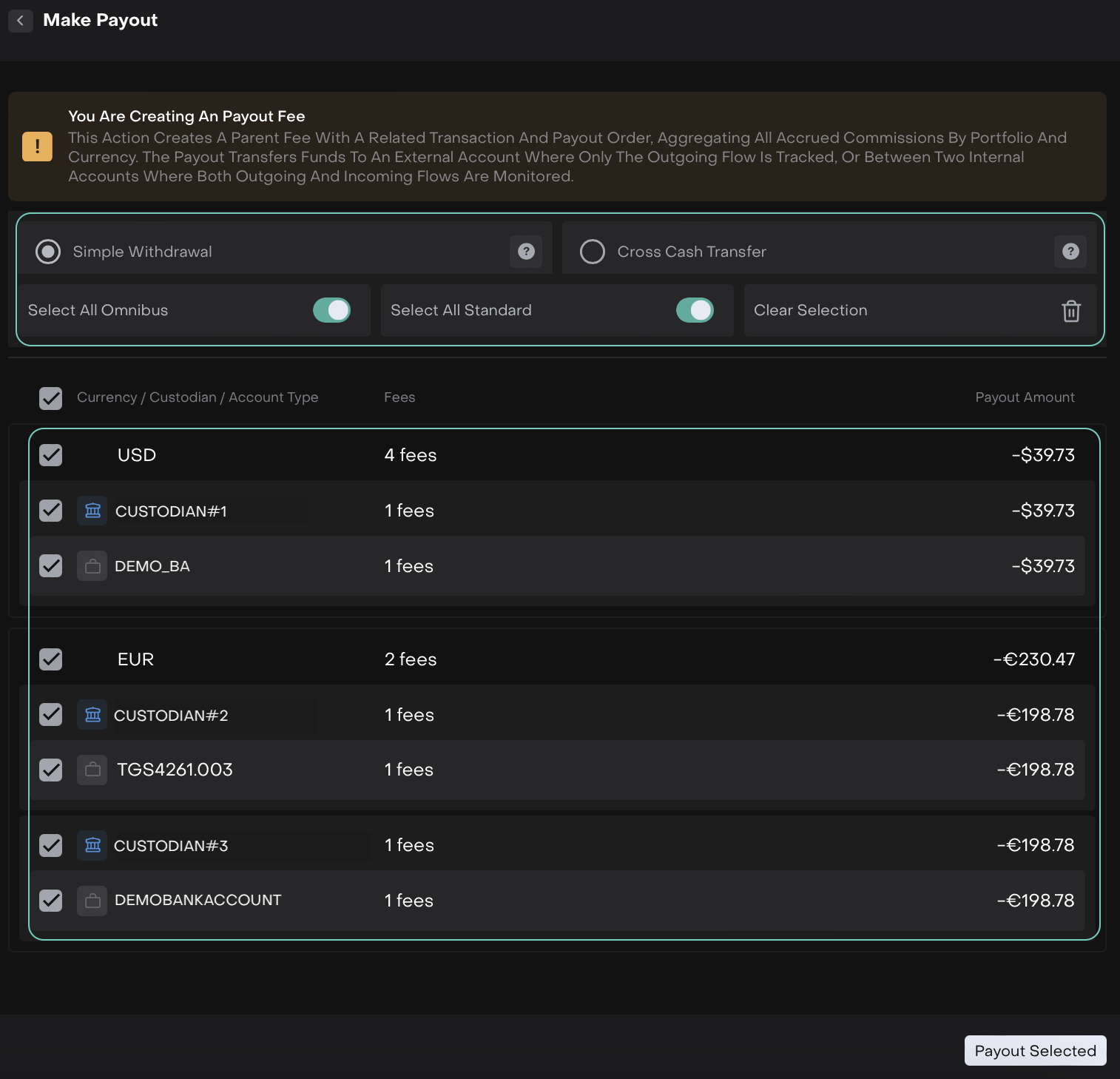

You can then generate a payout that automatically creates a Payout Fee, along with a related transaction and payout order, aggregating all accrued commissions by portfolio and currency.

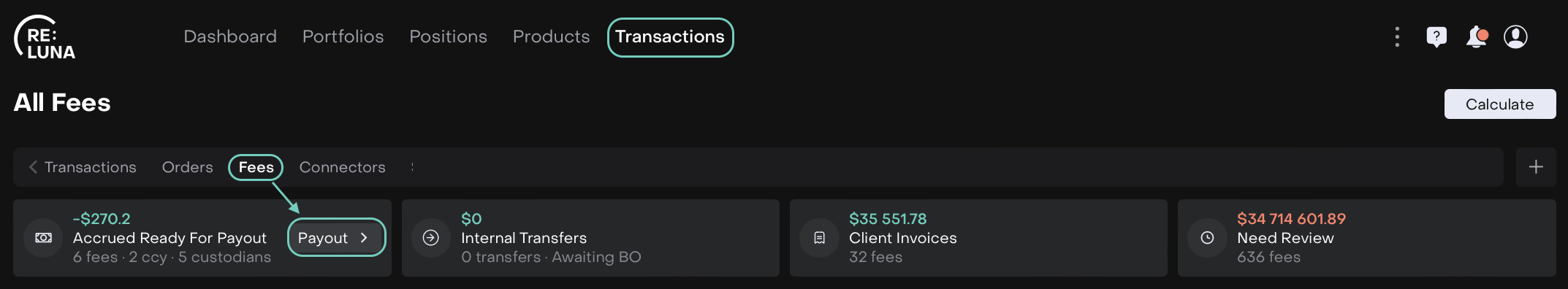

Go to Transactions > Fees > Payout

Choose how to transfer funds:

Simple Withdrawal: Transfer to or from an external account (not registered in the platform).

Cross Cash Transfer: Transfer between two internal accounts, where both outgoing and incoming flows are tracked.

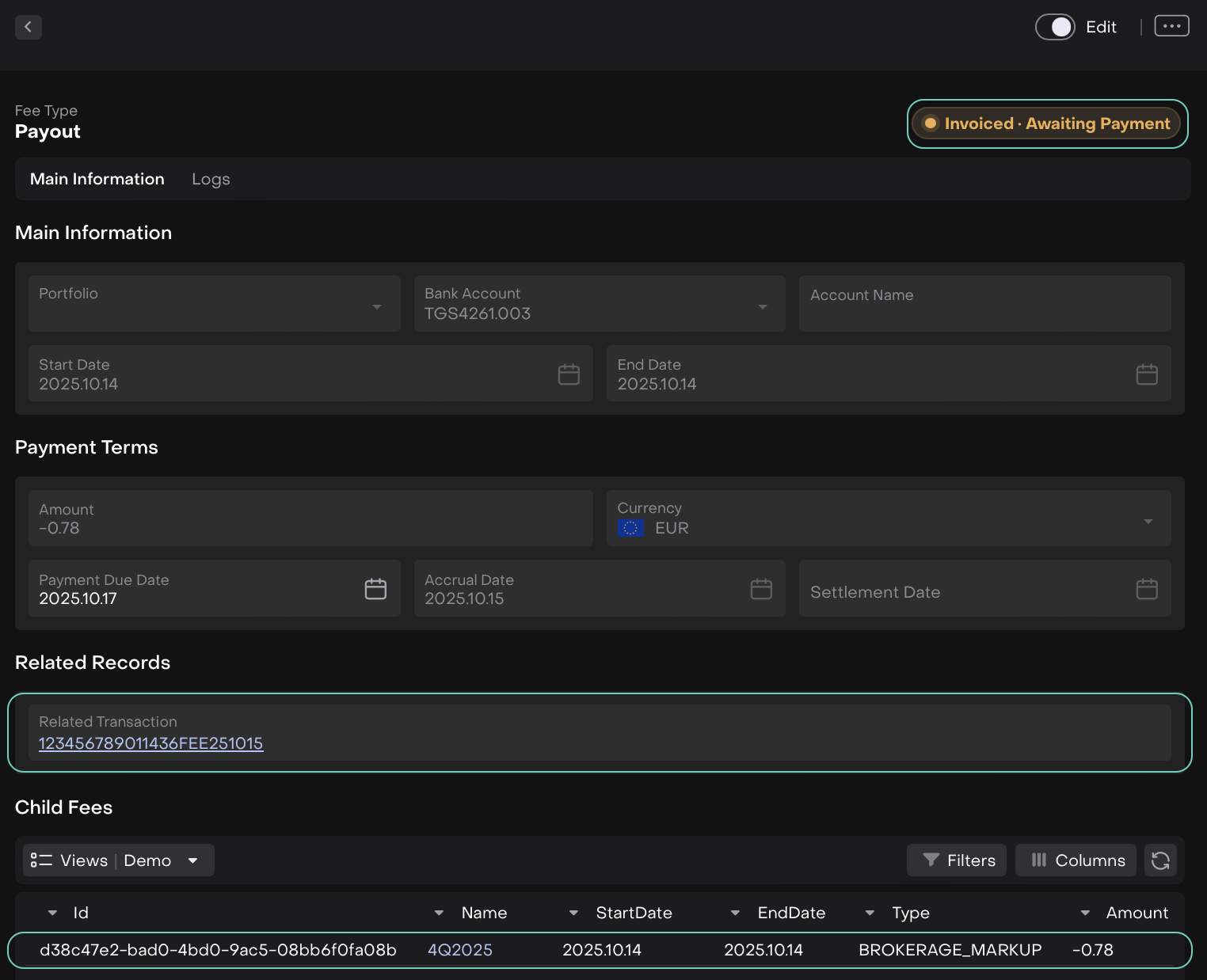

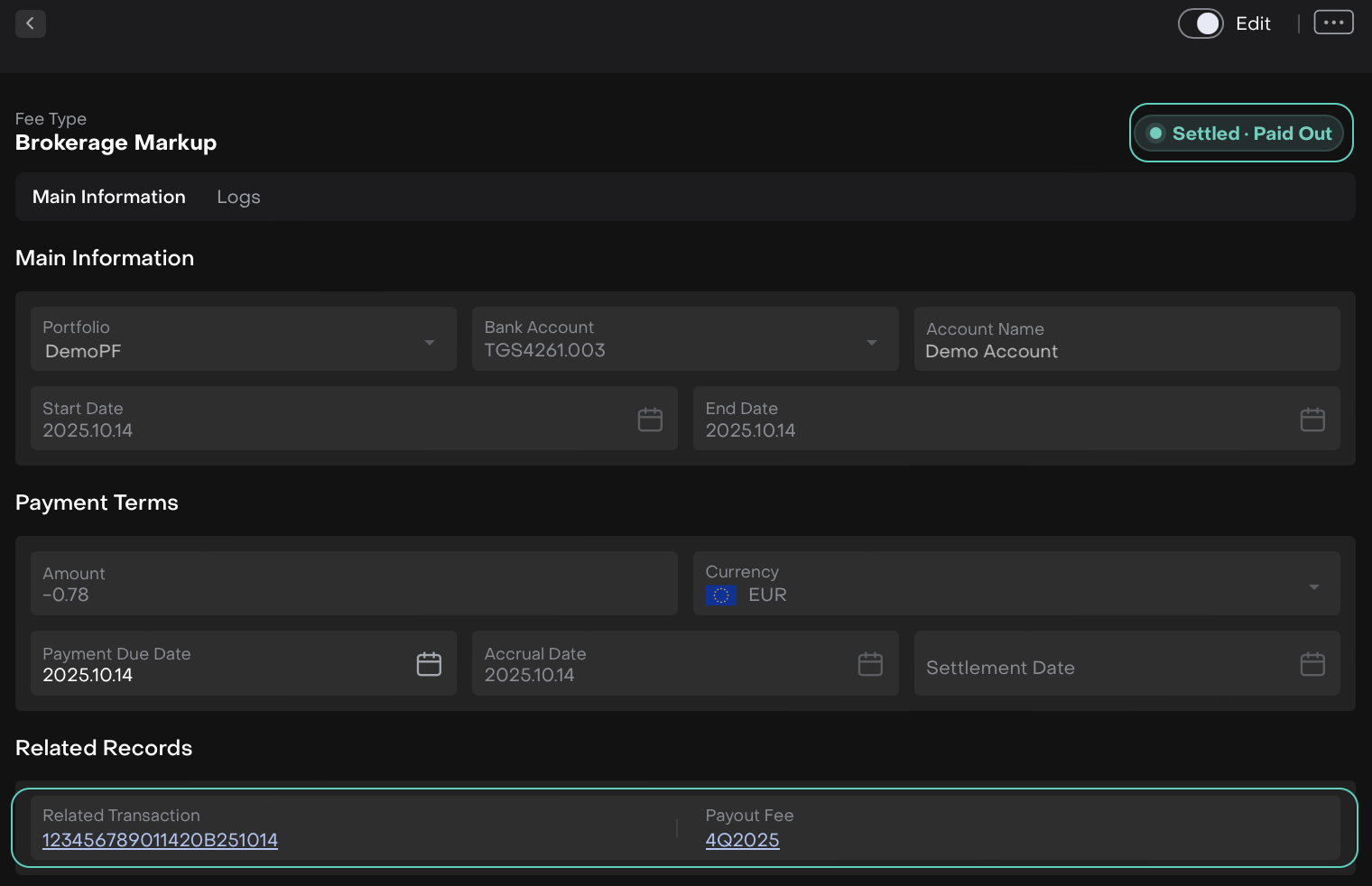

The Payout fee is created with the status Invoiced – Awaiting Payment, while the child fees appear as Settled – Paid Out.

Invoice – Awaiting Payment

Settled – Paid Out

Improved LEAD Information ENHANCEMENT

SALES MANAGER

A new Communications sub-tab added to the Leads page to help you track follow-ups:

Next Client Communication Date field moved to the Communications tab.

Text editor added for logging Notes (⚠️up to 10,000 characters).

Two new Opportunity Types are added to Lead:

Referral Agreement (RF)

Consulting Agreement (CONS)

The Opportunity Type can also displayed directly in the Lead table, making it easier to manage opportunities.

In the Lead table, manager UUIDs are now displayed as the full names of all managers assigned to the lead, making the information clearer and easier to read.

Fixed Creation of Private Equity Transactions BUG FIX

BACK OFFICE

Now you can correctly create buy, sell, income and expense transactions for Private Equity instruments.

Right-Click Pop-Ups Disabled on Tangible Assets BUG FIX

BACK OFFICE

Right-clicking on headers or assets (like Tangible Assets or Private Equity) in the Positions, no longer triggers unwanted pop-ups, ensuring a smoother experience.

Other minor bugs and fixes have also been resolved to ensure a smoother experience.

This release highlights the key updates and features in Reluna v4.24. For more details, check the platform or Contact Support. We hope you enjoy the new features!